Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Citrus Based Dietary Fibers Market Analysis Report 2025: Market to Grow by a CAGR of 6 to 2033, Driven by Government Incentives, Popularity of Virtual Assistants, and Strategic Partnerships

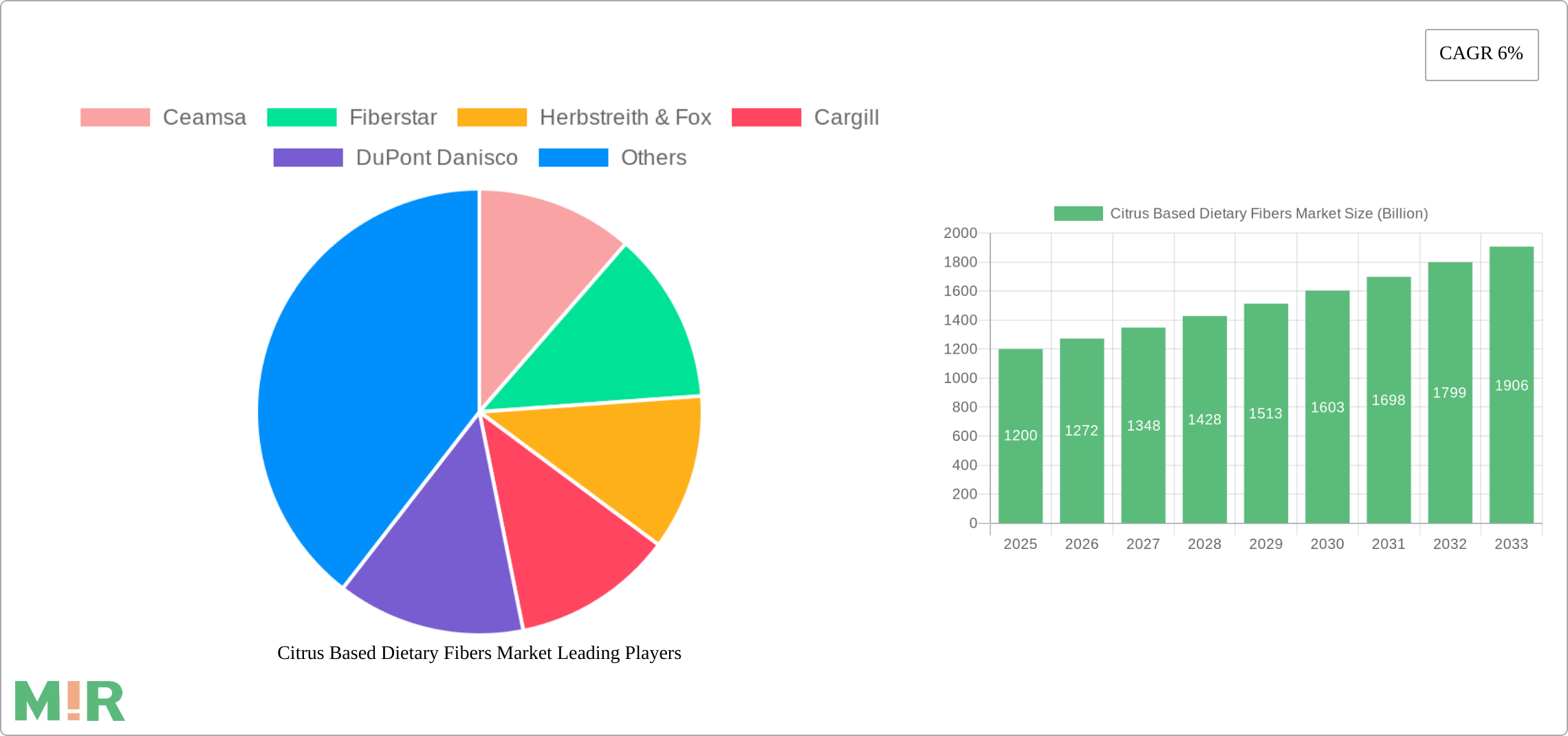

Citrus Based Dietary Fibers Market by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include (Ceamsa, Fiberstar, Herbstreith & Fox, Cargill, DuPont Danisco, CP Kelco, Yantai Andre Pectin), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include (Quadra Chemicals, DuPont Danisco, Triphase Pharmaceuticals, Reinert Gruppe Ingredients), by North America (U.S., Canada), by Europe (Germany, UK, France, Italy, Spain, Netherlands, Sweden, Rest of Europe), by Asia Pacific (China, India, Japan, South Korea, Australia, Singapore, Thailand, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Argentina, Chile, Colombia, Rest of Latin America), by MEA (Saudi Arabia, UAE, South Africa, Egypt, Nigeria, Rest of MEA) Forecast 2025-2033

Key Insights

The global citrus-based dietary fiber market, valued at $1.2 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6% from 2025 to 2033. This expansion is fueled by several key factors. Increasing consumer awareness of the health benefits associated with dietary fiber, including improved digestive health, weight management, and reduced risk of chronic diseases, is a primary driver. The rising prevalence of lifestyle-related health issues globally further fuels demand. Moreover, the versatility of citrus-based fibers, finding applications in various food and beverage products like functional foods, bakery items, and dairy products, contributes significantly to market growth. The food and beverage industry's growing focus on clean-label ingredients and natural alternatives to synthetic additives also presents a favorable market backdrop. Innovation within the industry, including the development of novel citrus-based fiber products with improved functionalities (such as enhanced solubility and texture), will continue to drive market expansion. Strategic partnerships and mergers and acquisitions among key players like Ceamsa, Fiberstar, Herbstreith & Fox, Cargill, DuPont Danisco, and CP Kelco will also shape the competitive landscape and market dynamics in the coming years.

The market is moderately fragmented, with a mix of large multinational corporations and smaller regional players. Competition is intense, with companies focusing on product innovation, strategic partnerships, and expanding their geographical reach to gain market share. While the North American and European markets currently hold significant shares, the Asia-Pacific region is expected to witness substantial growth due to rising disposable incomes and changing dietary habits. However, challenges remain. Price fluctuations in raw materials and stringent regulatory requirements in certain regions could potentially impede market growth. Nevertheless, the overall outlook for the citrus-based dietary fiber market remains positive, driven by strong consumer demand and continuous industry innovation.

Citrus Based Dietary Fibers Market Concentration & Characteristics

The global citrus-based dietary fibers market is moderately fragmented, characterized by a blend of large multinational corporations and smaller regional players. While a few dominant players capture a significant market share (estimated at around 40%), a substantial portion is held by numerous smaller companies, creating a competitive landscape.

Concentration Areas: North America and Europe currently hold the largest market share due to high consumer demand for health-conscious food products and established food processing industries. Asia Pacific is a rapidly growing region, exhibiting high potential for expansion.

Characteristics of Innovation: Innovation focuses on developing new citrus-based fibers with enhanced functionalities, such as improved texture, solubility, and prebiotic properties. This includes the creation of novel fiber blends designed to cater to specific applications within food and beverage, pharmaceutical, and animal feed industries.

Impact of Regulations: Government regulations related to food safety and labeling, along with evolving consumer awareness of dietary fiber's health benefits, influence market dynamics. Regulations promoting the use of natural ingredients are positively impacting market growth.

Product Substitutes: Other types of dietary fibers (e.g., inulin, oat bran, psyllium) present competition. However, citrus-based fibers offer unique qualities (like gelling properties and clean taste) that provide a competitive advantage in certain applications.

End-User Concentration: The market is diversified across various end-users, including food and beverage manufacturers (largest segment), pharmaceutical companies, and animal feed producers.

Level of M&A: The level of mergers and acquisitions is moderate, with larger players strategically acquiring smaller companies to expand their product portfolios and market presence. This activity is expected to increase as the market continues to grow.

Citrus Based Dietary Fibers Market Trends

The global citrus-based dietary fibers market is experiencing robust growth, driven by several key trends. The increasing prevalence of lifestyle diseases like diabetes and obesity is fueling consumer demand for healthier food choices, making dietary fiber a crucial ingredient. The growing awareness among consumers about the benefits of functional foods and dietary fiber's role in gut health is another significant driver.

The rising popularity of plant-based foods and beverages is also boosting market growth. Citrus-based fibers are frequently used as a functional ingredient in these products to enhance texture, improve nutritional value, and create healthier alternatives to traditional animal-based products. Moreover, the growing demand for clean-label products, containing naturally sourced ingredients without artificial additives, is further propelling market growth. Manufacturers are increasingly focusing on the development of citrus-based fibers with specific functional properties to meet the diverse requirements of various food and beverage applications. This includes the creation of fibers with optimized solubility, viscosity, and gelling properties tailored to specific products such as dairy alternatives, bakery items, and processed meat substitutes.

Furthermore, the expansion of the food and beverage processing industry in developing countries is creating new opportunities for citrus-based dietary fiber producers. The rise of e-commerce and online grocery shopping is also increasing accessibility to a wider range of food products containing dietary fibers, contributing to market expansion. The ongoing research and development in the area of citrus-based dietary fibers are yielding new fibers with improved properties and broadened applications, ensuring that the market remains innovative and dynamic.

This overall surge in demand is reflected in the market size, currently estimated at approximately $6.5 billion and projected to reach over $9 billion by 2028, exhibiting a significant Compound Annual Growth Rate (CAGR).

Key Region or Country & Segment to Dominate the Market

North America currently dominates the market, driven by strong consumer demand for health-conscious products and a well-established food processing industry. The U.S. is the largest market within this region.

Europe also holds a substantial market share, with Germany, France, and the UK being key consumers of citrus-based dietary fibers. The growing awareness of health benefits and the increasing adoption of plant-based diets are contributing factors to the region's growth.

Asia Pacific is experiencing the fastest growth, fueled by increasing disposable incomes, rising health awareness, and the growing popularity of functional foods in countries like China and India. This region's market potential is considerable, offering significant growth prospects in the coming years.

The Food and Beverage segment is the largest end-use application for citrus-based dietary fibers, driven by its use in various products like yogurt, jams, bakery goods, and beverages. This segment's growth is directly linked to the increased demand for healthier, functional food options. The pharmaceutical and animal feed sectors also represent substantial but smaller segments of the market.

Citrus Based Dietary Fibers Market Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the citrus-based dietary fibers market, encompassing market size, segmentation, key players, regional insights, trends, and growth forecasts. It offers detailed information on various types of citrus-based fibers, including their functional properties, applications, and market potential. The report also includes an in-depth competitive analysis, identifying key industry trends and growth drivers, and analyzing the competitive dynamics among major players. This detailed analysis enables stakeholders to make informed decisions regarding market entry, product development, and strategic planning.

Citrus Based Dietary Fibers Market Analysis

The global citrus-based dietary fibers market is witnessing robust growth, driven by factors such as increasing health consciousness, rising demand for functional foods, and the growing popularity of plant-based diets. The market size was estimated at $6 billion in 2023, and is projected to reach approximately $9.2 billion by 2028, reflecting a CAGR of approximately 7%. This growth is primarily attributed to the expanding food and beverage industry, increasing consumer preference for natural and healthy ingredients, and advancements in fiber extraction and modification technologies. The market share is moderately fragmented, with several key players competing for market dominance. Larger players are leveraging their established brand recognition and distribution networks to maintain a strong market position. Smaller players are focusing on niche market segments and developing innovative products with superior functionalities to compete effectively. This dynamic competitive environment is further driving innovation and product development in the market.

Citrus Based Dietary Fibers Market Regional Insights

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Sweden

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Thailand

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Colombia

- Rest of Latin America

- MEA

- Saudi Arabia

- UAE

- South Africa

- Egypt

- Nigeria

- Rest of MEA

Driving Forces: What's Propelling the Citrus Based Dietary Fibers Market

The market's growth is significantly fueled by the rising global awareness of the health benefits of dietary fiber. This is coupled with increasing consumer preference for natural and clean-label food products. Furthermore, the growing demand for plant-based and functional foods, along with the expansion of the food and beverage industry in emerging economies, is further driving market expansion.

Challenges and Restraints in Citrus Based Dietary Fibers Market

Challenges include the fluctuating prices of citrus fruits, competition from alternative fiber sources, and stringent regulatory requirements related to food safety and labeling. Maintaining consistent fiber quality and meeting the diverse functional requirements of various food applications are also key challenges faced by manufacturers.

Emerging Trends in Citrus Based Dietary Fibers Market

Emerging trends include the development of novel citrus-based fibers with enhanced functionalities and the growing focus on sustainable sourcing and production practices. There is also a rising interest in the use of citrus-based fibers in personalized nutrition and gut health products.

Citrus Based Dietary Fibers Industry News

- February 2023: Fiberstar announces expansion of its Citri-Fi line of citrus fibers.

- October 2022: Cargill invests in research and development of sustainable citrus fiber production methods.

- June 2022: New regulations regarding dietary fiber labeling are implemented in the European Union.

Leading Players in the Citrus Based Dietary Fibers Market

Citrus Based Dietary Fibers Market Segmentation

-

1. Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 1.1. Ceamsa

- 1.2. Fiberstar

- 1.3. Herbstreith & Fox

- 1.4. Cargill

- 1.5. DuPont Danisco

- 1.6. CP Kelco

- 1.7. Yantai Andre Pectin

-

2. New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include

- 2.1. Quadra Chemicals

- 2.2. DuPont Danisco

- 2.3. Triphase Pharmaceuticals

- 2.4. Reinert Gruppe Ingredients

Citrus Based Dietary Fibers Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Netherlands

- 2.7. Sweden

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Singapore

- 3.7. Thailand

- 3.8. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Chile

- 4.5. Colombia

- 4.6. Rest of Latin America

-

5. MEA

- 5.1. Saudi Arabia

- 5.2. UAE

- 5.3. South Africa

- 5.4. Egypt

- 5.5. Nigeria

- 5.6. Rest of MEA

Citrus Based Dietary Fibers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Citrus Based Dietary Fibers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 5.1.1. Ceamsa

- 5.1.2. Fiberstar

- 5.1.3. Herbstreith & Fox

- 5.1.4. Cargill

- 5.1.5. DuPont Danisco

- 5.1.6. CP Kelco

- 5.1.7. Yantai Andre Pectin

- 5.2. Market Analysis, Insights and Forecast - by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include

- 5.2.1. Quadra Chemicals

- 5.2.2. DuPont Danisco

- 5.2.3. Triphase Pharmaceuticals

- 5.2.4. Reinert Gruppe Ingredients

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 6. North America Citrus Based Dietary Fibers Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 6.1.1. Ceamsa

- 6.1.2. Fiberstar

- 6.1.3. Herbstreith & Fox

- 6.1.4. Cargill

- 6.1.5. DuPont Danisco

- 6.1.6. CP Kelco

- 6.1.7. Yantai Andre Pectin

- 6.2. Market Analysis, Insights and Forecast - by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include

- 6.2.1. Quadra Chemicals

- 6.2.2. DuPont Danisco

- 6.2.3. Triphase Pharmaceuticals

- 6.2.4. Reinert Gruppe Ingredients

- 6.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 7. Europe Citrus Based Dietary Fibers Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 7.1.1. Ceamsa

- 7.1.2. Fiberstar

- 7.1.3. Herbstreith & Fox

- 7.1.4. Cargill

- 7.1.5. DuPont Danisco

- 7.1.6. CP Kelco

- 7.1.7. Yantai Andre Pectin

- 7.2. Market Analysis, Insights and Forecast - by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include

- 7.2.1. Quadra Chemicals

- 7.2.2. DuPont Danisco

- 7.2.3. Triphase Pharmaceuticals

- 7.2.4. Reinert Gruppe Ingredients

- 7.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 8. Asia Pacific Citrus Based Dietary Fibers Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 8.1.1. Ceamsa

- 8.1.2. Fiberstar

- 8.1.3. Herbstreith & Fox

- 8.1.4. Cargill

- 8.1.5. DuPont Danisco

- 8.1.6. CP Kelco

- 8.1.7. Yantai Andre Pectin

- 8.2. Market Analysis, Insights and Forecast - by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include

- 8.2.1. Quadra Chemicals

- 8.2.2. DuPont Danisco

- 8.2.3. Triphase Pharmaceuticals

- 8.2.4. Reinert Gruppe Ingredients

- 8.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 9. Latin America Citrus Based Dietary Fibers Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 9.1.1. Ceamsa

- 9.1.2. Fiberstar

- 9.1.3. Herbstreith & Fox

- 9.1.4. Cargill

- 9.1.5. DuPont Danisco

- 9.1.6. CP Kelco

- 9.1.7. Yantai Andre Pectin

- 9.2. Market Analysis, Insights and Forecast - by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include

- 9.2.1. Quadra Chemicals

- 9.2.2. DuPont Danisco

- 9.2.3. Triphase Pharmaceuticals

- 9.2.4. Reinert Gruppe Ingredients

- 9.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 10. MEA Citrus Based Dietary Fibers Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 10.1.1. Ceamsa

- 10.1.2. Fiberstar

- 10.1.3. Herbstreith & Fox

- 10.1.4. Cargill

- 10.1.5. DuPont Danisco

- 10.1.6. CP Kelco

- 10.1.7. Yantai Andre Pectin

- 10.2. Market Analysis, Insights and Forecast - by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include

- 10.2.1. Quadra Chemicals

- 10.2.2. DuPont Danisco

- 10.2.3. Triphase Pharmaceuticals

- 10.2.4. Reinert Gruppe Ingredients

- 10.1. Market Analysis, Insights and Forecast - by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ceamsa

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fiberstar

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Herbstreith & Fox

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cargill

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DuPont Danisco

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CP Kelco

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yantai Andre Pectin

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Ceamsa

- Figure 1: Global Citrus Based Dietary Fibers Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Citrus Based Dietary Fibers Market Revenue (Billion), by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2024 & 2032

- Figure 3: North America Citrus Based Dietary Fibers Market Revenue Share (%), by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2024 & 2032

- Figure 4: North America Citrus Based Dietary Fibers Market Revenue (Billion), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2024 & 2032

- Figure 5: North America Citrus Based Dietary Fibers Market Revenue Share (%), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2024 & 2032

- Figure 6: North America Citrus Based Dietary Fibers Market Revenue (Billion), by Country 2024 & 2032

- Figure 7: North America Citrus Based Dietary Fibers Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Europe Citrus Based Dietary Fibers Market Revenue (Billion), by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2024 & 2032

- Figure 9: Europe Citrus Based Dietary Fibers Market Revenue Share (%), by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2024 & 2032

- Figure 10: Europe Citrus Based Dietary Fibers Market Revenue (Billion), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2024 & 2032

- Figure 11: Europe Citrus Based Dietary Fibers Market Revenue Share (%), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2024 & 2032

- Figure 12: Europe Citrus Based Dietary Fibers Market Revenue (Billion), by Country 2024 & 2032

- Figure 13: Europe Citrus Based Dietary Fibers Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Citrus Based Dietary Fibers Market Revenue (Billion), by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2024 & 2032

- Figure 15: Asia Pacific Citrus Based Dietary Fibers Market Revenue Share (%), by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2024 & 2032

- Figure 16: Asia Pacific Citrus Based Dietary Fibers Market Revenue (Billion), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2024 & 2032

- Figure 17: Asia Pacific Citrus Based Dietary Fibers Market Revenue Share (%), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2024 & 2032

- Figure 18: Asia Pacific Citrus Based Dietary Fibers Market Revenue (Billion), by Country 2024 & 2032

- Figure 19: Asia Pacific Citrus Based Dietary Fibers Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Latin America Citrus Based Dietary Fibers Market Revenue (Billion), by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2024 & 2032

- Figure 21: Latin America Citrus Based Dietary Fibers Market Revenue Share (%), by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2024 & 2032

- Figure 22: Latin America Citrus Based Dietary Fibers Market Revenue (Billion), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2024 & 2032

- Figure 23: Latin America Citrus Based Dietary Fibers Market Revenue Share (%), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2024 & 2032

- Figure 24: Latin America Citrus Based Dietary Fibers Market Revenue (Billion), by Country 2024 & 2032

- Figure 25: Latin America Citrus Based Dietary Fibers Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: MEA Citrus Based Dietary Fibers Market Revenue (Billion), by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2024 & 2032

- Figure 27: MEA Citrus Based Dietary Fibers Market Revenue Share (%), by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2024 & 2032

- Figure 28: MEA Citrus Based Dietary Fibers Market Revenue (Billion), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2024 & 2032

- Figure 29: MEA Citrus Based Dietary Fibers Market Revenue Share (%), by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2024 & 2032

- Figure 30: MEA Citrus Based Dietary Fibers Market Revenue (Billion), by Country 2024 & 2032

- Figure 31: MEA Citrus Based Dietary Fibers Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2019 & 2032

- Table 3: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2019 & 2032

- Table 4: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2019 & 2032

- Table 6: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2019 & 2032

- Table 7: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 8: U.S. Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 9: Canada Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 10: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2019 & 2032

- Table 11: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2019 & 2032

- Table 12: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 13: Germany Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 14: UK Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 15: France Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Italy Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 17: Spain Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: Netherlands Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 19: Sweden Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 21: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2019 & 2032

- Table 22: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2019 & 2032

- Table 23: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 24: China Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 25: India Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 26: Japan Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 27: South Korea Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: Australia Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 29: Singapore Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 30: Thailand Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2019 & 2032

- Table 33: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2019 & 2032

- Table 34: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 35: Brazil Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 36: Mexico Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 37: Argentina Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 38: Chile Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 39: Colombia Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 40: Rest of Latin America Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 41: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Global citrus based dietary fibers market share is moderately fragmented with presence of large number of global players accompanied by few regional manufacturers. The key players include 2019 & 2032

- Table 42: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by New product developments and strategic partnerships to expand their industry share are among key strategies adopted by the manufacturers. For instance, Fiberstar launched Citri-Fi 125 in 2017 for tomato-based foods including sauces, condiments, and spreads to replace gums. Other notable players include 2019 & 2032

- Table 43: Global Citrus Based Dietary Fibers Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 44: Saudi Arabia Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 45: UAE Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 46: South Africa Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 47: Egypt Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 48: Nigeria Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 49: Rest of MEA Citrus Based Dietary Fibers Market Revenue (Billion) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)