Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Automotive Brake Pads Market Unlocking Growth Opportunities: Analysis and Forecast 2025-2033

Automotive Brake Pads Market by Material Type (Semi-metallic, Non-asbestos, Low-metallic, Ceramic Brake Pads), by Vehicle Type (Passenger Cars, LCV, HCV, Two Wheelers), by North America (U.S., Canada), by Europe (Germany, UK, France, Italy, Spain, Rest of Europe), by Asia Pacific (China, Japan, India, South Korea, Australia, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Argentina, Rest of Latin America), by MEA (Saudi Arabia, UAE, South Africa, Rest of MEA) Forecast 2025-2033

Key Insights

The size of the Automotive Brake Pads Market was valued at USD 4 Billion in 2023 and is projected to reach USD 5.37 Billion by 2032, with an expected CAGR of 4.3% during the forecast period. The Automotive Brake Pads Market is centered on manufacturing and selling brake pads for vehicles to guarantee efficient braking and safety. Brake pads are crucial parts of disc brake systems, intended to generate friction on the brake rotor in order to decelerate or halt the vehicle. The growing emphasis on vehicle safety and performance, along with the increasing demand for vehicles, is what drives the market. Progress in materials technology is improving brake pad performance, resulting in the creation of high-performance choices with enhanced durability, heat resistance, and noise reduction capabilities. Moreover, the increasing popularity of electric and hybrid vehicles is leading to fresh opportunities in the market, as these vehicles frequently need specialized braking solutions to suit their distinct performance traits. The market for automotive brake pads is anticipated to grow substantially due to manufacturers developing new products to comply with strict safety standards and consumer demand for top-notch, dependable braking systems. Moreover, the growing preference for personalized vehicle modifications and additional enhancements is also boosting the need for a variety of brake pad choices for different types of vehicles.

Automotive Brake Pads Market Concentration & Characteristics

The market is moderately concentrated, with a few key players holding a significant market share. The industry is characterized by innovation, with manufacturers continuously developing new and improved brake pads. Regulations on vehicle safety and environmental protection impact the market. Substitutes like drum brakes exist, but disc brakes dominate the market. End-user concentration is low, with a wide range of consumers. M&A activity is moderate, with companies acquiring smaller players to expand their product portfolio and geographical presence.

Automotive Brake Pads Market Trends

Key market trends include the growing demand for electric vehicles, leading to the development of specialized brake pads for BEVs. Additionally, the trend towards lightweight vehicles is driving demand for lighter and more efficient brake pads. The increasing adoption of advanced driver assistance systems (ADAS) requires brake pads capable of handling higher braking forces and improved stopping distances.

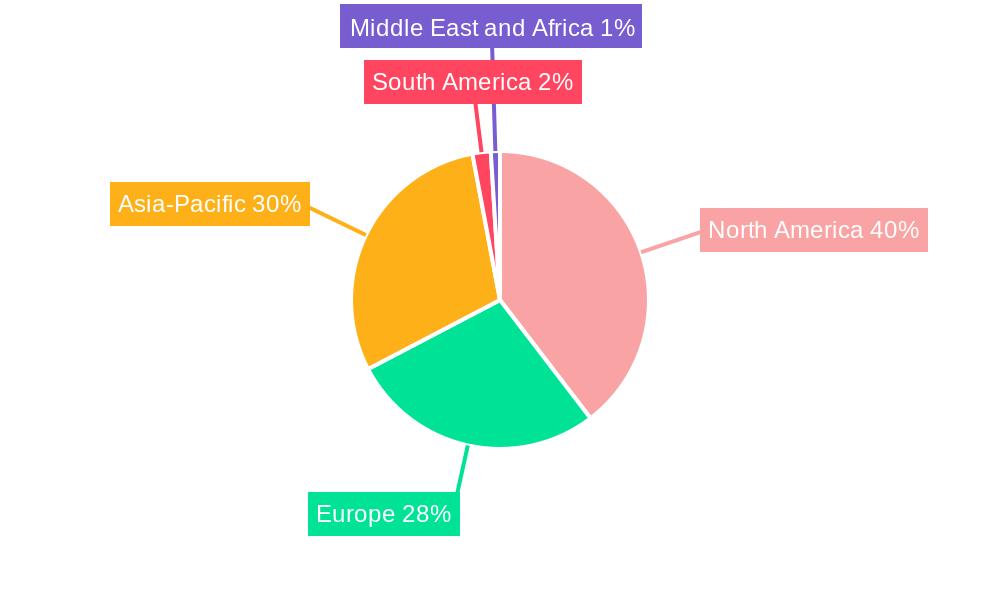

Key Region or Country & Segment to Dominate the Market

Asia Pacific is the dominant region in the Automotive Brake Pads Market, accounting for over 40% of the global market share. China and India are the key markets within the region due to their large vehicle production and growing demand for aftermarket brake pads.

In terms of segments, the ceramic brake pads segment is projected to witness the highest growth during the forecast period. These pads offer superior performance, longer lifespan, and reduced noise and dust compared to traditional brake pads.

Automotive Brake Pads Market Product Insights Report Coverage & Deliverables

The report provides a comprehensive analysis of the Automotive Brake Pads Market, including market size, market share, and growth. It also offers insights into the market segmentation, industry news, and leading players.

Automotive Brake Pads Market Analysis

The market is driven by factors such as the rising number of vehicles on the road, growing awareness about road safety, and stringent government regulations. The market is segmented into various types of brake pads, including semi-metallic, non-asbestos, low-metallic, and ceramic.

Automotive Brake Pads Market Regional Insights

North America

- U.S.

- Canada

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

Driving Forces: What's Propelling the Automotive Brake Pads Market

- Increasing vehicle production

- Growing awareness about road safety

- Stringent government regulations

- Technological advancements

Challenges and Restraints in Automotive Brake Pads Market

- High cost of raw materials

- Competition from aftermarket brake pads

- Counterfeit products

Emerging Trends in Automotive Brake Pads Market

- Development of specialized brake pads for electric vehicles

- Trend towards lightweight vehicles

- Increasing adoption of ADAS

Market Segmentation: Automotive Brake Pads

Material Type

- Semi-metallic

- Non-asbestos

- Low-metallic

- Ceramic Brake Pads

Vehicle Type

- Passenger Cars

- LCV

- HCV

Two Wheelers

Automotive Brake Pads Industry News

- February 2024: Webb launches new Ultra Grip air disc brake pads with three levels of performance.

- August 2023: Delphi introduces its range of BEV brake pads designed for the specific needs of electric vehicles.

- April 2023: SKF launches a new range of brake pads with advanced ceramic technology for lower dust generation and improved noise performance.

Leading Players in the Automotive Brake Pads Market

Automotive Brake Pads Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.3% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing demand for vehicles across the globe

- 3.2.2 Implementation of stringent regulations by governments

- 3.3. Market Restrains

- 3.3.1 Use of regenerative braking systems in hybrid and full-electric vehicles can be a hindrance to the market.

- 3.3.2 Growing trend of ridesharing and car-sharing services is posing a threat to the automotive market.

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Brake Pads Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Semi-metallic

- 5.1.2. Non-asbestos

- 5.1.3. Low-metallic

- 5.1.4. Ceramic Brake Pads

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. LCV

- 5.2.3. HCV

- 5.2.4. Two Wheelers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Automotive Brake Pads Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Semi-metallic

- 6.1.2. Non-asbestos

- 6.1.3. Low-metallic

- 6.1.4. Ceramic Brake Pads

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. LCV

- 6.2.3. HCV

- 6.2.4. Two Wheelers

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Automotive Brake Pads Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Semi-metallic

- 7.1.2. Non-asbestos

- 7.1.3. Low-metallic

- 7.1.4. Ceramic Brake Pads

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. LCV

- 7.2.3. HCV

- 7.2.4. Two Wheelers

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Automotive Brake Pads Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Semi-metallic

- 8.1.2. Non-asbestos

- 8.1.3. Low-metallic

- 8.1.4. Ceramic Brake Pads

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. LCV

- 8.2.3. HCV

- 8.2.4. Two Wheelers

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Automotive Brake Pads Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Semi-metallic

- 9.1.2. Non-asbestos

- 9.1.3. Low-metallic

- 9.1.4. Ceramic Brake Pads

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. LCV

- 9.2.3. HCV

- 9.2.4. Two Wheelers

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. MEA Automotive Brake Pads Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Semi-metallic

- 10.1.2. Non-asbestos

- 10.1.3. Low-metallic

- 10.1.4. Ceramic Brake Pads

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. LCV

- 10.2.3. HCV

- 10.2.4. Two Wheelers

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Akebono Brake Corporation.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Delphi Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DRiV Automotive Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dynamic Friction Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EBC Brakes

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HELLA GmbH & Co. KGaA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hitachi Astemo Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maruti Suzuki India Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Masu Brakes

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Robert Bosch LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SKF

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TOMEX Brakes sp. z o.o. sp.k.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TSF Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Webb Wheel Products Inc.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ZF Friedrichshafen AG

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Akebono Brake Corporation.

- Figure 1: Global Automotive Brake Pads Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: Global Automotive Brake Pads Market Volume Breakdown (K Tons, %) by Region 2024 & 2032

- Figure 3: North America Automotive Brake Pads Market Revenue (Billion), by Material Type 2024 & 2032

- Figure 4: North America Automotive Brake Pads Market Volume (K Tons), by Material Type 2024 & 2032

- Figure 5: North America Automotive Brake Pads Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 6: North America Automotive Brake Pads Market Volume Share (%), by Material Type 2024 & 2032

- Figure 7: North America Automotive Brake Pads Market Revenue (Billion), by Vehicle Type 2024 & 2032

- Figure 8: North America Automotive Brake Pads Market Volume (K Tons), by Vehicle Type 2024 & 2032

- Figure 9: North America Automotive Brake Pads Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 10: North America Automotive Brake Pads Market Volume Share (%), by Vehicle Type 2024 & 2032

- Figure 11: North America Automotive Brake Pads Market Revenue (Billion), by Country 2024 & 2032

- Figure 12: North America Automotive Brake Pads Market Volume (K Tons), by Country 2024 & 2032

- Figure 13: North America Automotive Brake Pads Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Automotive Brake Pads Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Automotive Brake Pads Market Revenue (Billion), by Material Type 2024 & 2032

- Figure 16: Europe Automotive Brake Pads Market Volume (K Tons), by Material Type 2024 & 2032

- Figure 17: Europe Automotive Brake Pads Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 18: Europe Automotive Brake Pads Market Volume Share (%), by Material Type 2024 & 2032

- Figure 19: Europe Automotive Brake Pads Market Revenue (Billion), by Vehicle Type 2024 & 2032

- Figure 20: Europe Automotive Brake Pads Market Volume (K Tons), by Vehicle Type 2024 & 2032

- Figure 21: Europe Automotive Brake Pads Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 22: Europe Automotive Brake Pads Market Volume Share (%), by Vehicle Type 2024 & 2032

- Figure 23: Europe Automotive Brake Pads Market Revenue (Billion), by Country 2024 & 2032

- Figure 24: Europe Automotive Brake Pads Market Volume (K Tons), by Country 2024 & 2032

- Figure 25: Europe Automotive Brake Pads Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Automotive Brake Pads Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Pacific Automotive Brake Pads Market Revenue (Billion), by Material Type 2024 & 2032

- Figure 28: Asia Pacific Automotive Brake Pads Market Volume (K Tons), by Material Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Brake Pads Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Brake Pads Market Volume Share (%), by Material Type 2024 & 2032

- Figure 31: Asia Pacific Automotive Brake Pads Market Revenue (Billion), by Vehicle Type 2024 & 2032

- Figure 32: Asia Pacific Automotive Brake Pads Market Volume (K Tons), by Vehicle Type 2024 & 2032

- Figure 33: Asia Pacific Automotive Brake Pads Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 34: Asia Pacific Automotive Brake Pads Market Volume Share (%), by Vehicle Type 2024 & 2032

- Figure 35: Asia Pacific Automotive Brake Pads Market Revenue (Billion), by Country 2024 & 2032

- Figure 36: Asia Pacific Automotive Brake Pads Market Volume (K Tons), by Country 2024 & 2032

- Figure 37: Asia Pacific Automotive Brake Pads Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Automotive Brake Pads Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Latin America Automotive Brake Pads Market Revenue (Billion), by Material Type 2024 & 2032

- Figure 40: Latin America Automotive Brake Pads Market Volume (K Tons), by Material Type 2024 & 2032

- Figure 41: Latin America Automotive Brake Pads Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 42: Latin America Automotive Brake Pads Market Volume Share (%), by Material Type 2024 & 2032

- Figure 43: Latin America Automotive Brake Pads Market Revenue (Billion), by Vehicle Type 2024 & 2032

- Figure 44: Latin America Automotive Brake Pads Market Volume (K Tons), by Vehicle Type 2024 & 2032

- Figure 45: Latin America Automotive Brake Pads Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 46: Latin America Automotive Brake Pads Market Volume Share (%), by Vehicle Type 2024 & 2032

- Figure 47: Latin America Automotive Brake Pads Market Revenue (Billion), by Country 2024 & 2032

- Figure 48: Latin America Automotive Brake Pads Market Volume (K Tons), by Country 2024 & 2032

- Figure 49: Latin America Automotive Brake Pads Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Latin America Automotive Brake Pads Market Volume Share (%), by Country 2024 & 2032

- Figure 51: MEA Automotive Brake Pads Market Revenue (Billion), by Material Type 2024 & 2032

- Figure 52: MEA Automotive Brake Pads Market Volume (K Tons), by Material Type 2024 & 2032

- Figure 53: MEA Automotive Brake Pads Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 54: MEA Automotive Brake Pads Market Volume Share (%), by Material Type 2024 & 2032

- Figure 55: MEA Automotive Brake Pads Market Revenue (Billion), by Vehicle Type 2024 & 2032

- Figure 56: MEA Automotive Brake Pads Market Volume (K Tons), by Vehicle Type 2024 & 2032

- Figure 57: MEA Automotive Brake Pads Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 58: MEA Automotive Brake Pads Market Volume Share (%), by Vehicle Type 2024 & 2032

- Figure 59: MEA Automotive Brake Pads Market Revenue (Billion), by Country 2024 & 2032

- Figure 60: MEA Automotive Brake Pads Market Volume (K Tons), by Country 2024 & 2032

- Figure 61: MEA Automotive Brake Pads Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: MEA Automotive Brake Pads Market Volume Share (%), by Country 2024 & 2032

- Table 1: Global Automotive Brake Pads Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Brake Pads Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Global Automotive Brake Pads Market Revenue Billion Forecast, by Material Type 2019 & 2032

- Table 4: Global Automotive Brake Pads Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 5: Global Automotive Brake Pads Market Revenue Billion Forecast, by Vehicle Type 2019 & 2032

- Table 6: Global Automotive Brake Pads Market Volume K Tons Forecast, by Vehicle Type 2019 & 2032

- Table 7: Global Automotive Brake Pads Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 8: Global Automotive Brake Pads Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Global Automotive Brake Pads Market Revenue Billion Forecast, by Material Type 2019 & 2032

- Table 10: Global Automotive Brake Pads Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 11: Global Automotive Brake Pads Market Revenue Billion Forecast, by Vehicle Type 2019 & 2032

- Table 12: Global Automotive Brake Pads Market Volume K Tons Forecast, by Vehicle Type 2019 & 2032

- Table 13: Global Automotive Brake Pads Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 14: Global Automotive Brake Pads Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 15: U.S. Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: U.S. Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Canada Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: Canada Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Global Automotive Brake Pads Market Revenue Billion Forecast, by Material Type 2019 & 2032

- Table 20: Global Automotive Brake Pads Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 21: Global Automotive Brake Pads Market Revenue Billion Forecast, by Vehicle Type 2019 & 2032

- Table 22: Global Automotive Brake Pads Market Volume K Tons Forecast, by Vehicle Type 2019 & 2032

- Table 23: Global Automotive Brake Pads Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 24: Global Automotive Brake Pads Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 25: Germany Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 26: Germany Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: UK Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: UK Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: France Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 30: France Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Italy Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: Italy Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Spain Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 34: Spain Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: Rest of Europe Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Global Automotive Brake Pads Market Revenue Billion Forecast, by Material Type 2019 & 2032

- Table 38: Global Automotive Brake Pads Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 39: Global Automotive Brake Pads Market Revenue Billion Forecast, by Vehicle Type 2019 & 2032

- Table 40: Global Automotive Brake Pads Market Volume K Tons Forecast, by Vehicle Type 2019 & 2032

- Table 41: Global Automotive Brake Pads Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 42: Global Automotive Brake Pads Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 43: China Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 44: China Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Japan Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 46: Japan Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: India Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 48: India Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: South Korea Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 50: South Korea Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Australia Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 52: Australia Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 55: Global Automotive Brake Pads Market Revenue Billion Forecast, by Material Type 2019 & 2032

- Table 56: Global Automotive Brake Pads Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 57: Global Automotive Brake Pads Market Revenue Billion Forecast, by Vehicle Type 2019 & 2032

- Table 58: Global Automotive Brake Pads Market Volume K Tons Forecast, by Vehicle Type 2019 & 2032

- Table 59: Global Automotive Brake Pads Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 60: Global Automotive Brake Pads Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 61: Brazil Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 62: Brazil Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 63: Mexico Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 64: Mexico Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 65: Argentina Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 66: Argentina Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 67: Rest of Latin America Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 68: Rest of Latin America Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 69: Global Automotive Brake Pads Market Revenue Billion Forecast, by Material Type 2019 & 2032

- Table 70: Global Automotive Brake Pads Market Volume K Tons Forecast, by Material Type 2019 & 2032

- Table 71: Global Automotive Brake Pads Market Revenue Billion Forecast, by Vehicle Type 2019 & 2032

- Table 72: Global Automotive Brake Pads Market Volume K Tons Forecast, by Vehicle Type 2019 & 2032

- Table 73: Global Automotive Brake Pads Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 74: Global Automotive Brake Pads Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 75: Saudi Arabia Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 76: Saudi Arabia Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 77: UAE Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 78: UAE Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 79: South Africa Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 80: South Africa Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 81: Rest of MEA Automotive Brake Pads Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 82: Rest of MEA Automotive Brake Pads Market Volume (K Tons) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)