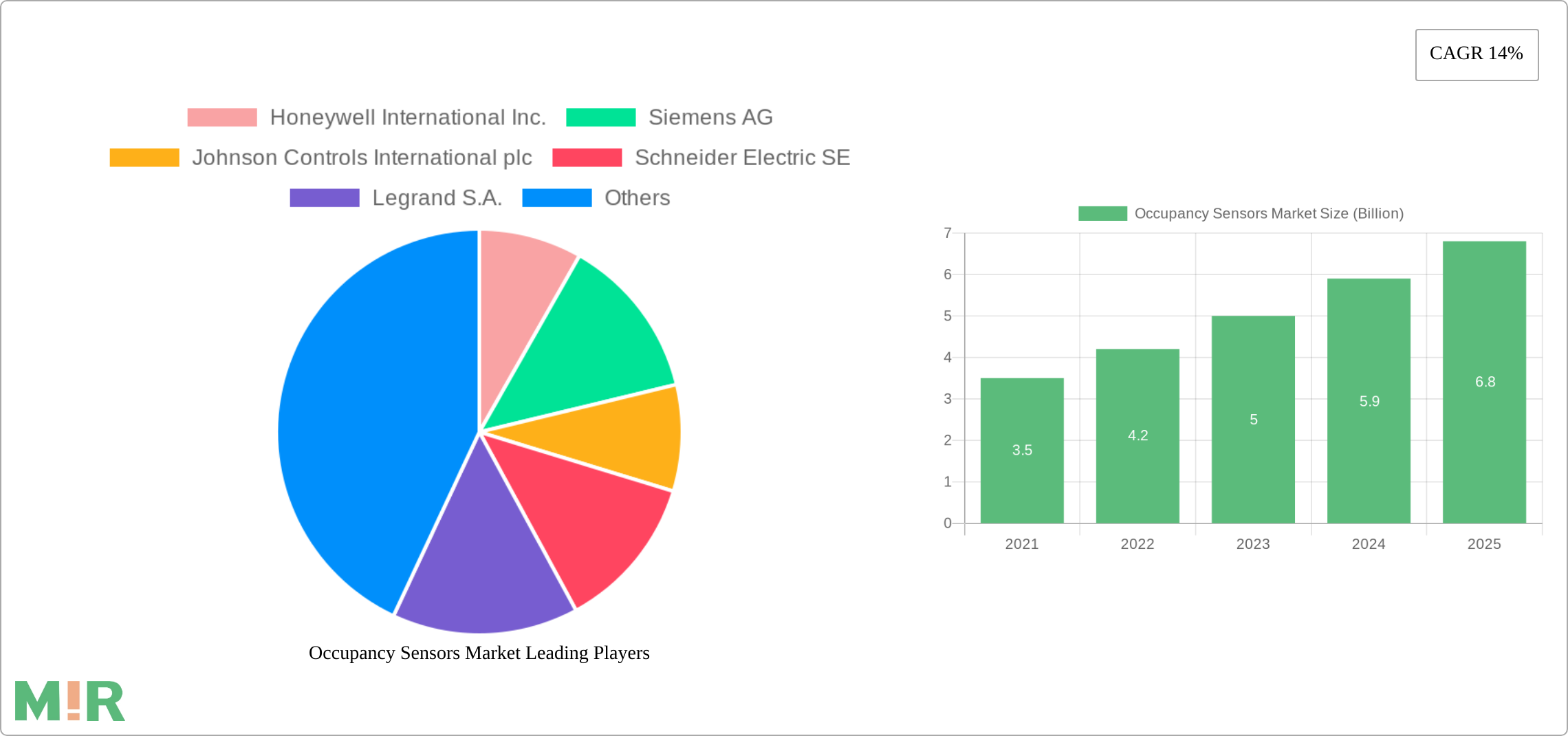

1. What is the projected Compound Annual Growth Rate (CAGR) of the Occupancy Sensors Market?

The projected CAGR is approximately 14%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Occupancy Sensors Market by Technology (Passive Infrared (PIR), Ultrasonic, Dual technology, Microwave, Others), by Operation (Indoor operation, Outdoor operation), by Coverage Area (Less than 90 degree, 70-90 degree, 180-360 degree), by Building Type (Residential buildings, Commercial buildings), by Network Connectivity (Wired, Wireless), by Application (Lighting control, HVAC, Security & surveillance, Others), by North America (U.S., Canada), by Europe (Germany, UK, France, Italy, Spain, Rest of Europe), by Asia Pacific (China, India, Japan, South Korea, ANZ, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Rest of Latin America), by MEA (UAE, Saudi Arabia, South Africa, Rest of MEA) Forecast 2025-2033

The size of the Occupancy Sensors Market was valued at USD 2 Billion in 2024 and is projected to reach USD 5.00 Billion by 2033, with an expected CAGR of 14% during the forecast period.These sensors play a crucial role in reducing energy consumption by automatically adjusting lighting, HVAC, and other building systems based on occupancy, leading to significant cost savings. The rise of smart homes and building automation systems has further fueled market demand. Technological advancements, including microwave, ultrasonic, and dual technology sensors, have enhanced accuracy and reliability, improving both convenience and security. With growing concerns over energy conservation and environmental sustainability, businesses and homeowners are increasingly adopting occupancy sensors to optimize resource utilization. Additionally, the integration of artificial intelligence (AI) and Internet of Things (IoT) technology is making these sensors more intelligent, allowing for advanced data analytics and predictive automation. As the market continues to expand, key players are focusing on innovation to enhance sensor capabilities and efficiency.

The Occupancy Sensors Market is characterized by a moderate level of concentration. Major players in the market include Honeywell International Inc., Siemens AG, Johnson Controls International plc, Schneider Electric SE, Legrand S.A., Lutron Electronics Co., Inc., and Texas Instruments Incorporated. These companies possess strong distribution networks and a wide range of product offerings, catering to various applications and market segments.

Innovation is a key characteristic of the Occupancy Sensors Market, with manufacturers continuously developing new technologies to improve sensor accuracy, reliability, and functionality. Government regulations and standards play a significant role in shaping the market, ensuring compliance with energy efficiency and safety requirements.

The Occupancy Sensors Market is witnessing several key trends that are shaping its growth trajectory. The adoption of wireless occupancy sensors is on the rise, offering flexibility and ease of installation. The integration of occupancy sensors with building management systems (BMS) is another prominent trend, enabling centralized control and monitoring of building systems.

Advanced analytics and data collection capabilities are also gaining traction in the Occupancy Sensors Market. By leveraging data on occupancy patterns, businesses and organizations can optimize energy use, improve space planning, and enhance overall operational efficiency.

Dominant Region: Asia Pacific is expected to remain the largest market for occupancy sensors throughout the forecast period. The region's rapid urbanization and growing construction industry are driving the demand for energy-efficient solutions.

Dominant Building Type: Commercial buildings are expected to account for the largest share of the Occupancy Sensors Market. The focus on energy conservation and the need for enhanced security in commercial spaces are contributing to the growing adoption of occupancy sensors in this segment.

Coverage:

Deliverables:

The Occupancy Sensors Market is expected to witness robust growth, reaching a valuation of 2 Billion by 2028. The rising demand for energy-efficient solutions, advancements in sensing technologies, and the growing adoption of smart building systems are key factors driving the market's growth.

North America: The North American market is expected to grow at a moderate pace, driven by government initiatives promoting energy efficiency and the increasing adoption of wireless occupancy sensors.

Europe: The European market is expected to witness significant growth, with the region's strong focus on sustainability and the growing adoption of occupancy sensors in commercial buildings.

Asia Pacific: The Asia Pacific market is expected to remain the largest and fastest-growing market, driven by the region's rapid urbanization, growing construction industry, and rising demand for energy-efficient solutions.

September 2022:

December 2021:

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14%.

Key companies in the market include Honeywell International Inc., Siemens AG, Johnson Controls International plc, Schneider Electric SE, Legrand S.A., Lutron Electronics Co., Inc., Texas Instruments Incorporated.

The market segments include Technology, Operation, Coverage Area, Building Type, Network Connectivity, Application.

The market size is estimated to be USD 2 Billion as of 2022.

Increasing need for energy-efficient solutions. Growing adoption in smart buildings. Rising emphasis on green technologies. Integration with IoT for smarter functionalities. Demand for smart home solutions.

The Occupancy Sensors Market is witnessing several key trends that are shaping its growth trajectory. The adoption of wireless occupancy sensors is on the rise. offering flexibility and ease of installation. The integration of occupancy sensors with building management systems (BMS) is another prominent trend. enabling centralized control and monitoring of building systems..

Occasional triggering errors impact reliability. Regular upkeep requires time and resources.

In September 2022, Novelda, the best-selling human presence sensor brand, announced its Ultra-wideband (UWB) occupancy sensor. When one approaches the sensor, lights are instantly turned on and quickly turned off, enhancing energy savings and improving the user experience. This sensor takes building lighting automation to the next level by allowing the user to configure the time-out and the precise detection zone.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4,850, USD 5,350, and USD 8,350 respectively.

The market size is provided in terms of value, measured in Billion and volume, measured in units.

Yes, the market keyword associated with the report is "Occupancy Sensors Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Occupancy Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

See the similar reports

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.