Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Autonomous Mobile Robot Market Analysis Report 2025: Market to Grow by a CAGR of 15 to 2033, Driven by Government Incentives, Popularity of Virtual Assistants, and Strategic Partnerships

Autonomous Mobile Robot Market by Type: (Delivery and material handling, Security and inspection, Cleaning and disinfection), by End-Use: (Manufacturing, 3PL and Logistics, E-commerce and retail, Hospital, Hospitality, Others), by North America (U.S., Canada), by Europe (UK, Germany, France, Italy, Russia, Spain), by Asia Pacific (China, India, Japan, Australia, South Korea), by Latin America (Brazil, Mexico, Argentina), by MEA (Saudi Arabia, UAE, South Africa) Forecast 2025-2033

Key Insights

The size of the Autonomous Mobile Robot Market was valued at USD 2.4 billion in 2024 and is projected to reach USD 6.38 billion by 2033, with an expected CAGR of 15% during the forecast period.This robust expansion is fueled by several key factors. The increasing demand for automation across diverse industries, driven by labor shortages and the need for enhanced efficiency, is a primary driver. The rising adoption of e-commerce and the subsequent surge in logistics and warehouse operations are significantly boosting AMR demand. Technological advancements, particularly in areas like artificial intelligence, sensor technology, and navigation systems, are continuously improving AMR capabilities, making them more versatile and reliable. Furthermore, government initiatives promoting automation and Industry 4.0 adoption are providing further impetus to market growth. The growing need for efficient material handling, improved security and inspection processes, and effective cleaning and disinfection solutions across various sectors contributes significantly to this expansion. Key players in this market are leveraging these trends by developing and deploying advanced AMR solutions tailored to meet the specific needs of various industries.

Autonomous Mobile Robot Market Concentration & Characteristics

The Autonomous Mobile Robot (AMR) market exhibits a moderately concentrated landscape, with a few key players holding significant market share. However, the market is also characterized by a high level of innovation, with numerous smaller companies and startups contributing to technological advancements and niche applications. This competitive environment fosters rapid innovation, leading to continuous improvements in AMR capabilities, such as enhanced navigation, payload capacity, and integration with existing systems.

Regulations play a crucial role in shaping the market, impacting safety standards, data privacy concerns, and operational guidelines. Compliance with these regulations is essential for AMR deployment and market entry. The market also faces potential disruption from emerging technologies or alternative solutions, though currently, AMRs hold a strong position in many applications. The end-user concentration is diverse, ranging from large manufacturing plants and logistics hubs to smaller hospitals and retail stores. This indicates a broad market reach and growth potential across various sectors. The level of mergers and acquisitions (M&A) activity in the AMR market is relatively high, indicating a consolidation trend among players seeking to expand their market share, product portfolios, and technological capabilities. Established players are actively acquiring smaller, innovative companies to bolster their offerings and maintain competitiveness.

Autonomous Mobile Robot Market Trends

The AMR market is characterized by several significant trends shaping its trajectory. The increasing demand for flexible and scalable automation solutions is driving the adoption of AMRs across diverse industries. AMRs are proving to be more adaptable to changing operational needs compared to traditional automated guided vehicles (AGVs). The integration of artificial intelligence (AI) and machine learning (ML) is enhancing AMR capabilities, enabling them to operate more autonomously, navigate complex environments, and learn from their experiences. This improves efficiency, reduces errors, and enhances decision-making. Cloud-based platforms are facilitating remote monitoring, data analytics, and fleet management, contributing to improved operational efficiency and cost optimization. The trend towards collaborative robots (cobots), where AMRs work alongside humans, is also gaining momentum, fostering safer and more efficient work environments. As e-commerce continues its exponential growth, the demand for AMRs in warehousing, fulfillment centers, and last-mile delivery is expected to remain strong. Lastly, the increasing focus on sustainability and reducing carbon footprints is driving the development of energy-efficient AMRs, aligning with the broader trend towards environmentally conscious operations. These trends collectively indicate a promising future for the AMR market, driven by continuous technological advancement and increased industry adoption.

Key Region or Country & Segment to Dominate the Market

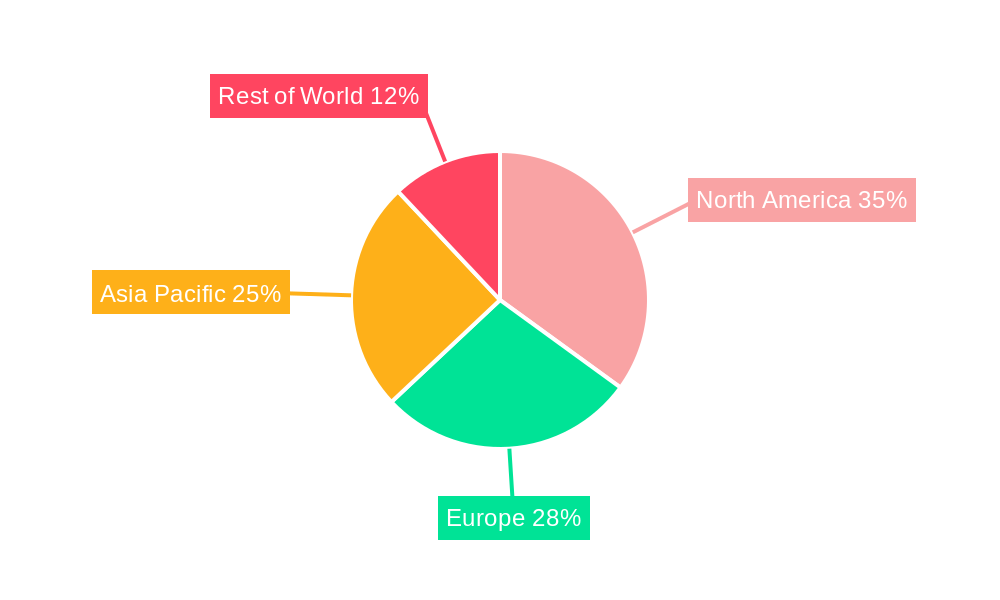

- North America (specifically the U.S.): This region currently holds a significant market share due to early adoption of automation technologies, strong technological infrastructure, and a robust presence of AMR vendors. The high concentration of manufacturing, logistics, and e-commerce operations fuels demand.

- Asia-Pacific (specifically China): This region is experiencing rapid growth, driven by substantial investments in automation and a surge in e-commerce activities. The expanding manufacturing sector, particularly in electronics and consumer goods, is also a key contributor.

- Dominant Segments:

- Delivery and Material Handling: This segment represents the largest share of the market due to the widespread application of AMRs in warehouses, distribution centers, and manufacturing facilities for efficient material movement.

- Manufacturing: This end-use sector is a significant driver of AMR adoption, with AMRs streamlining material handling, improving production efficiency, and optimizing workflows.

The combination of high technological readiness in North America and rapid growth in the Asia-Pacific region, particularly driven by the manufacturing and delivery and material handling sectors, establishes these as the key market leaders, poised for continued expansion.

Autonomous Mobile Robot Market Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the Autonomous Mobile Robot market, covering market size, growth drivers, trends, challenges, key players, and regional insights. It delivers actionable insights into market dynamics, competitive landscape, and future growth opportunities. Deliverables include market sizing and forecasts, competitive benchmarking, segment analysis, regional breakdowns, and trend analysis, providing a holistic view of the market's evolution.

Autonomous Mobile Robot Market Analysis

The Autonomous Mobile Robot market is characterized by substantial growth, driven by factors previously discussed. Market size is currently estimated at $2.4 billion, with projections indicating significant expansion in the coming years. Market share is distributed among several key players, with some holding dominant positions based on their technological capabilities, market reach, and established customer bases. However, the market also accommodates numerous smaller, innovative companies, often specializing in niche applications or offering unique technological advantages. Growth is expected to be driven by increasing automation needs across various sectors, technological advancements, and supportive government initiatives. The competitive landscape is dynamic, characterized by both organic growth strategies and strategic mergers and acquisitions, leading to market consolidation and the development of comprehensive solutions. The market analysis incorporates a granular examination of segments, geographic regions, and key drivers to offer precise insights into market dynamics and potential future trajectory.

Autonomous Mobile Robot Market Regional Insights

- North America:

- U.S.

- Canada

- Europe:

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- Latin America:

- Brazil

- Mexico

- Argentina

- MEA:

- Saudi Arabia

- UAE

- South Africa

Each region exhibits varying levels of AMR adoption, influenced by factors such as industrial development, technological infrastructure, and government policies. Detailed analysis of each region considers its unique market characteristics, identifying growth opportunities and potential challenges.

Driving Forces: What's Propelling the Autonomous Mobile Robot Market

The key drivers fueling the AMR market's growth include the increasing demand for automation across various sectors, particularly manufacturing, logistics, and healthcare. Labor shortages, rising labor costs, and the need for improved efficiency are pushing businesses to adopt AMR solutions. Technological advancements, such as improved AI and sensor technology, are enabling AMRs to perform more complex tasks with greater accuracy and reliability. Government initiatives supporting automation and Industry 4.0 adoption further contribute to market growth. Finally, the expansion of e-commerce and the resulting growth in logistics and warehouse operations are creating substantial demand for AMRs.

Challenges and Restraints in Autonomous Mobile Robot Market

Despite significant growth potential, the AMR market faces certain challenges. High initial investment costs for AMR implementation can be a barrier for some businesses. Concerns about data security and privacy, especially with the increasing use of AI and cloud-based solutions, require attention. The need for robust infrastructure and skilled personnel for operation and maintenance can also limit adoption. Regulatory uncertainties and compliance requirements in different regions can create additional hurdles. Finally, the potential for disruptions from competing technologies or alternative solutions needs to be carefully considered.

Emerging Trends in Autonomous Mobile Robot Market

Key emerging trends in the AMR market include the increasing integration of AI and ML for enhanced autonomy and decision-making capabilities. Cloud-based platforms are streamlining fleet management and data analytics, contributing to improved efficiency and reduced costs. The growing adoption of collaborative robots (cobots), where AMRs work alongside human workers, is enhancing safety and productivity. Furthermore, the development of energy-efficient and sustainable AMRs is addressing environmental concerns. The focus is shifting towards modular and customizable AMRs to cater to diverse industry requirements. And lastly, the integration of AMRs with other technologies within the Internet of Things (IoT) ecosystem is creating a more interconnected and intelligent factory or warehouse.

Autonomous Mobile Robot Industry News

In February 2024, Omron Corporation introduced the MD Series of autonomous mobile robots, designed to enhance efficiency in production environments. This launch aims to expand Omron's product portfolio and attract new customers

Leading Players in the Autonomous Mobile Robot Market

- Zebra Fetch Robotics

- SuperDroid Robots

- ST Engineering Aethon, Inc.

- SoftBank Robotics

- ROBOTLAB Inc.

- OTTO Motors

- Mobile Industrial Robots

- Locus Robotics

- GreyOrange

- Gideon Brothers

- Geekplus Technology Co Ltd.

- Blue Skye Automation

- 6 River Systems

Autonomous Mobile Robot Market Segmentation

- 1. Type:

- 1.1. Delivery and material handling

- 1.2. Security and inspection

- 1.3. Cleaning and disinfection

- 2. End-Use:

- 2.1. Manufacturing

- 2.2. 3PL and Logistics

- 2.3. E-commerce and retail

- 2.4. Hospital

- 2.5. Hospitality

- 2.6. Others

Autonomous Mobile Robot Market Segmentation By Geography

- 1. North America

- 1.1. U.S.

- 1.2. Canada

- 2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Spain

- 3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. South Korea

- 4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 5. MEA

- 5.1. Saudi Arabia

- 5.2. UAE

- 5.3. South Africa

Autonomous Mobile Robot Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Emerging e-commerce and retail industry in Asia Pacific

- 3.2.2 Rising demand from the manufacturing industry to supply material

- 3.2.3 Growing application of autonomous mobile robot in hospitality industry

- 3.2.4 Rise in demand for cleaning and disinfection robot across healthcare industry

- 3.2.5 Increasing demand for security and inspection mobile robots

- 3.3. Market Restrains

- 3.3.1. High cost associated with autonomous mobile robot

- 3.4. Market Trends

- 3.4.1 The AMR market is characterized by several significant trends shaping its trajectory. The increasing demand for flexible and scalable automation solutions is driving the adoption of AMRs across diverse industries. AMRs are proving to be more adaptable to changing operational needs compared to traditional automated guided vehicles (AGVs). The integration of artificial intelligence (AI) and machine learning (ML) is enhancing AMR capabilities

- 3.4.2 enabling them to operate more autonomously

- 3.4.3 navigate complex environments

- 3.4.4 and learn from their experiences. This improves efficiency

- 3.4.5 reduces errors

- 3.4.6 and enhances decision-making. Cloud-based platforms are facilitating remote monitoring

- 3.4.7 data analytics

- 3.4.8 and fleet management

- 3.4.9 contributing to improved operational efficiency and cost optimization. The trend towards collaborative robots (cobots)

- 3.4.10 where AMRs work alongside humans

- 3.4.11 is also gaining momentum

- 3.4.12 fostering safer and more efficient work environments. As e-commerce continues its exponential growth

- 3.4.13 the demand for AMRs in warehousing

- 3.4.14 fulfillment centers

- 3.4.15 and last-mile delivery is expected to remain strong. Lastly

- 3.4.16 the increasing focus on sustainability and reducing carbon footprints is driving the development of energy-efficient AMRs

- 3.4.17 aligning with the broader trend towards environmentally conscious operations. These trends collectively indicate a promising future for the AMR market

- 3.4.18 driven by continuous technological advancement and increased industry adoption.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Mobile Robot Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type:

- 5.1.1. Delivery and material handling

- 5.1.2. Security and inspection

- 5.1.3. Cleaning and disinfection

- 5.2. Market Analysis, Insights and Forecast - by End-Use:

- 5.2.1. Manufacturing

- 5.2.2. 3PL and Logistics

- 5.2.3. E-commerce and retail

- 5.2.4. Hospital

- 5.2.5. Hospitality

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Type:

- 6. North America Autonomous Mobile Robot Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type:

- 6.1.1. Delivery and material handling

- 6.1.2. Security and inspection

- 6.1.3. Cleaning and disinfection

- 6.2. Market Analysis, Insights and Forecast - by End-Use:

- 6.2.1. Manufacturing

- 6.2.2. 3PL and Logistics

- 6.2.3. E-commerce and retail

- 6.2.4. Hospital

- 6.2.5. Hospitality

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type:

- 7. Europe Autonomous Mobile Robot Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type:

- 7.1.1. Delivery and material handling

- 7.1.2. Security and inspection

- 7.1.3. Cleaning and disinfection

- 7.2. Market Analysis, Insights and Forecast - by End-Use:

- 7.2.1. Manufacturing

- 7.2.2. 3PL and Logistics

- 7.2.3. E-commerce and retail

- 7.2.4. Hospital

- 7.2.5. Hospitality

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type:

- 8. Asia Pacific Autonomous Mobile Robot Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type:

- 8.1.1. Delivery and material handling

- 8.1.2. Security and inspection

- 8.1.3. Cleaning and disinfection

- 8.2. Market Analysis, Insights and Forecast - by End-Use:

- 8.2.1. Manufacturing

- 8.2.2. 3PL and Logistics

- 8.2.3. E-commerce and retail

- 8.2.4. Hospital

- 8.2.5. Hospitality

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type:

- 9. Latin America Autonomous Mobile Robot Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type:

- 9.1.1. Delivery and material handling

- 9.1.2. Security and inspection

- 9.1.3. Cleaning and disinfection

- 9.2. Market Analysis, Insights and Forecast - by End-Use:

- 9.2.1. Manufacturing

- 9.2.2. 3PL and Logistics

- 9.2.3. E-commerce and retail

- 9.2.4. Hospital

- 9.2.5. Hospitality

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type:

- 10. MEA Autonomous Mobile Robot Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type:

- 10.1.1. Delivery and material handling

- 10.1.2. Security and inspection

- 10.1.3. Cleaning and disinfection

- 10.2. Market Analysis, Insights and Forecast - by End-Use:

- 10.2.1. Manufacturing

- 10.2.2. 3PL and Logistics

- 10.2.3. E-commerce and retail

- 10.2.4. Hospital

- 10.2.5. Hospitality

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type:

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Zebra Fetch Robotics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SuperDroid Robots

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ST Engineering Aethon Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SoftBank Robotics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ROBOTLAB Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OTTO Motors

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ABB Robotics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Omron Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mobile Industrial Robots

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Locus Robotics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GreyOrange

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Gideon Brothers

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Geekplus Technology Co Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Blue Skye Automation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 and 6 River Systems

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Zebra Fetch Robotics

- Figure 1: Global Autonomous Mobile Robot Market Revenue Breakdown (billion, %) by Region 2024 & 2032

- Figure 2: Global Autonomous Mobile Robot Market Volume Breakdown (units, %) by Region 2024 & 2032

- Figure 3: North America Autonomous Mobile Robot Market Revenue (billion), by Type: 2024 & 2032

- Figure 4: North America Autonomous Mobile Robot Market Volume (units), by Type: 2024 & 2032

- Figure 5: North America Autonomous Mobile Robot Market Revenue Share (%), by Type: 2024 & 2032

- Figure 6: North America Autonomous Mobile Robot Market Volume Share (%), by Type: 2024 & 2032

- Figure 7: North America Autonomous Mobile Robot Market Revenue (billion), by End-Use: 2024 & 2032

- Figure 8: North America Autonomous Mobile Robot Market Volume (units), by End-Use: 2024 & 2032

- Figure 9: North America Autonomous Mobile Robot Market Revenue Share (%), by End-Use: 2024 & 2032

- Figure 10: North America Autonomous Mobile Robot Market Volume Share (%), by End-Use: 2024 & 2032

- Figure 11: North America Autonomous Mobile Robot Market Revenue (billion), by Country 2024 & 2032

- Figure 12: North America Autonomous Mobile Robot Market Volume (units), by Country 2024 & 2032

- Figure 13: North America Autonomous Mobile Robot Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Autonomous Mobile Robot Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Autonomous Mobile Robot Market Revenue (billion), by Type: 2024 & 2032

- Figure 16: Europe Autonomous Mobile Robot Market Volume (units), by Type: 2024 & 2032

- Figure 17: Europe Autonomous Mobile Robot Market Revenue Share (%), by Type: 2024 & 2032

- Figure 18: Europe Autonomous Mobile Robot Market Volume Share (%), by Type: 2024 & 2032

- Figure 19: Europe Autonomous Mobile Robot Market Revenue (billion), by End-Use: 2024 & 2032

- Figure 20: Europe Autonomous Mobile Robot Market Volume (units), by End-Use: 2024 & 2032

- Figure 21: Europe Autonomous Mobile Robot Market Revenue Share (%), by End-Use: 2024 & 2032

- Figure 22: Europe Autonomous Mobile Robot Market Volume Share (%), by End-Use: 2024 & 2032

- Figure 23: Europe Autonomous Mobile Robot Market Revenue (billion), by Country 2024 & 2032

- Figure 24: Europe Autonomous Mobile Robot Market Volume (units), by Country 2024 & 2032

- Figure 25: Europe Autonomous Mobile Robot Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Autonomous Mobile Robot Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Pacific Autonomous Mobile Robot Market Revenue (billion), by Type: 2024 & 2032

- Figure 28: Asia Pacific Autonomous Mobile Robot Market Volume (units), by Type: 2024 & 2032

- Figure 29: Asia Pacific Autonomous Mobile Robot Market Revenue Share (%), by Type: 2024 & 2032

- Figure 30: Asia Pacific Autonomous Mobile Robot Market Volume Share (%), by Type: 2024 & 2032

- Figure 31: Asia Pacific Autonomous Mobile Robot Market Revenue (billion), by End-Use: 2024 & 2032

- Figure 32: Asia Pacific Autonomous Mobile Robot Market Volume (units), by End-Use: 2024 & 2032

- Figure 33: Asia Pacific Autonomous Mobile Robot Market Revenue Share (%), by End-Use: 2024 & 2032

- Figure 34: Asia Pacific Autonomous Mobile Robot Market Volume Share (%), by End-Use: 2024 & 2032

- Figure 35: Asia Pacific Autonomous Mobile Robot Market Revenue (billion), by Country 2024 & 2032

- Figure 36: Asia Pacific Autonomous Mobile Robot Market Volume (units), by Country 2024 & 2032

- Figure 37: Asia Pacific Autonomous Mobile Robot Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Autonomous Mobile Robot Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Latin America Autonomous Mobile Robot Market Revenue (billion), by Type: 2024 & 2032

- Figure 40: Latin America Autonomous Mobile Robot Market Volume (units), by Type: 2024 & 2032

- Figure 41: Latin America Autonomous Mobile Robot Market Revenue Share (%), by Type: 2024 & 2032

- Figure 42: Latin America Autonomous Mobile Robot Market Volume Share (%), by Type: 2024 & 2032

- Figure 43: Latin America Autonomous Mobile Robot Market Revenue (billion), by End-Use: 2024 & 2032

- Figure 44: Latin America Autonomous Mobile Robot Market Volume (units), by End-Use: 2024 & 2032

- Figure 45: Latin America Autonomous Mobile Robot Market Revenue Share (%), by End-Use: 2024 & 2032

- Figure 46: Latin America Autonomous Mobile Robot Market Volume Share (%), by End-Use: 2024 & 2032

- Figure 47: Latin America Autonomous Mobile Robot Market Revenue (billion), by Country 2024 & 2032

- Figure 48: Latin America Autonomous Mobile Robot Market Volume (units), by Country 2024 & 2032

- Figure 49: Latin America Autonomous Mobile Robot Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Latin America Autonomous Mobile Robot Market Volume Share (%), by Country 2024 & 2032

- Figure 51: MEA Autonomous Mobile Robot Market Revenue (billion), by Type: 2024 & 2032

- Figure 52: MEA Autonomous Mobile Robot Market Volume (units), by Type: 2024 & 2032

- Figure 53: MEA Autonomous Mobile Robot Market Revenue Share (%), by Type: 2024 & 2032

- Figure 54: MEA Autonomous Mobile Robot Market Volume Share (%), by Type: 2024 & 2032

- Figure 55: MEA Autonomous Mobile Robot Market Revenue (billion), by End-Use: 2024 & 2032

- Figure 56: MEA Autonomous Mobile Robot Market Volume (units), by End-Use: 2024 & 2032

- Figure 57: MEA Autonomous Mobile Robot Market Revenue Share (%), by End-Use: 2024 & 2032

- Figure 58: MEA Autonomous Mobile Robot Market Volume Share (%), by End-Use: 2024 & 2032

- Figure 59: MEA Autonomous Mobile Robot Market Revenue (billion), by Country 2024 & 2032

- Figure 60: MEA Autonomous Mobile Robot Market Volume (units), by Country 2024 & 2032

- Figure 61: MEA Autonomous Mobile Robot Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: MEA Autonomous Mobile Robot Market Volume Share (%), by Country 2024 & 2032

- Table 1: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Region 2019 & 2032

- Table 2: Global Autonomous Mobile Robot Market Volume units Forecast, by Region 2019 & 2032

- Table 3: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Type: 2019 & 2032

- Table 4: Global Autonomous Mobile Robot Market Volume units Forecast, by Type: 2019 & 2032

- Table 5: Global Autonomous Mobile Robot Market Revenue billion Forecast, by End-Use: 2019 & 2032

- Table 6: Global Autonomous Mobile Robot Market Volume units Forecast, by End-Use: 2019 & 2032

- Table 7: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Region 2019 & 2032

- Table 8: Global Autonomous Mobile Robot Market Volume units Forecast, by Region 2019 & 2032

- Table 9: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Type: 2019 & 2032

- Table 10: Global Autonomous Mobile Robot Market Volume units Forecast, by Type: 2019 & 2032

- Table 11: Global Autonomous Mobile Robot Market Revenue billion Forecast, by End-Use: 2019 & 2032

- Table 12: Global Autonomous Mobile Robot Market Volume units Forecast, by End-Use: 2019 & 2032

- Table 13: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Country 2019 & 2032

- Table 14: Global Autonomous Mobile Robot Market Volume units Forecast, by Country 2019 & 2032

- Table 15: U.S. Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 16: U.S. Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 17: Canada Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 18: Canada Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 19: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Type: 2019 & 2032

- Table 20: Global Autonomous Mobile Robot Market Volume units Forecast, by Type: 2019 & 2032

- Table 21: Global Autonomous Mobile Robot Market Revenue billion Forecast, by End-Use: 2019 & 2032

- Table 22: Global Autonomous Mobile Robot Market Volume units Forecast, by End-Use: 2019 & 2032

- Table 23: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Country 2019 & 2032

- Table 24: Global Autonomous Mobile Robot Market Volume units Forecast, by Country 2019 & 2032

- Table 25: UK Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 26: UK Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 27: Germany Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 28: Germany Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 29: France Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 30: France Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 31: Italy Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 32: Italy Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 33: Russia Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 34: Russia Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 35: Spain Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 36: Spain Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 37: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Type: 2019 & 2032

- Table 38: Global Autonomous Mobile Robot Market Volume units Forecast, by Type: 2019 & 2032

- Table 39: Global Autonomous Mobile Robot Market Revenue billion Forecast, by End-Use: 2019 & 2032

- Table 40: Global Autonomous Mobile Robot Market Volume units Forecast, by End-Use: 2019 & 2032

- Table 41: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Country 2019 & 2032

- Table 42: Global Autonomous Mobile Robot Market Volume units Forecast, by Country 2019 & 2032

- Table 43: China Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 44: China Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 45: India Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 46: India Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 47: Japan Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 48: Japan Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 49: Australia Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 50: Australia Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 51: South Korea Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 52: South Korea Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 53: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Type: 2019 & 2032

- Table 54: Global Autonomous Mobile Robot Market Volume units Forecast, by Type: 2019 & 2032

- Table 55: Global Autonomous Mobile Robot Market Revenue billion Forecast, by End-Use: 2019 & 2032

- Table 56: Global Autonomous Mobile Robot Market Volume units Forecast, by End-Use: 2019 & 2032

- Table 57: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Country 2019 & 2032

- Table 58: Global Autonomous Mobile Robot Market Volume units Forecast, by Country 2019 & 2032

- Table 59: Brazil Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 60: Brazil Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 61: Mexico Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 62: Mexico Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 63: Argentina Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 64: Argentina Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 65: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Type: 2019 & 2032

- Table 66: Global Autonomous Mobile Robot Market Volume units Forecast, by Type: 2019 & 2032

- Table 67: Global Autonomous Mobile Robot Market Revenue billion Forecast, by End-Use: 2019 & 2032

- Table 68: Global Autonomous Mobile Robot Market Volume units Forecast, by End-Use: 2019 & 2032

- Table 69: Global Autonomous Mobile Robot Market Revenue billion Forecast, by Country 2019 & 2032

- Table 70: Global Autonomous Mobile Robot Market Volume units Forecast, by Country 2019 & 2032

- Table 71: Saudi Arabia Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 72: Saudi Arabia Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 73: UAE Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 74: UAE Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

- Table 75: South Africa Autonomous Mobile Robot Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 76: South Africa Autonomous Mobile Robot Market Volume (units) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.