Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

North America Energy Storage Systems Market Unlocking Growth Opportunities: Analysis and Forecast 2025-2033

North America Energy Storage Systems Market by Technology (Pumped Hydro, Electro-Chemical, Electro-Mechanical, Thermal Energy Storage), by Application (Electric Time Energy Shift, Electric Supply Capacity, Black Start, Renewable Capacity Firming, Frequency Regulation, Others), by North America (U.S., Canada) Forecast 2025-2033

Key Insights

The North American energy storage systems market is experiencing robust growth, projected to reach a substantial size driven by increasing renewable energy integration, grid modernization initiatives, and the escalating demand for reliable and resilient power supplies. The market's Compound Annual Growth Rate (CAGR) of 16.1% from 2019 to 2033 signifies significant expansion opportunities. Key drivers include the need for grid stabilization, particularly with the intermittent nature of solar and wind power, along with the rising adoption of electric vehicles and the associated need for efficient charging infrastructure. Technological advancements in battery chemistry, such as the progression of lithium-ion and flow battery technologies, are further accelerating market penetration. Within North America, the United States is expected to dominate the market due to its larger energy consumption, substantial investments in renewable energy infrastructure, and supportive government policies. While pumped hydro storage remains a significant segment, the electro-chemical segment, particularly lithium-ion batteries, is experiencing the fastest growth due to its scalability and relatively lower installation costs compared to other technologies. The application segments of electric time energy shifting and renewable capacity firming are major contributors to market expansion. However, challenges such as high initial capital costs for some energy storage technologies, the need for advanced grid infrastructure, and concerns surrounding battery lifecycle management and recycling will require attention for sustained growth.

The substantial market size of $68.9 billion in 2025 underscores the significant investment and activity within the sector. Considering the 16.1% CAGR, a conservative extrapolation suggests a consistent growth trajectory. The market segmentation reveals a dynamic landscape, with diverse technologies competing based on factors such as cost-effectiveness, efficiency, and scalability. The strong presence of established companies such as ABB, General Electric, and Siemens, alongside emerging players like BYD and LG Energy Solution, highlights the competitive nature of the market. The North American market's advantage stems from its advanced technological infrastructure, supportive regulatory framework, and strong demand from both residential and industrial consumers, presenting significant opportunities for investors and businesses involved in the energy storage value chain. Furthermore, sustained government support through tax incentives and grant programs will be crucial for accelerating the transition to a more sustainable and reliable power grid.

North America Energy Storage Systems Market Concentration & Characteristics

The North American energy storage systems market is characterized by a moderately concentrated landscape with several large multinational corporations and a growing number of smaller, specialized players. Innovation is heavily focused on improving battery technologies (particularly Lithium-ion), lowering costs, and increasing system efficiency and lifespan. Pumped hydro remains a significant player, particularly in larger-scale projects, while the electrochemical segment shows the most rapid growth.

- Concentration Areas: California, Texas, and other states with robust renewable energy mandates exhibit high concentration of deployments.

- Characteristics of Innovation: Focus on improving battery chemistry, integrating AI for predictive maintenance, and developing safer and more sustainable storage solutions.

- Impact of Regulations: Government incentives, tax credits, and grid modernization initiatives are driving market expansion. However, regulatory uncertainties and permitting processes can sometimes create bottlenecks.

- Product Substitutes: While other energy storage technologies exist (e.g., compressed air), Lithium-ion batteries currently dominate due to their higher energy density and efficiency.

- End User Concentration: Utilities, independent power producers (IPPs), and large industrial consumers represent the largest end-user segments.

- Level of M&A: The market has witnessed a moderate level of mergers and acquisitions, with larger companies acquiring smaller technology firms or project developers to strengthen their market positions.

North America Energy Storage Systems Market Trends

The North American energy storage systems market is experiencing exponential growth, driven by several key trends. The increasing penetration of renewable energy sources like solar and wind power necessitates energy storage to address intermittency issues. Grid modernization efforts, aiming for improved resilience and efficiency, are also fueling demand. Furthermore, corporations and industrial facilities are increasingly adopting energy storage to reduce energy costs and improve operational reliability. Falling battery costs and technological advancements are making energy storage solutions more economically viable, accelerating market adoption. The focus is shifting towards larger-scale deployments, particularly for grid-scale applications, with significant investments in utility-scale projects. The market also shows a rising interest in microgrids and behind-the-meter storage solutions. Regulatory policies and government support, particularly in states with ambitious clean energy goals, are playing a crucial role in bolstering market growth. Finally, the emergence of advanced energy management systems (EMS) enhances storage system integration and optimization, further driving market expansion. These trends suggest the market will continue to expand significantly in the coming years, reaching an estimated value of over $100 billion by 2030.

Key Region or Country & Segment to Dominate the Market

The Lithium-ion battery technology segment within the electrochemical storage category is poised to dominate the North American market.

- Reasons for Dominance: Lithium-ion batteries currently offer the best combination of energy density, power output, lifespan, and cost-effectiveness compared to other battery technologies. Technological advancements continue to improve their performance and reduce their cost.

- Regional Dominance: California, Texas, and other states with supportive renewable energy policies and large-scale grid modernization projects are leading the adoption of Lithium-ion battery storage systems. The U.S. market significantly outpaces Canada at present.

- Application Dominance: Grid-scale energy storage (Renewable Capacity Firming and Electric Time Energy Shift) represents the largest application segment for Lithium-ion batteries, closely followed by behind-the-meter applications such as residential and commercial energy storage.

North America Energy Storage Systems Market Product Insights Report Coverage & Deliverables

This report provides in-depth analysis of the North American energy storage systems market, covering market sizing, segmentation by technology and application, regional breakdowns, competitive landscape, and key market trends. It offers insights into leading companies, their strategies, and market share. The report includes forecasts for market growth, identifies key drivers and challenges, and analyzes regulatory impacts. Finally, it provides actionable recommendations for stakeholders involved in the market.

North America Energy Storage Systems Market Analysis

The North American energy storage systems market is experiencing robust growth, driven by the increasing adoption of renewable energy sources and the need for grid modernization. The market size is estimated at $25 billion in 2024, with a projected Compound Annual Growth Rate (CAGR) of 20% between 2024 and 2030. Lithium-ion batteries currently hold the largest market share due to their superior performance and cost-effectiveness. The grid-scale segment accounts for the major portion of the market value, driven by large-scale renewable energy projects and utility-scale deployments. However, the behind-the-meter segment is also witnessing substantial growth, with increasing residential and commercial installations. Major players are focusing on technology innovation, strategic partnerships, and geographical expansion to strengthen their market position. The market is highly competitive, with a mix of established players and emerging companies.

North America Energy Storage Systems Market Regional Insights

- North America

- U.S.

- California

- Texas

- New York

- Other States

- Canada

- Ontario

- Quebec

- Other Provinces

- U.S.

Each region’s market is further segmented by technology (Pumped Hydro, Electro-Chemical, Electro-Mechanical, Thermal Energy Storage) and application (Electric Time Energy Shift, Electric Supply Capacity, Black Start, Renewable Capacity Firming, Frequency Regulation, Others).

Driving Forces: What's Propelling the North America Energy Storage Systems Market

The market is propelled by increasing renewable energy integration, the need for grid modernization, declining battery costs, supportive government policies (tax credits, incentives), and growing corporate sustainability initiatives. Furthermore, advancements in battery technology and improved energy management systems are major drivers.

Challenges and Restraints in North America Energy Storage Systems Market

Challenges include the high initial investment costs for some technologies, permitting and regulatory hurdles, supply chain constraints for critical materials (like lithium), and potential safety concerns related to battery storage. The intermittency of renewable energy sources also needs careful management.

Emerging Trends in North America Energy Storage Systems Market

Emerging trends include the increasing adoption of hybrid energy storage systems, advancements in battery management systems, the rise of second-life battery applications, integration of artificial intelligence for optimized system operation, and the growing importance of microgrids.

North America Energy Storage Systems Industry News

- April 2022: Pacific Gas & Electric Co. (PG&E) selected Tesla's Megapack for Moss Landing substation.

- June 2022: LG and Open Solar partnered to enhance the U.S. solar market customer experience.

Leading Players in the North America Energy Storage Systems Market

- ABB

- Abengoa S.A.

- Burns & McDonnell

- BYD Company Ltd.

- CALMAC

- Durapower Group

- Exide Technologies

- General Electric

- Hitachi Energy Ltd.

- Johnson Controls

- LG Energy Solution

- McDermott

- Narada Power Source Co. Ltd

- Panasonic Corporation

- Samsung SDI Co., Ltd

- SCHMID Group

- Siemens

- Sinohydro Corporation

- Toshiba Corporation

- Voith GmbH & Co. KGaA

North America Energy Storage Systems Market Segmentation

-

1. Technology

- 1.1. Pumped Hydro

-

1.2. Electro-Chemical

- 1.2.1. Lithium-Ion

- 1.2.2. Sodium Sulphur

- 1.2.3. Lead Acid

- 1.2.4. Flow Battery

- 1.2.5. Others

-

1.3. Electro-Mechanical

- 1.3.1. Flywheel

- 1.3.2. CAES

-

1.4. Thermal Energy Storage

- 1.4.1. Water

- 1.4.2. Molten Salt

- 1.4.3. PCM

- 1.4.4. Others

-

2. Application

- 2.1. Electric Time Energy Shift

- 2.2. Electric Supply Capacity

- 2.3. Black Start

- 2.4. Renewable Capacity Firming

- 2.5. Frequency Regulation

- 2.6. Others

North America Energy Storage Systems Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

North America Energy Storage Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.1% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Favorable regulatory framework

- 3.2.2 Growth in the renewable energy sector

- 3.2.3 Increasing concerns toward security of supply

- 3.3. Market Restrains

- 3.3.1 High capital cost of pumped storage plants

- 3.3.2 Safety concerns

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Energy Storage Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Pumped Hydro

- 5.1.2. Electro-Chemical

- 5.1.2.1. Lithium-Ion

- 5.1.2.2. Sodium Sulphur

- 5.1.2.3. Lead Acid

- 5.1.2.4. Flow Battery

- 5.1.2.5. Others

- 5.1.3. Electro-Mechanical

- 5.1.3.1. Flywheel

- 5.1.3.2. CAES

- 5.1.4. Thermal Energy Storage

- 5.1.4.1. Water

- 5.1.4.2. Molten Salt

- 5.1.4.3. PCM

- 5.1.4.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electric Time Energy Shift

- 5.2.2. Electric Supply Capacity

- 5.2.3. Black Start

- 5.2.4. Renewable Capacity Firming

- 5.2.5. Frequency Regulation

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ABB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abengoa S.A.

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Burns & McDonnell

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BYD Company Ltd.

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CALMAC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durapower Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Exide Technologies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hitachi Energy Ltd.

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Johnson Controls

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LG Energy Solution

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 McDermott

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Narada Power Source Co. Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Panasonic Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Samsung SDI Co. Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 SCHMID Group

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Siemens

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Sinohydro Corporation

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Toshiba Corporation

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Voith GmbH & Co. KGaA

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 ABB

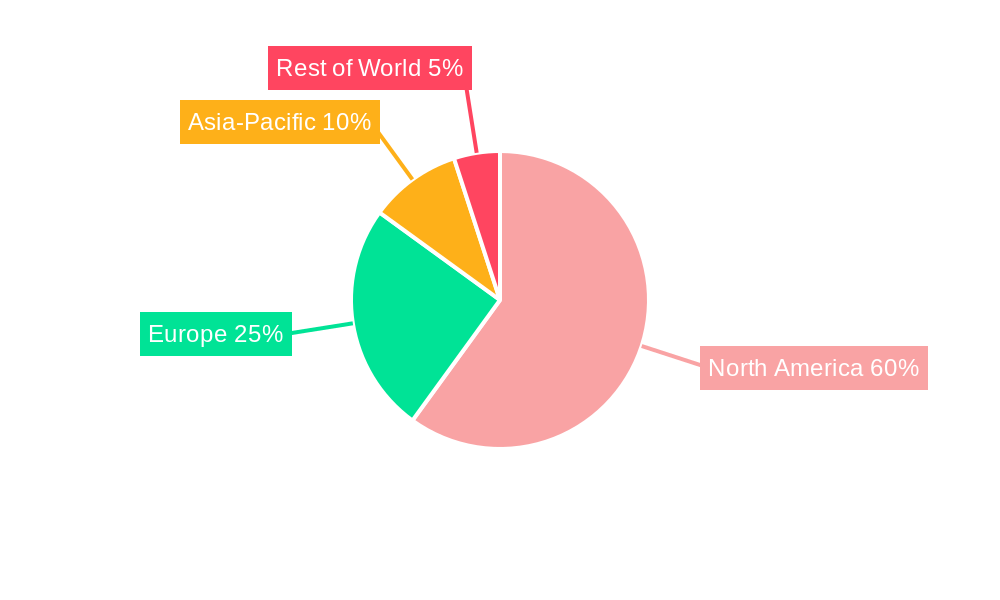

- Figure 1: North America Energy Storage Systems Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: North America Energy Storage Systems Market Share (%) by Company 2024

- Table 1: North America Energy Storage Systems Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: North America Energy Storage Systems Market Revenue Billion Forecast, by Technology 2019 & 2032

- Table 3: North America Energy Storage Systems Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 4: North America Energy Storage Systems Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: North America Energy Storage Systems Market Revenue Billion Forecast, by Technology 2019 & 2032

- Table 6: North America Energy Storage Systems Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 7: North America Energy Storage Systems Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 8: U.S. North America Energy Storage Systems Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Energy Storage Systems Market Revenue (Billion) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)