Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Biomass Hard Carbon Anode Precursor Report Probes the XXX million Size, Share, Growth Report and Future Analysis by 2033

Biomass Hard Carbon Anode Precursor by Application (Na Battery, Super Capacitor, Harsh Environment Batteries, Start-Stop Battery, Power Battery), by Types (Biomass, Biomass Polysaccharides), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global biomass hard carbon anode precursor market is experiencing robust growth, driven by the increasing demand for high-performance batteries in electric vehicles (EVs), energy storage systems (ESS), and portable electronics. The market's expansion is fueled by several key factors: the rising adoption of EVs globally, the urgent need for efficient and sustainable energy storage solutions, and the inherent advantages of biomass-derived hard carbon, such as its low cost, sustainability, and improved electrochemical performance compared to traditional graphite anodes. Specific applications like sodium-ion batteries (Na-ion batteries) and supercapacitors are significantly contributing to market growth, as these technologies are increasingly explored as cost-effective alternatives to lithium-ion batteries. The market is segmented by precursor type (e.g., biomass polysaccharides) and application, reflecting diverse usage across different battery technologies. While challenges remain, including the need for consistent quality control in biomass sourcing and processing, ongoing research and development efforts are continuously improving the performance and scalability of biomass hard carbon anode precursors, mitigating these limitations. Major players in the market, including Kuraray, Stora Enso, and Sumitomo Bakelite, are actively involved in developing innovative solutions and expanding their production capacity to meet the growing demand.

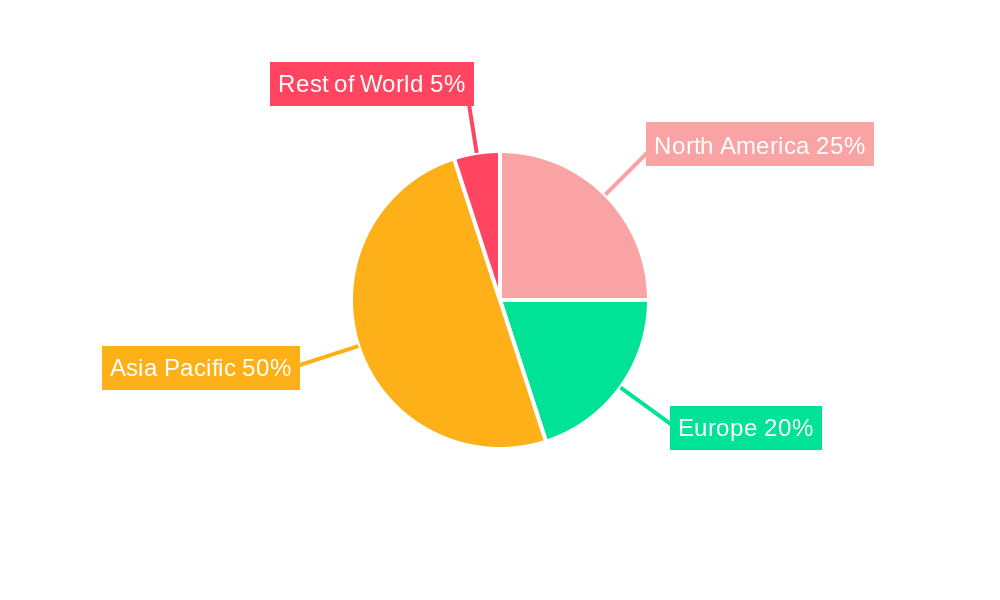

Looking forward, the market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) through 2033. This sustained growth will be propelled by continuous technological advancements, increased government support for renewable energy initiatives, and growing investments in battery manufacturing facilities worldwide. Regional variations in growth are expected, with Asia-Pacific (particularly China and India) leading the market expansion due to the rapid growth of the EV industry and robust manufacturing base in these regions. However, North America and Europe are also anticipated to contribute significantly, driven by policies promoting clean energy transition and the growing adoption of energy storage solutions in grid-scale applications. The competitive landscape is characterized by both established chemical companies and specialized battery material manufacturers, fostering innovation and ensuring market supply. The focus on improving the scalability and cost-effectiveness of biomass hard carbon anode precursor production will be key to sustaining future growth.

Biomass Hard Carbon Anode Precursor Concentration & Characteristics

The global biomass hard carbon anode precursor market is experiencing significant growth, driven by the burgeoning demand for energy storage solutions. Market concentration is moderate, with a few large players like Kuraray and Stora Enso holding substantial shares, alongside numerous smaller, regional producers. The market size is estimated at $2.5 billion in 2024, projected to reach $5 billion by 2028.

Concentration Areas:

- East Asia (China, Japan, South Korea) accounts for over 60% of global production due to robust battery manufacturing industries.

- Europe and North America exhibit significant demand but rely heavily on imports.

Characteristics of Innovation:

- Focus on developing precursors with enhanced electrochemical performance (higher capacity, better rate capability, longer cycle life).

- Research into sustainable and cost-effective biomass sources (agricultural waste, forestry residues).

- Advancements in carbonization techniques to optimize porosity and surface area.

Impact of Regulations:

Stringent environmental regulations are driving the adoption of sustainable anode materials, favoring biomass-based precursors. Government incentives for renewable energy storage are further boosting market growth.

Product Substitutes:

Graphite remains the dominant anode material, but its limitations in energy density are pushing the adoption of hard carbon. Other emerging anode materials like silicon and lithium titanate pose some competition, but biomass hard carbon offers a cost-effective and sustainable alternative.

End-User Concentration:

Major end-users include battery manufacturers (both large-scale and niche players) across various applications (electric vehicles, grid-scale energy storage).

Level of M&A:

Moderate M&A activity is observed, mainly focused on securing supply chains and acquiring specialized technologies. Larger players are strategically acquiring smaller companies with innovative precursor technologies.

Biomass Hard Carbon Anode Precursor Trends

The biomass hard carbon anode precursor market is experiencing robust growth, fueled by several key trends:

Expanding Electric Vehicle (EV) Market: The explosive growth of the EV industry is the primary driver, demanding massive quantities of high-performance batteries. Biomass hard carbon offers a compelling cost-effective and sustainable alternative to traditional graphite anodes, especially for sodium-ion batteries. The market value associated with EV battery applications is expected to account for approximately 65% of the total demand by 2028.

Growing Demand for Energy Storage Systems (ESS): The increasing integration of renewable energy sources (solar and wind) requires efficient and cost-effective energy storage solutions. Biomass-derived hard carbon anodes are well-suited for grid-scale ESS applications, contributing to the market's expansion. This segment is estimated to contribute approximately 20% to the total market value by 2028.

Advancements in Battery Technologies: Ongoing research and development efforts are focused on improving the performance characteristics of biomass hard carbon, including energy density, cycle life, and rate capability. This push for innovation is leading to more efficient and cost-effective battery technologies, further stimulating demand. Improvements in production methods that reduce impurities and optimize the carbon structure have led to cost reductions and performance enhancements.

Increasing Focus on Sustainability: The growing awareness of environmental concerns and the push for sustainable solutions are driving the adoption of biomass-derived materials. Biomass hard carbon offers a significant environmental advantage over graphite, reducing carbon footprint and utilizing waste materials. Government policies and regulations promoting sustainability are further bolstering the market.

Technological Advancements in Sodium-ion Batteries: Sodium-ion batteries are gaining traction as a cost-effective alternative to lithium-ion batteries, and biomass hard carbon is an ideal anode material for sodium-ion technologies. This segment is expected to experience exponential growth within the next five years.

Regional Variations in Market Growth: While East Asia currently dominates the market, other regions, particularly Europe and North America, are experiencing a rapid increase in demand, fueled by regional EV adoption and government support for sustainable energy technologies. This geographic expansion will contribute to global market growth.

Price Fluctuations and Raw Material Availability: The price volatility of raw materials and potential challenges associated with securing a consistent supply of suitable biomass feedstock could affect market growth. However, efficient waste management and innovative biomass sourcing strategies are mitigating these risks.

Key Region or Country & Segment to Dominate the Market

The China market is poised to dominate the biomass hard carbon anode precursor market, driven by the massive expansion of its domestic EV and energy storage industries. The country's strong manufacturing base, substantial investments in renewable energy, and supportive government policies are key factors contributing to its market leadership.

Dominant Segment: The Power Battery application segment will continue to be the most significant contributor to market growth due to the escalating demand for EVs and hybrid vehicles in China. The market's growth is tightly linked to the government's ambitious electrification targets and the continuous expansion of the electric vehicle market.

Regional Breakdown: Within China, regions like Jiangsu, Zhejiang, and Guangdong provinces are leading the production and adoption of biomass hard carbon anode materials. These regions boast a high concentration of battery manufacturing facilities, strong supply chains, and abundant access to suitable biomass feedstocks.

Other Key Regions: While China dominates, other regions are expected to witness significant growth. Europe is witnessing a rise in demand, driven by its commitment to renewable energy goals and the growing adoption of EVs. North America's market growth will be propelled by an increasing shift towards electric mobility and incentives for energy storage solutions.

Competitive Landscape: The Chinese market is highly competitive, with both large established players and numerous smaller companies vying for market share. This intense competition is fostering innovation and price optimization, benefiting end-users.

Challenges: Maintaining a consistent and sustainable supply of high-quality biomass feedstock and addressing potential environmental concerns related to carbonization processes are significant challenges for the industry. Stricter environmental regulations and the need for efficient waste management will shape the market's future.

Biomass Hard Carbon Anode Precursor Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the biomass hard carbon anode precursor market, including detailed market sizing and forecasting, regional and segment-specific insights, competitive landscape analysis, and future growth projections. It includes in-depth information on key players, market trends, technological advancements, and regulatory landscape. The report offers actionable insights and recommendations for stakeholders, enabling strategic decision-making within the rapidly evolving energy storage sector.

Biomass Hard Carbon Anode Precursor Analysis

The global biomass hard carbon anode precursor market is experiencing substantial growth, driven by the increasing demand for high-performance batteries in diverse applications. The market size is projected to reach $5 billion by 2028, registering a compound annual growth rate (CAGR) of over 20%. This significant growth is attributed to the escalating adoption of electric vehicles (EVs), the expanding energy storage sector, and advancements in battery technologies.

Major players, including Kuraray, Stora Enso, and Sumitomo Bakelite, are actively involved in developing and commercializing innovative biomass hard carbon anode precursors. These companies are leveraging their expertise in material science and manufacturing to meet the growing demand from battery manufacturers. The market share is relatively fragmented, with a few dominant players and several smaller regional manufacturers competing based on price, quality, and technological capabilities.

Growth is further fueled by favorable government regulations, increasing environmental awareness, and the cost-effectiveness of biomass-derived materials compared to traditional graphite anodes. However, challenges exist, including maintaining a consistent supply of suitable biomass feedstocks and managing environmental concerns related to the carbonization processes. Despite these challenges, the overall market outlook remains positive, with significant growth expected in the coming years.

Biomass Hard Carbon Anode Precursor Regional Insights

- North America

- United States: High demand driven by EV adoption and government support for renewable energy.

- Canada: Growing interest in sustainable energy solutions and potential for biomass resource utilization.

- Mexico: Moderate growth potential, dependent on investments in renewable energy infrastructure.

- South America

- Brazil: Emerging market with potential for growth, driven by increasing EV adoption.

- Argentina: Relatively small market compared to other regions.

- Rest of South America: Limited market size, significant growth potential in the long term.

- Europe

- United Kingdom: Strong demand fueled by government policies supporting electric mobility and renewable energy.

- Germany: Substantial market size, a major player in the automotive and energy sectors.

- France: Growing demand for sustainable energy solutions and electric vehicles.

- Italy: Moderate growth potential.

- Spain: Emerging market with increasing interest in renewable energy.

- Russia: Relatively small market size compared to Western Europe.

- Benelux: Moderate growth potential.

- Nordics: Strong focus on sustainability and renewable energy, high demand expected.

- Rest of Europe: Moderate growth potential.

- Middle East & Africa

- Turkey: Moderate growth potential.

- Israel: Relatively small market size, high demand in niche applications.

- GCC: Growing interest in renewable energy, potential for market growth.

- North Africa: Emerging market with limited market size.

- South Africa: Moderate growth potential.

- Rest of Middle East & Africa: Limited market size, potential for future growth.

- Asia Pacific

- China: Dominant market, driven by massive EV adoption and strong government support.

- India: Significant growth potential, due to increasing demand for affordable energy storage solutions.

- Japan: Large market with significant investments in battery technology.

- South Korea: Major player in the battery manufacturing industry.

- ASEAN: Moderate growth potential, driven by rising urbanization and industrialization.

- Oceania: Relatively small market size.

- Rest of Asia Pacific: Moderate growth potential.

Driving Forces: What's Propelling the Biomass Hard Carbon Anode Precursor

The burgeoning electric vehicle market, coupled with the expanding demand for renewable energy storage and the cost-effectiveness of biomass-derived materials compared to traditional graphite, are the primary driving forces. Government incentives and regulations supporting sustainable energy solutions also play a critical role.

Challenges and Restraints in Biomass Hard Carbon Anode Precursor

Challenges include securing a consistent supply chain of high-quality biomass feedstock, managing the price volatility of raw materials, and addressing environmental concerns related to carbonization processes. Competition from established anode materials like graphite also poses a restraint.

Emerging Trends in Biomass Hard Carbon Anode Precursor

Emerging trends include the development of advanced carbonization techniques to optimize material properties, research into novel biomass sources to enhance sustainability and cost-effectiveness, and the exploration of hybrid anode materials combining biomass hard carbon with other high-performance materials.

Biomass Hard Carbon Anode Precursor Industry News

- January 2024: Kuraray announces a new production facility for biomass hard carbon precursors in Japan.

- March 2024: Stora Enso secures a significant contract to supply biomass feedstock to a major battery manufacturer in China.

- June 2024: Sumitomo Bakelite unveils a new, high-performance biomass hard carbon anode precursor with enhanced energy density.

Leading Players in the Biomass Hard Carbon Anode Precursor

- Kuraray

- Stora Enso

- Sumitomo Bakelite Co.,Ltd.

- KUREHA CORPORATION

- JFE Holdings

- Btr New Material Group Co.,ltd. (China Bao'an Group Co.,Ltd.)

- Hunan Zhongke Electric Co.,Ltd.

- Xiang Fenghua

- Fujian Yuanli Active Carbon Co.,Ltd.

- Jinan Shengquan Group Share Holding Co.,ltd.

- Sxicc

- Do-Fluoride New Materials Co.,Ltd.

- Lsgraphene

- Rongnahc

- Cdbsg

- Shenzhen Jana Energy Technology Co.,Ltd.

- Wuhan Bisidi Battery Material Co.,Ltd.

- Sunwoda Power Technology Co.,Ltd.

- Hinabattery

- Putailai

Biomass Hard Carbon Anode Precursor Segmentation

-

1. Application

- 1.1. Na Battery

- 1.2. Super Capacitor

- 1.3. Harsh Environment Batteries

- 1.4. Start-Stop Battery

- 1.5. Power Battery

-

2. Types

- 2.1. Biomass

- 2.2. Biomass Polysaccharides

Biomass Hard Carbon Anode Precursor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Biomass Hard Carbon Anode Precursor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biomass Hard Carbon Anode Precursor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Na Battery

- 5.1.2. Super Capacitor

- 5.1.3. Harsh Environment Batteries

- 5.1.4. Start-Stop Battery

- 5.1.5. Power Battery

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Biomass

- 5.2.2. Biomass Polysaccharides

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Biomass Hard Carbon Anode Precursor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Na Battery

- 6.1.2. Super Capacitor

- 6.1.3. Harsh Environment Batteries

- 6.1.4. Start-Stop Battery

- 6.1.5. Power Battery

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Biomass

- 6.2.2. Biomass Polysaccharides

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Biomass Hard Carbon Anode Precursor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Na Battery

- 7.1.2. Super Capacitor

- 7.1.3. Harsh Environment Batteries

- 7.1.4. Start-Stop Battery

- 7.1.5. Power Battery

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Biomass

- 7.2.2. Biomass Polysaccharides

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Biomass Hard Carbon Anode Precursor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Na Battery

- 8.1.2. Super Capacitor

- 8.1.3. Harsh Environment Batteries

- 8.1.4. Start-Stop Battery

- 8.1.5. Power Battery

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Biomass

- 8.2.2. Biomass Polysaccharides

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Biomass Hard Carbon Anode Precursor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Na Battery

- 9.1.2. Super Capacitor

- 9.1.3. Harsh Environment Batteries

- 9.1.4. Start-Stop Battery

- 9.1.5. Power Battery

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Biomass

- 9.2.2. Biomass Polysaccharides

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Biomass Hard Carbon Anode Precursor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Na Battery

- 10.1.2. Super Capacitor

- 10.1.3. Harsh Environment Batteries

- 10.1.4. Start-Stop Battery

- 10.1.5. Power Battery

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Biomass

- 10.2.2. Biomass Polysaccharides

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Kuraray

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Stora Enso

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sumitomo Bakelite Co.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KUREHA CORPORATION

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JFE Holdings

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Btr New Material Group Co.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ltd. (China Bao'an Group Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hunan Zhongke Electric Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Xiang Fenghua

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Fujian Yuanli Active Carbon Co.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ltd.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Jinan Shengquan Group Share Holding Co.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ltd.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Sxicc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Do-Fluoride New Materials Co.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Ltd.

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Lsgraphene

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Rongnahc

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Cdbsg

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Shenzhen Jana Energy Technology Co.

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Ltd.

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Wuhan Bisidi Battery Material Co.

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Ltd.

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Sunwoda Power Technology Co.

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Ltd.

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Hinabattery

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Putailai

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.1 Kuraray

- Figure 1: Global Biomass Hard Carbon Anode Precursor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Biomass Hard Carbon Anode Precursor Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Biomass Hard Carbon Anode Precursor Revenue (million), by Application 2024 & 2032

- Figure 4: North America Biomass Hard Carbon Anode Precursor Volume (K), by Application 2024 & 2032

- Figure 5: North America Biomass Hard Carbon Anode Precursor Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Biomass Hard Carbon Anode Precursor Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Biomass Hard Carbon Anode Precursor Revenue (million), by Types 2024 & 2032

- Figure 8: North America Biomass Hard Carbon Anode Precursor Volume (K), by Types 2024 & 2032

- Figure 9: North America Biomass Hard Carbon Anode Precursor Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Biomass Hard Carbon Anode Precursor Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Biomass Hard Carbon Anode Precursor Revenue (million), by Country 2024 & 2032

- Figure 12: North America Biomass Hard Carbon Anode Precursor Volume (K), by Country 2024 & 2032

- Figure 13: North America Biomass Hard Carbon Anode Precursor Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Biomass Hard Carbon Anode Precursor Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Biomass Hard Carbon Anode Precursor Revenue (million), by Application 2024 & 2032

- Figure 16: South America Biomass Hard Carbon Anode Precursor Volume (K), by Application 2024 & 2032

- Figure 17: South America Biomass Hard Carbon Anode Precursor Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Biomass Hard Carbon Anode Precursor Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Biomass Hard Carbon Anode Precursor Revenue (million), by Types 2024 & 2032

- Figure 20: South America Biomass Hard Carbon Anode Precursor Volume (K), by Types 2024 & 2032

- Figure 21: South America Biomass Hard Carbon Anode Precursor Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Biomass Hard Carbon Anode Precursor Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Biomass Hard Carbon Anode Precursor Revenue (million), by Country 2024 & 2032

- Figure 24: South America Biomass Hard Carbon Anode Precursor Volume (K), by Country 2024 & 2032

- Figure 25: South America Biomass Hard Carbon Anode Precursor Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Biomass Hard Carbon Anode Precursor Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Biomass Hard Carbon Anode Precursor Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Biomass Hard Carbon Anode Precursor Volume (K), by Application 2024 & 2032

- Figure 29: Europe Biomass Hard Carbon Anode Precursor Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Biomass Hard Carbon Anode Precursor Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Biomass Hard Carbon Anode Precursor Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Biomass Hard Carbon Anode Precursor Volume (K), by Types 2024 & 2032

- Figure 33: Europe Biomass Hard Carbon Anode Precursor Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Biomass Hard Carbon Anode Precursor Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Biomass Hard Carbon Anode Precursor Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Biomass Hard Carbon Anode Precursor Volume (K), by Country 2024 & 2032

- Figure 37: Europe Biomass Hard Carbon Anode Precursor Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Biomass Hard Carbon Anode Precursor Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Biomass Hard Carbon Anode Precursor Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Biomass Hard Carbon Anode Precursor Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Biomass Hard Carbon Anode Precursor Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Biomass Hard Carbon Anode Precursor Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Biomass Hard Carbon Anode Precursor Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Biomass Hard Carbon Anode Precursor Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Biomass Hard Carbon Anode Precursor Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Biomass Hard Carbon Anode Precursor Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Biomass Hard Carbon Anode Precursor Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Biomass Hard Carbon Anode Precursor Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Biomass Hard Carbon Anode Precursor Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Biomass Hard Carbon Anode Precursor Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Biomass Hard Carbon Anode Precursor Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Biomass Hard Carbon Anode Precursor Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Biomass Hard Carbon Anode Precursor Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Biomass Hard Carbon Anode Precursor Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Biomass Hard Carbon Anode Precursor Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Biomass Hard Carbon Anode Precursor Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Biomass Hard Carbon Anode Precursor Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Biomass Hard Carbon Anode Precursor Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Biomass Hard Carbon Anode Precursor Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Biomass Hard Carbon Anode Precursor Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Biomass Hard Carbon Anode Precursor Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Biomass Hard Carbon Anode Precursor Volume Share (%), by Country 2024 & 2032

- Table 1: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Biomass Hard Carbon Anode Precursor Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Biomass Hard Carbon Anode Precursor Volume K Forecast, by Country 2019 & 2032

- Table 81: China Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Biomass Hard Carbon Anode Precursor Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Biomass Hard Carbon Anode Precursor Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)