1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Petroleum Refining Hydrogen Generation Market?

The projected CAGR is approximately 5.9%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

North America Petroleum Refining Hydrogen Generation Market by Delivery Mode (Captive, Merchant), by Process (Steam Reformer, Electrolysis, Others), by North America (U.S., Canada) Forecast 2025-2033

The North America Petroleum Refining Hydrogen Generation market is experiencing robust growth, projected to reach $10.2 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.9% from 2025 to 2033. This expansion is driven by increasing demand for cleaner fuels and stricter environmental regulations within the petroleum refining sector. The shift towards lower-carbon emission technologies is fueling the adoption of hydrogen generation methods like electrolysis, which, while currently a smaller segment, exhibits significant growth potential due to technological advancements and decreasing costs. Meanwhile, steam reforming, the dominant process currently, will continue to be a major contributor, though its share may gradually decrease as cleaner alternatives gain traction. The market is further segmented by delivery mode, with captive and merchant hydrogen delivery systems catering to different refinery needs and operational strategies. Key players, including Air Liquide, Air Products and Chemicals, Linde plc, and Shell Global, are actively investing in research and development, capacity expansion, and strategic partnerships to solidify their market positions. The North American market, particularly the U.S., benefits from established refining infrastructure and government support for clean energy initiatives, creating a favorable environment for market growth.

The competitive landscape is characterized by both established players and emerging companies focused on innovative hydrogen generation and delivery technologies. While substantial growth is anticipated, certain restraints, such as the high capital expenditure required for new hydrogen production facilities and the fluctuating price of natural gas (a key feedstock for steam reforming), need to be addressed for sustained market expansion. Further growth will be significantly influenced by the rate of adoption of alternative energy sources, government policies promoting renewable hydrogen, and improvements in the efficiency and cost-effectiveness of electrolysis. The focus on reducing carbon intensity across the petroleum refining value chain presents compelling opportunities for companies that can offer efficient, sustainable hydrogen generation solutions. The continued expansion of the hydrogen infrastructure within North America, including pipelines and storage facilities, will also play a crucial role in facilitating future market growth.

The North American petroleum refining hydrogen generation market is moderately concentrated, with a few major players holding significant market share. These include integrated oil and gas companies like ExxonMobil, Chevron, and Shell, alongside specialized industrial gas producers such as Air Liquide, Air Products, and Linde. However, the market is witnessing increased participation from smaller players and startups, particularly in the electrolysis segment.

Characteristics:

The North American petroleum refining hydrogen generation market is experiencing robust growth, driven primarily by the increasing demand for cleaner fuels and stricter environmental regulations. The shift towards low-carbon hydrogen production is a significant trend, with electrolysis gaining traction as a viable alternative to traditional steam methane reforming (SMR). This transition is fueled by declining renewable energy costs and government incentives for clean energy technologies. The development of large-scale green hydrogen projects is also becoming increasingly prominent, aligning with national net-zero emission targets.

Furthermore, the increasing integration of hydrogen into refinery operations, beyond its traditional role in hydrocracking and hydrotreating, is expanding market opportunities. This includes the use of hydrogen for fuel cell applications within refineries, further enhancing energy efficiency and reducing emissions. The development of hydrogen infrastructure, including pipelines and storage facilities, is crucial for supporting widespread adoption. Advancements in hydrogen storage technologies, such as compressed gas and liquid hydrogen, are also contributing to market growth. Finally, the rising investment in research and development, both from industry players and government agencies, is fostering innovation and driving technological advancements in hydrogen production and utilization. The market is also witnessing the emergence of innovative business models, including hydrogen-as-a-service, which are expected to boost market adoption and accelerate the energy transition. Regional variations exist, with some areas showing faster adoption rates than others due to differing policy frameworks and energy mixes.

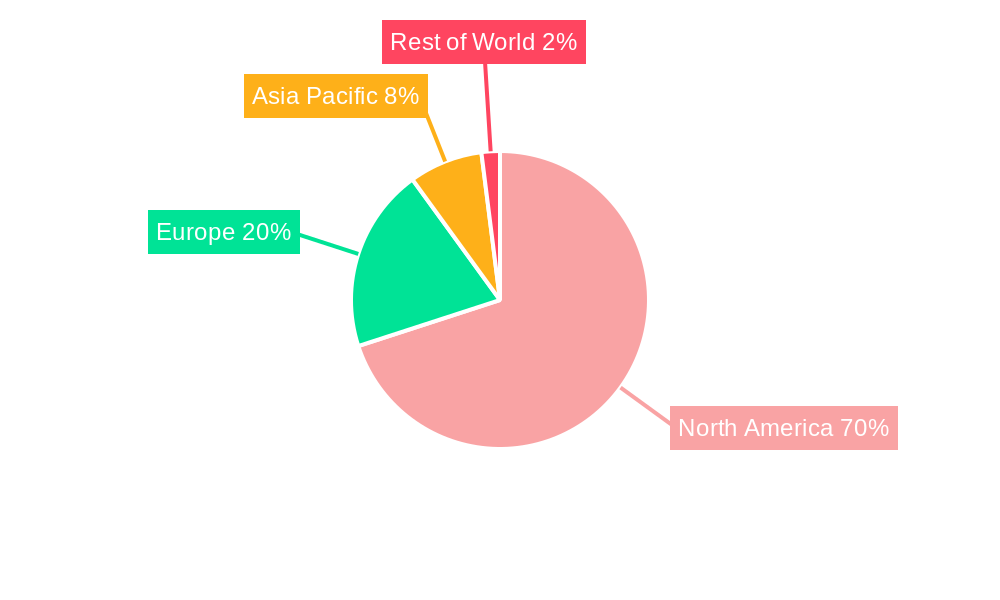

The U.S. is projected to dominate the North American petroleum refining hydrogen generation market due to its large refining capacity, substantial investments in clean energy infrastructure, and supportive government policies. Canada also presents significant growth potential, particularly given its ambitious climate targets and investments in renewable energy.

Regarding segments, the captive delivery mode is currently dominant. However, the merchant segment is poised for significant expansion as the demand for clean hydrogen increases beyond the immediate needs of refineries. In terms of processes, steam methane reforming (SMR) remains the most widely used method, due to its established infrastructure and lower upfront costs. However, electrolysis is experiencing rapid growth, driven by its potential to produce green hydrogen and government incentives. Electrolysis is expected to capture an increasing market share in the coming years as costs decrease and technological advancements improve efficiency.

This report provides a comprehensive analysis of the North American petroleum refining hydrogen generation market, covering market size, growth forecasts, and segment-specific trends. It delves into the competitive landscape, highlighting key players and their strategies. The report also examines the regulatory environment, technological advancements, and future market prospects. Key deliverables include detailed market sizing, segment-wise market share analysis, competitive benchmarking, and a comprehensive forecast to 2030.

The North American petroleum refining hydrogen generation market is estimated to be valued at approximately $15 billion in 2023 and is projected to reach $25 billion by 2030, exhibiting a compound annual growth rate (CAGR) of over 7%. This growth is primarily attributed to the increasing demand for cleaner fuels, stringent environmental regulations, and the rising adoption of hydrogen in various industrial applications. The market share is currently dominated by steam methane reforming (SMR), but this is gradually shifting towards electrolysis as technological advancements and cost reductions make it more competitive. The captive delivery mode holds the largest market share, followed by the merchant segment, which is witnessing rapid growth driven by increased demand for green hydrogen from various industrial sectors. The market landscape is characterized by both large multinational corporations and smaller niche players, fostering a competitive yet dynamic environment.

The market is driven by stringent environmental regulations aimed at reducing greenhouse gas emissions from refineries, the increasing demand for low-carbon fuels, and government incentives for clean energy technologies. Technological advancements in electrolysis, making it a cost-effective alternative to traditional methods, also significantly contribute to growth. Furthermore, the growing integration of hydrogen into refinery operations beyond its traditional uses is opening new avenues for market expansion.

High capital costs associated with hydrogen production and infrastructure development pose a significant challenge. The intermittent nature of renewable energy sources used for electrolysis requires efficient and reliable energy storage solutions. Competition from established fossil fuel-based hydrogen production methods also acts as a restraint. Lastly, the lack of standardized safety protocols and regulations for hydrogen handling and transportation can hinder market growth.

The market is witnessing a shift towards green hydrogen production through electrolysis powered by renewable energy. The development of advanced hydrogen storage and transportation technologies is crucial. Furthermore, the integration of digital technologies and data analytics for optimizing hydrogen production and distribution is gaining traction. Finally, the exploration of innovative business models, such as hydrogen-as-a-service, is transforming the market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.9% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.9%.

Key companies in the market include Air Liquide, Air Products and Chemicals, Inc, BP Plc, Cummins Inc, Chevron Corporation, ExxonMobil, Irving Oil, Linde plc, Messer Group GmbH, Nel Hydrogen, Praxair, Inc, Plug Power Inc., Shell Global, Suncor Energy.

The market segments include Delivery Mode, Process.

The market size is estimated to be USD 10.2 Billion as of 2022.

Increasing refinery capacity. Rising government support and policies. Transition towards energy independence.

N/A

High operational and maintenance costs.

In July 2022, Irving Oil planned to enhance its hydrogen capacity at the Saint John refinery, aiming to establish hydrogen fueling infrastructure in the Atlantic Canada. This initiative positions the company as the first to introduce hydrogen to the market. It will become the first refinery in Canada and one of the first in the region to purchase an electrolyzer, and invest in this clean energy technology.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,250, USD 3,750, and USD 5,750 respectively.

The market size is provided in terms of value, measured in Billion.

Yes, the market keyword associated with the report is "North America Petroleum Refining Hydrogen Generation Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the North America Petroleum Refining Hydrogen Generation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

See the similar reports

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.