Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Asia Pacific Traction Battery Market Future-Proof Strategies: Market Trends 2025-2033

Asia Pacific Traction Battery Market by Chemistry (Lead Acid, Lithium-Ion, Nickel-Based, Others), by Application (Electric Vehicles, Industrial, E-Bikes), by China, by Japan, by South Korea, by Australia, by India, by Thailand Forecast 2025-2033

Key Insights

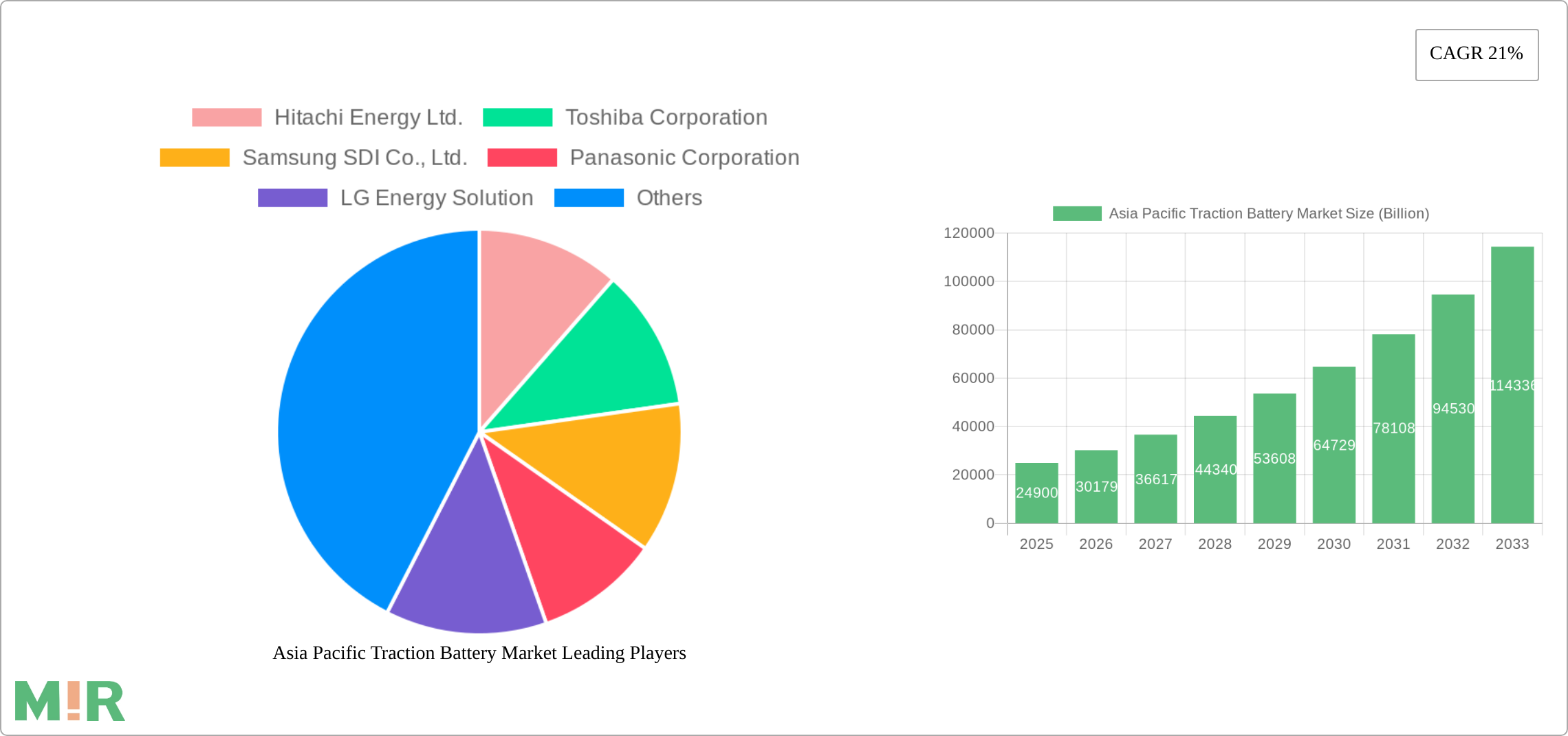

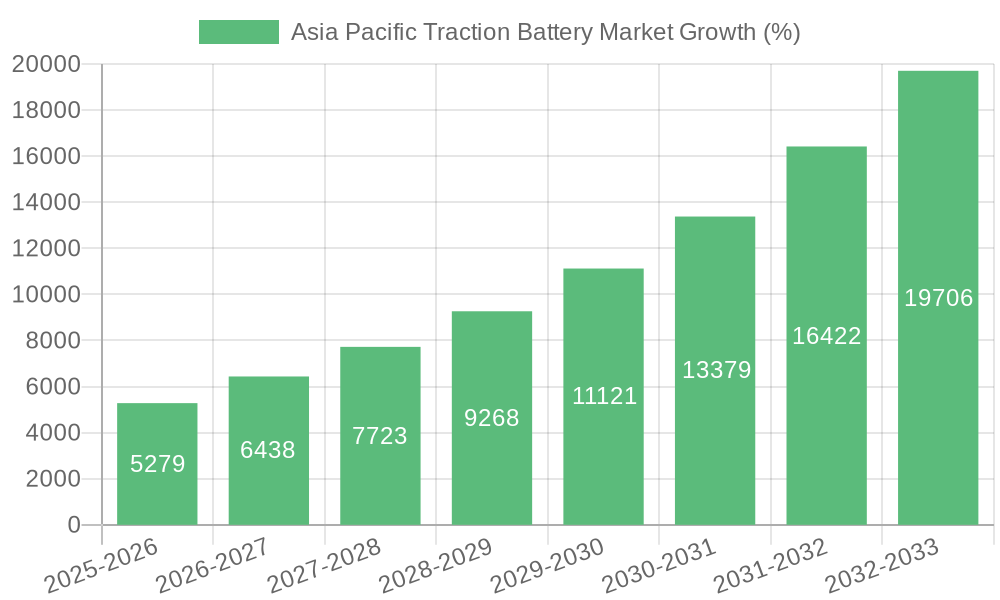

The Asia Pacific traction battery market is experiencing robust growth, projected to reach \$24.9 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 21% from 2025 to 2033. This surge is primarily driven by the burgeoning electric vehicle (EV) sector, encompassing both Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), across various segments like passenger cars, commercial vehicles, and two-wheelers. The increasing adoption of EVs, spurred by government initiatives promoting sustainable transportation and rising consumer awareness of environmental concerns, significantly fuels market expansion. Furthermore, the growth of industrial applications, such as material handling equipment (Class 1, 2, and 3) and the expanding e-bike market (e-scooters and e-motorcycles), contribute to the overall market dynamism. Technological advancements in battery chemistries, particularly Lithium-ion batteries, offering improved energy density, lifespan, and safety, further propel market growth. While challenges exist, such as the fluctuating prices of raw materials and the need for robust charging infrastructure development, the long-term outlook for the Asia Pacific traction battery market remains exceptionally positive.

The market segmentation reveals a diverse landscape. Lithium-ion batteries dominate the chemistry segment due to their superior performance characteristics. Electric vehicles constitute the largest application segment, reflecting the rapid electrification of transportation. China, Japan, and South Korea are key regional players, benefiting from established manufacturing bases and strong technological capabilities. India and Thailand represent emerging markets with significant growth potential, fueled by increasing EV adoption and supportive government policies. Major players like Hitachi Energy, Toshiba, Samsung SDI, Panasonic, LG Energy Solution, and others are strategically investing in expanding production capacity and R&D to capitalize on the growing market opportunities. The competitive landscape is characterized by both established players and emerging companies vying for market share, leading to innovation and price competitiveness, further benefitting consumers and promoting wider EV adoption.

Asia Pacific Traction Battery Market Concentration & Characteristics

The Asia Pacific traction battery market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share. However, the market is also experiencing a rise in new entrants, particularly in the lithium-ion segment. Concentration is highest in China, driven by substantial domestic manufacturing and government support. Japan and South Korea also show high levels of concentration due to the presence of established electronics giants and specialized battery producers.

- Concentration Areas: China, Japan, South Korea

- Characteristics:

- Innovation: Significant focus on improving energy density, lifespan, safety, and cost-effectiveness of lithium-ion batteries. Research and development are concentrated in developing next-generation battery technologies, including solid-state batteries.

- Impact of Regulations: Stringent emission standards and government incentives for electric vehicles are driving the market's growth. Regulations also focus on battery safety and recycling.

- Product Substitutes: While lithium-ion is dominant, lead-acid batteries continue to hold a niche in certain applications due to lower cost. Emerging technologies like solid-state batteries pose a long-term substitution threat.

- End-User Concentration: The market is significantly influenced by the automotive sector (EVs), with the industrial and e-bike segments also growing rapidly. China's massive EV market significantly influences overall market dynamics.

- Level of M&A: The market has witnessed several mergers and acquisitions, primarily focused on securing supply chains, technological advancements, and expanding market presence. The pace of M&A is expected to accelerate.

Asia Pacific Traction Battery Market Trends

The Asia Pacific traction battery market is experiencing explosive growth, driven primarily by the burgeoning electric vehicle (EV) sector. The rapid adoption of EVs across countries like China, India, and others is fueling demand for high-performance lithium-ion batteries. Government policies promoting clean energy and reducing carbon emissions are also significant drivers. Furthermore, the increasing popularity of e-bikes and the electrification of industrial equipment are creating additional growth opportunities. The market is also witnessing a shift towards higher energy density batteries to extend the range of EVs. Advancements in battery management systems (BMS) are improving battery performance and safety. Companies are investing heavily in R&D to develop more sustainable and cost-effective battery technologies, including solid-state batteries and improved recycling processes. This focus on sustainability is becoming increasingly important as environmental concerns grow. The market also displays a trend toward regionalization of production, with countries aiming for self-sufficiency in battery manufacturing to reduce reliance on imports and support domestic industries. This trend is particularly visible in China and India. Finally, the increasing adoption of battery swapping technology is also shaping the market, offering an alternative to traditional charging infrastructure.

Key Region or Country & Segment to Dominate the Market

China is expected to dominate the Asia Pacific traction battery market, driven by its massive EV market and robust domestic manufacturing base. The lithium-ion battery segment will continue to hold the largest market share due to its high energy density and suitability for EVs and other applications.

- Dominant Region: China

- Dominant Segment (Chemistry): Lithium-ion batteries. Their higher energy density, longer lifespan, and improved performance compared to lead-acid batteries make them the preferred choice for electric vehicles and other high-power applications. This segment is projected to maintain its dominant position with continuous technological advancements and cost reductions.

- Dominant Segment (Application): Electric Vehicles (BEVs and PHEVs). The explosive growth of the EV sector in China and other Asian countries is directly proportional to the demand for lithium-ion traction batteries, making it the dominant application segment by a considerable margin.

China's dominance stems from its large-scale EV manufacturing, supportive government policies, and the presence of major battery manufacturers. The lithium-ion segment's dominance is due to its superior performance and suitability for high-power applications. The EV application segment’s dominance is driven by the rapid expansion of the electric vehicle industry across the Asia-Pacific region.

Asia Pacific Traction Battery Market Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the Asia Pacific traction battery market, including market sizing, segmentation by chemistry type (lead-acid, lithium-ion, nickel-based, others) and application (EVs, industrial, e-bikes), key players' market share, and detailed regional insights across key countries. The report also incorporates forecasts, trend analysis, and an examination of the competitive landscape, including mergers and acquisitions. Deliverables include market size estimations (in billion USD), market share analysis, detailed segment analysis, regional breakdowns, and company profiles.

Asia Pacific Traction Battery Market Analysis

The Asia Pacific traction battery market is valued at approximately $80 billion in 2023 and is projected to experience a Compound Annual Growth Rate (CAGR) of over 15% from 2023 to 2030, reaching an estimated value of $250 billion. This significant growth is driven primarily by the increasing adoption of electric vehicles and the expansion of related industries. Lithium-ion batteries dominate the market, accounting for more than 70% of the total market share, reflecting their superior energy density and performance characteristics. The market share is further segmented by application, with electric vehicles representing the largest share, followed by industrial applications and e-bikes. China holds the largest regional market share, owing to its massive EV market and well-established battery manufacturing sector. However, other countries in the region, such as India, Japan, and South Korea, are also exhibiting substantial growth. The competitive landscape is dynamic, with both established players and new entrants vying for market share. Consolidation through mergers and acquisitions is expected to continue, shaping the future market structure.

Asia Pacific Traction Battery Market Regional Insights

- China:

- Largest market share due to high EV adoption and domestic manufacturing.

- Dominated by lithium-ion battery chemistry.

- Strong government support for EV and battery industries.

- Japan:

- Significant presence of established battery manufacturers.

- Focus on high-quality, technologically advanced batteries.

- Strong R&D efforts in next-generation battery technologies.

- South Korea:

- Key player in lithium-ion battery manufacturing and technology.

- Growing presence in the global EV battery supply chain.

- Focus on innovation and partnerships to expand market reach.

- Australia:

- Growing market driven by government incentives for EVs.

- Focus on renewable energy integration with battery storage.

- Potential for growth in stationary energy storage applications.

- India:

- Rapidly growing EV market, creating significant demand for batteries.

- Government initiatives to promote domestic battery manufacturing.

- Opportunities for growth in both two-wheeler and four-wheeler EVs.

- Thailand:

- Growing EV market driven by government policies.

- Attracting investments in battery manufacturing facilities.

- Potential for growth as a regional manufacturing hub.

Driving Forces: What's Propelling the Asia Pacific Traction Battery Market

The Asia Pacific traction battery market is propelled by the increasing adoption of electric vehicles, government regulations promoting clean energy, and the growing demand for energy storage solutions. Furthermore, advancements in battery technology, decreasing battery costs, and supportive government policies in several countries are significantly contributing to this market's expansion.

Challenges and Restraints in Asia Pacific Traction Battery Market

Challenges include the high initial cost of batteries, concerns about battery safety and lifespan, the need for robust recycling infrastructure, and the dependence on raw materials with geographically concentrated supply chains. Fluctuations in raw material prices and potential supply chain disruptions also pose challenges to the industry's growth.

Emerging Trends in Asia Pacific Traction Battery Market

Emerging trends include the development of solid-state batteries, advancements in battery management systems (BMS), increased focus on battery recycling and sustainability, and the rise of battery swapping technologies as alternatives to traditional charging.

Asia Pacific Traction Battery Industry News

- December 2022: Camel Group announced its plan to enhance the production capacity at its Malaysian base to meet the increasing demand for batteries. The upgrade aims to reach the production capacity of 5 million units per year in June 2023.

Leading Players in the Asia Pacific Traction Battery Market

- Hitachi Energy Ltd.

- Toshiba Corporation

- Samsung SDI Co., Ltd.

- Panasonic Corporation

- LG Energy Solution

- Camel Group Co., Ltd

- Mutlu Corporation

- Amara Raja Batteries Ltd.

- HOPPECKE Batteries GmbH & Co. KG

- ENERSYS

- EXIDE INDUSTRIES LTD.

Asia Pacific Traction Battery Market Segmentation

-

1. Chemistry

- 1.1. Lead Acid

- 1.2. Lithium-Ion

- 1.3. Nickel-Based

- 1.4. Others

-

2. Application

-

2.1. Electric Vehicles

- 2.1.1. BEV

- 2.1.2. PHEV

-

2.2. Industrial

- 2.2.1. Class 1

- 2.2.2. Class 2

- 2.2.3. Class 3

-

2.3. E-Bikes

- 2.3.1. E-Scooters

- 2.3.2. E-Motorcycles

-

2.1. Electric Vehicles

Asia Pacific Traction Battery Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. South Korea

- 4. Australia

- 5. India

- 6. Thailand

Asia Pacific Traction Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing adoption of electric vehicles

- 3.2.2 Enhanced battery capacity and reduced costs

- 3.2.3 Favorable government policies & tax incentives

- 3.3. Market Restrains

- 3.3.1 Safety concerns

- 3.3.2 Lack of adequate charging infrastructure

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Traction Battery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Chemistry

- 5.1.1. Lead Acid

- 5.1.2. Lithium-Ion

- 5.1.3. Nickel-Based

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electric Vehicles

- 5.2.1.1. BEV

- 5.2.1.2. PHEV

- 5.2.2. Industrial

- 5.2.2.1. Class 1

- 5.2.2.2. Class 2

- 5.2.2.3. Class 3

- 5.2.3. E-Bikes

- 5.2.3.1. E-Scooters

- 5.2.3.2. E-Motorcycles

- 5.2.1. Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. South Korea

- 5.3.4. Australia

- 5.3.5. India

- 5.3.6. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Chemistry

- 6. China Asia Pacific Traction Battery Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Chemistry

- 6.1.1. Lead Acid

- 6.1.2. Lithium-Ion

- 6.1.3. Nickel-Based

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Electric Vehicles

- 6.2.1.1. BEV

- 6.2.1.2. PHEV

- 6.2.2. Industrial

- 6.2.2.1. Class 1

- 6.2.2.2. Class 2

- 6.2.2.3. Class 3

- 6.2.3. E-Bikes

- 6.2.3.1. E-Scooters

- 6.2.3.2. E-Motorcycles

- 6.2.1. Electric Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Chemistry

- 7. Japan Asia Pacific Traction Battery Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Chemistry

- 7.1.1. Lead Acid

- 7.1.2. Lithium-Ion

- 7.1.3. Nickel-Based

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Electric Vehicles

- 7.2.1.1. BEV

- 7.2.1.2. PHEV

- 7.2.2. Industrial

- 7.2.2.1. Class 1

- 7.2.2.2. Class 2

- 7.2.2.3. Class 3

- 7.2.3. E-Bikes

- 7.2.3.1. E-Scooters

- 7.2.3.2. E-Motorcycles

- 7.2.1. Electric Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Chemistry

- 8. South Korea Asia Pacific Traction Battery Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Chemistry

- 8.1.1. Lead Acid

- 8.1.2. Lithium-Ion

- 8.1.3. Nickel-Based

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Electric Vehicles

- 8.2.1.1. BEV

- 8.2.1.2. PHEV

- 8.2.2. Industrial

- 8.2.2.1. Class 1

- 8.2.2.2. Class 2

- 8.2.2.3. Class 3

- 8.2.3. E-Bikes

- 8.2.3.1. E-Scooters

- 8.2.3.2. E-Motorcycles

- 8.2.1. Electric Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Chemistry

- 9. Australia Asia Pacific Traction Battery Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Chemistry

- 9.1.1. Lead Acid

- 9.1.2. Lithium-Ion

- 9.1.3. Nickel-Based

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Electric Vehicles

- 9.2.1.1. BEV

- 9.2.1.2. PHEV

- 9.2.2. Industrial

- 9.2.2.1. Class 1

- 9.2.2.2. Class 2

- 9.2.2.3. Class 3

- 9.2.3. E-Bikes

- 9.2.3.1. E-Scooters

- 9.2.3.2. E-Motorcycles

- 9.2.1. Electric Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Chemistry

- 10. India Asia Pacific Traction Battery Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Chemistry

- 10.1.1. Lead Acid

- 10.1.2. Lithium-Ion

- 10.1.3. Nickel-Based

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Electric Vehicles

- 10.2.1.1. BEV

- 10.2.1.2. PHEV

- 10.2.2. Industrial

- 10.2.2.1. Class 1

- 10.2.2.2. Class 2

- 10.2.2.3. Class 3

- 10.2.3. E-Bikes

- 10.2.3.1. E-Scooters

- 10.2.3.2. E-Motorcycles

- 10.2.1. Electric Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Chemistry

- 11. Thailand Asia Pacific Traction Battery Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Chemistry

- 11.1.1. Lead Acid

- 11.1.2. Lithium-Ion

- 11.1.3. Nickel-Based

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Electric Vehicles

- 11.2.1.1. BEV

- 11.2.1.2. PHEV

- 11.2.2. Industrial

- 11.2.2.1. Class 1

- 11.2.2.2. Class 2

- 11.2.2.3. Class 3

- 11.2.3. E-Bikes

- 11.2.3.1. E-Scooters

- 11.2.3.2. E-Motorcycles

- 11.2.1. Electric Vehicles

- 11.1. Market Analysis, Insights and Forecast - by Chemistry

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Hitachi Energy Ltd.

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Toshiba Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Samsung SDI Co. Ltd.

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Panasonic Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 LG Energy Solution

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Camel Group Co. Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mutlu Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Amara Raja Batteries Ltd.

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 HOPPECKE Batteries GmbH & Co. KG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ENERSYS

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 EXIDE INDUSTRIES LTD.

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Hitachi Energy Ltd.

- Figure 1: Asia Pacific Traction Battery Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Traction Battery Market Share (%) by Company 2024

- Table 1: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Chemistry 2019 & 2032

- Table 3: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 4: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Chemistry 2019 & 2032

- Table 6: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 7: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 8: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Chemistry 2019 & 2032

- Table 9: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 10: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 11: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Chemistry 2019 & 2032

- Table 12: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 14: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Chemistry 2019 & 2032

- Table 15: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 17: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Chemistry 2019 & 2032

- Table 18: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 19: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 20: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Chemistry 2019 & 2032

- Table 21: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 22: Asia Pacific Traction Battery Market Revenue Billion Forecast, by Country 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)