Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Foam Packaging Market Unlocking Growth Opportunities: Analysis and Forecast 2025-2033

Foam Packaging Market, by North America (U.S., Canada), by Europe (UK, Germany, France, Italy, Spain, Russia), by Asia Pacific (China, India, Japan, South Korea, Australia), by Latin America (Brazil, Mexico), by MEA (UAE, Saudi Arabia, South Africa) Forecast 2025-2033

Key Insights

The size of the Foam Packaging Market was valued at USD 11.6 Billion in 2024 and is projected to reach USD 15.47 Billion by 2033, with an expected CAGR of 4.2% during the forecast period. The Foam Packaging Market is centered on offering packaging solutions created from foam substances, including expanded polystyrene (EPS), polyurethane, polyethylene, and polyethylene foam. These packaging materials are commonly utilized to safeguard delicate products, including electronics, food, pharmaceuticals, and consumer goods, by providing cushioning, insulation, and shock resistance. The market is fueled by the rising demand for secure and efficient packaging options that safeguard against damage during storage and transport, along with the heightened need for lightweight and affordable packaging. Foam packaging is especially preferred in the food sector for products that need temperature regulation, such as perishable items and frozen products. Although there are worries about the environmental effects of specific foam materials like EPS, the demand is growing for sustainable alternatives, such as biodegradable and recyclable foam types. With sustainability gaining importance for both companies and consumers, the Foam Packaging Market is transforming through advancements in eco-friendly materials and recycling methods. The market is projected to expand as companies worldwide keep looking for dependable, protective, and eco-friendly packaging options.

Foam Packaging Market Concentration & Characteristics

The Foam Packaging Market is characterized by a moderate level of concentration, with a few key players holding a significant market share. Innovation is a key driving force in the market, with manufacturers constantly developing new products and technologies to meet the evolving needs of end-users. Regulations on environmental sustainability are influencing market dynamics, leading to the adoption of eco-friendly foam packaging solutions. The presence of product substitutes, such as plastics and corrugated cardboard, creates competitive pressure. The market is also witnessing a trend towards M&A activity as companies seek to expand their product offerings and geographical reach.

Foam Packaging Market Trends

Key market insights include:

- Growing demand for sustainable packaging solutions due to rising environmental concerns.

- Increasing use of foam packaging in the e-commerce sector to protect products during shipping.

- Development of customized packaging solutions tailored to specific industry requirements.

- Advancements in foam technology, resulting in enhanced durability and insulation properties.

- Adoption of biodegradable and recyclable foams to promote environmental sustainability.

Key Region or Country & Segment to Dominate the Market

North America is expected to dominate the Foam Packaging Market, driven by the region's strong manufacturing base and growing e-commerce industry. The Asia Pacific region is projected to witness significant growth due to the increasing demand for foam packaging in various industries, including food and beverage, electronics, and pharmaceuticals. In terms of segments:

- Polyethylene (PE) Foam is expected to hold the largest share of the market due to its cost-effectiveness and versatility.

- Polypropylene (PP) Foam is gaining popularity due to its high strength and resistance to chemicals and moisture.

- Polystyrene (PS) Foam remains a widely used material for disposable packaging applications.

Foam Packaging Market Product Insights

Report Coverage & Deliverables:

- Market Size: Provides historical and forecast data on market size in both revenue and volume.

- Market Share: Analyzes the market share of key players and tracks their market strategies.

- Growth Analysis: Assesses market growth drivers and challenges, providing insights into market expansion opportunities.

Foam Packaging Market Analysis

Market Size: The global Foam Packaging Market was valued at $11.6 billion in 2022 and is projected to reach $16.2 billion by 2028.

Market Share: Sabic and Armacell hold significant market shares in the global Foam Packaging Market.

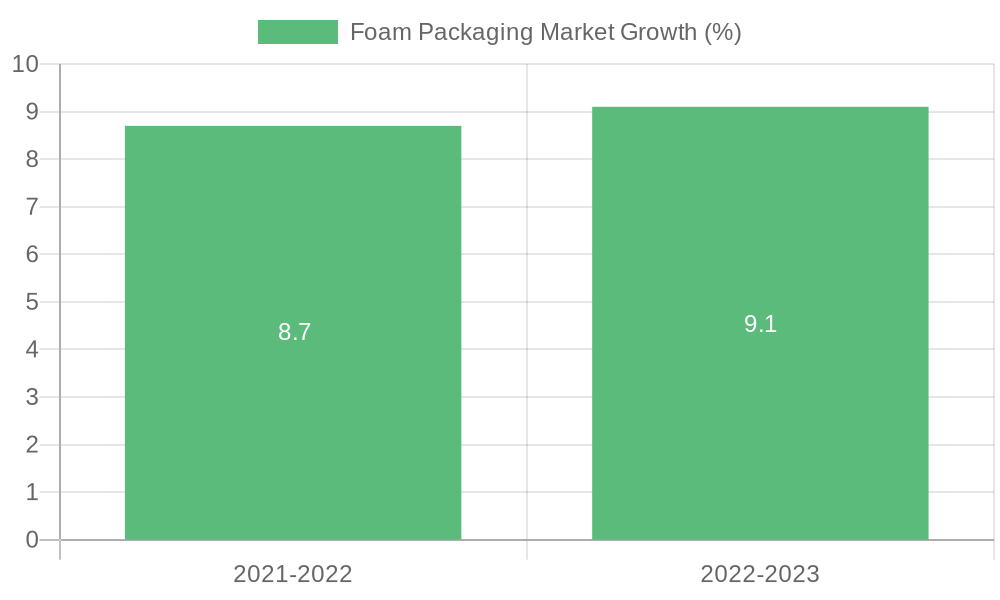

Growth: The market is expected to grow at a CAGR of 4.2% from 2023 to 2028.

Foam Packaging Market Regional Insights

North America:

- U.S.

- Canada

Europe:

- UK

- Germany

- France

- Italy

- Spain

- Russia

Asia Pacific:

- China

- India

- Japan

- South Korea

- Australia

Latin America:

- Brazil

- Mexico

MEA:

- UAE

- Saudi Arabia

- South Africa

Driving Forces: What's Propelling the Foam Packaging Market

- Rising environmental concerns

- Growing e-commerce industry

- Increasing demand for customized packaging solutions

- Advancements in foam technology

- Adoption of sustainable materials

Challenges and Restraints in Foam Packaging Market

- Competition from alternative packaging materials

- Fluctuating raw material prices

- Environmental regulations

- Lack of awareness about sustainable packaging solutions

Emerging Trends in Foam Packaging Market

- Development of biodegradable and recyclable foams

- Customization of foam packaging for specific industry applications

- Use of artificial intelligence (AI) and data analytics for packaging optimization

- Growth of online packaging solutions

Foam Packaging Industry News

- 2023: Sabic launches a new line of sustainable foam packaging solutions made from recycled materials.

- 2022: UFP Technologies acquires a leading manufacturer of foam packaging products, expanding its product portfolio.

Leading Players in the Foam Packaging Market

Foam Packaging Market Segmentation By Geography

- 1. North America

- 1.1. U.S.

- 1.2. Canada

- 2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Russia

- 3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 5. MEA

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. South Africa

Foam Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.2% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rapidly growing electrical & electronics industry across the globe

- 3.2.2 Increasing defense expenditure by major countries

- 3.2.3 Rising e-commerce industry

- 3.2.4 Increasing automotive production inn China

- 3.2.5 Asian healthcare industry growth

- 3.3. Market Restrains

- 3.3.1 Environmental hazardous nature of the product

- 3.3.2 Increasing regulations on product usage

- 3.3.3 Availability of the substitute

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Foam Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Region

- 5.1.1. North America

- 5.1.2. Europe

- 5.1.3. Asia Pacific

- 5.1.4. Latin America

- 5.1.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Region

- 6. North America Foam Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7. Europe Foam Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8. Asia Pacific Foam Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9. Latin America Foam Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10. MEA Foam Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SABIC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Armacell

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UFP Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Greiner

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Foam Partner

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Smurfit Kappa

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 SABIC

- Figure 1: Global Foam Packaging Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: Global Foam Packaging Market Volume Breakdown (K Tons, %) by Region 2024 & 2032

- Figure 3: North America Foam Packaging Market Revenue (Billion), by Country 2024 & 2032

- Figure 4: North America Foam Packaging Market Volume (K Tons), by Country 2024 & 2032

- Figure 5: North America Foam Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Foam Packaging Market Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Foam Packaging Market Revenue (Billion), by Country 2024 & 2032

- Figure 8: Europe Foam Packaging Market Volume (K Tons), by Country 2024 & 2032

- Figure 9: Europe Foam Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Foam Packaging Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Foam Packaging Market Revenue (Billion), by Country 2024 & 2032

- Figure 12: Asia Pacific Foam Packaging Market Volume (K Tons), by Country 2024 & 2032

- Figure 13: Asia Pacific Foam Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Foam Packaging Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Latin America Foam Packaging Market Revenue (Billion), by Country 2024 & 2032

- Figure 16: Latin America Foam Packaging Market Volume (K Tons), by Country 2024 & 2032

- Figure 17: Latin America Foam Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Latin America Foam Packaging Market Volume Share (%), by Country 2024 & 2032

- Figure 19: MEA Foam Packaging Market Revenue (Billion), by Country 2024 & 2032

- Figure 20: MEA Foam Packaging Market Volume (K Tons), by Country 2024 & 2032

- Figure 21: MEA Foam Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: MEA Foam Packaging Market Volume Share (%), by Country 2024 & 2032

- Table 1: Global Foam Packaging Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Foam Packaging Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Global Foam Packaging Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 4: Global Foam Packaging Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 5: Global Foam Packaging Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 6: Global Foam Packaging Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 7: U.S. Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 8: U.S. Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 9: Canada Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 10: Canada Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 11: Global Foam Packaging Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 12: Global Foam Packaging Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: UK Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 14: UK Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Germany Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Germany Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: France Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: France Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Italy Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: Italy Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Spain Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Spain Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Russia Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 24: Russia Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Global Foam Packaging Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 26: Global Foam Packaging Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 27: China Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: China Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: India Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 30: India Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Japan Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: Japan Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: South Korea Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 34: South Korea Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: Australia Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 36: Australia Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Global Foam Packaging Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 38: Global Foam Packaging Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 39: Brazil Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 40: Brazil Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Mexico Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 42: Mexico Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Global Foam Packaging Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 44: Global Foam Packaging Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 45: UAE Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 46: UAE Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: South Africa Foam Packaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 50: South Africa Foam Packaging Market Volume (K Tons) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)