Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Algae Protein Market 2025-2033 Overview: Trends, Dynamics, and Growth Opportunities

Algae Protein Market by Source (Seaweed, Micro algae), by Dosage Form (Capsules, Liquid, Powder, Others), by Application (Dietary Supplements, Food & Beverage, Animal Feed, Cosmetics, Others), by North America (U.S., Canada, Mexico), by Europe (Germany, UK, France, Italy, Spain, Russia), by Asia Pacific (China, India, Japan, Australia, South Korea, Malaysia), by Latin America (Brazil), by Middle East & Africa (UAE, South Africa) Forecast 2025-2033

Key Insights

The global algae protein market, valued at $876.12 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.4% from 2025 to 2033. This expansion is driven by several key factors. The increasing consumer awareness of the health benefits associated with plant-based proteins, coupled with the rising demand for sustainable and ethically sourced food products, is significantly fueling market growth. Algae protein, with its high protein content, rich nutrient profile (including essential amino acids, vitamins, and minerals), and environmentally friendly production, is perfectly positioned to capitalize on these trends. Furthermore, the versatility of algae protein, allowing its incorporation into diverse applications such as dietary supplements, food and beverages (bakery, confectionery, protein drinks, and more), animal feed, and cosmetics, further broadens its market appeal and contributes to its expanding market share. Innovation in algae cultivation techniques and extraction processes is also playing a crucial role, enhancing the efficiency and cost-effectiveness of algae protein production, making it a more competitive alternative to traditional protein sources.

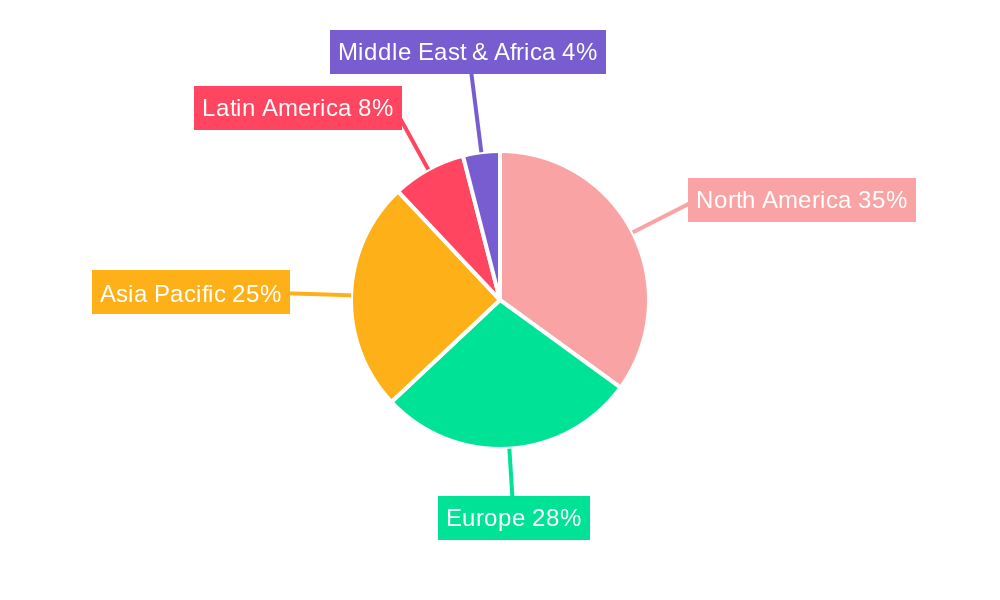

The market segmentation reveals that brown, green, and red seaweed sources, alongside microalgae like spirulina and chlorella, are major contributors. Capsules, liquids, and powders are the dominant dosage forms, reflecting consumer preference and product versatility. While dietary supplements represent a significant portion of the market, the expanding applications in food and beverages, particularly within the rapidly growing plant-based food sector, indicate a promising future for algae protein. Geographic analysis suggests that North America and Europe currently hold substantial market shares, driven by high consumer awareness and established distribution channels. However, the Asia-Pacific region, particularly China and India, presents significant growth potential due to the rising population, increasing disposable incomes, and growing demand for nutritious and sustainable food options. Competitive landscape analysis reveals the presence of both established players and emerging companies, indicating a dynamic and competitive market with ample opportunities for innovation and expansion.

Algae Protein Market Concentration & Characteristics

The algae protein market is characterized by a moderately fragmented competitive landscape. While a few large players like Corbion and Roquette hold significant market share, numerous smaller companies, particularly those focused on niche applications or specific algae species, contribute substantially. This fragmentation is partly due to the diverse range of algae species and their applications.

Concentration Areas:

- Spirulina and Chlorella: These microalgae species dominate the market due to their established production methods and relatively high protein content.

- Dietary Supplements: A significant portion of market concentration lies within the dietary supplement sector, driven by consumer demand for plant-based protein alternatives.

- North America and Europe: These regions represent significant market concentration due to higher consumer awareness and purchasing power related to health and sustainable food choices.

Characteristics:

- Innovation: A key characteristic is the ongoing innovation in algae cultivation techniques, extraction methods, and product formulations to improve protein yield, reduce costs, and enhance functionality.

- Impact of Regulations: Regulations concerning food safety and labeling significantly impact market development. Stringent regulations in certain regions can create barriers to entry for smaller companies.

- Product Substitutes: Plant-based protein sources like soy, pea, and brown rice protein pose competitive challenges to algae protein. However, the unique nutritional profile and sustainability benefits of algae protein offer differentiation.

- End-User Concentration: The market is spread across diverse end-users, including individual consumers, food and beverage manufacturers, animal feed producers, and cosmetic companies. No single end-user group dominates.

- Level of M&A: The level of mergers and acquisitions (M&A) activity is moderate. Larger players are likely to acquire smaller companies to expand their product portfolios and production capacities.

Algae Protein Market Trends

The algae protein market is experiencing robust growth, driven by several converging trends. The increasing global population and rising demand for sustainable and healthy food options are major catalysts. The expanding awareness of the environmental benefits of algae cultivation, such as its lower water and land footprint compared to traditional protein sources, further fuels market expansion. The increasing demand for plant-based alternatives to traditional protein sources, particularly among health-conscious consumers, creates a powerful market pull. Furthermore, the ongoing research and development efforts focusing on optimizing algae cultivation techniques and improving the taste and texture of algae-based products are opening up new applications and driving growth.

Technological advancements in algae cultivation are leading to greater yields and lower production costs. This makes algae protein more competitive in price compared to established protein sources. The growing integration of algae protein into mainstream food and beverage products, such as protein bars, beverages, and baked goods, is steadily increasing its visibility and acceptance among consumers. This increasing market penetration further supports robust market expansion. Government initiatives and funding supporting sustainable agriculture and alternative protein sources are also bolstering the market growth trajectory. The rising interest in the use of algae protein in animal feed, driven by its nutritional value and environmental sustainability, is creating new market opportunities. Lastly, the development of novel algae-derived ingredients with added functionalities, like functional food ingredients for improved health benefits, is expanding the market applications.

Key Region or Country & Segment to Dominate the Market

The North American market, particularly the United States, is expected to dominate the algae protein market in the coming years. This is primarily due to high consumer awareness of health and sustainability, coupled with strong regulatory support for innovative food technologies.

Dominating Segments:

- Microalgae: Microalgae, specifically spirulina and chlorella, currently hold a larger market share compared to seaweed due to established production and processing techniques and a wider range of applications.

- Dietary Supplements: The dietary supplement segment represents a substantial market share, owing to the strong consumer base seeking plant-based protein alternatives with added health benefits.

- Powder Dosage Form: The powder form is favored for its versatility in incorporating algae protein into a range of food and beverage products and supplement formulations. This leads to higher adoption than other dosage forms.

Reasons for Dominance:

- High Consumer Awareness: North American consumers are more aware of the health and environmental benefits associated with plant-based protein and sustainable food choices.

- Strong Regulatory Support: The regulatory environment in North America is supportive of innovation and adoption of novel food technologies.

- Established Distribution Channels: Robust and established distribution networks make it easier to reach a wider consumer base.

- High Disposable Income: The higher disposable income in North America allows consumers to spend more on premium, health-conscious products like algae protein.

Algae Protein Market Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the algae protein market, encompassing market size and growth projections, competitive landscape analysis, key trends, and regional market insights. The report will cover major algae sources (microalgae and seaweed), dosage forms (capsules, liquids, powders), and applications (dietary supplements, food & beverage, animal feed, cosmetics). It will also deliver detailed profiles of leading market players and their strategies, regulatory landscape analysis, and future growth potential. The report provides actionable insights for businesses involved in the algae protein sector, including manufacturers, suppliers, and investors.

Algae Protein Market Analysis

The global algae protein market is valued at approximately $700 million in 2024. This figure is projected to grow at a Compound Annual Growth Rate (CAGR) of 15% between 2024 and 2030, reaching an estimated $1.8 billion by 2030. The growth is driven by the factors already discussed, such as increasing consumer demand for plant-based proteins, growing awareness of algae’s sustainability advantages, and continuous innovation in algae production technologies and applications.

Market share is presently distributed among a few larger, established players, alongside numerous smaller, specialized firms. The larger companies hold a majority of the market share, mainly due to their established production capabilities and distribution networks. However, the smaller companies are growing rapidly due to innovations in specific niche areas like novel food formulations. The competitive landscape is expected to further evolve due to anticipated mergers and acquisitions, strategic partnerships, and new entrants with innovative technologies.

Algae Protein Market Regional Insights

- North America

- U.S.: High market share due to strong consumer awareness of health and sustainability, coupled with robust regulatory support.

- Canada: Moderate market share, similar to the U.S., but with a slightly smaller consumer base.

- Mexico: Emerging market with growing potential, driven by increasing demand for plant-based alternatives and affordability.

- Europe

- Germany, UK, France, Italy, Spain: Significant market shares owing to strong consumer interest in healthy and sustainable food options.

- Russia: Relatively smaller market share due to slower adoption of novel food products.

- Asia Pacific

- China, India, Japan: Rapidly growing markets with high populations and increasing consumer awareness.

- Australia, South Korea, Malaysia: Moderate growth driven by increasing demand for functional foods.

- Latin America

- Brazil: A key market with increasing interest in sustainable food choices.

- Middle East & Africa

- UAE, South Africa: Emerging markets with potential for growth, particularly in urban centers.

Driving Forces: What's Propelling the Algae Protein Market

The algae protein market is propelled by a confluence of factors: the growing global population's demand for sustainable and nutritious protein sources, increasing consumer awareness of the environmental benefits of algae cultivation, the rising popularity of plant-based diets, and continuous technological advancements in algae cultivation and product development that enhance taste, texture, and affordability. Government support for sustainable agriculture and innovation in alternative protein sources further accelerates market growth.

Challenges and Restraints in Algae Protein Market

Challenges include high production costs, scaling up production to meet growing demand, maintaining consistent product quality, and overcoming consumer perception issues related to the taste and texture of algae protein in some applications. Stringent regulations and the competitive landscape with established plant-based protein sources also pose obstacles to market penetration.

Emerging Trends in Algae Protein Market

Emerging trends include the use of advanced cultivation techniques such as photobioreactors to improve production efficiency, the development of new algae-based ingredients with enhanced functionalities, and expanding applications in new areas like cosmetics and animal feed. Also significant is the growing use of innovative processing techniques to improve the organoleptic properties of algae protein products, enhancing consumer acceptance.

Algae Protein Industry News

- September 2023: Phycom secured €9 million investment to scale microalgae production for sustainable proteins and nutritious food.

- September 2022: DIC Corporation invested $9M in environmental initiatives at Earthrise and Hainan DIC to achieve zero water emission by 2023 while producing Spirulina and LINABLUE®.

Leading Players in the Algae Protein Market

- Heliae Development LLC

- AlgalR NutraPharms Pvt Ltd

- ENERGYbits Inc

- Fuqing King Dnarmsa Spirulina Co., Ltd

- Far East Bio-Tec Co., Ltd. (FEBICO)

- Bliss Lifesciences LLP

- Cyanotech Corporation

- Euglena Co Ltd

- Roquette Klötze GmbH & Co. KG

- Veramaris

- Nutrex Hawaii Inc

- JUNE Group of Companies (JUNE Spirulina)

- Prolgae Spirulina Supplies Pvt. Ltd

- Corbion NV

- Allmicroalgae

- Yunnan Green A Biological Project Co., Ltd

- JFE Steel Corporation

- Phycom Microalgae

- E.I.D. Parry (India) Limited

- Earthrise Nutritionals LLC. (DIC Corporation)

Algae Protein Market Segmentation

-

1. Source

-

1.1. Seaweed

- 1.1.1. Brown Algae

- 1.1.2. Green Algae

- 1.1.3. Red Algae

-

1.2. Micro algae

- 1.2.1. Spirulina (Blue-green algae)

- 1.2.2. Chlorella (Green Algae)

- 1.2.3. Others

-

1.1. Seaweed

-

2. Dosage Form

- 2.1. Capsules

- 2.2. Liquid

- 2.3. Powder

- 2.4. Others

-

3. Application

- 3.1. Dietary Supplements

-

3.2. Food & Beverage

- 3.2.1. Bakery & Confectionery

- 3.2.2. Protein Drinks

- 3.2.3. Breakfast Cereals

- 3.2.4. Snacks

- 3.3. Animal Feed

- 3.4. Cosmetics

- 3.5. Others

Algae Protein Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Russia

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. South Korea

- 3.6. Malaysia

-

4. Latin America

- 4.1. Brazil

-

5. Middle East & Africa

- 5.1. UAE

- 5.2. South Africa

Algae Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.4% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. North America

- 3.3. Market Restrains

- 3.3.1. Presence of other protein-based food products

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Seaweed

- 5.1.1.1. Brown Algae

- 5.1.1.2. Green Algae

- 5.1.1.3. Red Algae

- 5.1.2. Micro algae

- 5.1.2.1. Spirulina (Blue-green algae)

- 5.1.2.2. Chlorella (Green Algae)

- 5.1.2.3. Others

- 5.1.1. Seaweed

- 5.2. Market Analysis, Insights and Forecast - by Dosage Form

- 5.2.1. Capsules

- 5.2.2. Liquid

- 5.2.3. Powder

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Dietary Supplements

- 5.3.2. Food & Beverage

- 5.3.2.1. Bakery & Confectionery

- 5.3.2.2. Protein Drinks

- 5.3.2.3. Breakfast Cereals

- 5.3.2.4. Snacks

- 5.3.3. Animal Feed

- 5.3.4. Cosmetics

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East & Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North America Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Seaweed

- 6.1.1.1. Brown Algae

- 6.1.1.2. Green Algae

- 6.1.1.3. Red Algae

- 6.1.2. Micro algae

- 6.1.2.1. Spirulina (Blue-green algae)

- 6.1.2.2. Chlorella (Green Algae)

- 6.1.2.3. Others

- 6.1.1. Seaweed

- 6.2. Market Analysis, Insights and Forecast - by Dosage Form

- 6.2.1. Capsules

- 6.2.2. Liquid

- 6.2.3. Powder

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Dietary Supplements

- 6.3.2. Food & Beverage

- 6.3.2.1. Bakery & Confectionery

- 6.3.2.2. Protein Drinks

- 6.3.2.3. Breakfast Cereals

- 6.3.2.4. Snacks

- 6.3.3. Animal Feed

- 6.3.4. Cosmetics

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Europe Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Seaweed

- 7.1.1.1. Brown Algae

- 7.1.1.2. Green Algae

- 7.1.1.3. Red Algae

- 7.1.2. Micro algae

- 7.1.2.1. Spirulina (Blue-green algae)

- 7.1.2.2. Chlorella (Green Algae)

- 7.1.2.3. Others

- 7.1.1. Seaweed

- 7.2. Market Analysis, Insights and Forecast - by Dosage Form

- 7.2.1. Capsules

- 7.2.2. Liquid

- 7.2.3. Powder

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Dietary Supplements

- 7.3.2. Food & Beverage

- 7.3.2.1. Bakery & Confectionery

- 7.3.2.2. Protein Drinks

- 7.3.2.3. Breakfast Cereals

- 7.3.2.4. Snacks

- 7.3.3. Animal Feed

- 7.3.4. Cosmetics

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Asia Pacific Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Seaweed

- 8.1.1.1. Brown Algae

- 8.1.1.2. Green Algae

- 8.1.1.3. Red Algae

- 8.1.2. Micro algae

- 8.1.2.1. Spirulina (Blue-green algae)

- 8.1.2.2. Chlorella (Green Algae)

- 8.1.2.3. Others

- 8.1.1. Seaweed

- 8.2. Market Analysis, Insights and Forecast - by Dosage Form

- 8.2.1. Capsules

- 8.2.2. Liquid

- 8.2.3. Powder

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Dietary Supplements

- 8.3.2. Food & Beverage

- 8.3.2.1. Bakery & Confectionery

- 8.3.2.2. Protein Drinks

- 8.3.2.3. Breakfast Cereals

- 8.3.2.4. Snacks

- 8.3.3. Animal Feed

- 8.3.4. Cosmetics

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Latin America Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Seaweed

- 9.1.1.1. Brown Algae

- 9.1.1.2. Green Algae

- 9.1.1.3. Red Algae

- 9.1.2. Micro algae

- 9.1.2.1. Spirulina (Blue-green algae)

- 9.1.2.2. Chlorella (Green Algae)

- 9.1.2.3. Others

- 9.1.1. Seaweed

- 9.2. Market Analysis, Insights and Forecast - by Dosage Form

- 9.2.1. Capsules

- 9.2.2. Liquid

- 9.2.3. Powder

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Dietary Supplements

- 9.3.2. Food & Beverage

- 9.3.2.1. Bakery & Confectionery

- 9.3.2.2. Protein Drinks

- 9.3.2.3. Breakfast Cereals

- 9.3.2.4. Snacks

- 9.3.3. Animal Feed

- 9.3.4. Cosmetics

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Middle East & Africa Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Seaweed

- 10.1.1.1. Brown Algae

- 10.1.1.2. Green Algae

- 10.1.1.3. Red Algae

- 10.1.2. Micro algae

- 10.1.2.1. Spirulina (Blue-green algae)

- 10.1.2.2. Chlorella (Green Algae)

- 10.1.2.3. Others

- 10.1.1. Seaweed

- 10.2. Market Analysis, Insights and Forecast - by Dosage Form

- 10.2.1. Capsules

- 10.2.2. Liquid

- 10.2.3. Powder

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Dietary Supplements

- 10.3.2. Food & Beverage

- 10.3.2.1. Bakery & Confectionery

- 10.3.2.2. Protein Drinks

- 10.3.2.3. Breakfast Cereals

- 10.3.2.4. Snacks

- 10.3.3. Animal Feed

- 10.3.4. Cosmetics

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Heliae Development LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AlgalR NutraPharms Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ENERGYbits Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fuqing King Dnarmsa Spirulina Co. Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Far East Bio-Tec Co. Ltd. (FEBICO)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bliss Lifesciences LLP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cyanotech Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Euglena Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Roquette Klötze GmbH & Co. KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Veramaris

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nutrex Hawaii Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 JUNE Group of Companies (JUNE Spirulina)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Prolgae Spirulina Supplies Pvt. Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Corbion NV Allmicroalgae

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yunnan Green A Biological Project Co. Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 JFE Steel Corporation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Phycom Microalgae

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 E.I.D. Parry (India) Limited

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Earthrise Nutritionals LLC. (DIC Corporation)

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Heliae Development LLC

- Figure 1: Global Algae Protein Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Algae Protein Market Revenue (Million), by Source 2024 & 2032

- Figure 3: North America Algae Protein Market Revenue Share (%), by Source 2024 & 2032

- Figure 4: North America Algae Protein Market Revenue (Million), by Dosage Form 2024 & 2032

- Figure 5: North America Algae Protein Market Revenue Share (%), by Dosage Form 2024 & 2032

- Figure 6: North America Algae Protein Market Revenue (Million), by Application 2024 & 2032

- Figure 7: North America Algae Protein Market Revenue Share (%), by Application 2024 & 2032

- Figure 8: North America Algae Protein Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Algae Protein Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Algae Protein Market Revenue (Million), by Source 2024 & 2032

- Figure 11: Europe Algae Protein Market Revenue Share (%), by Source 2024 & 2032

- Figure 12: Europe Algae Protein Market Revenue (Million), by Dosage Form 2024 & 2032

- Figure 13: Europe Algae Protein Market Revenue Share (%), by Dosage Form 2024 & 2032

- Figure 14: Europe Algae Protein Market Revenue (Million), by Application 2024 & 2032

- Figure 15: Europe Algae Protein Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Algae Protein Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Algae Protein Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Algae Protein Market Revenue (Million), by Source 2024 & 2032

- Figure 19: Asia Pacific Algae Protein Market Revenue Share (%), by Source 2024 & 2032

- Figure 20: Asia Pacific Algae Protein Market Revenue (Million), by Dosage Form 2024 & 2032

- Figure 21: Asia Pacific Algae Protein Market Revenue Share (%), by Dosage Form 2024 & 2032

- Figure 22: Asia Pacific Algae Protein Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Asia Pacific Algae Protein Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Asia Pacific Algae Protein Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Algae Protein Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Latin America Algae Protein Market Revenue (Million), by Source 2024 & 2032

- Figure 27: Latin America Algae Protein Market Revenue Share (%), by Source 2024 & 2032

- Figure 28: Latin America Algae Protein Market Revenue (Million), by Dosage Form 2024 & 2032

- Figure 29: Latin America Algae Protein Market Revenue Share (%), by Dosage Form 2024 & 2032

- Figure 30: Latin America Algae Protein Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Algae Protein Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Algae Protein Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America Algae Protein Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Algae Protein Market Revenue (Million), by Source 2024 & 2032

- Figure 35: Middle East & Africa Algae Protein Market Revenue Share (%), by Source 2024 & 2032

- Figure 36: Middle East & Africa Algae Protein Market Revenue (Million), by Dosage Form 2024 & 2032

- Figure 37: Middle East & Africa Algae Protein Market Revenue Share (%), by Dosage Form 2024 & 2032

- Figure 38: Middle East & Africa Algae Protein Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East & Africa Algae Protein Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East & Africa Algae Protein Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East & Africa Algae Protein Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Algae Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Algae Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Global Algae Protein Market Revenue Million Forecast, by Dosage Form 2019 & 2032

- Table 4: Global Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Algae Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Algae Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 7: Global Algae Protein Market Revenue Million Forecast, by Dosage Form 2019 & 2032

- Table 8: Global Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Global Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: U.S. Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Algae Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 14: Global Algae Protein Market Revenue Million Forecast, by Dosage Form 2019 & 2032

- Table 15: Global Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Germany Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: UK Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Algae Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 24: Global Algae Protein Market Revenue Million Forecast, by Dosage Form 2019 & 2032

- Table 25: Global Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Global Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: China Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: India Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Japan Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Australia Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Korea Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Malaysia Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Algae Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 34: Global Algae Protein Market Revenue Million Forecast, by Dosage Form 2019 & 2032

- Table 35: Global Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Brazil Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Algae Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 39: Global Algae Protein Market Revenue Million Forecast, by Dosage Form 2019 & 2032

- Table 40: Global Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: UAE Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)