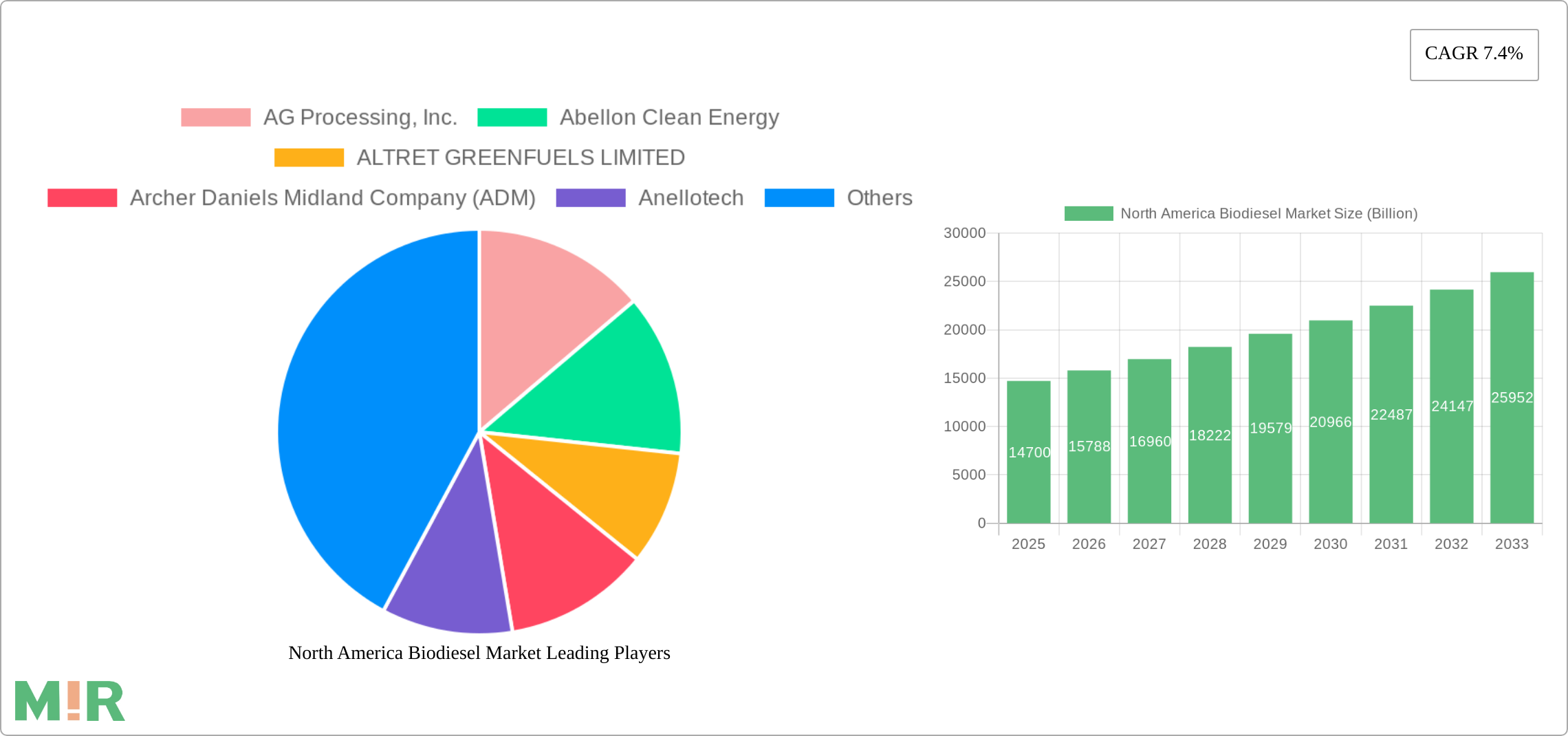

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Biodiesel Market?

The projected CAGR is approximately 7.4%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

North America Biodiesel Market by Feedstock (Animal fat, Vegetable oil, Others), by Application (Transportation, Power generation, Others), by North America (U.S., Canada) Forecast 2025-2033

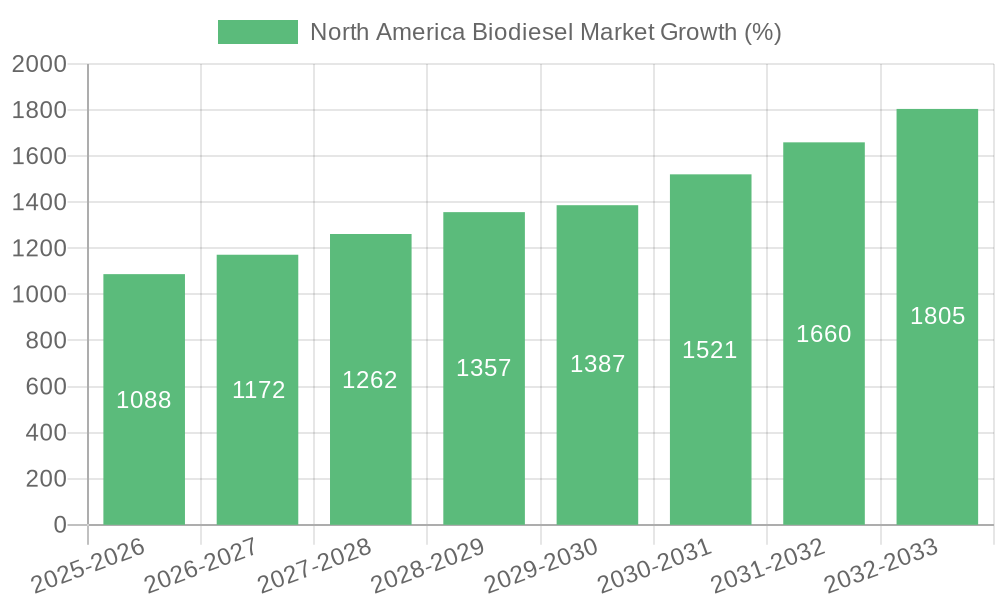

The North American biodiesel market, valued at $14.7 billion in 2025, is projected to experience robust growth, driven by increasing government mandates for renewable fuels, rising environmental concerns, and the expanding transportation and power generation sectors. A Compound Annual Growth Rate (CAGR) of 7.4% from 2025 to 2033 signifies a significant market expansion. Key drivers include stringent emission regulations pushing for cleaner fuel alternatives, growing awareness of the environmental benefits of biodiesel compared to fossil fuels, and increasing investments in renewable energy infrastructure. The market segmentation reveals a strong demand across diverse applications, with transportation likely dominating due to its compatibility with existing diesel engines. The feedstock segment is characterized by a significant contribution from animal fat and vegetable oils, reflecting both the readily available resources and the ongoing research into maximizing yield and efficiency from various sources. Major players like Archer Daniels Midland Company (ADM), Cargill, and Renewable Energy Group are strategically positioning themselves to capitalize on this growth, driving innovation and competition within the sector. While challenges such as feedstock price volatility and potential competition from other renewable fuels exist, the long-term outlook remains positive, supported by continued government support and growing consumer preference for sustainable energy solutions.

The market's growth trajectory is also influenced by technological advancements in biodiesel production, leading to higher efficiency and reduced costs. Furthermore, increasing collaborations between biodiesel producers and automotive manufacturers are facilitating the development of optimized engines and fuels. The regional focus on North America, specifically the U.S. and Canada, reflects the strong regulatory environment and established infrastructure supporting the biodiesel industry. While data for other regions is unavailable, it is expected that global market trends will influence the overall growth of the North American market. The historical period (2019-2024) likely showed varying growth rates influenced by factors like fluctuating oil prices and policy changes; however, the steady 7.4% CAGR forecast for 2025-2033 indicates a sustained upward trend. This continued growth trajectory points towards a substantial increase in market size by 2033, creating opportunities for both established players and new entrants to participate in this dynamic sector.

The North American biodiesel market is moderately concentrated, with a few large players like Archer Daniels Midland (ADM), Bunge Ltd., and Cargill holding significant market share. However, a considerable number of smaller, regional producers also contribute to the overall market volume. Innovation is driven by advancements in feedstock utilization (e.g., exploring non-food sources), process efficiency improvements, and the development of biodiesel blends with enhanced performance characteristics.

The North American biodiesel market is experiencing robust growth, driven by several key trends. Stringent environmental regulations aimed at reducing greenhouse gas emissions are pushing for greater adoption of biofuels, with biodiesel playing a pivotal role. Furthermore, increasing consumer awareness of sustainable transportation solutions is boosting demand for biodiesel as a cleaner alternative to conventional diesel fuel. Technological advancements in feedstock processing and production efficiency are also contributing to cost reductions, enhancing the market's competitiveness. The rising prices of conventional diesel fuel are making biodiesel a more economically viable option, further propelling market expansion. Finally, significant investments in research and development (R&D) are focused on exploring novel feedstock sources, improving biodiesel quality, and reducing its environmental footprint. This includes exploring waste streams and algae as sustainable feedstock options. Government incentives and policies supporting the use of renewable fuels are also playing a significant role in fostering market growth. However, challenges such as feedstock price volatility and the need for sustainable feedstock sourcing remain crucial considerations for long-term market development. The expansion of blending infrastructure and the development of superior biodiesel blends tailored to specific applications are expected to shape the market's trajectory in the coming years.

The United States is the dominant market within North America, owing to its larger population, significant agricultural production (providing ample feedstock), established infrastructure, and robust policy support through the Renewable Fuel Standard (RFS). Canada, while smaller, also exhibits considerable growth potential driven by similar factors.

Within the feedstock segment, vegetable oils (primarily soybean oil) currently hold the largest market share, due to their established supply chains and relative cost-effectiveness. However, other feedstocks like animal fats are gaining traction owing to their sustainability aspects and potential to further reduce reliance on food crops. The transportation application segment is the most significant end-use sector for biodiesel in North America, driven by increasing demand for cleaner transportation fuels in various sectors such as trucking, buses, and trains.

This report provides a comprehensive analysis of the North American biodiesel market, covering market size and growth projections, key trends, competitive landscape, and regional variations. It delves into specific product segments (feedstocks and applications), highlighting the market share of each and future growth potentials. Detailed insights into market drivers, restraints, and emerging trends are provided, along with profiles of key market players and their strategies. The report also offers forecasts for various market segments, allowing stakeholders to make informed strategic decisions.

The North American biodiesel market is valued at approximately $15 billion in 2024. The market is projected to witness a Compound Annual Growth Rate (CAGR) of around 7% from 2024 to 2030, reaching an estimated value of $25 billion by 2030. This robust growth is driven by favorable government policies, environmental concerns, and the increasing demand for sustainable transportation fuels. Market share is currently fragmented among several players, with a few large multinational corporations dominating and smaller, regional players occupying niches. Future market growth will depend heavily on technological advancements, feedstock availability, and continued government support.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.4% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.4%.

Key companies in the market include AG Processing, Inc., Abellon Clean Energy, ALTRET GREENFUELS LIMITED, Archer Daniels Midland Company (ADM), Anellotech, Bunge Ltd., Cargill, Clariant, Chevron Corporation, FutureFuel Corporation, Greenergy, Manuelita S.A., Renewable Energy Group, Renewable Biofuels, Inc., TerraVia Holdings, Inc., Total Energies, Universal Biofuels Private Limited, Wilmar International Ltd., Washwell Biodiesel.

The market segments include Feedstock, Application.

The market size is estimated to be USD 14.7 Billion as of 2022.

Rising demand for sustainable energy. Fluctuating oil prices.

N/A

Feedstock availability and cost.

In March 2024, Chevron has idled two biodiesel production facilities of production in the U.S. Chevron has acquired Renewable Energy Group for USD 3.15 billion in 2022 to boost its biofuels production to 1 lakh barrels per day by 2030.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4,850, USD 5,350, and USD 7,350 respectively.

The market size is provided in terms of value, measured in Billion.

Yes, the market keyword associated with the report is "North America Biodiesel Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the North America Biodiesel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

See the similar reports

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.