Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Smartwatch Metal Case 2025 Trends and Forecasts 2033: Analyzing Growth Opportunities

Smartwatch Metal Case by Application (Sporty, High-end Model), by Types (Stainless Steels, Aluminum, Ttitanium, Zinc, Liquid Metals), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

Key Insights

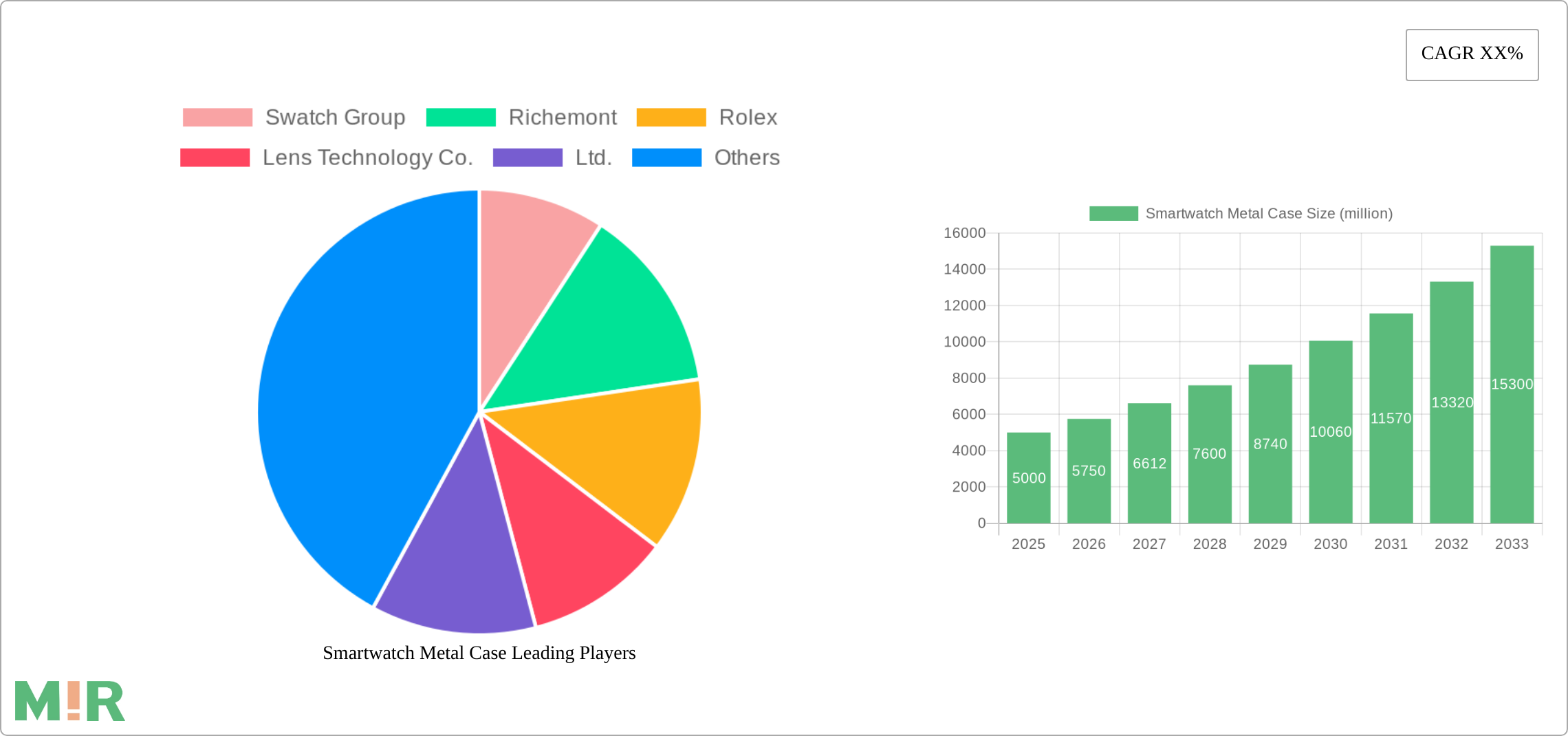

The smartwatch market is experiencing robust growth, driven by increasing demand for sophisticated wearable technology and the integration of advanced functionalities. The metal case segment, specifically, is witnessing a significant upswing due to its premium appeal, durability, and compatibility with high-end smartwatch models. The market size for smartwatch metal cases in 2025 is estimated at $5 billion, exhibiting a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, projected to reach approximately $15 billion by 2033. This growth is fueled by several key drivers: the rising popularity of fitness trackers and smartwatches, technological advancements leading to lighter and more aesthetically pleasing designs, and the increasing adoption of premium materials like titanium and liquid metals among consumers seeking high-quality products. The increasing demand from the sporty and high-end segments is particularly noteworthy. Stainless steel currently dominates the materials market share, but aluminum, titanium, and zinc are gaining traction due to their unique properties and cost-effectiveness. Key players like Swatch Group, Richemont, and Rolex, along with significant manufacturers in China, are actively shaping the market through innovation and competitive pricing strategies. Geographic expansion, particularly in Asia-Pacific, is another major contributor to the market's growth trajectory.

The market faces certain restraints, primarily concerning the cost of premium materials and the potential for supply chain disruptions. However, these challenges are likely to be mitigated by ongoing material innovation, efficient manufacturing techniques, and increased regional diversification. The segment is poised for sustained growth, with continuous technological developments and evolving consumer preferences driving further expansion in both established and emerging markets. The competition among manufacturers is likely to remain intense, prompting further innovation and potentially leading to more competitive pricing, benefiting consumers in the long term. Future market growth hinges on continued technological advancements in material science, miniaturization of components, and the introduction of new features that further enhance the user experience of smartwatches.

Smartwatch Metal Case Concentration & Characteristics

The smartwatch metal case market is experiencing substantial growth, driven by the increasing popularity of smartwatches. Market concentration is moderate, with a few key players holding significant market share, but a considerable number of smaller manufacturers also contributing. Swatch Group, Richemont, and Rolex dominate the high-end segment, while numerous Chinese manufacturers like Lens Technology Co., Ltd., Shenzhen Everwin Precision Technology Co., Ltd., and Jiangsu Gian Technology Co., Ltd. are major players in the mid-to-lower price ranges. The market is characterized by ongoing innovation in materials (e.g., lightweight titanium alloys, liquid metal coatings), manufacturing processes (e.g., advanced machining, 3D printing), and surface finishing techniques (e.g., PVD coating, laser engraving).

Concentration Areas:

- High-End Segment: Dominated by established watchmakers focusing on luxury materials and intricate designs.

- Mid-Range Segment: High competition among numerous manufacturers focusing on cost-effective production and diverse designs.

- Manufacturing Hubs: China remains a prominent manufacturing hub, particularly for mid-range and lower-priced cases.

Characteristics of Innovation:

- Material advancements for lighter, stronger, and more durable cases.

- Improved manufacturing techniques for enhanced precision and reduced costs.

- Novel surface treatments for enhanced aesthetics and durability.

Impact of Regulations:

Environmental regulations regarding material sourcing and waste disposal are becoming increasingly influential, pushing for sustainable manufacturing practices.

Product Substitutes:

Plastic and ceramic cases are primary substitutes, particularly in lower-priced segments. However, metal cases maintain a significant advantage in terms of durability and perceived premium quality.

End User Concentration:

The market is broadly distributed across various demographics, reflecting the broad appeal of smartwatches. However, high-end models cater specifically to affluent consumers.

Level of M&A:

Consolidation is expected to increase, with larger players potentially acquiring smaller manufacturers to expand their market share and capabilities. We project approximately 15-20 million units involved in M&A activity over the next 5 years, representing roughly 5-7% of the total market.

Smartwatch Metal Case Trends

The smartwatch metal case market displays several key trends:

The demand for lightweight yet durable materials is rapidly increasing. Titanium and aluminum alloys are gaining popularity over traditional stainless steel due to their superior strength-to-weight ratios. This trend is particularly prominent in the sporty application segment, where lighter weight is crucial for comfort and performance during activities. Simultaneously, the high-end segment is showcasing innovative materials like liquid metals for unique aesthetics and durability. This trend is driven by a growing consumer base that prioritizes both performance and style, pushing manufacturers to integrate advanced materials in their smartwatches.

Another significant trend is the rise of customization options. Consumers are increasingly seeking personalized designs, leading manufacturers to offer a wider array of colors, finishes, and engraving options. This is particularly evident in the online sales channels where direct engagement with consumers allows for more flexible customization choices. This trend is driven by the need to create unique identity and value proposition for smartwatches.

Furthermore, there is a notable shift towards sustainable manufacturing practices. Consumers are increasingly concerned about environmental impact, leading manufacturers to adopt more eco-friendly materials and production methods. This trend is supported by growing regulatory pressure and consumer advocacy towards sustainable sourcing, recycling and disposal practices, influencing the entire supply chain.

Finally, advanced manufacturing techniques are transforming the industry. 3D printing, precision machining, and improved surface treatments are enabling the creation of more complex and aesthetically pleasing designs. This trend is driving the creation of more sophisticated and durable cases, creating a competitive advantage in terms of the product's longevity and appeal. These trends suggest that the market will continue to evolve, with manufacturers constantly seeking to improve their offerings to meet the ever-changing demands of consumers.

Key Region or Country & Segment to Dominate the Market

The high-end segment, utilizing stainless steel cases, is poised to dominate the market in the coming years. This segment is driven by consumers seeking premium quality, durability, and aesthetic appeal, justifying a higher price point. While other materials like titanium and aluminum are gaining traction, stainless steel retains its dominance due to its proven track record, established manufacturing processes, and versatility in design.

Key Factors:

- Strong Brand Recognition: Established luxury watch brands leverage their existing reputation and customer loyalty in the high-end segment.

- High Profit Margins: The high price point associated with high-end smartwatches ensures substantial profit margins for manufacturers.

- Technological Advancements: Ongoing innovation in stainless steel metallurgy and surface finishing techniques continuously enhances the quality and attractiveness of these cases.

Regional Dominance:

While the market is global, North America and Europe are expected to remain the leading regions for high-end smartwatch purchases due to higher disposable incomes and established luxury markets. Within these regions, the United States, United Kingdom, and Germany are particularly significant.

- North America: High consumer spending on electronics and premium goods.

- Europe: Strong established luxury market and significant tech adoption.

- Asia-Pacific: Growing market, with a concentration in China and Japan in terms of high-end model sales.

The combination of a sophisticated consumer base favoring premium products and established manufacturing capabilities positions stainless steel cases in the high-end segment for sustained market leadership.

Smartwatch Metal Case Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the smartwatch metal case market, encompassing market size and growth forecasts, competitive landscape, key trends, regional variations, and detailed insights into different product segments (stainless steel, aluminum, titanium, zinc, and liquid metals) and applications (sporty and high-end models). The report also includes an assessment of the leading players and an outlook on the future of the industry. The key deliverables are market sizing, market share analysis, competitive landscape mapping, trend analysis, regional insights and future outlook.

Smartwatch Metal Case Analysis

The global smartwatch metal case market is experiencing significant growth, driven primarily by the increasing adoption of smartwatches and the growing demand for stylish and durable accessories. The market size is estimated to be in the hundreds of millions of units annually. While precise figures are proprietary, estimates place the overall market in excess of 250 million units annually, with a compound annual growth rate (CAGR) hovering around 8-10% over the next five years. This growth is expected to be fueled by several factors, including the expanding smartphone market, decreasing prices of smartwatches, and technological advancements in material science and manufacturing processes.

Market share is largely fragmented, although several key players hold significant portions. Swatch Group, Richemont, and Rolex collectively represent a considerable portion of the high-end segment, while various manufacturers in China and other Asian countries hold significant market share in the mid-to-lower price ranges. The market share distribution is fluid, with ongoing competition and emerging players constantly challenging the status quo. The growth potential is particularly high in the emerging markets of Asia and Africa, which are experiencing a surge in smartphone adoption and subsequently in demand for related accessories.

Smartwatch Metal Case Regional Insights

- North America

- United States: High demand for premium and mid-range smartwatches.

- Canada: Growing market with increasing adoption of smartwatches.

- Mexico: Emerging market with potential for growth.

- South America

- Brazil: Significant market with increasing smartphone penetration.

- Argentina: Growing market with potential for future growth.

- Rest of South America: Lower adoption rates compared to other regions.

- Europe

- United Kingdom: Strong market for premium smartwatches.

- Germany: Significant demand for both premium and mid-range products.

- France: Growing market with increasing adoption.

- Italy: Strong market for premium fashion accessories including smartwatches.

- Spain: Growing market with potential for higher growth.

- Russia: Market growth somewhat constrained by economic factors.

- Benelux: Solid demand for both premium and mid-range smartwatches.

- Nordics: High tech adoption rates driving smartwatch adoption.

- Rest of Europe: Varied market conditions across countries.

- Middle East & Africa

- Turkey: Growing market with increasing smartphone penetration.

- Israel: Strong demand for high-tech products.

- GCC: Higher disposable income drives demand for premium smartwatches.

- North Africa: Emerging market with potential for future growth.

- South Africa: Relatively developed market within the region.

- Rest of Middle East & Africa: Significant growth potential with increasing smartphone and internet penetration.

- Asia Pacific

- China: Largest market globally, with a wide range of price points and product offerings.

- India: Rapidly growing market with substantial potential.

- Japan: Strong demand for premium and technologically advanced products.

- South Korea: High tech adoption and demand for premium electronics.

- ASEAN: Varied market conditions across Southeast Asian countries, but with overall growth potential.

- Oceania: Relatively small market but with a high adoption rate of premium electronics.

- Rest of Asia Pacific: Varied market conditions with substantial growth potential.

Driving Forces: What's Propelling the Smartwatch Metal Case

The smartwatch metal case market is propelled by several key factors: the increasing popularity of smartwatches, the demand for durable and aesthetically pleasing designs, advancements in material science and manufacturing techniques, and the growth of the e-commerce sector which facilitates direct consumer engagement and customization. These factors collectively contribute to increased market volume and growth.

Challenges and Restraints in Smartwatch Metal Case

Key challenges include intense competition, fluctuating raw material prices, environmental regulations impacting manufacturing, and the potential for design obsolescence due to rapid technological advancements. These factors can influence cost, production, and market sustainability.

Emerging Trends in Smartwatch Metal Case

Emerging trends include a growing focus on sustainability, the incorporation of smart materials and innovative designs, the increasing use of 3D printing for customized case production, and a shift toward modular designs that allow for easy repairs and upgrades. These developments aim to improve functionality, sustainability and consumer satisfaction.

Smartwatch Metal Case Industry News

- January 2024: New titanium alloy developed for enhanced strength and lightness in smartwatch cases.

- March 2024: Major manufacturer announces investment in sustainable manufacturing practices.

- June 2024: New regulations regarding material safety and disposal implemented in the EU.

- September 2024: Leading smartwatch brand launches a highly customizable smartwatch case option.

Leading Players in the Smartwatch Metal Case Keyword

- Swatch Group

- Richemont

- Rolex

- Lens Technology Co.,Ltd.

- Shenzhen Everwin Precision Technology Co.,Ltd.

- Jiangsu Gian Technology Co.,Ltd.

- Dongguan Chitwing Technology Co.,Ltd.

- Shenzhen CDL Precision Technology Co.,Ltd

Smartwatch Metal Case Segmentation

-

1. Application

- 1.1. Sporty

- 1.2. High-end Model

-

2. Types

- 2.1. Stainless Steels

- 2.2. Aluminum

- 2.3. Ttitanium

- 2.4. Zinc

- 2.5. Liquid Metals

Smartwatch Metal Case Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Smartwatch Metal Case REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smartwatch Metal Case Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sporty

- 5.1.2. High-end Model

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Stainless Steels

- 5.2.2. Aluminum

- 5.2.3. Ttitanium

- 5.2.4. Zinc

- 5.2.5. Liquid Metals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Smartwatch Metal Case Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sporty

- 6.1.2. High-end Model

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Stainless Steels

- 6.2.2. Aluminum

- 6.2.3. Ttitanium

- 6.2.4. Zinc

- 6.2.5. Liquid Metals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Smartwatch Metal Case Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sporty

- 7.1.2. High-end Model

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Stainless Steels

- 7.2.2. Aluminum

- 7.2.3. Ttitanium

- 7.2.4. Zinc

- 7.2.5. Liquid Metals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Smartwatch Metal Case Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sporty

- 8.1.2. High-end Model

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Stainless Steels

- 8.2.2. Aluminum

- 8.2.3. Ttitanium

- 8.2.4. Zinc

- 8.2.5. Liquid Metals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Smartwatch Metal Case Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sporty

- 9.1.2. High-end Model

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Stainless Steels

- 9.2.2. Aluminum

- 9.2.3. Ttitanium

- 9.2.4. Zinc

- 9.2.5. Liquid Metals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Smartwatch Metal Case Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sporty

- 10.1.2. High-end Model

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Stainless Steels

- 10.2.2. Aluminum

- 10.2.3. Ttitanium

- 10.2.4. Zinc

- 10.2.5. Liquid Metals

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Swatch Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Richemont

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rolex

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lens Technology Co.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shenzhen Everwin Precision Technology Co.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jiangsu Gian Technology Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dongguan Chitwing Technology Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shenzhen CDL Precision Technology Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Swatch Group

- Figure 1: Global Smartwatch Metal Case Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Smartwatch Metal Case Revenue (million), by Application 2024 & 2032

- Figure 3: North America Smartwatch Metal Case Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Smartwatch Metal Case Revenue (million), by Types 2024 & 2032

- Figure 5: North America Smartwatch Metal Case Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Smartwatch Metal Case Revenue (million), by Country 2024 & 2032

- Figure 7: North America Smartwatch Metal Case Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Smartwatch Metal Case Revenue (million), by Application 2024 & 2032

- Figure 9: South America Smartwatch Metal Case Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Smartwatch Metal Case Revenue (million), by Types 2024 & 2032

- Figure 11: South America Smartwatch Metal Case Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Smartwatch Metal Case Revenue (million), by Country 2024 & 2032

- Figure 13: South America Smartwatch Metal Case Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Smartwatch Metal Case Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Smartwatch Metal Case Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Smartwatch Metal Case Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Smartwatch Metal Case Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Smartwatch Metal Case Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Smartwatch Metal Case Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Smartwatch Metal Case Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Smartwatch Metal Case Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Smartwatch Metal Case Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Smartwatch Metal Case Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Smartwatch Metal Case Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Smartwatch Metal Case Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Smartwatch Metal Case Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Smartwatch Metal Case Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Smartwatch Metal Case Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Smartwatch Metal Case Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Smartwatch Metal Case Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Smartwatch Metal Case Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Smartwatch Metal Case Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Smartwatch Metal Case Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Smartwatch Metal Case Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Smartwatch Metal Case Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Smartwatch Metal Case Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Smartwatch Metal Case Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Smartwatch Metal Case Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Smartwatch Metal Case Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Smartwatch Metal Case Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Smartwatch Metal Case Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Smartwatch Metal Case Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Smartwatch Metal Case Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Smartwatch Metal Case Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Smartwatch Metal Case Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Smartwatch Metal Case Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Smartwatch Metal Case Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Smartwatch Metal Case Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Smartwatch Metal Case Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Smartwatch Metal Case Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Smartwatch Metal Case Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)