Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Enterprise WLAN Market 2025-2033 Trends: Unveiling Growth Opportunities and Competitor Dynamics

Enterprise WLAN Market by Component (Hardware, Software, Service), by Organization (Large Enterprises, SME), by Application (BFSI, IT & Telecom, Healthcare, Retail, Government, Hospitality, Education, Others), by North America (U.S., Canada), by Europe (UK, Germany, France, Spain, Italy, Netherlands, Nordics), by Asia Pacific (China, Japan, South Korea, India, Australia & New Zealand (ANZ), Singapore), by Latin America (Brazil, Mexico, Argentina), by Middle East & Africa (Saudi Arabia, UAE, South Africa) Forecast 2025-2033

Key Insights

The size of the Enterprise WLAN Market was valued at USD 10 Billion in 2024 and is projected to reach USD 35.83 Billion by 2033, with an expected CAGR of 20% during the forecast period. This expansion is fueled by several key factors. The increasing adoption of cloud-based services and the burgeoning demand for seamless connectivity in businesses of all sizes are primary drivers. The shift towards remote work models, accelerated by recent global events, necessitates robust and secure wireless networks. Furthermore, technological advancements, such as the introduction of Wi-Fi 6 and 6E, offering higher speeds and greater capacity, are significantly boosting market growth. The rising adoption of IoT devices within enterprises further increases the demand for sophisticated WLAN infrastructure capable of handling substantial data traffic. Finally, stringent government regulations promoting digital transformation and improved network security are also contributing to this market expansion.

Enterprise WLAN Market Concentration & Characteristics

The Enterprise WLAN market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share. However, the market also exhibits a dynamic competitive environment with several emerging players offering innovative solutions. Cisco, Aruba (HPE), and Huawei are currently leading the market, leveraging their established brand recognition and comprehensive product portfolios. Innovation in this sector is primarily focused on enhancing speed, security, and management capabilities of WLAN systems. The development of Wi-Fi 6E, with its expanded frequency spectrum, represents a significant technological leap. Regulations, such as those pertaining to data privacy and security, are increasingly influencing product design and market strategies. While wired Ethernet connections remain a substitute, the convenience and flexibility of WLAN solutions make them the preferred choice for many applications. End-user concentration is skewed towards large enterprises and government organizations, who require extensive network deployments. Mergers and acquisitions (M&A) activity within the market is moderate, with strategic acquisitions driving consolidation among existing players and enabling the integration of new technologies.

Enterprise WLAN Market Trends

Several key trends are shaping the evolution of the Enterprise WLAN market. The ongoing transition to cloud-managed WLAN solutions is prominent, offering centralized control and simplified management. The increasing adoption of Software-Defined Networking (SDN) principles is enhancing network agility and scalability. Security remains a paramount concern, with a focus on advanced encryption protocols and robust threat detection capabilities. The growing integration of Artificial Intelligence (AI) and Machine Learning (ML) into WLAN management platforms is optimizing network performance and enhancing troubleshooting capabilities. The demand for high-bandwidth applications, like video conferencing and real-time data analytics, is driving the adoption of Wi-Fi 6 and 6E. Furthermore, the rise of the Internet of Things (IoT) is creating a significant demand for highly scalable and reliable WLAN infrastructure capable of handling a vast number of connected devices. The increasing focus on location-based services within enterprise environments is also driving demand for specialized WLAN solutions. Finally, the ongoing development of 5G technology and its convergence with WLAN solutions is expected to further transform the market landscape, offering unparalleled connectivity speed and reliability.

Key Region or Country & Segment to Dominate the Market

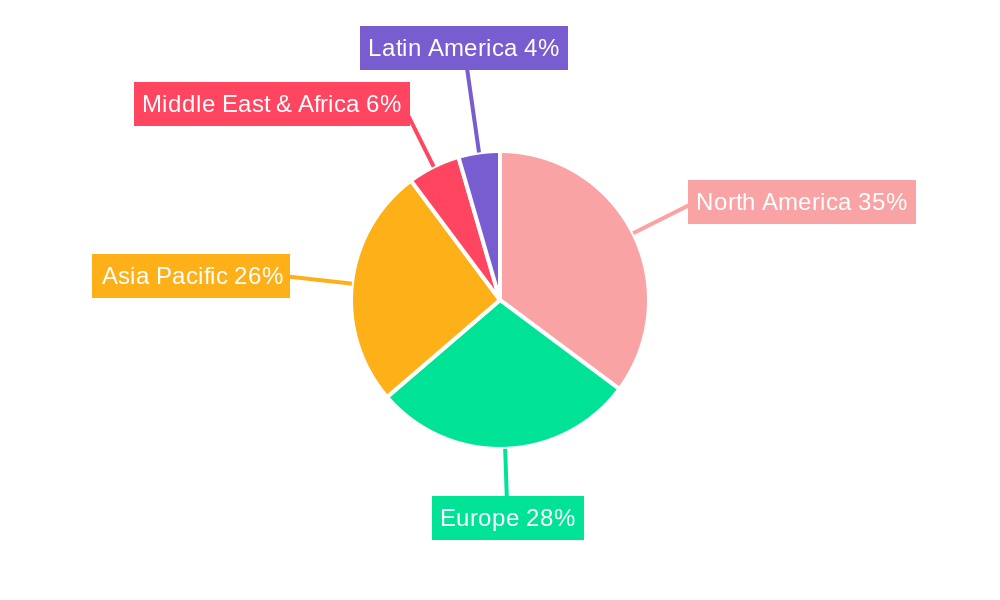

- North America (specifically the U.S.) is expected to dominate the Enterprise WLAN market due to high technological adoption, substantial investments in IT infrastructure, and a strong presence of major technology players. The region's well-developed economy and high density of large enterprises further contribute to its market leadership. Early adoption of new technologies like Wi-Fi 6 and 6E along with a strong focus on network security strengthens the North American market dominance.

- Large Enterprises segment is leading the market owing to their greater financial capacity to invest in advanced WLAN solutions and high demand for robust and scalable network infrastructure. Their adoption of advanced applications and the need for high security contribute significantly to the growth of this segment.

- Hardware (specifically Wireless Access Points) represents a substantial portion of the market due to the fundamental need for physical devices to establish wireless networks. The ongoing demand for higher capacity and advanced features in wireless access points drives this segment's growth.

Enterprise WLAN Market Product Insights Report Coverage & Deliverables

This report offers comprehensive insights into the Enterprise WLAN market, providing a detailed analysis of market size, growth drivers, key trends, competitive landscape, and regional dynamics. It includes an in-depth examination of various segments, including hardware, software, and services, along with an assessment of major players and their market strategies. The report delivers actionable insights to aid stakeholders in making informed business decisions.

Enterprise WLAN Market Analysis

The Enterprise WLAN market is witnessing substantial growth, driven by the factors discussed previously. Market size is currently estimated at $10 billion, with projections indicating continued expansion. Market share is primarily held by established vendors like Cisco and Aruba, though competitive pressures are leading to increased market fragmentation. Growth rates vary across segments and regions, with North America and large enterprise segments exhibiting the strongest growth trajectories. The market analysis involves a rigorous assessment of historical data, current trends, and future projections to provide a comprehensive understanding of market dynamics. This allows for a robust estimation of future market sizes and shares.

Enterprise WLAN Market Regional Insights

- North America:

- U.S.

- Canada

- Europe:

- UK

- Germany

- France

- Spain

- Italy

- Netherlands

- Nordics

- Asia Pacific:

- China

- Japan

- South Korea

- India

- Australia & New Zealand (ANZ)

- Singapore

- Latin America:

- Brazil

- Mexico

- Argentina

- Middle East & Africa:

- Saudi Arabia

- UAE

- South Africa

Driving Forces: What's Propelling the Enterprise WLAN Market

The enterprise WLAN market is propelled by factors including increasing adoption of cloud services, the rise of remote work, technological advancements like Wi-Fi 6E, the growth of IoT devices, and government initiatives promoting digitalization. These factors collectively drive significant demand for robust and scalable WLAN solutions.

Challenges and Restraints in Enterprise WLAN Market

Challenges include managing increasing network complexity, ensuring robust security against cyber threats, maintaining high network performance with a growing number of devices, and effectively integrating WLAN solutions with other IT infrastructure components. These challenges often involve high initial investment costs and ongoing maintenance requirements.

Emerging Trends in Enterprise WLAN Market

Emerging trends include the adoption of AI/ML for network optimization, the integration of 5G technologies, the increasing importance of network security and privacy, and the growth of location-based services. These advancements are shaping the future of enterprise WLAN infrastructure.

Enterprise WLAN Industry News

- January 2023: Cisco announced new advancements in its Wi-Fi 6E portfolio.

- March 2023: Aruba announced a new cloud-managed WLAN solution.

- June 2023: Huawei launched a new high-capacity wireless access point.

Leading Players in the Enterprise WLAN Market

- ADTRAN, Inc.

- Alcatel Lucent Enterprise

- Allied Telesis, Inc.

- Arista Networks, Inc.

- Aruba Networks (HPE)

- Boingo Wireless, Inc.

- Cambium Networks, Ltd.

- Cisco Systems, Inc.

- Commscope, Inc.

- Dell Technologies, Inc.

- Extreme Networks, Inc.

- Fortinet, Inc.

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Netgear, Inc.

- Ubiquiti, Inc.

Enterprise WLAN Market Segmentation

- 1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Service

- 2. Organization

- 2.1. Large Enterprises

- 2.2. SME

- 3. Application

- 3.1. BFSI

- 3.2. IT & Telecom

- 3.3. Healthcare

- 3.4. Retail

- 3.5. Government

- 3.6. Hospitality

- 3.7. Education

- 3.8. Others

Enterprise WLAN Market Segmentation By Geography

- 1. North America

- 1.1. U.S.

- 1.2. Canada

- 2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Netherlands

- 2.7. Nordics

- 3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Australia & New Zealand (ANZ)

- 3.6. Singapore

- 4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 5. Middle East & Africa

- 5.1. Saudi Arabia

- 5.2. UAE

- 5.3. South Africa

Enterprise WLAN Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing demand for faster data transmission and better Wi-Fi coverage

- 3.2.2 Increase in number of wireless devices

- 3.2.3 Rapid adoption of Bring Your Own Device (BYOD) trend

- 3.2.4 Demand for continuous coverage for enterprise networks

- 3.2.5 Increasing demand for easy and cost-effective deployment of enterprise WLAN

- 3.3. Market Restrains

- 3.3.1 Network traffic bottleneck

- 3.3.2 Dependency on a single device for network coverage in case of lightweight access points

- 3.4. Market Trends

- 3.4.1 Several key trends are shaping the evolution of the Enterprise WLAN market. The ongoing transition to cloud-managed WLAN solutions is prominent

- 3.4.2 offering centralized control and simplified management. The increasing adoption of Software-Defined Networking (SDN) principles is enhancing network agility and scalability. Security remains a paramount concern

- 3.4.3 with a focus on advanced encryption protocols and robust threat detection capabilities. The growing integration of Artificial Intelligence (AI) and Machine Learning (ML) into WLAN management platforms is optimizing network performance and enhancing troubleshooting capabilities. The demand for high-bandwidth applications

- 3.4.4 like video conferencing and real-time data analytics

- 3.4.5 is driving the adoption of Wi-Fi 6 and 6E. Furthermore

- 3.4.6 the rise of the Internet of Things (IoT) is creating a significant demand for highly scalable and reliable WLAN infrastructure capable of handling a vast number of connected devices. The increasing focus on location-based services within enterprise environments is also driving demand for specialized WLAN solutions. Finally

- 3.4.7 the ongoing development of 5G technology and its convergence with WLAN solutions is expected to further transform the market landscape

- 3.4.8 offering unparalleled connectivity speed and reliability.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enterprise WLAN Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Service

- 5.2. Market Analysis, Insights and Forecast - by Organization

- 5.2.1. Large Enterprises

- 5.2.2. SME

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. BFSI

- 5.3.2. IT & Telecom

- 5.3.3. Healthcare

- 5.3.4. Retail

- 5.3.5. Government

- 5.3.6. Hospitality

- 5.3.7. Education

- 5.3.8. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East & Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Enterprise WLAN Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Service

- 6.2. Market Analysis, Insights and Forecast - by Organization

- 6.2.1. Large Enterprises

- 6.2.2. SME

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. BFSI

- 6.3.2. IT & Telecom

- 6.3.3. Healthcare

- 6.3.4. Retail

- 6.3.5. Government

- 6.3.6. Hospitality

- 6.3.7. Education

- 6.3.8. Others

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Enterprise WLAN Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Service

- 7.2. Market Analysis, Insights and Forecast - by Organization

- 7.2.1. Large Enterprises

- 7.2.2. SME

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. BFSI

- 7.3.2. IT & Telecom

- 7.3.3. Healthcare

- 7.3.4. Retail

- 7.3.5. Government

- 7.3.6. Hospitality

- 7.3.7. Education

- 7.3.8. Others

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Enterprise WLAN Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Service

- 8.2. Market Analysis, Insights and Forecast - by Organization

- 8.2.1. Large Enterprises

- 8.2.2. SME

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. BFSI

- 8.3.2. IT & Telecom

- 8.3.3. Healthcare

- 8.3.4. Retail

- 8.3.5. Government

- 8.3.6. Hospitality

- 8.3.7. Education

- 8.3.8. Others

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Enterprise WLAN Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Service

- 9.2. Market Analysis, Insights and Forecast - by Organization

- 9.2.1. Large Enterprises

- 9.2.2. SME

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. BFSI

- 9.3.2. IT & Telecom

- 9.3.3. Healthcare

- 9.3.4. Retail

- 9.3.5. Government

- 9.3.6. Hospitality

- 9.3.7. Education

- 9.3.8. Others

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East & Africa Enterprise WLAN Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Service

- 10.2. Market Analysis, Insights and Forecast - by Organization

- 10.2.1. Large Enterprises

- 10.2.2. SME

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. BFSI

- 10.3.2. IT & Telecom

- 10.3.3. Healthcare

- 10.3.4. Retail

- 10.3.5. Government

- 10.3.6. Hospitality

- 10.3.7. Education

- 10.3.8. Others

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ADTRAN Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alcatel Lucent Enterprise

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Allied Telesis Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Arista Networks Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aruba Networks (HPE)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Boingo Wireless Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cambium Networks Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cisco Systems Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Commscope Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 D-Link Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dell Technologies Inc.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Extreme Networks Inc.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Fortinet Inc.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 New H3C Technologies Co. Ltd.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Huawei Technologies Co. Ltd.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Juniper Networks Inc.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 LANCOM Systems GmbH

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Netgear Inc.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Ruijie Networks Co. Ltd.

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 TP-Link Technologies Co. Ltd.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Ubiquiti Inc.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 ADTRAN Inc.

- Figure 1: Global Enterprise WLAN Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: Global Enterprise WLAN Market Volume Breakdown (units, %) by Region 2024 & 2032

- Figure 3: North America Enterprise WLAN Market Revenue (Billion), by Component 2024 & 2032

- Figure 4: North America Enterprise WLAN Market Volume (units), by Component 2024 & 2032

- Figure 5: North America Enterprise WLAN Market Revenue Share (%), by Component 2024 & 2032

- Figure 6: North America Enterprise WLAN Market Volume Share (%), by Component 2024 & 2032

- Figure 7: North America Enterprise WLAN Market Revenue (Billion), by Organization 2024 & 2032

- Figure 8: North America Enterprise WLAN Market Volume (units), by Organization 2024 & 2032

- Figure 9: North America Enterprise WLAN Market Revenue Share (%), by Organization 2024 & 2032

- Figure 10: North America Enterprise WLAN Market Volume Share (%), by Organization 2024 & 2032

- Figure 11: North America Enterprise WLAN Market Revenue (Billion), by Application 2024 & 2032

- Figure 12: North America Enterprise WLAN Market Volume (units), by Application 2024 & 2032

- Figure 13: North America Enterprise WLAN Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Enterprise WLAN Market Volume Share (%), by Application 2024 & 2032

- Figure 15: North America Enterprise WLAN Market Revenue (Billion), by Country 2024 & 2032

- Figure 16: North America Enterprise WLAN Market Volume (units), by Country 2024 & 2032

- Figure 17: North America Enterprise WLAN Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Enterprise WLAN Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Europe Enterprise WLAN Market Revenue (Billion), by Component 2024 & 2032

- Figure 20: Europe Enterprise WLAN Market Volume (units), by Component 2024 & 2032

- Figure 21: Europe Enterprise WLAN Market Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe Enterprise WLAN Market Volume Share (%), by Component 2024 & 2032

- Figure 23: Europe Enterprise WLAN Market Revenue (Billion), by Organization 2024 & 2032

- Figure 24: Europe Enterprise WLAN Market Volume (units), by Organization 2024 & 2032

- Figure 25: Europe Enterprise WLAN Market Revenue Share (%), by Organization 2024 & 2032

- Figure 26: Europe Enterprise WLAN Market Volume Share (%), by Organization 2024 & 2032

- Figure 27: Europe Enterprise WLAN Market Revenue (Billion), by Application 2024 & 2032

- Figure 28: Europe Enterprise WLAN Market Volume (units), by Application 2024 & 2032

- Figure 29: Europe Enterprise WLAN Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Enterprise WLAN Market Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Enterprise WLAN Market Revenue (Billion), by Country 2024 & 2032

- Figure 32: Europe Enterprise WLAN Market Volume (units), by Country 2024 & 2032

- Figure 33: Europe Enterprise WLAN Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe Enterprise WLAN Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Asia Pacific Enterprise WLAN Market Revenue (Billion), by Component 2024 & 2032

- Figure 36: Asia Pacific Enterprise WLAN Market Volume (units), by Component 2024 & 2032

- Figure 37: Asia Pacific Enterprise WLAN Market Revenue Share (%), by Component 2024 & 2032

- Figure 38: Asia Pacific Enterprise WLAN Market Volume Share (%), by Component 2024 & 2032

- Figure 39: Asia Pacific Enterprise WLAN Market Revenue (Billion), by Organization 2024 & 2032

- Figure 40: Asia Pacific Enterprise WLAN Market Volume (units), by Organization 2024 & 2032

- Figure 41: Asia Pacific Enterprise WLAN Market Revenue Share (%), by Organization 2024 & 2032

- Figure 42: Asia Pacific Enterprise WLAN Market Volume Share (%), by Organization 2024 & 2032

- Figure 43: Asia Pacific Enterprise WLAN Market Revenue (Billion), by Application 2024 & 2032

- Figure 44: Asia Pacific Enterprise WLAN Market Volume (units), by Application 2024 & 2032

- Figure 45: Asia Pacific Enterprise WLAN Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: Asia Pacific Enterprise WLAN Market Volume Share (%), by Application 2024 & 2032

- Figure 47: Asia Pacific Enterprise WLAN Market Revenue (Billion), by Country 2024 & 2032

- Figure 48: Asia Pacific Enterprise WLAN Market Volume (units), by Country 2024 & 2032

- Figure 49: Asia Pacific Enterprise WLAN Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Pacific Enterprise WLAN Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Enterprise WLAN Market Revenue (Billion), by Component 2024 & 2032

- Figure 52: Latin America Enterprise WLAN Market Volume (units), by Component 2024 & 2032

- Figure 53: Latin America Enterprise WLAN Market Revenue Share (%), by Component 2024 & 2032

- Figure 54: Latin America Enterprise WLAN Market Volume Share (%), by Component 2024 & 2032

- Figure 55: Latin America Enterprise WLAN Market Revenue (Billion), by Organization 2024 & 2032

- Figure 56: Latin America Enterprise WLAN Market Volume (units), by Organization 2024 & 2032

- Figure 57: Latin America Enterprise WLAN Market Revenue Share (%), by Organization 2024 & 2032

- Figure 58: Latin America Enterprise WLAN Market Volume Share (%), by Organization 2024 & 2032

- Figure 59: Latin America Enterprise WLAN Market Revenue (Billion), by Application 2024 & 2032

- Figure 60: Latin America Enterprise WLAN Market Volume (units), by Application 2024 & 2032

- Figure 61: Latin America Enterprise WLAN Market Revenue Share (%), by Application 2024 & 2032

- Figure 62: Latin America Enterprise WLAN Market Volume Share (%), by Application 2024 & 2032

- Figure 63: Latin America Enterprise WLAN Market Revenue (Billion), by Country 2024 & 2032

- Figure 64: Latin America Enterprise WLAN Market Volume (units), by Country 2024 & 2032

- Figure 65: Latin America Enterprise WLAN Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Latin America Enterprise WLAN Market Volume Share (%), by Country 2024 & 2032

- Figure 67: Middle East & Africa Enterprise WLAN Market Revenue (Billion), by Component 2024 & 2032

- Figure 68: Middle East & Africa Enterprise WLAN Market Volume (units), by Component 2024 & 2032

- Figure 69: Middle East & Africa Enterprise WLAN Market Revenue Share (%), by Component 2024 & 2032

- Figure 70: Middle East & Africa Enterprise WLAN Market Volume Share (%), by Component 2024 & 2032

- Figure 71: Middle East & Africa Enterprise WLAN Market Revenue (Billion), by Organization 2024 & 2032

- Figure 72: Middle East & Africa Enterprise WLAN Market Volume (units), by Organization 2024 & 2032

- Figure 73: Middle East & Africa Enterprise WLAN Market Revenue Share (%), by Organization 2024 & 2032

- Figure 74: Middle East & Africa Enterprise WLAN Market Volume Share (%), by Organization 2024 & 2032

- Figure 75: Middle East & Africa Enterprise WLAN Market Revenue (Billion), by Application 2024 & 2032

- Figure 76: Middle East & Africa Enterprise WLAN Market Volume (units), by Application 2024 & 2032

- Figure 77: Middle East & Africa Enterprise WLAN Market Revenue Share (%), by Application 2024 & 2032

- Figure 78: Middle East & Africa Enterprise WLAN Market Volume Share (%), by Application 2024 & 2032

- Figure 79: Middle East & Africa Enterprise WLAN Market Revenue (Billion), by Country 2024 & 2032

- Figure 80: Middle East & Africa Enterprise WLAN Market Volume (units), by Country 2024 & 2032

- Figure 81: Middle East & Africa Enterprise WLAN Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Middle East & Africa Enterprise WLAN Market Volume Share (%), by Country 2024 & 2032

- Table 1: Global Enterprise WLAN Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Enterprise WLAN Market Volume units Forecast, by Region 2019 & 2032

- Table 3: Global Enterprise WLAN Market Revenue Billion Forecast, by Component 2019 & 2032

- Table 4: Global Enterprise WLAN Market Volume units Forecast, by Component 2019 & 2032

- Table 5: Global Enterprise WLAN Market Revenue Billion Forecast, by Organization 2019 & 2032

- Table 6: Global Enterprise WLAN Market Volume units Forecast, by Organization 2019 & 2032

- Table 7: Global Enterprise WLAN Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 8: Global Enterprise WLAN Market Volume units Forecast, by Application 2019 & 2032

- Table 9: Global Enterprise WLAN Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 10: Global Enterprise WLAN Market Volume units Forecast, by Region 2019 & 2032

- Table 11: Global Enterprise WLAN Market Revenue Billion Forecast, by Component 2019 & 2032

- Table 12: Global Enterprise WLAN Market Volume units Forecast, by Component 2019 & 2032

- Table 13: Global Enterprise WLAN Market Revenue Billion Forecast, by Organization 2019 & 2032

- Table 14: Global Enterprise WLAN Market Volume units Forecast, by Organization 2019 & 2032

- Table 15: Global Enterprise WLAN Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 16: Global Enterprise WLAN Market Volume units Forecast, by Application 2019 & 2032

- Table 17: Global Enterprise WLAN Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 18: Global Enterprise WLAN Market Volume units Forecast, by Country 2019 & 2032

- Table 19: U.S. Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: U.S. Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 21: Canada Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Canada Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 23: Global Enterprise WLAN Market Revenue Billion Forecast, by Component 2019 & 2032

- Table 24: Global Enterprise WLAN Market Volume units Forecast, by Component 2019 & 2032

- Table 25: Global Enterprise WLAN Market Revenue Billion Forecast, by Organization 2019 & 2032

- Table 26: Global Enterprise WLAN Market Volume units Forecast, by Organization 2019 & 2032

- Table 27: Global Enterprise WLAN Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 28: Global Enterprise WLAN Market Volume units Forecast, by Application 2019 & 2032

- Table 29: Global Enterprise WLAN Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 30: Global Enterprise WLAN Market Volume units Forecast, by Country 2019 & 2032

- Table 31: UK Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: UK Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 33: Germany Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 34: Germany Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 35: France Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 36: France Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 37: Spain Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 38: Spain Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 39: Italy Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 40: Italy Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 43: Nordics Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 44: Nordics Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 45: Global Enterprise WLAN Market Revenue Billion Forecast, by Component 2019 & 2032

- Table 46: Global Enterprise WLAN Market Volume units Forecast, by Component 2019 & 2032

- Table 47: Global Enterprise WLAN Market Revenue Billion Forecast, by Organization 2019 & 2032

- Table 48: Global Enterprise WLAN Market Volume units Forecast, by Organization 2019 & 2032

- Table 49: Global Enterprise WLAN Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 50: Global Enterprise WLAN Market Volume units Forecast, by Application 2019 & 2032

- Table 51: Global Enterprise WLAN Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 52: Global Enterprise WLAN Market Volume units Forecast, by Country 2019 & 2032

- Table 53: China Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 54: China Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 55: Japan Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 56: Japan Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 57: South Korea Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 58: South Korea Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 59: India Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 60: India Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 61: Australia & New Zealand (ANZ) Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 62: Australia & New Zealand (ANZ) Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 63: Singapore Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 64: Singapore Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 65: Global Enterprise WLAN Market Revenue Billion Forecast, by Component 2019 & 2032

- Table 66: Global Enterprise WLAN Market Volume units Forecast, by Component 2019 & 2032

- Table 67: Global Enterprise WLAN Market Revenue Billion Forecast, by Organization 2019 & 2032

- Table 68: Global Enterprise WLAN Market Volume units Forecast, by Organization 2019 & 2032

- Table 69: Global Enterprise WLAN Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 70: Global Enterprise WLAN Market Volume units Forecast, by Application 2019 & 2032

- Table 71: Global Enterprise WLAN Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 72: Global Enterprise WLAN Market Volume units Forecast, by Country 2019 & 2032

- Table 73: Brazil Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 74: Brazil Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 75: Mexico Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 76: Mexico Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 77: Argentina Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 78: Argentina Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 79: Global Enterprise WLAN Market Revenue Billion Forecast, by Component 2019 & 2032

- Table 80: Global Enterprise WLAN Market Volume units Forecast, by Component 2019 & 2032

- Table 81: Global Enterprise WLAN Market Revenue Billion Forecast, by Organization 2019 & 2032

- Table 82: Global Enterprise WLAN Market Volume units Forecast, by Organization 2019 & 2032

- Table 83: Global Enterprise WLAN Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 84: Global Enterprise WLAN Market Volume units Forecast, by Application 2019 & 2032

- Table 85: Global Enterprise WLAN Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 86: Global Enterprise WLAN Market Volume units Forecast, by Country 2019 & 2032

- Table 87: Saudi Arabia Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 88: Saudi Arabia Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 89: UAE Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 90: UAE Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

- Table 91: South Africa Enterprise WLAN Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 92: South Africa Enterprise WLAN Market Volume (units) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

Which companies are prominent players in the Enterprise WLAN Market?

Key companies in the market include ADTRAN, Inc.,Alcatel Lucent Enterprise,Allied Telesis, Inc.,Arista Networks, Inc.,Aruba Networks (HPE),Boingo Wireless, Inc.,Cambium Networks, Ltd.,Cisco Systems, Inc.,Commscope, Inc.,D-Link Corporation,Dell Technologies, Inc.,Extreme Networks, Inc.,Fortinet, Inc.,New H3C Technologies Co., Ltd.,Huawei Technologies Co., Ltd.,Juniper Networks, Inc.,LANCOM Systems GmbH,Netgear, Inc.,Ruijie Networks Co., Ltd.,TP-Link Technologies Co., Ltd.,Ubiquiti, Inc.

Are there any restraints impacting market growth?

Network traffic bottleneck., Dependency on a single device for network coverage in case of lightweight access points.

How can I stay updated on further developments or reports in the Enterprise WLAN Market?

To stay informed about further developments, trends, and reports in the Enterprise WLAN Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise WLAN Market ?

The projected CAGR is approximately 20%.

What are the notable trends driving market growth?

Several key trends are shaping the evolution of the Enterprise WLAN market. The ongoing transition to cloud-managed WLAN solutions is prominent., offering centralized control and simplified management. The increasing adoption of Software-Defined Networking (SDN) principles is enhancing network agility and scalability. Security remains a paramount concern., with a focus on advanced encryption protocols and robust threat detection capabilities. The growing integration of Artificial Intelligence (AI) and Machine Learning (ML) into WLAN management platforms is optimizing network performance and enhancing troubleshooting capabilities. The demand for high-bandwidth applications., like video conferencing and real-time data analytics., is driving the adoption of Wi-Fi 6 and 6E. Furthermore., the rise of the Internet of Things (IoT) is creating a significant demand for highly scalable and reliable WLAN infrastructure capable of handling a vast number of connected devices. The increasing focus on location-based services within enterprise environments is also driving demand for specialized WLAN solutions. Finally., the ongoing development of 5G technology and its convergence with WLAN solutions is expected to further transform the market landscape., offering unparalleled connectivity speed and reliability..

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in units.

Can you provide details about the market size?

The market size is estimated to be USD 10 Billion as of 2022.

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.