Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Cloud Data Center Market Unlocking Growth Potential: 2025-2033 Analysis and Forecasts

Cloud Data Center Market by Service Model (Infrastructure-as-a-service model (IaaS), Platform-as-a-service model (PaaS), Software-as-a-service model (SaaS)), by Deployment Model (Public, Private, Hybrid), by Organization Size (Small/Medium Enterprises, Large Enterprises), by End-use (BFSI, Colocation, Energy, Government, Healthcare, Manufacturing, IT & Telecom, Others), by North America (U.S., Canada, Mexico), by Europe (UK, Germany, France, Spain, Poland, Benelux), by Asia Pacific (China, India, Japan, Singapore, Australia, South Korea), by South America (Brazil, Argentina, Chile, Colombia), by MEA (UAE, Saudi Arabia, South Africa) Forecast 2025-2033

Key Insights

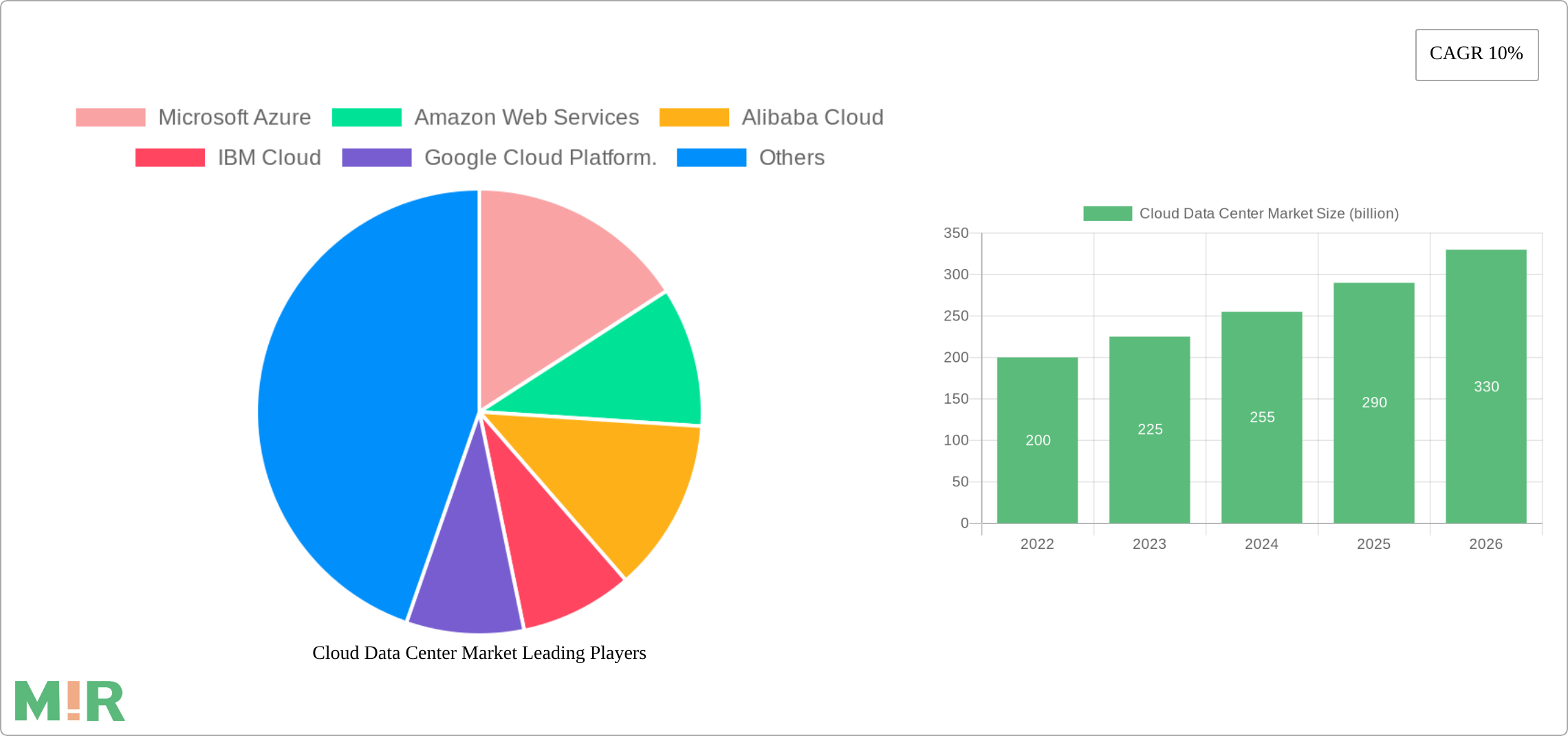

The size of the Cloud Data Center Market was valued at USD 20 billion in 2024 and is projected to reach USD 38.97 billion by 2033, with an expected CAGR of 10% during the forecast period. The Cloud Data Center market is a rapidly expanding sector, currently valued at $20 billion and projected to experience substantial growth with a compound annual growth rate (CAGR) of 10%. This robust expansion is fueled by several key factors. The increasing adoption of cloud computing across diverse industries, driven by the need for enhanced scalability, flexibility, and cost-effectiveness, is a primary driver. Organizations are increasingly migrating their IT infrastructure to the cloud to leverage its inherent advantages in terms of agility and reduced capital expenditure. Furthermore, government initiatives promoting digital transformation and the escalating demand for data storage and processing are significantly contributing to market growth. Technological advancements, such as the development of more efficient and powerful hardware and software solutions, are further accelerating this expansion. The rise of hybrid cloud models, offering a blend of public and private cloud environments, allows organizations to optimize their cloud strategies, enhancing security and control while benefiting from the scalability of public cloud services. This versatility is a crucial factor in the market's continued growth. The market encompasses a broad range of applications, from managing large datasets for businesses to powering critical government services, underpinning its expansive potential. Major players like Amazon Web Services, Microsoft Azure, and Google Cloud Platform are continuously innovating and expanding their offerings, further driving market competition and growth.

Cloud Data Center Market Concentration & Characteristics

The cloud data center market exhibits a high degree of concentration, with a few dominant players—namely, Amazon Web Services, Microsoft Azure, Google Cloud Platform, Alibaba Cloud, and IBM Cloud—holding significant market share. This oligopolistic structure is characterized by intense competition, driving continuous innovation in service offerings, pricing strategies, and technological advancements. The market is highly innovative, with companies constantly striving to enhance their services through advancements in areas such as artificial intelligence (AI), machine learning (ML), and edge computing. Regulations, particularly those concerning data privacy and security (like GDPR), significantly impact the market. Companies must comply with these regulations, leading to increased costs and operational complexities. Product substitution is limited, as the services offered are relatively specialized and integrated. End-user concentration varies across sectors, with some industries, such as IT and Telecom, exhibiting higher adoption rates than others. The level of mergers and acquisitions (M&A) activity is high, reflecting the industry's dynamic nature and the ongoing consolidation of market share amongst the major players. This strategic activity allows companies to expand their service portfolios, gain access to new technologies, and strengthen their competitive positions.

Cloud Data Center Market Trends

The cloud data center market is witnessing several key trends. The increasing adoption of hybrid cloud models allows organizations to combine the benefits of public and private clouds, optimizing their infrastructure based on specific needs for security, compliance, and cost. The rise of edge computing is another significant trend, as organizations seek to process data closer to the source to reduce latency and improve response times. Artificial intelligence (AI) and machine learning (ML) are being increasingly integrated into cloud data center solutions, enabling advanced analytics and automation capabilities. Serverless computing is gaining traction, offering a more efficient and cost-effective way to manage applications. The focus on security is also intensifying, with companies investing heavily in measures to protect their data and infrastructure from cyber threats. The growth of the Internet of Things (IoT) is driving the demand for increased storage and processing capabilities in cloud data centers, leading to further market expansion. Sustainability initiatives are gaining prominence, with companies aiming to reduce the environmental impact of their data centers through energy efficiency measures. Finally, the increasing adoption of DevOps practices is streamlining the development and deployment of applications, increasing agility and efficiency.

Key Region or Country & Segment to Dominate the Market

- North America (Specifically, the U.S.) is expected to dominate the cloud data center market due to the high concentration of major technology companies, a strong IT infrastructure, and significant investments in cloud technology. The U.S. possesses a mature technological landscape and a robust ecosystem of cloud service providers, contributing to its market leadership. High levels of technological adoption and early investments in cloud infrastructure position the U.S. as a primary driver of global cloud adoption. Canada and Mexico are also important markets, albeit smaller compared to the U.S., and are expected to contribute to the North American regional dominance.

- Segment Dominance: The Infrastructure-as-a-Service (IaaS) segment is poised to maintain its leading position due to its scalability, cost-effectiveness, and broad applicability across diverse industries. IaaS provides a foundational layer for cloud computing, supporting a wide range of applications and services. The inherent flexibility and scalability of IaaS make it a preferred choice for businesses of all sizes, further fueling its market dominance.

Cloud Data Center Market Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the Cloud Data Center market, covering market size, growth trends, key players, and regional insights. The deliverables include detailed market segmentation by service model (IaaS, PaaS, SaaS), deployment model (public, private, hybrid), organization size (SMEs, large enterprises), and end-use industry. The report also analyzes competitive landscapes, including market share, mergers and acquisitions, and profiles of major players. Furthermore, it incorporates detailed regional breakdowns and forecasts, offering insights into future market dynamics and trends.

Cloud Data Center Market Analysis

The global Cloud Data Center market size is substantial, currently estimated at $20 billion, and is projected to grow significantly over the forecast period. This growth is propelled by various factors including the increasing adoption of cloud computing, rising data volumes, and the growing need for scalability and flexibility in IT infrastructure. Market share is highly concentrated among leading players, with a few dominant companies commanding a large percentage of the overall market. The growth rate varies across different segments, with certain segments, such as IaaS and public cloud deployments, experiencing faster growth compared to others. Market dynamics are influenced by technological advancements, regulatory changes, and competitive pressures.

Cloud Data Center Market Regional Insights

- North America:

- U.S.

- Canada

- Mexico

- Europe:

- UK

- Germany

- France

- Spain

- Poland

- Benelux

- Asia Pacific:

- China

- India

- Japan

- Singapore

- Australia

- South Korea

- South America:

- Brazil

- Argentina

- Chile

- Colombia

- MEA:

- UAE

- Saudi Arabia

- South Africa

Driving Forces: What's Propelling the Cloud Data Center Market

- Increasing adoption of cloud computing across industries.

- Rising data volumes and need for scalable infrastructure.

- Government initiatives promoting digital transformation.

- Technological advancements in cloud technologies.

- Growing demand for enhanced security and compliance.

- Cost optimization and efficiency gains.

Challenges and Restraints in Cloud Data Center Market

- Data security and privacy concerns.

- Regulatory compliance complexities.

- Vendor lock-in risks.

- High initial investment costs.

- Skilled workforce shortages.

- Network latency and connectivity issues in certain regions.

Emerging Trends in Cloud Data Center Market

- Hybrid cloud adoption.

- Edge computing.

- Serverless computing.

- Artificial intelligence (AI) and Machine Learning (ML) integration.

- Automation and orchestration.

- Sustainability initiatives in data center operations.

Cloud Data Center Industry News

Microsoft's Investment in Veeam Software: Microsoft has made an undisclosed equity investment in Veeam Software to enhance their collaboration in developing artificial intelligence (AI) products. Veeam specializes in software that enables rapid data recovery following cybersecurity incidents, offering immutable backups to prevent ransomware from altering or deleting data. This partnership aims to integrate Microsoft's AI services into Veeam's offerings, focusing on research and development and design collaboration.

Leading Players in the Cloud Data Center Market

Cloud Data Center Market Segmentation

- 1. Service Model

- 1.1. Infrastructure-as-a-service model (IaaS)

- 1.2. Platform-as-a-service model (PaaS)

- 1.3. Software-as-a-service model (SaaS)

- 2. Deployment Model

- 2.1. Public

- 2.2. Private

- 2.3. Hybrid

- 3. Organization Size

- 3.1. Small/Medium Enterprises

- 3.2. Large Enterprises

- 4. End-use

- 4.1. BFSI

- 4.2. Colocation

- 4.3. Energy

- 4.4. Government

- 4.5. Healthcare

- 4.6. Manufacturing

- 4.7. IT & Telecom

- 4.8. Others

Cloud Data Center Market Segmentation By Geography

- 1. North America

- 1.1. U.S.

- 1.2. Canada

- 1.3. Mexico

- 2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Poland

- 2.6. Benelux

- 3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Singapore

- 3.5. Australia

- 3.6. South Korea

- 4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Chile

- 4.4. Colombia

- 5. MEA

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. South Africa

Cloud Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased adoption of cloud-based services

- 3.2.2 Rising digitalization in various industries

- 3.2.3 Growth of e-commerce and online services

- 3.2.4 Government initiatives for cloud computing

- 3.2.5 Increasing data storage and processing requirements

- 3.3. Market Restrains

- 3.3.1 Complexity of cloud infrastructure

- 3.3.2 Data privacy and security

- 3.4. Market Trends

- 3.4.1 The cloud data center market is witnessing several key trends. The increasing adoption of hybrid cloud models allows organizations to combine the benefits of public and private clouds

- 3.4.2 optimizing their infrastructure based on specific needs for security

- 3.4.3 compliance

- 3.4.4 and cost. The rise of edge computing is another significant trend

- 3.4.5 as organizations seek to process data closer to the source to reduce latency and improve response times. Artificial intelligence (AI) and machine learning (ML) are being increasingly integrated into cloud data center solutions

- 3.4.6 enabling advanced analytics and automation capabilities. Serverless computing is gaining traction

- 3.4.7 offering a more efficient and cost-effective way to manage applications. The focus on security is also intensifying

- 3.4.8 with companies investing heavily in measures to protect their data and infrastructure from cyber threats. The growth of the Internet of Things (IoT) is driving the demand for increased storage and processing capabilities in cloud data centers

- 3.4.9 leading to further market expansion. Sustainability initiatives are gaining prominence

- 3.4.10 with companies aiming to reduce the environmental impact of their data centers through energy efficiency measures. Finally

- 3.4.11 the increasing adoption of DevOps practices is streamlining the development and deployment of applications

- 3.4.12 increasing agility and efficiency.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Model

- 5.1.1. Infrastructure-as-a-service model (IaaS)

- 5.1.2. Platform-as-a-service model (PaaS)

- 5.1.3. Software-as-a-service model (SaaS)

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. Public

- 5.2.2. Private

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Small/Medium Enterprises

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-use

- 5.4.1. BFSI

- 5.4.2. Colocation

- 5.4.3. Energy

- 5.4.4. Government

- 5.4.5. Healthcare

- 5.4.6. Manufacturing

- 5.4.7. IT & Telecom

- 5.4.8. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Service Model

- 6. North America Cloud Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Model

- 6.1.1. Infrastructure-as-a-service model (IaaS)

- 6.1.2. Platform-as-a-service model (PaaS)

- 6.1.3. Software-as-a-service model (SaaS)

- 6.2. Market Analysis, Insights and Forecast - by Deployment Model

- 6.2.1. Public

- 6.2.2. Private

- 6.2.3. Hybrid

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. Small/Medium Enterprises

- 6.3.2. Large Enterprises

- 6.4. Market Analysis, Insights and Forecast - by End-use

- 6.4.1. BFSI

- 6.4.2. Colocation

- 6.4.3. Energy

- 6.4.4. Government

- 6.4.5. Healthcare

- 6.4.6. Manufacturing

- 6.4.7. IT & Telecom

- 6.4.8. Others

- 6.1. Market Analysis, Insights and Forecast - by Service Model

- 7. Europe Cloud Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Model

- 7.1.1. Infrastructure-as-a-service model (IaaS)

- 7.1.2. Platform-as-a-service model (PaaS)

- 7.1.3. Software-as-a-service model (SaaS)

- 7.2. Market Analysis, Insights and Forecast - by Deployment Model

- 7.2.1. Public

- 7.2.2. Private

- 7.2.3. Hybrid

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. Small/Medium Enterprises

- 7.3.2. Large Enterprises

- 7.4. Market Analysis, Insights and Forecast - by End-use

- 7.4.1. BFSI

- 7.4.2. Colocation

- 7.4.3. Energy

- 7.4.4. Government

- 7.4.5. Healthcare

- 7.4.6. Manufacturing

- 7.4.7. IT & Telecom

- 7.4.8. Others

- 7.1. Market Analysis, Insights and Forecast - by Service Model

- 8. Asia Pacific Cloud Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Model

- 8.1.1. Infrastructure-as-a-service model (IaaS)

- 8.1.2. Platform-as-a-service model (PaaS)

- 8.1.3. Software-as-a-service model (SaaS)

- 8.2. Market Analysis, Insights and Forecast - by Deployment Model

- 8.2.1. Public

- 8.2.2. Private

- 8.2.3. Hybrid

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. Small/Medium Enterprises

- 8.3.2. Large Enterprises

- 8.4. Market Analysis, Insights and Forecast - by End-use

- 8.4.1. BFSI

- 8.4.2. Colocation

- 8.4.3. Energy

- 8.4.4. Government

- 8.4.5. Healthcare

- 8.4.6. Manufacturing

- 8.4.7. IT & Telecom

- 8.4.8. Others

- 8.1. Market Analysis, Insights and Forecast - by Service Model

- 9. South America Cloud Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Model

- 9.1.1. Infrastructure-as-a-service model (IaaS)

- 9.1.2. Platform-as-a-service model (PaaS)

- 9.1.3. Software-as-a-service model (SaaS)

- 9.2. Market Analysis, Insights and Forecast - by Deployment Model

- 9.2.1. Public

- 9.2.2. Private

- 9.2.3. Hybrid

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. Small/Medium Enterprises

- 9.3.2. Large Enterprises

- 9.4. Market Analysis, Insights and Forecast - by End-use

- 9.4.1. BFSI

- 9.4.2. Colocation

- 9.4.3. Energy

- 9.4.4. Government

- 9.4.5. Healthcare

- 9.4.6. Manufacturing

- 9.4.7. IT & Telecom

- 9.4.8. Others

- 9.1. Market Analysis, Insights and Forecast - by Service Model

- 10. MEA Cloud Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Service Model

- 10.1.1. Infrastructure-as-a-service model (IaaS)

- 10.1.2. Platform-as-a-service model (PaaS)

- 10.1.3. Software-as-a-service model (SaaS)

- 10.2. Market Analysis, Insights and Forecast - by Deployment Model

- 10.2.1. Public

- 10.2.2. Private

- 10.2.3. Hybrid

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. Small/Medium Enterprises

- 10.3.2. Large Enterprises

- 10.4. Market Analysis, Insights and Forecast - by End-use

- 10.4.1. BFSI

- 10.4.2. Colocation

- 10.4.3. Energy

- 10.4.4. Government

- 10.4.5. Healthcare

- 10.4.6. Manufacturing

- 10.4.7. IT & Telecom

- 10.4.8. Others

- 10.1. Market Analysis, Insights and Forecast - by Service Model

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Microsoft Azure

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amazon Web Services

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alibaba Cloud

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Cloud

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Google Cloud Platform.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Microsoft Azure

- Figure 1: Global Cloud Data Center Market Revenue Breakdown (billion, %) by Region 2024 & 2032

- Figure 2: Global Cloud Data Center Market Volume Breakdown (units, %) by Region 2024 & 2032

- Figure 3: North America Cloud Data Center Market Revenue (billion), by Service Model 2024 & 2032

- Figure 4: North America Cloud Data Center Market Volume (units), by Service Model 2024 & 2032

- Figure 5: North America Cloud Data Center Market Revenue Share (%), by Service Model 2024 & 2032

- Figure 6: North America Cloud Data Center Market Volume Share (%), by Service Model 2024 & 2032

- Figure 7: North America Cloud Data Center Market Revenue (billion), by Deployment Model 2024 & 2032

- Figure 8: North America Cloud Data Center Market Volume (units), by Deployment Model 2024 & 2032

- Figure 9: North America Cloud Data Center Market Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 10: North America Cloud Data Center Market Volume Share (%), by Deployment Model 2024 & 2032

- Figure 11: North America Cloud Data Center Market Revenue (billion), by Organization Size 2024 & 2032

- Figure 12: North America Cloud Data Center Market Volume (units), by Organization Size 2024 & 2032

- Figure 13: North America Cloud Data Center Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 14: North America Cloud Data Center Market Volume Share (%), by Organization Size 2024 & 2032

- Figure 15: North America Cloud Data Center Market Revenue (billion), by End-use 2024 & 2032

- Figure 16: North America Cloud Data Center Market Volume (units), by End-use 2024 & 2032

- Figure 17: North America Cloud Data Center Market Revenue Share (%), by End-use 2024 & 2032

- Figure 18: North America Cloud Data Center Market Volume Share (%), by End-use 2024 & 2032

- Figure 19: North America Cloud Data Center Market Revenue (billion), by Country 2024 & 2032

- Figure 20: North America Cloud Data Center Market Volume (units), by Country 2024 & 2032

- Figure 21: North America Cloud Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Cloud Data Center Market Volume Share (%), by Country 2024 & 2032

- Figure 23: Europe Cloud Data Center Market Revenue (billion), by Service Model 2024 & 2032

- Figure 24: Europe Cloud Data Center Market Volume (units), by Service Model 2024 & 2032

- Figure 25: Europe Cloud Data Center Market Revenue Share (%), by Service Model 2024 & 2032

- Figure 26: Europe Cloud Data Center Market Volume Share (%), by Service Model 2024 & 2032

- Figure 27: Europe Cloud Data Center Market Revenue (billion), by Deployment Model 2024 & 2032

- Figure 28: Europe Cloud Data Center Market Volume (units), by Deployment Model 2024 & 2032

- Figure 29: Europe Cloud Data Center Market Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 30: Europe Cloud Data Center Market Volume Share (%), by Deployment Model 2024 & 2032

- Figure 31: Europe Cloud Data Center Market Revenue (billion), by Organization Size 2024 & 2032

- Figure 32: Europe Cloud Data Center Market Volume (units), by Organization Size 2024 & 2032

- Figure 33: Europe Cloud Data Center Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 34: Europe Cloud Data Center Market Volume Share (%), by Organization Size 2024 & 2032

- Figure 35: Europe Cloud Data Center Market Revenue (billion), by End-use 2024 & 2032

- Figure 36: Europe Cloud Data Center Market Volume (units), by End-use 2024 & 2032

- Figure 37: Europe Cloud Data Center Market Revenue Share (%), by End-use 2024 & 2032

- Figure 38: Europe Cloud Data Center Market Volume Share (%), by End-use 2024 & 2032

- Figure 39: Europe Cloud Data Center Market Revenue (billion), by Country 2024 & 2032

- Figure 40: Europe Cloud Data Center Market Volume (units), by Country 2024 & 2032

- Figure 41: Europe Cloud Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Cloud Data Center Market Volume Share (%), by Country 2024 & 2032

- Figure 43: Asia Pacific Cloud Data Center Market Revenue (billion), by Service Model 2024 & 2032

- Figure 44: Asia Pacific Cloud Data Center Market Volume (units), by Service Model 2024 & 2032

- Figure 45: Asia Pacific Cloud Data Center Market Revenue Share (%), by Service Model 2024 & 2032

- Figure 46: Asia Pacific Cloud Data Center Market Volume Share (%), by Service Model 2024 & 2032

- Figure 47: Asia Pacific Cloud Data Center Market Revenue (billion), by Deployment Model 2024 & 2032

- Figure 48: Asia Pacific Cloud Data Center Market Volume (units), by Deployment Model 2024 & 2032

- Figure 49: Asia Pacific Cloud Data Center Market Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 50: Asia Pacific Cloud Data Center Market Volume Share (%), by Deployment Model 2024 & 2032

- Figure 51: Asia Pacific Cloud Data Center Market Revenue (billion), by Organization Size 2024 & 2032

- Figure 52: Asia Pacific Cloud Data Center Market Volume (units), by Organization Size 2024 & 2032

- Figure 53: Asia Pacific Cloud Data Center Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 54: Asia Pacific Cloud Data Center Market Volume Share (%), by Organization Size 2024 & 2032

- Figure 55: Asia Pacific Cloud Data Center Market Revenue (billion), by End-use 2024 & 2032

- Figure 56: Asia Pacific Cloud Data Center Market Volume (units), by End-use 2024 & 2032

- Figure 57: Asia Pacific Cloud Data Center Market Revenue Share (%), by End-use 2024 & 2032

- Figure 58: Asia Pacific Cloud Data Center Market Volume Share (%), by End-use 2024 & 2032

- Figure 59: Asia Pacific Cloud Data Center Market Revenue (billion), by Country 2024 & 2032

- Figure 60: Asia Pacific Cloud Data Center Market Volume (units), by Country 2024 & 2032

- Figure 61: Asia Pacific Cloud Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Cloud Data Center Market Volume Share (%), by Country 2024 & 2032

- Figure 63: South America Cloud Data Center Market Revenue (billion), by Service Model 2024 & 2032

- Figure 64: South America Cloud Data Center Market Volume (units), by Service Model 2024 & 2032

- Figure 65: South America Cloud Data Center Market Revenue Share (%), by Service Model 2024 & 2032

- Figure 66: South America Cloud Data Center Market Volume Share (%), by Service Model 2024 & 2032

- Figure 67: South America Cloud Data Center Market Revenue (billion), by Deployment Model 2024 & 2032

- Figure 68: South America Cloud Data Center Market Volume (units), by Deployment Model 2024 & 2032

- Figure 69: South America Cloud Data Center Market Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 70: South America Cloud Data Center Market Volume Share (%), by Deployment Model 2024 & 2032

- Figure 71: South America Cloud Data Center Market Revenue (billion), by Organization Size 2024 & 2032

- Figure 72: South America Cloud Data Center Market Volume (units), by Organization Size 2024 & 2032

- Figure 73: South America Cloud Data Center Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 74: South America Cloud Data Center Market Volume Share (%), by Organization Size 2024 & 2032

- Figure 75: South America Cloud Data Center Market Revenue (billion), by End-use 2024 & 2032

- Figure 76: South America Cloud Data Center Market Volume (units), by End-use 2024 & 2032

- Figure 77: South America Cloud Data Center Market Revenue Share (%), by End-use 2024 & 2032

- Figure 78: South America Cloud Data Center Market Volume Share (%), by End-use 2024 & 2032

- Figure 79: South America Cloud Data Center Market Revenue (billion), by Country 2024 & 2032

- Figure 80: South America Cloud Data Center Market Volume (units), by Country 2024 & 2032

- Figure 81: South America Cloud Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: South America Cloud Data Center Market Volume Share (%), by Country 2024 & 2032

- Figure 83: MEA Cloud Data Center Market Revenue (billion), by Service Model 2024 & 2032

- Figure 84: MEA Cloud Data Center Market Volume (units), by Service Model 2024 & 2032

- Figure 85: MEA Cloud Data Center Market Revenue Share (%), by Service Model 2024 & 2032

- Figure 86: MEA Cloud Data Center Market Volume Share (%), by Service Model 2024 & 2032

- Figure 87: MEA Cloud Data Center Market Revenue (billion), by Deployment Model 2024 & 2032

- Figure 88: MEA Cloud Data Center Market Volume (units), by Deployment Model 2024 & 2032

- Figure 89: MEA Cloud Data Center Market Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 90: MEA Cloud Data Center Market Volume Share (%), by Deployment Model 2024 & 2032

- Figure 91: MEA Cloud Data Center Market Revenue (billion), by Organization Size 2024 & 2032

- Figure 92: MEA Cloud Data Center Market Volume (units), by Organization Size 2024 & 2032

- Figure 93: MEA Cloud Data Center Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 94: MEA Cloud Data Center Market Volume Share (%), by Organization Size 2024 & 2032

- Figure 95: MEA Cloud Data Center Market Revenue (billion), by End-use 2024 & 2032

- Figure 96: MEA Cloud Data Center Market Volume (units), by End-use 2024 & 2032

- Figure 97: MEA Cloud Data Center Market Revenue Share (%), by End-use 2024 & 2032

- Figure 98: MEA Cloud Data Center Market Volume Share (%), by End-use 2024 & 2032

- Figure 99: MEA Cloud Data Center Market Revenue (billion), by Country 2024 & 2032

- Figure 100: MEA Cloud Data Center Market Volume (units), by Country 2024 & 2032

- Figure 101: MEA Cloud Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 102: MEA Cloud Data Center Market Volume Share (%), by Country 2024 & 2032

- Table 1: Global Cloud Data Center Market Revenue billion Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Data Center Market Volume units Forecast, by Region 2019 & 2032

- Table 3: Global Cloud Data Center Market Revenue billion Forecast, by Service Model 2019 & 2032

- Table 4: Global Cloud Data Center Market Volume units Forecast, by Service Model 2019 & 2032

- Table 5: Global Cloud Data Center Market Revenue billion Forecast, by Deployment Model 2019 & 2032

- Table 6: Global Cloud Data Center Market Volume units Forecast, by Deployment Model 2019 & 2032

- Table 7: Global Cloud Data Center Market Revenue billion Forecast, by Organization Size 2019 & 2032

- Table 8: Global Cloud Data Center Market Volume units Forecast, by Organization Size 2019 & 2032

- Table 9: Global Cloud Data Center Market Revenue billion Forecast, by End-use 2019 & 2032

- Table 10: Global Cloud Data Center Market Volume units Forecast, by End-use 2019 & 2032

- Table 11: Global Cloud Data Center Market Revenue billion Forecast, by Region 2019 & 2032

- Table 12: Global Cloud Data Center Market Volume units Forecast, by Region 2019 & 2032

- Table 13: Global Cloud Data Center Market Revenue billion Forecast, by Service Model 2019 & 2032

- Table 14: Global Cloud Data Center Market Volume units Forecast, by Service Model 2019 & 2032

- Table 15: Global Cloud Data Center Market Revenue billion Forecast, by Deployment Model 2019 & 2032

- Table 16: Global Cloud Data Center Market Volume units Forecast, by Deployment Model 2019 & 2032

- Table 17: Global Cloud Data Center Market Revenue billion Forecast, by Organization Size 2019 & 2032

- Table 18: Global Cloud Data Center Market Volume units Forecast, by Organization Size 2019 & 2032

- Table 19: Global Cloud Data Center Market Revenue billion Forecast, by End-use 2019 & 2032

- Table 20: Global Cloud Data Center Market Volume units Forecast, by End-use 2019 & 2032

- Table 21: Global Cloud Data Center Market Revenue billion Forecast, by Country 2019 & 2032

- Table 22: Global Cloud Data Center Market Volume units Forecast, by Country 2019 & 2032

- Table 23: U.S. Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 24: U.S. Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 25: Canada Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 26: Canada Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 27: Mexico Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 28: Mexico Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 29: Global Cloud Data Center Market Revenue billion Forecast, by Service Model 2019 & 2032

- Table 30: Global Cloud Data Center Market Volume units Forecast, by Service Model 2019 & 2032

- Table 31: Global Cloud Data Center Market Revenue billion Forecast, by Deployment Model 2019 & 2032

- Table 32: Global Cloud Data Center Market Volume units Forecast, by Deployment Model 2019 & 2032

- Table 33: Global Cloud Data Center Market Revenue billion Forecast, by Organization Size 2019 & 2032

- Table 34: Global Cloud Data Center Market Volume units Forecast, by Organization Size 2019 & 2032

- Table 35: Global Cloud Data Center Market Revenue billion Forecast, by End-use 2019 & 2032

- Table 36: Global Cloud Data Center Market Volume units Forecast, by End-use 2019 & 2032

- Table 37: Global Cloud Data Center Market Revenue billion Forecast, by Country 2019 & 2032

- Table 38: Global Cloud Data Center Market Volume units Forecast, by Country 2019 & 2032

- Table 39: UK Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 40: UK Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 41: Germany Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 42: Germany Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 43: France Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 44: France Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 45: Spain Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 46: Spain Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 47: Poland Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 48: Poland Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 49: Benelux Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 50: Benelux Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 51: Global Cloud Data Center Market Revenue billion Forecast, by Service Model 2019 & 2032

- Table 52: Global Cloud Data Center Market Volume units Forecast, by Service Model 2019 & 2032

- Table 53: Global Cloud Data Center Market Revenue billion Forecast, by Deployment Model 2019 & 2032

- Table 54: Global Cloud Data Center Market Volume units Forecast, by Deployment Model 2019 & 2032

- Table 55: Global Cloud Data Center Market Revenue billion Forecast, by Organization Size 2019 & 2032

- Table 56: Global Cloud Data Center Market Volume units Forecast, by Organization Size 2019 & 2032

- Table 57: Global Cloud Data Center Market Revenue billion Forecast, by End-use 2019 & 2032

- Table 58: Global Cloud Data Center Market Volume units Forecast, by End-use 2019 & 2032

- Table 59: Global Cloud Data Center Market Revenue billion Forecast, by Country 2019 & 2032

- Table 60: Global Cloud Data Center Market Volume units Forecast, by Country 2019 & 2032

- Table 61: China Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 62: China Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 63: India Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 64: India Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 65: Japan Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 66: Japan Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 67: Singapore Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 68: Singapore Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 69: Australia Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 70: Australia Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 71: South Korea Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 72: South Korea Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 73: Global Cloud Data Center Market Revenue billion Forecast, by Service Model 2019 & 2032

- Table 74: Global Cloud Data Center Market Volume units Forecast, by Service Model 2019 & 2032

- Table 75: Global Cloud Data Center Market Revenue billion Forecast, by Deployment Model 2019 & 2032

- Table 76: Global Cloud Data Center Market Volume units Forecast, by Deployment Model 2019 & 2032

- Table 77: Global Cloud Data Center Market Revenue billion Forecast, by Organization Size 2019 & 2032

- Table 78: Global Cloud Data Center Market Volume units Forecast, by Organization Size 2019 & 2032

- Table 79: Global Cloud Data Center Market Revenue billion Forecast, by End-use 2019 & 2032

- Table 80: Global Cloud Data Center Market Volume units Forecast, by End-use 2019 & 2032

- Table 81: Global Cloud Data Center Market Revenue billion Forecast, by Country 2019 & 2032

- Table 82: Global Cloud Data Center Market Volume units Forecast, by Country 2019 & 2032

- Table 83: Brazil Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 84: Brazil Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 85: Argentina Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 86: Argentina Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 87: Chile Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 88: Chile Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 89: Colombia Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 90: Colombia Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 91: Global Cloud Data Center Market Revenue billion Forecast, by Service Model 2019 & 2032

- Table 92: Global Cloud Data Center Market Volume units Forecast, by Service Model 2019 & 2032

- Table 93: Global Cloud Data Center Market Revenue billion Forecast, by Deployment Model 2019 & 2032

- Table 94: Global Cloud Data Center Market Volume units Forecast, by Deployment Model 2019 & 2032

- Table 95: Global Cloud Data Center Market Revenue billion Forecast, by Organization Size 2019 & 2032

- Table 96: Global Cloud Data Center Market Volume units Forecast, by Organization Size 2019 & 2032

- Table 97: Global Cloud Data Center Market Revenue billion Forecast, by End-use 2019 & 2032

- Table 98: Global Cloud Data Center Market Volume units Forecast, by End-use 2019 & 2032

- Table 99: Global Cloud Data Center Market Revenue billion Forecast, by Country 2019 & 2032

- Table 100: Global Cloud Data Center Market Volume units Forecast, by Country 2019 & 2032

- Table 101: UAE Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 102: UAE Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 103: Saudi Arabia Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 104: Saudi Arabia Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

- Table 105: South Africa Cloud Data Center Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 106: South Africa Cloud Data Center Market Volume (units) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.