1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Power Generation Carbon Capture and Storage Market?

The projected CAGR is approximately 29%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

North America Power Generation Carbon Capture and Storage Market by Technology (Pre-Combustion, Post Combustion, Oxy-Fuel Combustion), by U.S. Forecast 2025-2033

The North America power generation carbon capture and storage (CCS) market is experiencing robust growth, driven by increasing regulatory pressure to reduce greenhouse gas emissions and a rising awareness of climate change. The market, valued at $800 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 29% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, significant investments in renewable energy sources are creating a need for CCS to address intermittency issues and ensure grid stability. Secondly, advancements in CCS technologies, particularly in pre-combustion, post-combustion, and oxy-fuel combustion methods, are improving efficiency and reducing costs. Finally, government incentives and carbon pricing mechanisms are incentivizing the adoption of CCS technologies across the power generation sector. Major players like Aker Solutions, Baker Hughes, and ExxonMobil are actively involved, driving innovation and market penetration. While technological challenges and high initial capital costs remain restraints, ongoing research and development efforts, coupled with supportive policies, are poised to overcome these hurdles.

The market segmentation reveals a diverse landscape, with pre-combustion, post-combustion, and oxy-fuel combustion technologies each contributing to the overall growth. The U.S. market dominates the North American region, reflecting the country's significant power generation capacity and stringent environmental regulations. The forecast period (2025-2033) promises continued expansion, driven by increased deployment of CCS in existing and new power plants. However, the market's success will depend on sustained policy support, technological breakthroughs that further reduce costs, and successful demonstration projects showcasing the viability and reliability of CCS solutions at scale. This will further attract investment and encourage wider adoption across the North American power generation sector.

The North American power generation carbon capture and storage (CCS) market is characterized by moderate concentration, with a few large multinational players alongside several smaller, specialized companies. Major players like ExxonMobil, Shell, and General Electric hold significant market share due to their established presence and technological expertise. However, the market also exhibits a fragmented landscape with numerous smaller companies focusing on specific technologies or niche applications.

Concentration Areas: The majority of CCS projects are currently concentrated in regions with existing fossil fuel infrastructure and supportive regulatory frameworks, primarily in the U.S. (Texas, Louisiana, and the Midwest) and Alberta, Canada.

Characteristics of Innovation: Innovation is driven by improvements in capture technologies (pre-combustion, post-combustion, oxy-fuel), advancements in CO2 transportation and storage methodologies, and the development of integrated CCS solutions. The market is witnessing increased investment in novel technologies like direct air capture (DAC).

Impact of Regulations: Government policies, tax incentives (like the 45Q tax credit in the U.S.), and carbon pricing mechanisms are significant drivers of market growth. Stringent emission reduction targets are pushing power generators to adopt CCS technologies. However, regulatory inconsistencies and permitting complexities across different jurisdictions pose challenges.

Product Substitutes: Renewable energy sources (solar, wind) and nuclear power represent the most significant substitutes for fossil fuel-based power generation incorporating CCS. However, CCS extends the lifespan of existing power plants, offering a transitional solution until renewable energy sources can fully replace fossil fuels.

End User Concentration: The market is primarily driven by large-scale power generation companies and independent power producers (IPPs) aiming to meet environmental regulations and reduce their carbon footprint.

Level of M&A: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity, primarily focused on technology acquisition and geographic expansion. Larger companies are seeking to strengthen their technological portfolios and market share through acquisitions of smaller, innovative firms.

The North American power generation CCS market is experiencing significant growth driven by a confluence of factors. Increasing environmental regulations and rising carbon pricing are incentivizing power producers to adopt CCS technologies to reduce their emissions. Furthermore, technological advancements are leading to greater efficiency and cost-effectiveness of CCS systems, making them a more viable option for wider adoption. The significant financial investments from both public and private sectors, as exemplified by the USD 867 million U.S. government Industrial Demonstration Program and the USD 2 billion investment in Canadian oil sands infrastructure, underscore the growing momentum. This funding is not only driving the development of new CCS projects but also fostering innovation in capture, transport, and storage technologies. The integration of CCS into existing power plants is gaining traction as a means of decarbonizing the existing power generation fleet. This is particularly relevant in regions where retiring aging plants is economically unfeasible. The focus is shifting towards creating efficient and cost-effective solutions for retrofitting existing infrastructure. Furthermore, the exploration and development of suitable geological storage sites are crucial for successful CCS project deployment. Technological advancements such as enhanced monitoring and verification techniques are helping to mitigate risks and enhance the safety and security of CO2 storage. Finally, growing public awareness of climate change and increasing corporate social responsibility initiatives are also pushing companies to invest in CCS as a means of demonstrating their commitment to environmental sustainability. The overall trend points towards accelerated adoption of CCS in the coming decade, significantly impacting the power generation landscape in North America.

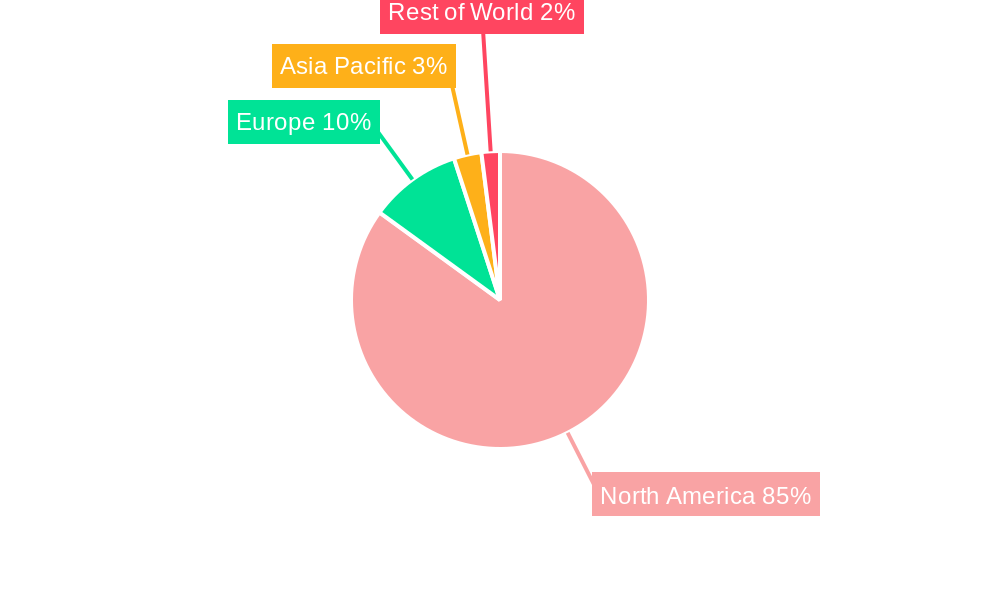

The U.S. is projected to dominate the North American power generation CCS market due to its significant fossil fuel-based power generation capacity, supportive government policies (including the 45Q tax credit), and extensive research and development efforts. Within the U.S., states such as Texas and Louisiana, with their existing oil and gas infrastructure and suitable geological storage formations, are expected to lead the way. Canada, particularly Alberta, is another key player, driven by the oil sands industry's need to reduce emissions and the government's commitment to CCS development.

This report provides a comprehensive analysis of the North American power generation carbon capture and storage market. It covers market size and forecast, technology analysis (pre-combustion, post-combustion, oxy-fuel combustion), regional insights (U.S. and Canada), key industry players, regulatory landscape, and emerging trends. The deliverables include detailed market sizing and forecasting, competitive analysis, technology assessments, and regional market breakdowns, enabling informed decision-making and strategic planning.

The North American power generation CCS market is valued at approximately $2.5 billion in 2024, projecting a compound annual growth rate (CAGR) of 15% from 2024 to 2030. This growth is primarily driven by increasing government regulations, carbon pricing policies, and technological advancements that are making CCS more cost-effective. The market share is currently dominated by a few large players, but the landscape is becoming increasingly fragmented with the emergence of numerous smaller, specialized companies. The U.S. currently holds the largest market share, followed by Canada. However, the Canadian market is expected to grow at a faster rate driven by investments in oil sands CCS projects. The post-combustion capture technology segment currently holds the largest market share due to its suitability for retrofitting existing power plants, although pre-combustion and oxy-fuel technologies are anticipated to gain traction in new construction projects. The market is witnessing increased competition amongst technology providers and engineering, procurement, and construction (EPC) firms, leading to a more dynamic and competitive market environment. The market size will be influenced by factors such as government policies, technological innovations, and the cost of carbon. Significant investment in research and development will be crucial in driving down the cost of CCS, making it more accessible to a wider range of power generators.

The North American power generation CCS market is propelled by stringent emission reduction targets, increasing carbon pricing, government incentives (e.g., the 45Q tax credit), technological advancements leading to lower costs, and corporate social responsibility initiatives. The growing public awareness of climate change is also a significant driver, creating market demand for sustainable energy solutions.

Challenges include high capital costs associated with CCS implementation, permitting complexities, CO2 storage site availability and suitability, and the need for reliable and cost-effective CO2 transportation infrastructure. The absence of consistent carbon pricing mechanisms across different jurisdictions also poses a hurdle.

Emerging trends include the integration of CCS with renewable energy sources (hybrid systems), the development of advanced capture technologies (e.g., direct air capture), the utilization of captured CO2 in various industrial processes, and the exploration of enhanced storage techniques to ensure long-term CO2 sequestration.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 29% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 29%.

Key companies in the market include Aker Solutions, Baker Hughes, CarbonFree, Dakota Gasification Company, Equinor, Exxon Mobil, Fluor, General Electric, Global Thermostat, Halliburton, Linde, NRG Energy, Shell.

The market segments include Technology.

The market size is estimated to be USD 800 Million as of 2022.

Rigrous government mandates towards adoption of sustainable practices. Rising awareness towards CCS technology adoption.

N/A

High project implementation cost.

In April 2024, the U.S. government launched the Industrial Demonstration Program, potentially allocating up to USD 867 million to carbon capture, utilization, and storage (CCUS) projects. The program targets carbon capture primarily in the hydrogen industry, with the power sector as the second-largest focus, driving overall market growth.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,250, USD 3,750, and USD 5,750 respectively.

The market size is provided in terms of value, measured in Million.

Yes, the market keyword associated with the report is "North America Power Generation Carbon Capture and Storage Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the North America Power Generation Carbon Capture and Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.