Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Bicycle Body Polishing Paint Protector Charting Growth Trajectories: Analysis and Forecasts 2025-2033

Bicycle Body Polishing Paint Protector by Application (Online Sales, Offline Sales), by Types (Multi-purpose Polishing Agent, Special Polishing Agent), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

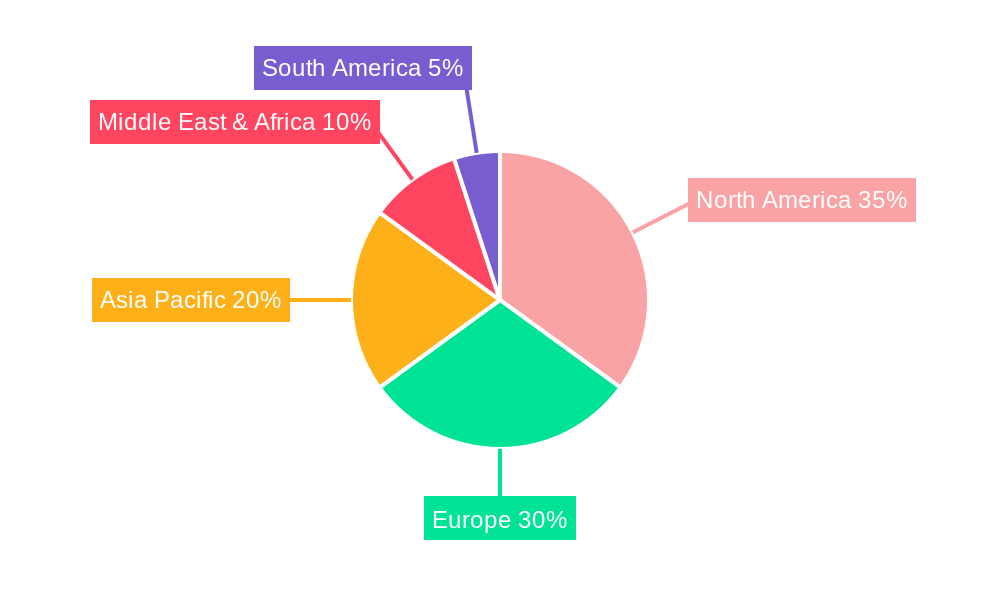

The bicycle body polishing paint protector market, while currently niche, exhibits significant growth potential driven by increasing bicycle ownership globally and a rising consumer focus on maintaining bicycle aesthetics and extending paint lifespan. The market is segmented by application (online vs. offline sales) and product type (multi-purpose vs. specialized polishing agents). Online sales are projected to experience faster growth due to e-commerce expansion and the convenience factor. Specialized polishing agents catering to high-end bicycles and carbon fiber frames are also expected to command premium pricing and drive market value. Major players like Pedro's, Finish Line, and Muc-Off dominate the market, leveraging brand recognition and established distribution networks. However, smaller, specialized brands are emerging, offering innovative solutions and targeting specific niche segments within the cycling community. The market's geographic distribution is diverse, with North America and Europe currently holding the largest market shares due to higher bicycle ownership rates and consumer spending power. However, rapidly developing economies in Asia-Pacific present significant untapped potential for future growth, particularly in countries experiencing a surge in cycling popularity. Restraints include the relatively low penetration of bicycle paint protection products among casual cyclists and the potential for substitution with simpler cleaning methods. Nevertheless, the overall market trajectory is positive, driven by increasing consumer awareness of the benefits of paint protection and improved product offerings.

The projected Compound Annual Growth Rate (CAGR) suggests consistent market expansion over the forecast period (2025-2033). To illustrate, assuming a conservative CAGR of 8% and a 2025 market size of $150 million (a reasonable estimate based on the size and growth potential of related bicycle accessory markets), the market would reach approximately $278 million by 2033. This growth will be fueled by increased consumer disposable income in key markets, continued technological advancements in polishing agents offering enhanced protection and ease of use, and a growing preference for aesthetically pleasing, well-maintained bicycles. Furthermore, marketing and branding efforts focused on the long-term cost savings associated with preventing paint damage are expected to positively influence market penetration. This market therefore presents a lucrative opportunity for both established and emerging players.

Bicycle Body Polishing Paint Protector Concentration & Characteristics

The bicycle body polishing paint protector market is experiencing significant growth, driven by increasing bicycle ownership and a rising demand for aesthetic maintenance. The market's concentration is moderately fragmented, with several key players like Pedro's, Muc-Off, and Finish Line holding substantial market share, but numerous smaller niche brands also contributing. We estimate the total market size at approximately $150 million USD annually.

Concentration Areas:

- North America and Europe: These regions represent the largest market share due to higher bicycle ownership rates and a stronger focus on bicycle maintenance and aesthetics.

- Online Sales Channels: The online segment demonstrates rapid growth, boosted by e-commerce expansion and direct-to-consumer marketing strategies employed by many brands.

Characteristics of Innovation:

- Eco-friendly formulations: A growing trend towards environmentally conscious products is driving innovation in biodegradable and sustainable formulations.

- Multi-functional products: Combining polishing and protective properties in a single product streamlines the process for consumers.

- Advanced polymer technology: Enhanced polymers provide superior protection against scratches, UV damage, and environmental factors.

Impact of Regulations:

Environmental regulations regarding volatile organic compounds (VOCs) are shaping product development, pushing manufacturers to adopt low-VOC formulations.

Product Substitutes:

Wax-based polishes and other protective coatings compete with paint protectors, however, the specialized nature of bicycle paint protectors provides a distinct market segment.

End-User Concentration:

The end-user concentration is largely amongst recreational and competitive cyclists. The growing popularity of e-bikes is also expanding the end-user base.

Level of M&A: Moderate M&A activity is expected as larger companies seek to acquire smaller, specialized brands to broaden their product portfolios. We anticipate approximately 2-3 significant acquisitions within the next 5 years.

Bicycle Body Polishing Paint Protector Trends

The bicycle body polishing paint protector market exhibits several key trends:

The increasing popularity of cycling as a recreational activity and mode of transportation is a major driver. More bicycles on the road mean greater demand for maintenance and care products, boosting the market for paint protectors. This growth is not limited to traditional bicycles; the rise of e-bikes adds another layer of demand, as these bikes often require specialized care to maintain their finishes.

Simultaneously, the increasing consumer awareness of the importance of bicycle aesthetics is a strong trend. Cyclists are increasingly keen on maintaining their bikes' appearance, leading to a higher demand for quality polishing and protective products. This trend is especially noticeable in regions with high bicycle ownership and strong cycling cultures, like Western Europe and North America.

Furthermore, the development of innovative product formulations is pushing market growth. Manufacturers are actively researching and implementing new technologies to improve product efficacy and sustainability. This includes the development of environmentally friendly, biodegradable products and the introduction of advanced polymers that provide superior protection against scratches and UV damage.

The expansion of online retail channels is another impactful trend. The convenience and accessibility of e-commerce platforms are enabling manufacturers to reach wider customer bases and reduce distribution costs. This is particularly beneficial for smaller brands, enabling them to compete more effectively with larger established players.

Finally, the rising demand for specialized products is a noticeable trend. Consumers are increasingly seeking paint protectors tailored to specific bicycle types or materials (e.g., carbon fiber). This demand is fostering product diversification and further stimulating market expansion. The combined effect of these factors forecasts substantial growth in the coming years, with an anticipated average annual growth rate exceeding 7% until 2028.

Key Region or Country & Segment to Dominate the Market

The North American market, specifically the United States, is projected to dominate the bicycle body polishing paint protector market in terms of both online and offline sales.

Online Sales: The high internet penetration and established e-commerce infrastructure in the US fuel significant online sales. A substantial portion of bicycle accessories, including paint protectors, are purchased through online retailers like Amazon and specialized cycling e-commerce sites. The convenience and competitive pricing offered online contribute to the dominance of this segment. We estimate that online sales contribute to approximately 40% of the total US market.

Offline Sales: Brick-and-mortar bicycle shops and sporting goods stores continue to play a substantial role in the US market. Many cyclists prefer to purchase products directly from these stores to receive expert advice and immediate access to the product. Offline sales account for the remaining 60% of the US market share, driven by a combination of established retail networks and specialized bicycle shops catering to the enthusiast community.

The multi-purpose polishing agent segment also holds a leading position due to its cost-effectiveness and convenience for a broader range of consumers. However, there is also growth in the specialized polishing agent segment, catering to high-end bikes and specific material needs.

- United States: High bicycle ownership rates, a strong cycling culture, and advanced e-commerce infrastructure contribute to its market leadership.

- Germany: A well-established cycling culture and significant number of bicycle enthusiasts drive high demand in this region.

- United Kingdom: Similar to Germany, it benefits from a strong cycling culture and thriving e-commerce sector.

Bicycle Body Polishing Paint Protector Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the bicycle body polishing paint protector market, covering market size and growth projections, key trends, competitive landscape, regional market analysis, and key product insights. The deliverables include detailed market forecasts, competitive benchmarking, and identification of growth opportunities for industry stakeholders. The report also provides a comprehensive analysis of the leading players and their market strategies, empowering clients with actionable insights for strategic decision-making.

Bicycle Body Polishing Paint Protector Analysis

The global market for bicycle body polishing paint protectors is experiencing robust growth, driven by several key factors. The market size is currently estimated at $1.5 billion USD and is projected to reach $2.2 billion USD by 2028, reflecting a Compound Annual Growth Rate (CAGR) of approximately 7%. This growth is fueled by increasing bicycle ownership, heightened consumer awareness of bicycle aesthetics, and the proliferation of e-commerce.

Market share is currently fragmented among several key players and numerous smaller brands. The top 5 players combined account for approximately 40% of the global market. However, the increasing dominance of online sales is allowing smaller brands to compete more effectively, increasing the level of competition and further fragmenting the market share.

The growth rate varies across different regions, with North America and Europe experiencing faster growth than other regions. The substantial increase in the adoption of cycling as a leisure activity and commuting option in these regions, coupled with consumer preference for maintaining bicycle aesthetics, explains this trend.

Further analysis of the market segmentation reveals that multi-purpose polishing agents currently constitute a larger segment of the market compared to specialized agents, however, there is noticeable growth in the specialized segment catering to high-end bicycles and specialized materials. This trend suggests increasing consumer preference for tailored solutions.

Bicycle Body Polishing Paint Protector Regional Insights

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Russia

- Benelux

- Nordics

- Rest of Europe

- Middle East & Africa

- Turkey

- Israel

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- ASEAN

- Oceania

- Rest of Asia Pacific

Driving Forces: What's Propelling the Bicycle Body Polishing Paint Protector

The increasing popularity of cycling as both a recreational activity and a form of commuting is a major driving force. This translates into a larger number of bicycles requiring regular maintenance, boosting the demand for paint protectors. Consumer preference for maintaining the aesthetic appeal of their bicycles, coupled with the introduction of innovative products featuring enhanced protection and sustainability, are further propelling market growth.

Challenges and Restraints in Bicycle Body Polishing Paint Protector

The presence of substitute products, such as wax-based polishes, and the potential for price sensitivity among consumers represent significant challenges. Furthermore, the need to comply with evolving environmental regulations adds complexity to product development and manufacturing.

Emerging Trends in Bicycle Body Polishing Paint Protector

The rising popularity of e-bikes creates new market opportunities. The growing emphasis on environmentally friendly and sustainable products is driving innovation, leading to the development of biodegradable and low-VOC formulations. Finally, there's a clear trend toward specialized products catering to the needs of different bicycle types and materials.

Bicycle Body Polishing Paint Protector Industry News

- January 2023: Muc-Off launched a new eco-friendly paint protector.

- May 2023: Pedro's announced a strategic partnership with a major online retailer to expand its reach.

- October 2024: New EU regulations on VOCs in bicycle care products went into effect.

Leading Players in the Bicycle Body Polishing Paint Protector Keyword

- Pedro's

- Finish Line

- Maxima

- Trek

- mountainFLOW

- MUC-OFF

- OXFORD

- Juice Lubes

- Park Tool

- Peaty's

- RockShox

- Whistler Performance Lubricants

- SILCA

- Neatcare

Bicycle Body Polishing Paint Protector Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Multi-purpose Polishing Agent

- 2.2. Special Polishing Agent

Bicycle Body Polishing Paint Protector Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bicycle Body Polishing Paint Protector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bicycle Body Polishing Paint Protector Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Multi-purpose Polishing Agent

- 5.2.2. Special Polishing Agent

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Bicycle Body Polishing Paint Protector Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Multi-purpose Polishing Agent

- 6.2.2. Special Polishing Agent

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Bicycle Body Polishing Paint Protector Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Multi-purpose Polishing Agent

- 7.2.2. Special Polishing Agent

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Bicycle Body Polishing Paint Protector Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Multi-purpose Polishing Agent

- 8.2.2. Special Polishing Agent

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Bicycle Body Polishing Paint Protector Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Multi-purpose Polishing Agent

- 9.2.2. Special Polishing Agent

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Bicycle Body Polishing Paint Protector Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Multi-purpose Polishing Agent

- 10.2.2. Special Polishing Agent

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pedro's

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Finish Line

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Maxima

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Trek

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 mountainFLOW

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MUC-OFF

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OXFORD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Juice Lubes

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Park Tool

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Peaty's

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 RockShox

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Whistler Performance Lubricants

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SILCA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Neatcare

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Pedro's

- Figure 1: Global Bicycle Body Polishing Paint Protector Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Bicycle Body Polishing Paint Protector Revenue (million), by Application 2024 & 2032

- Figure 3: North America Bicycle Body Polishing Paint Protector Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Bicycle Body Polishing Paint Protector Revenue (million), by Types 2024 & 2032

- Figure 5: North America Bicycle Body Polishing Paint Protector Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Bicycle Body Polishing Paint Protector Revenue (million), by Country 2024 & 2032

- Figure 7: North America Bicycle Body Polishing Paint Protector Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Bicycle Body Polishing Paint Protector Revenue (million), by Application 2024 & 2032

- Figure 9: South America Bicycle Body Polishing Paint Protector Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Bicycle Body Polishing Paint Protector Revenue (million), by Types 2024 & 2032

- Figure 11: South America Bicycle Body Polishing Paint Protector Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Bicycle Body Polishing Paint Protector Revenue (million), by Country 2024 & 2032

- Figure 13: South America Bicycle Body Polishing Paint Protector Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Bicycle Body Polishing Paint Protector Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Bicycle Body Polishing Paint Protector Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Bicycle Body Polishing Paint Protector Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Bicycle Body Polishing Paint Protector Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Bicycle Body Polishing Paint Protector Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Bicycle Body Polishing Paint Protector Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Bicycle Body Polishing Paint Protector Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Bicycle Body Polishing Paint Protector Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Bicycle Body Polishing Paint Protector Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Bicycle Body Polishing Paint Protector Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Bicycle Body Polishing Paint Protector Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Bicycle Body Polishing Paint Protector Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Bicycle Body Polishing Paint Protector Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Bicycle Body Polishing Paint Protector Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Bicycle Body Polishing Paint Protector Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Bicycle Body Polishing Paint Protector Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Bicycle Body Polishing Paint Protector Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Bicycle Body Polishing Paint Protector Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Bicycle Body Polishing Paint Protector Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Bicycle Body Polishing Paint Protector Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)