1. What is the projected Compound Annual Growth Rate (CAGR) of the Public Cloud Market?

The projected CAGR is approximately 10%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Public Cloud Market by Deployment Model (SaaS, IaaS, PaaS), by Organization Size (Large enterprise, SME), by Application (BFSI, Healthcare, Media and Entertainment, Retail & Consumer Goods, Automotive, IT & Telecom, Manufacturing, Government, Others), by North America (U.S., Canada), by Europe (UK, Germany, France, Italy, Netherlands, Switzerland), by Asia Pacific (China, India, Japan, South Korea, Australia, Singapore), by Latin America (Brazil, Mexico, Argentina), by Middle East & Africa (Saudi Arabia, UAE, South Africa) Forecast 2025-2033

The Public Cloud Market, currently valued at $400 billion, is experiencing explosive growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 10%. This expansion is fueled by several key factors. The increasing adoption of cloud-based solutions across diverse industries stems from the inherent advantages of scalability, cost-effectiveness, and enhanced agility. Businesses are increasingly migrating their IT infrastructure to the cloud to reduce capital expenditure on hardware and maintenance, focusing resources instead on core business functions. Government initiatives promoting digital transformation and cloud adoption further accelerate this shift. Technological advancements, including the development of advanced analytics, artificial intelligence (AI), and machine learning (ML) capabilities integrated into cloud platforms, provide businesses with powerful tools for data analysis and process optimization. Finally, the rising demand for secure and reliable data storage and processing further fuels the market's growth. The diverse applications of public cloud services across sectors, including BFSI, healthcare, and retail, solidify its position as a crucial component of modern business infrastructure. Major players like Amazon Web Services, Microsoft Azure, and Google Cloud Platform constantly innovate, expanding their services and fostering competition, driving further market expansion.

The public cloud market is highly concentrated, with a few dominant players, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), holding significant market share. This concentration, however, is coupled with substantial innovation. These leading players continuously introduce new services, features, and pricing models, driving competition and benefiting end users. Government regulations, particularly concerning data privacy and security (like GDPR and CCPA), significantly impact market dynamics. Companies must adapt to these regulations, increasing compliance costs and potentially slowing down market growth in certain sectors. Product substitutes, although limited in the core aspects of public cloud services, exist in the form of on-premises data centers and private clouds. However, the scalability and cost-effectiveness advantages of public cloud often outweigh these alternatives. End-user concentration is evident, with large enterprises accounting for a significant portion of the market due to their greater capacity for adopting and scaling cloud solutions. The level of mergers and acquisitions (M&A) activity in the public cloud market is high, with companies acquiring smaller players to expand their service offerings and market reach, further consolidating the market.

The public cloud market is characterized by a shift toward serverless computing, where users only pay for the computing resources they consume, eliminating the need to manage servers. This model contributes to higher efficiency and cost optimization. Artificial intelligence (AI) and machine learning (ML) are rapidly integrating with cloud platforms, providing enhanced analytical capabilities and automation opportunities for businesses. The growth of edge computing, which brings cloud capabilities closer to the data source, is also transforming the landscape, addressing latency challenges for applications requiring real-time processing. Security continues to be a critical concern, and the market is witnessing advancements in cloud security technologies, including enhanced encryption and access control mechanisms. The increasing importance of data privacy regulations is further propelling investment in robust security solutions. Sustainability is also gaining traction, with cloud providers focusing on energy-efficient data centers and carbon offsetting initiatives to lessen their environmental impact. Furthermore, the growing adoption of hybrid cloud models, combining public and private cloud environments, offers businesses a flexible and secure approach to leveraging cloud technology. Finally, the increasing demand for cloud-native applications specifically designed for cloud environments and the adoption of DevOps practices are streamlining development cycles and enhancing collaboration.

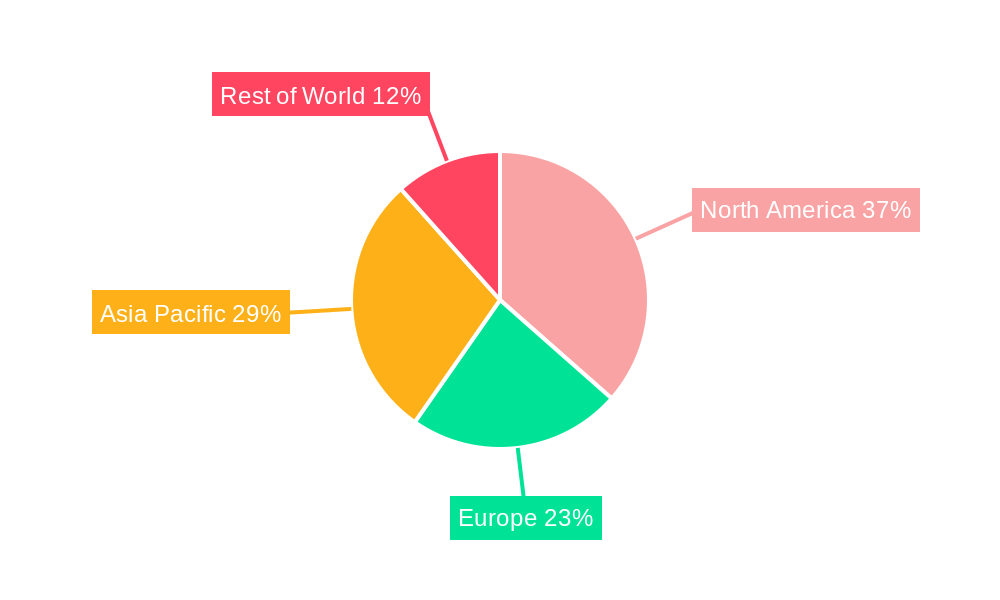

The rapid expansion of cloud services in North America, the strong demand from large enterprises, the underlying support provided by IaaS, and the high adoption rate within the BFSI sector all contribute to the dominant positioning of these segments in the public cloud market. Their combined influence is projected to sustain considerable growth in the years ahead.

This report provides a comprehensive overview of the public cloud market, including market size, growth projections, segment analysis, competitive landscape, and key trends. The deliverables include detailed market forecasts, in-depth analysis of major market segments, profiles of leading players, and identification of key growth opportunities.

The public cloud market size is currently estimated at $400 billion, growing at a CAGR of 10%. Market share is concentrated among the top three providers—AWS, Microsoft Azure, and Google Cloud—with the remaining share distributed amongst other significant players such as Salesforce, Alibaba, and others. The growth is driven by increased digital transformation initiatives, the cost-effectiveness of cloud solutions, and the enhanced scalability and agility they offer. The market exhibits diverse segments based on deployment models (SaaS, IaaS, PaaS), organization size (large enterprises, SMEs), and industry verticals (BFSI, healthcare, retail, etc.). Analysis of these segments reveals varied growth rates based on factors like industry-specific requirements and the readiness to adopt cloud technologies. Market analysis also involves assessing the competitive landscape, including strategic alliances, partnerships, and mergers & acquisitions that shape market dynamics.

Each region exhibits unique characteristics in terms of cloud adoption rates, regulatory frameworks, and technological advancements. North America currently holds the largest market share, followed by Europe and Asia Pacific.

(This section would require current news updates at the time of report generation. Examples of news items could include new product launches by major cloud providers, significant partnerships or acquisitions, regulatory changes impacting the industry, and significant market reports.)

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10%.

Key companies in the market include Microsoft Corporation, Amazon Web Services, Inc., Google LLC., Salesforce, Inc., Alibaba Group Holding Limited, SAP SE, Oracle Corporation, IBM Corporation, Tencent Cloud, Nutanix, OVH SAS, VMware, Inc., Kamatera, Inc., DigitalOcean, LLC., Rackspace Technology.

The market segments include Deployment Model, Organization Size, Application.

The market size is estimated to be USD 400 Billion as of 2022.

Increasing Integration of big data. AI. and ML with cloud. Increasing public cloud spending. Growing adoption of cloud computing solutions in developing countries. Rising deployment of IaaS and PaaS in SME. Cost-effective and scalable.

N/A

Data privacy and information security concerns. Cloud Wastage.

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4,850, USD 5,350, and USD 8,350 respectively.

The market size is provided in terms of value, measured in Billion and volume, measured in K Units.

Yes, the market keyword associated with the report is "Public Cloud Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Public Cloud Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

See the similar reports

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.