Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Radiation Protection Gloves 2025 to Grow at XX CAGR with XXX million Market Size: Analysis and Forecasts 2033

Radiation Protection Gloves by Application ( Hospitals, Diagnostic Centers, Research Centers), by Types ( Interventional Protection Gloves, Ordinary Protection Gloves), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

The global radiation protection gloves market is experiencing robust growth, driven by the increasing prevalence of ionizing radiation in healthcare and industrial settings. The market's expansion is fueled by the rising demand for advanced radiation protection equipment in hospitals, diagnostic centers, and research facilities. The escalating number of radiological procedures, coupled with stringent safety regulations aimed at minimizing healthcare worker exposure to radiation, significantly contributes to market growth. Furthermore, technological advancements in glove materials, leading to improved dexterity, comfort, and radiation shielding capabilities, are driving market expansion. The market is segmented by application (hospitals, diagnostic centers, research centers) and type (interventional and ordinary protection gloves), with interventional gloves commanding a higher price point due to their specialized design and functionality. While the market faces restraints such as high initial investment costs and the availability of alternative safety measures, the overall growth trajectory remains positive, fueled by consistent demand across diverse geographical regions.

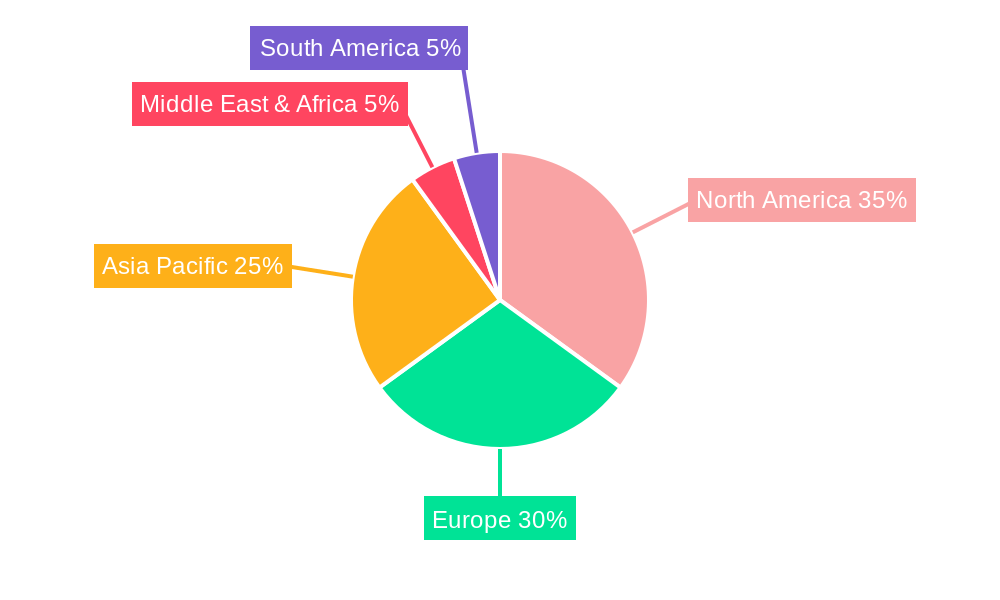

Market forecasts suggest a steady Compound Annual Growth Rate (CAGR), resulting in substantial market expansion over the projected period (2025-2033). North America and Europe are currently leading the market due to the advanced healthcare infrastructure and high adoption rates of radiation protection measures in these regions. However, emerging economies in Asia-Pacific, particularly China and India, are witnessing significant growth potential, propelled by expanding healthcare sectors and increasing awareness of radiation safety. Competitive dynamics within the market are characterized by a mix of established multinational corporations and regional players. Strategic partnerships, collaborations, and product innovations will play a crucial role in shaping the future competitive landscape of this dynamic and evolving market.

Radiation Protection Gloves Concentration & Characteristics

The global radiation protection gloves market is estimated at $2 billion USD. Key concentration areas include hospitals (accounting for approximately 60% of the market, or $1.2 billion USD), diagnostic centers (25%, or $500 million USD), and research facilities (15%, or $300 million USD). The market is further segmented into interventional protection gloves (70%, or $1.4 billion USD), which offer higher levels of protection for complex procedures, and ordinary protection gloves (30%, or $600 million USD), suited for routine tasks.

Characteristics of Innovation:

- Material advancements: Increased use of lead-free materials like tungsten alloys for enhanced flexibility and lighter weight gloves.

- Ergonomic design: Improved dexterity and comfort to reduce user fatigue during prolonged use.

- Enhanced durability: Longer lifespan gloves minimizing replacement frequency and associated costs.

- Smart technology integration: Development of gloves with embedded sensors for real-time radiation dose monitoring.

Impact of Regulations: Stringent regulations on radiation safety in healthcare settings are driving market growth, mandating the use of certified radiation protection gloves. This regulatory pressure is pushing manufacturers towards improved testing protocols and higher quality standards.

Product Substitutes: While limited, alternatives include lead aprons or thicker shielding materials, but these lack the dexterity and precision of gloves, limiting their application in many scenarios.

End-User Concentration: Hospitals and large diagnostic imaging chains represent the highest concentration of end-users, driving bulk purchasing and influencing market pricing.

Level of M&A: The market has seen a moderate level of mergers and acquisitions in recent years, with larger companies acquiring smaller manufacturers to expand their product portfolios and geographical reach. We estimate approximately 5-10 major M&A deals per year with a combined value exceeding $50 million USD.

Radiation Protection Gloves Trends

The radiation protection gloves market exhibits several key trends: A significant shift is occurring towards lead-free materials, driven by concerns about lead toxicity and environmental regulations. Tungsten alloys and other advanced materials are gaining traction due to their comparable shielding effectiveness, superior flexibility, and reduced weight. This improves user comfort and reduces fatigue during procedures. This trend is expected to continue, with a projected market share increase for lead-free gloves reaching 40% within the next five years.

Simultaneously, a demand for enhanced ergonomic design is emerging. Gloves are being designed for better dexterity, comfort, and reduced hand fatigue, particularly crucial during lengthy procedures. Manufacturers are investing in advanced materials and designs to address these needs. The increased focus on ergonomics is reflected in the rising adoption of advanced materials and designs resulting in a projected 15% annual growth rate for ergonomic gloves in the coming decade.

Another notable trend is the growing integration of smart technology. While still in its early stages, the development of radiation protection gloves with embedded sensors for real-time dose monitoring has the potential to revolutionize radiation safety practices. This technology enables precise dose tracking and facilitates adjustments to minimize radiation exposure. This technological integration will eventually see a market share capturing at least 10% of the total radiation protection gloves within the next ten years. Furthermore, the market is witnessing an increase in the adoption of disposable gloves due to concerns about hygiene and infection control, driving demand for cost-effective, high-quality disposable options.

Finally, customization is on the rise. Manufacturers are offering customized solutions to cater to specific needs of different healthcare facilities and research institutions, driving further market segmentation and niche product development. This includes tailored sizes, materials, and levels of protection based on the specific application. We project this trend to account for an increasing 20% of the market's customized glove orders in five years.

Key Region or Country & Segment to Dominate the Market

The Hospitals segment is currently dominating the radiation protection gloves market. This dominance is due to the high volume of radiation procedures performed in hospitals, ranging from diagnostic imaging (X-rays, CT scans) to interventional radiology and nuclear medicine. The substantial number of healthcare professionals requiring protection in this setting generates significant demand.

- High concentration of radiation-related procedures.

- Stricter regulatory requirements for radiation safety.

- Greater awareness of radiation risks among healthcare personnel.

- Established procurement channels within hospital systems.

North America, specifically the United States, is a key region dominating the market due to factors like stringent regulatory frameworks, high healthcare expenditure, and advanced technological adoption. Similarly, Europe, particularly countries such as Germany and the United Kingdom, are also significant markets due to robust healthcare systems and well-established medical device industries. The strong emphasis on patient and worker safety in these regions translates to consistently high demand for high-quality radiation protection gloves.

- High healthcare expenditure: enabling investment in advanced safety equipment.

- Stringent regulatory frameworks: enforcing the use of certified protective gear.

- Advanced medical technology: driving the need for specialized gloves in complex procedures.

- High awareness of radiation risks: among both healthcare providers and the public.

Radiation Protection Gloves Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the radiation protection gloves market, encompassing market size, segmentation, growth drivers, challenges, and key players. It delivers detailed insights into product trends, regional dynamics, and competitive landscapes. The report provides market forecasts and analyses, along with key strategic recommendations for manufacturers, distributors, and healthcare professionals. This also includes an analysis of industry developments.

Radiation Protection Gloves Analysis

The global radiation protection gloves market is experiencing substantial growth, driven by factors such as the increasing prevalence of radiation-related procedures in healthcare and research settings, coupled with stricter regulatory requirements for radiation safety. The market size is estimated at $2 billion USD, and we project a compound annual growth rate (CAGR) of approximately 7% over the next decade, reaching an estimated value exceeding $3.5 billion USD by 2033.

Market share is currently fragmented among numerous manufacturers, with a few major players holding a dominant position. These companies focus on innovation and product differentiation to maintain a competitive edge. The largest players in the market hold around 40% of the market share, with the remaining 60% shared among a significant number of smaller and regional manufacturers. Market growth is influenced by factors such as technological advancements in glove materials, ergonomics, and the incorporation of smart technology for enhanced safety.

Competition in this market is fierce, with existing companies focusing on new product development and expansion into emerging markets. We anticipate that there will be further consolidation of market share in the future as the demand for sophisticated protective wear grows.

Radiation Protection Gloves Regional Insights

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Russia

- Benelux

- Nordics

- Rest of Europe

- Middle East & Africa

- Turkey

- Israel

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- ASEAN

- Oceania

- Rest of Asia Pacific

Driving Forces: What's Propelling the Radiation Protection Gloves Market?

The primary drivers are the increasing prevalence of radiation-related medical procedures, stringent regulatory requirements emphasizing worker safety, and continuous advancements in glove materials and technology leading to enhanced protection and comfort. Growing awareness among healthcare professionals regarding the long-term health risks of radiation exposure further propels the market.

Challenges and Restraints in Radiation Protection Gloves

Key challenges include the high cost of advanced materials, the need for continuous innovation to meet evolving regulatory standards, and maintaining a balance between protection levels and glove dexterity. Competition from cheaper, lower-quality alternatives also presents a significant hurdle.

Emerging Trends in Radiation Protection Gloves

Emerging trends include the development of lead-free materials, incorporation of smart technologies for real-time dose monitoring, improved ergonomic designs, and a growing preference for disposable gloves to enhance hygiene and infection control. Customization options are also becoming increasingly important to meet the diverse needs of healthcare providers.

Radiation Protection Gloves Industry News

- March 2023: WRP Gloves announces a new line of lead-free radiation protection gloves.

- June 2022: Infab Corporation receives FDA approval for its innovative ergonomic glove design.

- October 2021: Shielding International partners with a research institution to develop smart gloves with integrated radiation dose monitoring.

Leading Players in the Radiation Protection Gloves Market

- WRP Gloves

- Infab Corporation

- Longkou Sanyi Medical Device

- Burlington Medical

- Barrier Technologies

- Shielding International

- Protech Medical

- Kangningda Medical

- Shanghai Anlan X-Ray Protection Medical

- Kiran X-Ray

- KONSTON

- Mirion Medical

- Suzhou Colour-way New Material

- Beijing Oriental Yuantong Science Technology

Radiation Protection Gloves Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Diagnostic Centers

- 1.3. Research Centers

-

2. Types

- 2.1. Interventional Protection Gloves

- 2.2. Ordinary Protection Gloves

Radiation Protection Gloves Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Radiation Protection Gloves REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radiation Protection Gloves Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Diagnostic Centers

- 5.1.3. Research Centers

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Interventional Protection Gloves

- 5.2.2. Ordinary Protection Gloves

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Radiation Protection Gloves Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Diagnostic Centers

- 6.1.3. Research Centers

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Interventional Protection Gloves

- 6.2.2. Ordinary Protection Gloves

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Radiation Protection Gloves Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Diagnostic Centers

- 7.1.3. Research Centers

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Interventional Protection Gloves

- 7.2.2. Ordinary Protection Gloves

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Radiation Protection Gloves Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Diagnostic Centers

- 8.1.3. Research Centers

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Interventional Protection Gloves

- 8.2.2. Ordinary Protection Gloves

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Radiation Protection Gloves Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Diagnostic Centers

- 9.1.3. Research Centers

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Interventional Protection Gloves

- 9.2.2. Ordinary Protection Gloves

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Radiation Protection Gloves Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Diagnostic Centers

- 10.1.3. Research Centers

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Interventional Protection Gloves

- 10.2.2. Ordinary Protection Gloves

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 WRP Gloves

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infab Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Longkou Sanyi Medical Device

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Burlington Medical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Barrier Technologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shielding International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Protech Medical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kangningda Medical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shanghai Anlan X-Ray Protection Medical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kiran X-Ray

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KONSTON

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mirion Medical

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Suzhou Colour-way New Material

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Beijing Oriental Yuantong Science Technology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 WRP Gloves

- Figure 1: Global Radiation Protection Gloves Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Radiation Protection Gloves Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Radiation Protection Gloves Revenue (million), by Application 2024 & 2032

- Figure 4: North America Radiation Protection Gloves Volume (K), by Application 2024 & 2032

- Figure 5: North America Radiation Protection Gloves Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Radiation Protection Gloves Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Radiation Protection Gloves Revenue (million), by Types 2024 & 2032

- Figure 8: North America Radiation Protection Gloves Volume (K), by Types 2024 & 2032

- Figure 9: North America Radiation Protection Gloves Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Radiation Protection Gloves Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Radiation Protection Gloves Revenue (million), by Country 2024 & 2032

- Figure 12: North America Radiation Protection Gloves Volume (K), by Country 2024 & 2032

- Figure 13: North America Radiation Protection Gloves Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Radiation Protection Gloves Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Radiation Protection Gloves Revenue (million), by Application 2024 & 2032

- Figure 16: South America Radiation Protection Gloves Volume (K), by Application 2024 & 2032

- Figure 17: South America Radiation Protection Gloves Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Radiation Protection Gloves Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Radiation Protection Gloves Revenue (million), by Types 2024 & 2032

- Figure 20: South America Radiation Protection Gloves Volume (K), by Types 2024 & 2032

- Figure 21: South America Radiation Protection Gloves Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Radiation Protection Gloves Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Radiation Protection Gloves Revenue (million), by Country 2024 & 2032

- Figure 24: South America Radiation Protection Gloves Volume (K), by Country 2024 & 2032

- Figure 25: South America Radiation Protection Gloves Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Radiation Protection Gloves Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Radiation Protection Gloves Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Radiation Protection Gloves Volume (K), by Application 2024 & 2032

- Figure 29: Europe Radiation Protection Gloves Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Radiation Protection Gloves Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Radiation Protection Gloves Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Radiation Protection Gloves Volume (K), by Types 2024 & 2032

- Figure 33: Europe Radiation Protection Gloves Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Radiation Protection Gloves Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Radiation Protection Gloves Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Radiation Protection Gloves Volume (K), by Country 2024 & 2032

- Figure 37: Europe Radiation Protection Gloves Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Radiation Protection Gloves Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Radiation Protection Gloves Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Radiation Protection Gloves Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Radiation Protection Gloves Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Radiation Protection Gloves Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Radiation Protection Gloves Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Radiation Protection Gloves Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Radiation Protection Gloves Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Radiation Protection Gloves Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Radiation Protection Gloves Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Radiation Protection Gloves Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Radiation Protection Gloves Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Radiation Protection Gloves Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Radiation Protection Gloves Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Radiation Protection Gloves Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Radiation Protection Gloves Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Radiation Protection Gloves Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Radiation Protection Gloves Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Radiation Protection Gloves Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Radiation Protection Gloves Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Radiation Protection Gloves Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Radiation Protection Gloves Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Radiation Protection Gloves Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Radiation Protection Gloves Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Radiation Protection Gloves Volume Share (%), by Country 2024 & 2032

- Table 1: Global Radiation Protection Gloves Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Radiation Protection Gloves Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Radiation Protection Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Radiation Protection Gloves Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Radiation Protection Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Radiation Protection Gloves Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Radiation Protection Gloves Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Radiation Protection Gloves Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Radiation Protection Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Radiation Protection Gloves Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Radiation Protection Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Radiation Protection Gloves Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Radiation Protection Gloves Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Radiation Protection Gloves Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Radiation Protection Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Radiation Protection Gloves Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Radiation Protection Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Radiation Protection Gloves Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Radiation Protection Gloves Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Radiation Protection Gloves Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Radiation Protection Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Radiation Protection Gloves Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Radiation Protection Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Radiation Protection Gloves Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Radiation Protection Gloves Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Radiation Protection Gloves Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Radiation Protection Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Radiation Protection Gloves Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Radiation Protection Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Radiation Protection Gloves Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Radiation Protection Gloves Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Radiation Protection Gloves Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Radiation Protection Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Radiation Protection Gloves Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Radiation Protection Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Radiation Protection Gloves Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Radiation Protection Gloves Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Radiation Protection Gloves Volume K Forecast, by Country 2019 & 2032

- Table 81: China Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Radiation Protection Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Radiation Protection Gloves Volume (K) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)