Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

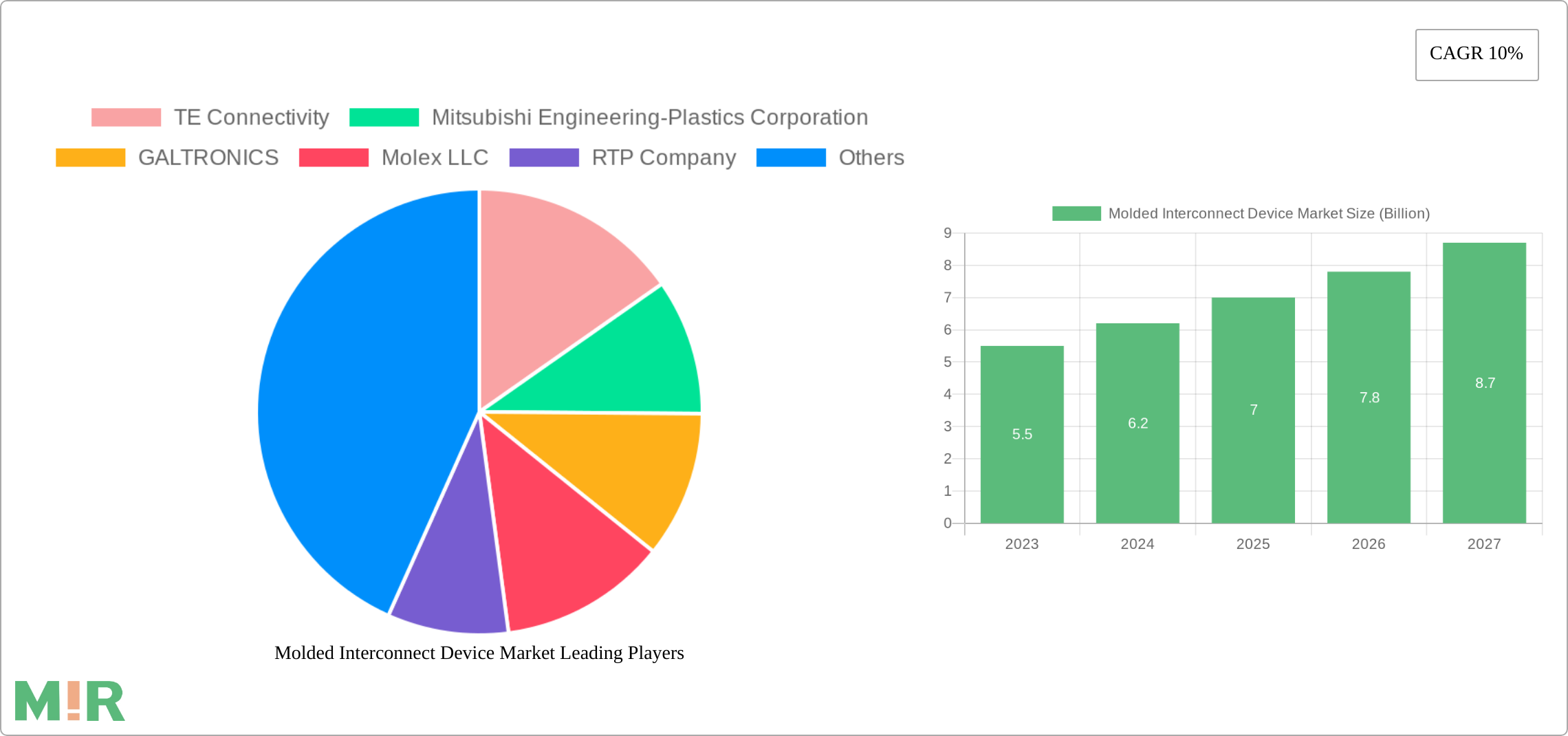

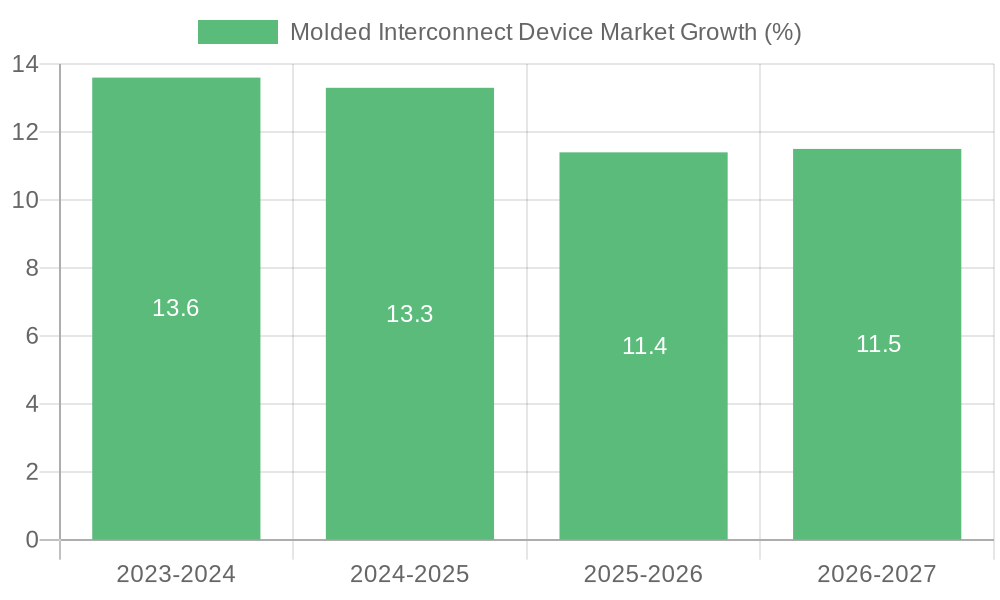

Molded Interconnect Device Market Analysis Report 2025: Market to Grow by a CAGR of 10 to 2033, Driven by Government Incentives, Popularity of Virtual Assistants, and Strategic Partnerships

Molded Interconnect Device Market by Process Segment (Laser Direct Structuring, 2-Shot Molding, Film Techniques), by Product Type (Antennae & Connectivity Modules, Connectors & Switches, Sensors, Lighting, Others), by Industry Vertical (Telecommunications, Consumer Electronics, BFSI, Military & Aerospace, Industrial, Healthcare, Automotive, Others), by North America (U.S., Canada), by Europe (Germany, UK, France, Italy, Spain, Rest of Europe), by Asia Pacific (China, India, Japan, South Korea, ANZ, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Rest of Latin America), by MEA (UAE, Saudi Arabia, South Africa, Rest of MEA) Forecast 2025-2033

Key Insights

The size of the Molded Interconnect Device Market was valued at USD 1.65 Billion in 2024 and is projected to reach USD 3.22 Billion by 2033, with an expected CAGR of 10% during the forecast period. The Molded Interconnect Device (MID) sector concentrates on embedding electronic circuits straight into molded plastic components, removing the necessity for conventional wiring and connectors. MID technology enables the creation of smaller, lighter, and more adaptable electronic parts, making it perfect for applications in automotive, consumer electronics, medical devices, and industry. The market is propelled by the need for smaller sizes, lower costs, and enhanced design efficiency in electronic gadgets. MID technology provides advantages including increased reliability, reduced assembly expenses, and the capacity to produce intricate shapes and multifunctional parts. As sectors increasingly emphasize innovation, energy efficiency, and sustainability, MID solutions are gaining popularity for their capability to merge electrical and mechanical functions into one component. Moreover, developments in molding methods, like laser direct structuring (LDS), are enhancing the accuracy and potential of MID production. As the need for smaller, more efficient gadgets increases, the Molded Interconnect Device market is projected to experience notable growth in multiple sectors, providing distinct solutions for next-generation electronic products.

Molded Interconnect Device Market Concentration & Characteristics

- The MID market is moderately concentrated, with key players holding significant market share.

- Innovation is a key characteristic, with companies investing in R&D for new materials and processes.

- Regulations and product substitutes can impact market dynamics.

- End-user concentration is high in certain industries, such as telecommunications and automotive.

- M&A activity is moderate, with companies seeking to expand portfolios or enter new markets.

Molded Interconnect Device Market Trends

- Miniaturization and integration trends are driving demand for MIDS.

- Advanced packaging technologies are enhancing device performance and reliability.

- The growing Internet of Things (IoT) is creating new opportunities for MIDs.

- Sustainability concerns are driving the adoption of eco-friendly materials and processes.

- Customization and rapid prototyping are becoming increasingly important.

Key Region or Country & Segment to Dominate the Market

Dominant Region: Asia Pacific, driven by growth in China, India, and Japan. Dominant Segments:

- Product Type: Connectors & Switches (estimated 45% market share)

- Industry Vertical: Telecommunications (estimated 30% market share)

Molded Interconnect Device Market Product Insights Report Coverage & Deliverables

- Market size, share, and growth forecasts

- Analysis of key industry trends

- Competitive landscape and market share analysis

- Company profiles and product offerings

Molded Interconnect Device Market Analysis

- Market size estimated at USD 1.65 billion in 2023, projected to reach USD 2.85 billion by 2028.

- Telecommunications segment to contribute the largest market share due to rising demand for network infrastructure and 5G applications.

Molded Interconnect Device Market Regional Insights

North America:

- High demand from the electronics and automotive industries

- Strong presence of major MID manufacturers Europe:

- Advanced manufacturing capabilities and stringent quality standards

- Key markets include Germany, UK, and France Asia Pacific:

- Leading region in MID production and consumption

- Rapid growth driven by China, India, and Japan

Driving Forces: What's Propelling the Molded Interconnect Device Market

- Miniaturization and weight reduction demands in electronics devices

- Rising adoption of advanced packaging technologies

- Growing demand for connectivity and data transmission

- Government initiatives to promote electronics manufacturing

Challenges and Restraints in Molded Interconnect Device Market

- High cost of materials and production processes

- Limited design complexity and scalability

- Competition from printed circuit boards (PCBs)

- Stringent regulatory requirements

Emerging Trends in Molded Interconnect Device Market

- Development of eco-friendly materials and processes

- Integration of sensors, antennas, and other electronic components

- Customization and mass production capabilities

- Advancements in 3D printing for MID fabrication

Molded Interconnect Device Industry News

- November 2023: NextFlex announces $6.49 million in funding for flexible hybrid electronics projects, including in-mold flexible electronics.

- August 2023: Molex receives China Industry Award for its enhanced high-speed connectors.

- July 2022: TE Connectivity acquires Linx Technologies to strengthen its IoT market presence.

- January 2022: Tide Rock Holdings acquires Plastic Molding Technology to enhance its injection molding capabilities.

Leading Players in the Molded Interconnect Device Market

Molded Interconnect Device Market Segmentation

- 1. Process Segment

- 1.1. Laser Direct Structuring

- 1.2. 2-Shot Molding

- 1.3. Film Techniques

- 2. Product Type

- 2.1. Antennae & Connectivity Modules

- 2.2. Connectors & Switches

- 2.3. Sensors

- 2.4. Lighting

- 2.5. Others

- 3. Industry Vertical

- 3.1. Telecommunications

- 3.2. Consumer Electronics

- 3.3. BFSI

- 3.4. Military & Aerospace

- 3.5. Industrial

- 3.6. Healthcare

- 3.7. Automotive

- 3.8. Others

Molded Interconnect Device Market Segmentation By Geography

- 1. North America

- 1.1. U.S.

- 1.2. Canada

- 2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

- 3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ANZ

- 3.6. Rest of Asia Pacific

- 4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. MEA

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of MEA

Molded Interconnect Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Miniaturization of electronic devices

- 3.2.2 Advancements in manufacturing technologies

- 3.2.3 Growing demand in automotive industry

- 3.2.4 Environmental and regulatory benefits

- 3.2.5 Increasing adoption in medical devices

- 3.3. Market Restrains

- 3.3.1 High initial manufacturing costs

- 3.3.2 Design complexity and expertise requirements

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Molded Interconnect Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process Segment

- 5.1.1. Laser Direct Structuring

- 5.1.2. 2-Shot Molding

- 5.1.3. Film Techniques

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Antennae & Connectivity Modules

- 5.2.2. Connectors & Switches

- 5.2.3. Sensors

- 5.2.4. Lighting

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. Telecommunications

- 5.3.2. Consumer Electronics

- 5.3.3. BFSI

- 5.3.4. Military & Aerospace

- 5.3.5. Industrial

- 5.3.6. Healthcare

- 5.3.7. Automotive

- 5.3.8. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Process Segment

- 6. North America Molded Interconnect Device Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Process Segment

- 6.1.1. Laser Direct Structuring

- 6.1.2. 2-Shot Molding

- 6.1.3. Film Techniques

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Antennae & Connectivity Modules

- 6.2.2. Connectors & Switches

- 6.2.3. Sensors

- 6.2.4. Lighting

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.3.1. Telecommunications

- 6.3.2. Consumer Electronics

- 6.3.3. BFSI

- 6.3.4. Military & Aerospace

- 6.3.5. Industrial

- 6.3.6. Healthcare

- 6.3.7. Automotive

- 6.3.8. Others

- 6.1. Market Analysis, Insights and Forecast - by Process Segment

- 7. Europe Molded Interconnect Device Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Process Segment

- 7.1.1. Laser Direct Structuring

- 7.1.2. 2-Shot Molding

- 7.1.3. Film Techniques

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Antennae & Connectivity Modules

- 7.2.2. Connectors & Switches

- 7.2.3. Sensors

- 7.2.4. Lighting

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.3.1. Telecommunications

- 7.3.2. Consumer Electronics

- 7.3.3. BFSI

- 7.3.4. Military & Aerospace

- 7.3.5. Industrial

- 7.3.6. Healthcare

- 7.3.7. Automotive

- 7.3.8. Others

- 7.1. Market Analysis, Insights and Forecast - by Process Segment

- 8. Asia Pacific Molded Interconnect Device Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Process Segment

- 8.1.1. Laser Direct Structuring

- 8.1.2. 2-Shot Molding

- 8.1.3. Film Techniques

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Antennae & Connectivity Modules

- 8.2.2. Connectors & Switches

- 8.2.3. Sensors

- 8.2.4. Lighting

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.3.1. Telecommunications

- 8.3.2. Consumer Electronics

- 8.3.3. BFSI

- 8.3.4. Military & Aerospace

- 8.3.5. Industrial

- 8.3.6. Healthcare

- 8.3.7. Automotive

- 8.3.8. Others

- 8.1. Market Analysis, Insights and Forecast - by Process Segment

- 9. Latin America Molded Interconnect Device Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Process Segment

- 9.1.1. Laser Direct Structuring

- 9.1.2. 2-Shot Molding

- 9.1.3. Film Techniques

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Antennae & Connectivity Modules

- 9.2.2. Connectors & Switches

- 9.2.3. Sensors

- 9.2.4. Lighting

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.3.1. Telecommunications

- 9.3.2. Consumer Electronics

- 9.3.3. BFSI

- 9.3.4. Military & Aerospace

- 9.3.5. Industrial

- 9.3.6. Healthcare

- 9.3.7. Automotive

- 9.3.8. Others

- 9.1. Market Analysis, Insights and Forecast - by Process Segment

- 10. MEA Molded Interconnect Device Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Process Segment

- 10.1.1. Laser Direct Structuring

- 10.1.2. 2-Shot Molding

- 10.1.3. Film Techniques

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Antennae & Connectivity Modules

- 10.2.2. Connectors & Switches

- 10.2.3. Sensors

- 10.2.4. Lighting

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.3.1. Telecommunications

- 10.3.2. Consumer Electronics

- 10.3.3. BFSI

- 10.3.4. Military & Aerospace

- 10.3.5. Industrial

- 10.3.6. Healthcare

- 10.3.7. Automotive

- 10.3.8. Others

- 10.1. Market Analysis, Insights and Forecast - by Process Segment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TE Connectivity

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mitsubishi Engineering-Plastics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GALTRONICS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Molex LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RTP Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 TE Connectivity

- Figure 1: Global Molded Interconnect Device Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: Global Molded Interconnect Device Market Volume Breakdown (K Tons, %) by Region 2024 & 2032

- Figure 3: North America Molded Interconnect Device Market Revenue (Billion), by Process Segment 2024 & 2032

- Figure 4: North America Molded Interconnect Device Market Volume (K Tons), by Process Segment 2024 & 2032

- Figure 5: North America Molded Interconnect Device Market Revenue Share (%), by Process Segment 2024 & 2032

- Figure 6: North America Molded Interconnect Device Market Volume Share (%), by Process Segment 2024 & 2032

- Figure 7: North America Molded Interconnect Device Market Revenue (Billion), by Product Type 2024 & 2032

- Figure 8: North America Molded Interconnect Device Market Volume (K Tons), by Product Type 2024 & 2032

- Figure 9: North America Molded Interconnect Device Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 10: North America Molded Interconnect Device Market Volume Share (%), by Product Type 2024 & 2032

- Figure 11: North America Molded Interconnect Device Market Revenue (Billion), by Industry Vertical 2024 & 2032

- Figure 12: North America Molded Interconnect Device Market Volume (K Tons), by Industry Vertical 2024 & 2032

- Figure 13: North America Molded Interconnect Device Market Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 14: North America Molded Interconnect Device Market Volume Share (%), by Industry Vertical 2024 & 2032

- Figure 15: North America Molded Interconnect Device Market Revenue (Billion), by Country 2024 & 2032

- Figure 16: North America Molded Interconnect Device Market Volume (K Tons), by Country 2024 & 2032

- Figure 17: North America Molded Interconnect Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Molded Interconnect Device Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Europe Molded Interconnect Device Market Revenue (Billion), by Process Segment 2024 & 2032

- Figure 20: Europe Molded Interconnect Device Market Volume (K Tons), by Process Segment 2024 & 2032

- Figure 21: Europe Molded Interconnect Device Market Revenue Share (%), by Process Segment 2024 & 2032

- Figure 22: Europe Molded Interconnect Device Market Volume Share (%), by Process Segment 2024 & 2032

- Figure 23: Europe Molded Interconnect Device Market Revenue (Billion), by Product Type 2024 & 2032

- Figure 24: Europe Molded Interconnect Device Market Volume (K Tons), by Product Type 2024 & 2032

- Figure 25: Europe Molded Interconnect Device Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Europe Molded Interconnect Device Market Volume Share (%), by Product Type 2024 & 2032

- Figure 27: Europe Molded Interconnect Device Market Revenue (Billion), by Industry Vertical 2024 & 2032

- Figure 28: Europe Molded Interconnect Device Market Volume (K Tons), by Industry Vertical 2024 & 2032

- Figure 29: Europe Molded Interconnect Device Market Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 30: Europe Molded Interconnect Device Market Volume Share (%), by Industry Vertical 2024 & 2032

- Figure 31: Europe Molded Interconnect Device Market Revenue (Billion), by Country 2024 & 2032

- Figure 32: Europe Molded Interconnect Device Market Volume (K Tons), by Country 2024 & 2032

- Figure 33: Europe Molded Interconnect Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe Molded Interconnect Device Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Asia Pacific Molded Interconnect Device Market Revenue (Billion), by Process Segment 2024 & 2032

- Figure 36: Asia Pacific Molded Interconnect Device Market Volume (K Tons), by Process Segment 2024 & 2032

- Figure 37: Asia Pacific Molded Interconnect Device Market Revenue Share (%), by Process Segment 2024 & 2032

- Figure 38: Asia Pacific Molded Interconnect Device Market Volume Share (%), by Process Segment 2024 & 2032

- Figure 39: Asia Pacific Molded Interconnect Device Market Revenue (Billion), by Product Type 2024 & 2032

- Figure 40: Asia Pacific Molded Interconnect Device Market Volume (K Tons), by Product Type 2024 & 2032

- Figure 41: Asia Pacific Molded Interconnect Device Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 42: Asia Pacific Molded Interconnect Device Market Volume Share (%), by Product Type 2024 & 2032

- Figure 43: Asia Pacific Molded Interconnect Device Market Revenue (Billion), by Industry Vertical 2024 & 2032

- Figure 44: Asia Pacific Molded Interconnect Device Market Volume (K Tons), by Industry Vertical 2024 & 2032

- Figure 45: Asia Pacific Molded Interconnect Device Market Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 46: Asia Pacific Molded Interconnect Device Market Volume Share (%), by Industry Vertical 2024 & 2032

- Figure 47: Asia Pacific Molded Interconnect Device Market Revenue (Billion), by Country 2024 & 2032

- Figure 48: Asia Pacific Molded Interconnect Device Market Volume (K Tons), by Country 2024 & 2032

- Figure 49: Asia Pacific Molded Interconnect Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Pacific Molded Interconnect Device Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Molded Interconnect Device Market Revenue (Billion), by Process Segment 2024 & 2032

- Figure 52: Latin America Molded Interconnect Device Market Volume (K Tons), by Process Segment 2024 & 2032

- Figure 53: Latin America Molded Interconnect Device Market Revenue Share (%), by Process Segment 2024 & 2032

- Figure 54: Latin America Molded Interconnect Device Market Volume Share (%), by Process Segment 2024 & 2032

- Figure 55: Latin America Molded Interconnect Device Market Revenue (Billion), by Product Type 2024 & 2032

- Figure 56: Latin America Molded Interconnect Device Market Volume (K Tons), by Product Type 2024 & 2032

- Figure 57: Latin America Molded Interconnect Device Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 58: Latin America Molded Interconnect Device Market Volume Share (%), by Product Type 2024 & 2032

- Figure 59: Latin America Molded Interconnect Device Market Revenue (Billion), by Industry Vertical 2024 & 2032

- Figure 60: Latin America Molded Interconnect Device Market Volume (K Tons), by Industry Vertical 2024 & 2032

- Figure 61: Latin America Molded Interconnect Device Market Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 62: Latin America Molded Interconnect Device Market Volume Share (%), by Industry Vertical 2024 & 2032

- Figure 63: Latin America Molded Interconnect Device Market Revenue (Billion), by Country 2024 & 2032

- Figure 64: Latin America Molded Interconnect Device Market Volume (K Tons), by Country 2024 & 2032

- Figure 65: Latin America Molded Interconnect Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Latin America Molded Interconnect Device Market Volume Share (%), by Country 2024 & 2032

- Figure 67: MEA Molded Interconnect Device Market Revenue (Billion), by Process Segment 2024 & 2032

- Figure 68: MEA Molded Interconnect Device Market Volume (K Tons), by Process Segment 2024 & 2032

- Figure 69: MEA Molded Interconnect Device Market Revenue Share (%), by Process Segment 2024 & 2032

- Figure 70: MEA Molded Interconnect Device Market Volume Share (%), by Process Segment 2024 & 2032

- Figure 71: MEA Molded Interconnect Device Market Revenue (Billion), by Product Type 2024 & 2032

- Figure 72: MEA Molded Interconnect Device Market Volume (K Tons), by Product Type 2024 & 2032

- Figure 73: MEA Molded Interconnect Device Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 74: MEA Molded Interconnect Device Market Volume Share (%), by Product Type 2024 & 2032

- Figure 75: MEA Molded Interconnect Device Market Revenue (Billion), by Industry Vertical 2024 & 2032

- Figure 76: MEA Molded Interconnect Device Market Volume (K Tons), by Industry Vertical 2024 & 2032

- Figure 77: MEA Molded Interconnect Device Market Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 78: MEA Molded Interconnect Device Market Volume Share (%), by Industry Vertical 2024 & 2032

- Figure 79: MEA Molded Interconnect Device Market Revenue (Billion), by Country 2024 & 2032

- Figure 80: MEA Molded Interconnect Device Market Volume (K Tons), by Country 2024 & 2032

- Figure 81: MEA Molded Interconnect Device Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: MEA Molded Interconnect Device Market Volume Share (%), by Country 2024 & 2032

- Table 1: Global Molded Interconnect Device Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Molded Interconnect Device Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Global Molded Interconnect Device Market Revenue Billion Forecast, by Process Segment 2019 & 2032

- Table 4: Global Molded Interconnect Device Market Volume K Tons Forecast, by Process Segment 2019 & 2032

- Table 5: Global Molded Interconnect Device Market Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 6: Global Molded Interconnect Device Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 7: Global Molded Interconnect Device Market Revenue Billion Forecast, by Industry Vertical 2019 & 2032

- Table 8: Global Molded Interconnect Device Market Volume K Tons Forecast, by Industry Vertical 2019 & 2032

- Table 9: Global Molded Interconnect Device Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 10: Global Molded Interconnect Device Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Global Molded Interconnect Device Market Revenue Billion Forecast, by Process Segment 2019 & 2032

- Table 12: Global Molded Interconnect Device Market Volume K Tons Forecast, by Process Segment 2019 & 2032

- Table 13: Global Molded Interconnect Device Market Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 14: Global Molded Interconnect Device Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 15: Global Molded Interconnect Device Market Revenue Billion Forecast, by Industry Vertical 2019 & 2032

- Table 16: Global Molded Interconnect Device Market Volume K Tons Forecast, by Industry Vertical 2019 & 2032

- Table 17: Global Molded Interconnect Device Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 18: Global Molded Interconnect Device Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 19: U.S. Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: U.S. Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Canada Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Canada Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Global Molded Interconnect Device Market Revenue Billion Forecast, by Process Segment 2019 & 2032

- Table 24: Global Molded Interconnect Device Market Volume K Tons Forecast, by Process Segment 2019 & 2032

- Table 25: Global Molded Interconnect Device Market Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 26: Global Molded Interconnect Device Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 27: Global Molded Interconnect Device Market Revenue Billion Forecast, by Industry Vertical 2019 & 2032

- Table 28: Global Molded Interconnect Device Market Volume K Tons Forecast, by Industry Vertical 2019 & 2032

- Table 29: Global Molded Interconnect Device Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 30: Global Molded Interconnect Device Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: Germany Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: Germany Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: UK Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 34: UK Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: France Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 36: France Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Italy Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 38: Italy Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Spain Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 40: Spain Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Global Molded Interconnect Device Market Revenue Billion Forecast, by Process Segment 2019 & 2032

- Table 44: Global Molded Interconnect Device Market Volume K Tons Forecast, by Process Segment 2019 & 2032

- Table 45: Global Molded Interconnect Device Market Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 46: Global Molded Interconnect Device Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 47: Global Molded Interconnect Device Market Revenue Billion Forecast, by Industry Vertical 2019 & 2032

- Table 48: Global Molded Interconnect Device Market Volume K Tons Forecast, by Industry Vertical 2019 & 2032

- Table 49: Global Molded Interconnect Device Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 50: Global Molded Interconnect Device Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 51: China Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 52: China Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 53: India Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 54: India Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 55: Japan Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 56: Japan Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 57: South Korea Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 58: South Korea Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 59: ANZ Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 60: ANZ Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 61: Rest of Asia Pacific Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 62: Rest of Asia Pacific Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 63: Global Molded Interconnect Device Market Revenue Billion Forecast, by Process Segment 2019 & 2032

- Table 64: Global Molded Interconnect Device Market Volume K Tons Forecast, by Process Segment 2019 & 2032

- Table 65: Global Molded Interconnect Device Market Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 66: Global Molded Interconnect Device Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 67: Global Molded Interconnect Device Market Revenue Billion Forecast, by Industry Vertical 2019 & 2032

- Table 68: Global Molded Interconnect Device Market Volume K Tons Forecast, by Industry Vertical 2019 & 2032

- Table 69: Global Molded Interconnect Device Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 70: Global Molded Interconnect Device Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 71: Brazil Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 72: Brazil Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 73: Mexico Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 74: Mexico Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 75: Rest of Latin America Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 76: Rest of Latin America Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 77: Global Molded Interconnect Device Market Revenue Billion Forecast, by Process Segment 2019 & 2032

- Table 78: Global Molded Interconnect Device Market Volume K Tons Forecast, by Process Segment 2019 & 2032

- Table 79: Global Molded Interconnect Device Market Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 80: Global Molded Interconnect Device Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 81: Global Molded Interconnect Device Market Revenue Billion Forecast, by Industry Vertical 2019 & 2032

- Table 82: Global Molded Interconnect Device Market Volume K Tons Forecast, by Industry Vertical 2019 & 2032

- Table 83: Global Molded Interconnect Device Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 84: Global Molded Interconnect Device Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 85: UAE Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 86: UAE Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 87: Saudi Arabia Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 88: Saudi Arabia Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 89: South Africa Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 90: South Africa Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 91: Rest of MEA Molded Interconnect Device Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 92: Rest of MEA Molded Interconnect Device Market Volume (K Tons) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.