Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Vegan Protein Powder Market Future-Proof Strategies: Market Trends 2025-2033

Vegan Protein Powder Market by Product (Hemp protein, Soy protein isolate, Soy protein concentrate, Rice protein isolate, Rice protein concentrate, Pea protein isolate, Pea protein concentrate, Spirulina protein, Quinoa protein, Protein blends), by Nature (Organic, Conventional), by Flavor (Unflavoured, Chocolate, Vanilla, Strawberry, Others), by Application (Sports Nutrition, Beverages, Functional food, Others), by Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online Retail, Others), by North America (U.S., Canada), by Europe (Germany, UK, France, Italy, Spain, Netherlands, Sweden, Rest of Europe), by Asia Pacific (China, India, Japan, South Korea, Australia, Singapore, Thailand, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Argentina, Chile, Colombia, Rest of Latin America), by MEA (Saudi Arabia, UAE, South Africa, Egypt, Nigeria, Rest of MEA) Forecast 2025-2033

Key Insights

The global vegan protein powder market, currently valued at approximately $4 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 7.5% from 2025 to 2033. This expansion is fueled by several key drivers. The rising popularity of vegan and plant-based diets, driven by health consciousness and ethical concerns regarding animal welfare, is a primary factor. Increasing consumer awareness of the health benefits associated with protein consumption, including muscle building, weight management, and improved satiety, further boosts market demand. The growing prevalence of chronic diseases like obesity and diabetes, coupled with the understanding that plant-based protein can contribute to disease prevention, also contributes to market growth. Furthermore, the increasing availability of diverse product formulations, including flavored options and convenient formats, caters to expanding consumer preferences and enhances market penetration. The market segmentation reveals a wide variety of protein sources, including soy, pea, hemp, and rice, catering to specific dietary needs and preferences. Organic options are also gaining traction, reflecting the growing demand for natural and sustainably sourced products. Distribution channels, spanning hypermarkets, specialty stores, and online retail, provide broad accessibility. Major players in the industry, including Archer-Daniels-Midland, Cargill, and Glanbia, are continuously innovating to meet evolving consumer demands and expand their market share.

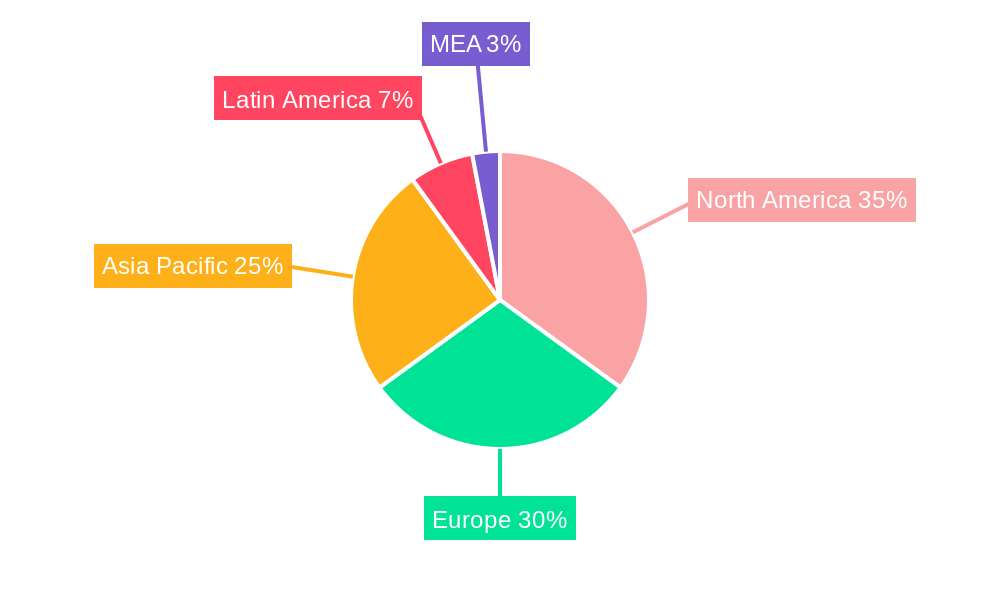

The market's growth trajectory is expected to be influenced by various factors. Continued innovation in product development, focusing on novel protein sources and improved taste profiles, will be crucial. The increasing adoption of online retail channels will further propel market expansion. However, potential restraints include fluctuating raw material prices and the potential for allergen concerns associated with specific protein sources. Regional variations in market growth are anticipated, with North America and Europe likely to maintain strong positions due to high consumer awareness and adoption of vegan lifestyles. The Asia-Pacific region, however, is poised for significant growth driven by rising disposable incomes and increasing health consciousness in developing economies. The continued focus on sustainable and ethically sourced ingredients will also be a key factor shaping future market dynamics. Effective marketing strategies emphasizing the health and wellness benefits of vegan protein powder will be crucial for continued market expansion.

Vegan Protein Powder Market Concentration & Characteristics

The global vegan protein powder market is moderately concentrated, with a few large players like ADM, Cargill, and Glanbia holding significant market share. However, numerous smaller companies and specialized brands also contribute significantly, creating a dynamic competitive landscape.

Concentration Areas:

- North America and Europe: These regions currently hold the largest market share due to high vegan adoption rates and established distribution networks.

- Pea and Soy Protein: These two protein sources dominate the market due to their affordability and relatively high protein content.

Characteristics:

- Innovation: The market is characterized by constant innovation in product formulations, including novel protein blends, functional additions (e.g., probiotics, digestive enzymes), and diverse flavor profiles. Organic and sustainably sourced ingredients are also driving innovation.

- Impact of Regulations: Food safety regulations and labeling requirements significantly impact the market. Regulations regarding claims (e.g., protein content, health benefits) and allergen labeling vary across regions.

- Product Substitutes: Other plant-based protein sources, such as tofu, tempeh, and seitan, compete with vegan protein powders, although powders offer convenience. Whey protein powder remains a significant competitor, although its appeal is diminished by the rising vegan consumer base.

- End-User Concentration: The primary end-users are health-conscious consumers, athletes, and individuals following vegan or vegetarian diets. Growth is driven by expanding awareness of the health benefits of plant-based protein.

- Level of M&A: The market witnesses moderate merger and acquisition activity, with larger players acquiring smaller brands to expand their product portfolios and market reach. Consolidation is expected to continue as the market matures.

Vegan Protein Powder Market Trends

The vegan protein powder market exhibits several key trends. The rising global adoption of veganism and vegetarianism is a primary driver, fuelled by concerns about animal welfare, environmental sustainability, and health benefits associated with plant-based diets. This has led to an increased demand for convenient and high-quality protein sources.

The market is witnessing a shift towards more sophisticated and specialized products. Consumers are increasingly seeking protein powders with added functional benefits such as enhanced digestibility, improved nutrient absorption, and specific health-promoting properties. This has resulted in the development of novel protein blends incorporating various plant sources (e.g., pea, brown rice, soy), prebiotics, probiotics, and digestive enzymes. Organic and sustainably sourced ingredients are gaining popularity, reflecting growing consumer preference for environmentally friendly products. The market also showcases a trend towards personalized nutrition, with customized protein blends tailored to individual dietary needs and fitness goals. Innovation in flavor profiles and product formats (e.g., ready-to-mix packets, ready-to-drink beverages) enhances convenience and appeal.

Furthermore, the e-commerce channel is playing an increasingly important role in driving market growth. Online retailers offer a wide selection of products, detailed information, and convenient home delivery, expanding the reach and accessibility of vegan protein powders. Growing awareness of the health and environmental benefits of vegan protein, along with increased marketing and promotion efforts by manufacturers, are bolstering market growth. The market also witnesses a trend towards transparency and traceability, with consumers seeking greater information about the origin and processing of ingredients. As health consciousness continues to rise and consumer awareness grows, the vegan protein powder market is poised for significant growth in the coming years. The increasing focus on sustainability and ethical sourcing practices is another prominent trend, impacting consumer choices and influencing manufacturing practices within the industry.

Key Region or Country & Segment to Dominate the Market

The North American market currently dominates the vegan protein powder market due to high consumer awareness and strong distribution channels. Within this region, the United States is the largest consumer.

Dominating Segments:

- Product: Pea protein isolate and Pea protein concentrate are leading segments due to their high protein content, affordability, and mild flavor profile, making them versatile ingredients for a wide range of applications.

- Nature: The demand for organic vegan protein powders is growing rapidly, driven by health consciousness and environmental concerns.

- Flavor: Chocolate and vanilla remain the most popular flavors, although innovation in unique and exotic flavors is attracting new consumers.

- Application: The sports nutrition sector is a significant driver of market growth, with vegan protein powders playing a key role in athletic performance and recovery. However, increasing use in beverages and functional foods also contributes significantly.

- Distribution Channel: Online retail is experiencing significant growth, but hypermarkets and supermarkets remain the dominant distribution channels.

The dominance of these segments is expected to continue, though other segments will experience growth, driven by factors such as the introduction of novel protein sources, innovative product formulations, and changing consumer preferences. The focus on organic and sustainably sourced ingredients is also anticipated to fuel the growth of the organic segment significantly. In terms of applications, the expansion of vegan protein powders into functional foods and beverages represents a lucrative growth opportunity.

Vegan Protein Powder Market Product Insights Report Coverage & Deliverables

This report provides comprehensive insights into the vegan protein powder market, covering market size and growth projections, key segments (by product type, nature, flavor, application, and distribution channel), competitive landscape, and regional analysis across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. The report also analyzes market trends, drivers, challenges, opportunities, and future outlook. It includes detailed company profiles of leading players in the industry, focusing on their market share, product offerings, and competitive strategies.

Vegan Protein Powder Market Analysis

The global vegan protein powder market is experiencing significant growth, driven by the rising popularity of veganism and increased consumer awareness of the health benefits of plant-based protein. The market size is estimated to be approximately $5 billion in 2024 and is projected to reach $8 billion by 2029, exhibiting a compound annual growth rate (CAGR) of approximately 8%. The growth is fueled by a confluence of factors, including rising vegan and vegetarian populations globally, a growing focus on health and wellness, and the increasing demand for convenient and high-quality protein sources.

Market share is distributed across various players, with some major players having a substantial share but also with many smaller players contributing significantly. The competitive landscape is characterized by ongoing product innovation, strategic partnerships, and expansions into new markets.

The growth of specific segments varies. For instance, the organic segment is experiencing faster growth compared to the conventional segment, while the demand for specialized protein blends is rising. The market is evolving rapidly, with new product introductions, technological advancements, and shifting consumer preferences influencing the market dynamics.

Vegan Protein Powder Market Regional Insights

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Sweden

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Thailand

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Colombia

- Rest of Latin America

- MEA

- Saudi Arabia

- UAE

- South Africa

- Egypt

- Nigeria

- Rest of MEA

Each region exhibits unique market characteristics influenced by factors such as consumer preferences, regulatory frameworks, and economic conditions. North America and Europe generally demonstrate higher per capita consumption than other regions. Asia-Pacific is a rapidly growing market, driven by increasing disposable incomes and rising awareness of health and wellness.

Driving Forces: What's Propelling the Vegan Protein Powder Market

The market is propelled by several key factors: the growing popularity of vegan and vegetarian diets globally, increasing health consciousness among consumers, the rising demand for convenient and high-protein foods, and the growing awareness of the environmental and ethical concerns surrounding animal agriculture. The expanding fitness and sports nutrition sectors also significantly contribute to the market's growth.

Challenges and Restraints in Vegan Protein Powder Market

Challenges include ensuring consistent quality and taste across different batches, maintaining the affordability of products, and addressing consumer concerns about potential allergens or other potential health issues. Competition from traditional protein sources and the need for effective marketing to reach a wider consumer base also pose challenges.

Emerging Trends in Vegan Protein Powder Market

Emerging trends include the incorporation of functional ingredients (e.g., prebiotics, probiotics, adaptogens), personalized nutrition solutions, the increasing use of sustainable and ethically sourced ingredients, and the growth of innovative product formats like ready-to-drink beverages and convenient single-serve packs.

Vegan Protein Powder Industry News

- January 2023: ADM launches a new line of organic vegan protein powders.

- March 2023: Cargill announces investment in pea protein production capacity.

- July 2024: Glanbia acquires a smaller vegan protein brand.

Leading Players in the Vegan Protein Powder Market

- Archer-Daniels-Midland Company (ADM)

- Cargill Inc.

- Farbest Brands

- Abbott Laboratories

- The Scoular Company

- Glanbia Group

- Makers Nutrition

- Vitaco Health

- Ingredion Incorporated

- Kerry Group

Note: Links provided are to the global websites of the companies. Specific product or vegan protein powder related links may not always be readily available on the main company website.

Vegan Protein Powder Market Segmentation

-

1. Product

- 1.1. Hemp protein

- 1.2. Soy protein isolate

- 1.3. Soy protein concentrate

- 1.4. Rice protein isolate

- 1.5. Rice protein concentrate

- 1.6. Pea protein isolate

- 1.7. Pea protein concentrate

- 1.8. Spirulina protein

- 1.9. Quinoa protein

- 1.10. Protein blends

-

2. Nature

- 2.1. Organic

- 2.2. Conventional

-

3. Flavor

- 3.1. Unflavoured

- 3.2. Chocolate

- 3.3. Vanilla

- 3.4. Strawberry

- 3.5. Others

-

4. Application

- 4.1. Sports Nutrition

- 4.2. Beverages

- 4.3. Functional food

- 4.4. Others

-

5. Distribution Channel

- 5.1. Hypermarkets & Supermarkets

- 5.2. Specialty Stores

- 5.3. Online Retail

- 5.4. Others

Vegan Protein Powder Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Netherlands

- 2.7. Sweden

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Singapore

- 3.7. Thailand

- 3.8. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Chile

- 4.5. Colombia

- 4.6. Rest of Latin America

-

5. MEA

- 5.1. Saudi Arabia

- 5.2. UAE

- 5.3. South Africa

- 5.4. Egypt

- 5.5. Nigeria

- 5.6. Rest of MEA

Vegan Protein Powder Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.5% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising demand for plant-based food & beverages due to growing vegan population is driving market growth

- 3.2.2 Increasing demand for functional food and healthy products with high protein content

- 3.2.3 Growing market for sports nutrition

- 3.3. Market Restrains

- 3.3.1. High production cost

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vegan Protein Powder Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Hemp protein

- 5.1.2. Soy protein isolate

- 5.1.3. Soy protein concentrate

- 5.1.4. Rice protein isolate

- 5.1.5. Rice protein concentrate

- 5.1.6. Pea protein isolate

- 5.1.7. Pea protein concentrate

- 5.1.8. Spirulina protein

- 5.1.9. Quinoa protein

- 5.1.10. Protein blends

- 5.2. Market Analysis, Insights and Forecast - by Nature

- 5.2.1. Organic

- 5.2.2. Conventional

- 5.3. Market Analysis, Insights and Forecast - by Flavor

- 5.3.1. Unflavoured

- 5.3.2. Chocolate

- 5.3.3. Vanilla

- 5.3.4. Strawberry

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Sports Nutrition

- 5.4.2. Beverages

- 5.4.3. Functional food

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.5.1. Hypermarkets & Supermarkets

- 5.5.2. Specialty Stores

- 5.5.3. Online Retail

- 5.5.4. Others

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Latin America

- 5.6.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Vegan Protein Powder Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Hemp protein

- 6.1.2. Soy protein isolate

- 6.1.3. Soy protein concentrate

- 6.1.4. Rice protein isolate

- 6.1.5. Rice protein concentrate

- 6.1.6. Pea protein isolate

- 6.1.7. Pea protein concentrate

- 6.1.8. Spirulina protein

- 6.1.9. Quinoa protein

- 6.1.10. Protein blends

- 6.2. Market Analysis, Insights and Forecast - by Nature

- 6.2.1. Organic

- 6.2.2. Conventional

- 6.3. Market Analysis, Insights and Forecast - by Flavor

- 6.3.1. Unflavoured

- 6.3.2. Chocolate

- 6.3.3. Vanilla

- 6.3.4. Strawberry

- 6.3.5. Others

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Sports Nutrition

- 6.4.2. Beverages

- 6.4.3. Functional food

- 6.4.4. Others

- 6.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.5.1. Hypermarkets & Supermarkets

- 6.5.2. Specialty Stores

- 6.5.3. Online Retail

- 6.5.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Vegan Protein Powder Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Hemp protein

- 7.1.2. Soy protein isolate

- 7.1.3. Soy protein concentrate

- 7.1.4. Rice protein isolate

- 7.1.5. Rice protein concentrate

- 7.1.6. Pea protein isolate

- 7.1.7. Pea protein concentrate

- 7.1.8. Spirulina protein

- 7.1.9. Quinoa protein

- 7.1.10. Protein blends

- 7.2. Market Analysis, Insights and Forecast - by Nature

- 7.2.1. Organic

- 7.2.2. Conventional

- 7.3. Market Analysis, Insights and Forecast - by Flavor

- 7.3.1. Unflavoured

- 7.3.2. Chocolate

- 7.3.3. Vanilla

- 7.3.4. Strawberry

- 7.3.5. Others

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Sports Nutrition

- 7.4.2. Beverages

- 7.4.3. Functional food

- 7.4.4. Others

- 7.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.5.1. Hypermarkets & Supermarkets

- 7.5.2. Specialty Stores

- 7.5.3. Online Retail

- 7.5.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Vegan Protein Powder Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Hemp protein

- 8.1.2. Soy protein isolate

- 8.1.3. Soy protein concentrate

- 8.1.4. Rice protein isolate

- 8.1.5. Rice protein concentrate

- 8.1.6. Pea protein isolate

- 8.1.7. Pea protein concentrate

- 8.1.8. Spirulina protein

- 8.1.9. Quinoa protein

- 8.1.10. Protein blends

- 8.2. Market Analysis, Insights and Forecast - by Nature

- 8.2.1. Organic

- 8.2.2. Conventional

- 8.3. Market Analysis, Insights and Forecast - by Flavor

- 8.3.1. Unflavoured

- 8.3.2. Chocolate

- 8.3.3. Vanilla

- 8.3.4. Strawberry

- 8.3.5. Others

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Sports Nutrition

- 8.4.2. Beverages

- 8.4.3. Functional food

- 8.4.4. Others

- 8.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.5.1. Hypermarkets & Supermarkets

- 8.5.2. Specialty Stores

- 8.5.3. Online Retail

- 8.5.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America Vegan Protein Powder Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Hemp protein

- 9.1.2. Soy protein isolate

- 9.1.3. Soy protein concentrate

- 9.1.4. Rice protein isolate

- 9.1.5. Rice protein concentrate

- 9.1.6. Pea protein isolate

- 9.1.7. Pea protein concentrate

- 9.1.8. Spirulina protein

- 9.1.9. Quinoa protein

- 9.1.10. Protein blends

- 9.2. Market Analysis, Insights and Forecast - by Nature

- 9.2.1. Organic

- 9.2.2. Conventional

- 9.3. Market Analysis, Insights and Forecast - by Flavor

- 9.3.1. Unflavoured

- 9.3.2. Chocolate

- 9.3.3. Vanilla

- 9.3.4. Strawberry

- 9.3.5. Others

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Sports Nutrition

- 9.4.2. Beverages

- 9.4.3. Functional food

- 9.4.4. Others

- 9.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.5.1. Hypermarkets & Supermarkets

- 9.5.2. Specialty Stores

- 9.5.3. Online Retail

- 9.5.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. MEA Vegan Protein Powder Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Hemp protein

- 10.1.2. Soy protein isolate

- 10.1.3. Soy protein concentrate

- 10.1.4. Rice protein isolate

- 10.1.5. Rice protein concentrate

- 10.1.6. Pea protein isolate

- 10.1.7. Pea protein concentrate

- 10.1.8. Spirulina protein

- 10.1.9. Quinoa protein

- 10.1.10. Protein blends

- 10.2. Market Analysis, Insights and Forecast - by Nature

- 10.2.1. Organic

- 10.2.2. Conventional

- 10.3. Market Analysis, Insights and Forecast - by Flavor

- 10.3.1. Unflavoured

- 10.3.2. Chocolate

- 10.3.3. Vanilla

- 10.3.4. Strawberry

- 10.3.5. Others

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Sports Nutrition

- 10.4.2. Beverages

- 10.4.3. Functional food

- 10.4.4. Others

- 10.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.5.1. Hypermarkets & Supermarkets

- 10.5.2. Specialty Stores

- 10.5.3. Online Retail

- 10.5.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Archer-Daniels-Midland Company (ADM)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cargill Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Farbest Brands

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abott Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Scoular Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Glanbia Group.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Makers Nutrition

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vitaco Health

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ingredion Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 and Kerry Group.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Archer-Daniels-Midland Company (ADM)

- Figure 1: Global Vegan Protein Powder Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Vegan Protein Powder Market Revenue (Billion), by Product 2024 & 2032

- Figure 3: North America Vegan Protein Powder Market Revenue Share (%), by Product 2024 & 2032

- Figure 4: North America Vegan Protein Powder Market Revenue (Billion), by Nature 2024 & 2032

- Figure 5: North America Vegan Protein Powder Market Revenue Share (%), by Nature 2024 & 2032

- Figure 6: North America Vegan Protein Powder Market Revenue (Billion), by Flavor 2024 & 2032

- Figure 7: North America Vegan Protein Powder Market Revenue Share (%), by Flavor 2024 & 2032

- Figure 8: North America Vegan Protein Powder Market Revenue (Billion), by Application 2024 & 2032

- Figure 9: North America Vegan Protein Powder Market Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Vegan Protein Powder Market Revenue (Billion), by Distribution Channel 2024 & 2032

- Figure 11: North America Vegan Protein Powder Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: North America Vegan Protein Powder Market Revenue (Billion), by Country 2024 & 2032

- Figure 13: North America Vegan Protein Powder Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Vegan Protein Powder Market Revenue (Billion), by Product 2024 & 2032

- Figure 15: Europe Vegan Protein Powder Market Revenue Share (%), by Product 2024 & 2032

- Figure 16: Europe Vegan Protein Powder Market Revenue (Billion), by Nature 2024 & 2032

- Figure 17: Europe Vegan Protein Powder Market Revenue Share (%), by Nature 2024 & 2032

- Figure 18: Europe Vegan Protein Powder Market Revenue (Billion), by Flavor 2024 & 2032

- Figure 19: Europe Vegan Protein Powder Market Revenue Share (%), by Flavor 2024 & 2032

- Figure 20: Europe Vegan Protein Powder Market Revenue (Billion), by Application 2024 & 2032

- Figure 21: Europe Vegan Protein Powder Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Vegan Protein Powder Market Revenue (Billion), by Distribution Channel 2024 & 2032

- Figure 23: Europe Vegan Protein Powder Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Europe Vegan Protein Powder Market Revenue (Billion), by Country 2024 & 2032

- Figure 25: Europe Vegan Protein Powder Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Vegan Protein Powder Market Revenue (Billion), by Product 2024 & 2032

- Figure 27: Asia Pacific Vegan Protein Powder Market Revenue Share (%), by Product 2024 & 2032

- Figure 28: Asia Pacific Vegan Protein Powder Market Revenue (Billion), by Nature 2024 & 2032

- Figure 29: Asia Pacific Vegan Protein Powder Market Revenue Share (%), by Nature 2024 & 2032

- Figure 30: Asia Pacific Vegan Protein Powder Market Revenue (Billion), by Flavor 2024 & 2032

- Figure 31: Asia Pacific Vegan Protein Powder Market Revenue Share (%), by Flavor 2024 & 2032

- Figure 32: Asia Pacific Vegan Protein Powder Market Revenue (Billion), by Application 2024 & 2032

- Figure 33: Asia Pacific Vegan Protein Powder Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Vegan Protein Powder Market Revenue (Billion), by Distribution Channel 2024 & 2032

- Figure 35: Asia Pacific Vegan Protein Powder Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 36: Asia Pacific Vegan Protein Powder Market Revenue (Billion), by Country 2024 & 2032

- Figure 37: Asia Pacific Vegan Protein Powder Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Vegan Protein Powder Market Revenue (Billion), by Product 2024 & 2032

- Figure 39: Latin America Vegan Protein Powder Market Revenue Share (%), by Product 2024 & 2032

- Figure 40: Latin America Vegan Protein Powder Market Revenue (Billion), by Nature 2024 & 2032

- Figure 41: Latin America Vegan Protein Powder Market Revenue Share (%), by Nature 2024 & 2032

- Figure 42: Latin America Vegan Protein Powder Market Revenue (Billion), by Flavor 2024 & 2032

- Figure 43: Latin America Vegan Protein Powder Market Revenue Share (%), by Flavor 2024 & 2032

- Figure 44: Latin America Vegan Protein Powder Market Revenue (Billion), by Application 2024 & 2032

- Figure 45: Latin America Vegan Protein Powder Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: Latin America Vegan Protein Powder Market Revenue (Billion), by Distribution Channel 2024 & 2032

- Figure 47: Latin America Vegan Protein Powder Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 48: Latin America Vegan Protein Powder Market Revenue (Billion), by Country 2024 & 2032

- Figure 49: Latin America Vegan Protein Powder Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: MEA Vegan Protein Powder Market Revenue (Billion), by Product 2024 & 2032

- Figure 51: MEA Vegan Protein Powder Market Revenue Share (%), by Product 2024 & 2032

- Figure 52: MEA Vegan Protein Powder Market Revenue (Billion), by Nature 2024 & 2032

- Figure 53: MEA Vegan Protein Powder Market Revenue Share (%), by Nature 2024 & 2032

- Figure 54: MEA Vegan Protein Powder Market Revenue (Billion), by Flavor 2024 & 2032

- Figure 55: MEA Vegan Protein Powder Market Revenue Share (%), by Flavor 2024 & 2032

- Figure 56: MEA Vegan Protein Powder Market Revenue (Billion), by Application 2024 & 2032

- Figure 57: MEA Vegan Protein Powder Market Revenue Share (%), by Application 2024 & 2032

- Figure 58: MEA Vegan Protein Powder Market Revenue (Billion), by Distribution Channel 2024 & 2032

- Figure 59: MEA Vegan Protein Powder Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 60: MEA Vegan Protein Powder Market Revenue (Billion), by Country 2024 & 2032

- Figure 61: MEA Vegan Protein Powder Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Vegan Protein Powder Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Vegan Protein Powder Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 3: Global Vegan Protein Powder Market Revenue Billion Forecast, by Nature 2019 & 2032

- Table 4: Global Vegan Protein Powder Market Revenue Billion Forecast, by Flavor 2019 & 2032

- Table 5: Global Vegan Protein Powder Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 6: Global Vegan Protein Powder Market Revenue Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Vegan Protein Powder Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 8: Global Vegan Protein Powder Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 9: Global Vegan Protein Powder Market Revenue Billion Forecast, by Nature 2019 & 2032

- Table 10: Global Vegan Protein Powder Market Revenue Billion Forecast, by Flavor 2019 & 2032

- Table 11: Global Vegan Protein Powder Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 12: Global Vegan Protein Powder Market Revenue Billion Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Vegan Protein Powder Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 14: U.S. Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 15: Canada Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Global Vegan Protein Powder Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 17: Global Vegan Protein Powder Market Revenue Billion Forecast, by Nature 2019 & 2032

- Table 18: Global Vegan Protein Powder Market Revenue Billion Forecast, by Flavor 2019 & 2032

- Table 19: Global Vegan Protein Powder Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 20: Global Vegan Protein Powder Market Revenue Billion Forecast, by Distribution Channel 2019 & 2032

- Table 21: Global Vegan Protein Powder Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 22: Germany Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 23: UK Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 24: France Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 25: Italy Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 26: Spain Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: Sweden Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 30: Global Vegan Protein Powder Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 31: Global Vegan Protein Powder Market Revenue Billion Forecast, by Nature 2019 & 2032

- Table 32: Global Vegan Protein Powder Market Revenue Billion Forecast, by Flavor 2019 & 2032

- Table 33: Global Vegan Protein Powder Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 34: Global Vegan Protein Powder Market Revenue Billion Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global Vegan Protein Powder Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 36: China Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 37: India Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 38: Japan Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 39: South Korea Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 40: Australia Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 41: Singapore Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 42: Thailand Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 44: Global Vegan Protein Powder Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 45: Global Vegan Protein Powder Market Revenue Billion Forecast, by Nature 2019 & 2032

- Table 46: Global Vegan Protein Powder Market Revenue Billion Forecast, by Flavor 2019 & 2032

- Table 47: Global Vegan Protein Powder Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 48: Global Vegan Protein Powder Market Revenue Billion Forecast, by Distribution Channel 2019 & 2032

- Table 49: Global Vegan Protein Powder Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 50: Brazil Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 51: Mexico Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 52: Argentina Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 53: Chile Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 54: Colombia Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 55: Rest of Latin America Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 56: Global Vegan Protein Powder Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 57: Global Vegan Protein Powder Market Revenue Billion Forecast, by Nature 2019 & 2032

- Table 58: Global Vegan Protein Powder Market Revenue Billion Forecast, by Flavor 2019 & 2032

- Table 59: Global Vegan Protein Powder Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 60: Global Vegan Protein Powder Market Revenue Billion Forecast, by Distribution Channel 2019 & 2032

- Table 61: Global Vegan Protein Powder Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 62: Saudi Arabia Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 63: UAE Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 64: South Africa Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 65: Egypt Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 66: Nigeria Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 67: Rest of MEA Vegan Protein Powder Market Revenue (Billion) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Are there any restraints impacting market growth?

High production cost.

What is the projected Compound Annual Growth Rate (CAGR) of the Vegan Protein Powder Market ?

The projected CAGR is approximately 7.5%.

Can you provide examples of recent developments in the market?

undefined

Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion .

What are some drivers contributing to market growth?

Rising demand for plant-based food & beverages due to growing vegan population is driving market growth., Increasing demand for functional food and healthy products with high protein content., Growing market for sports nutrition.

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vegan Protein Powder Market," which aids in identifying and referencing the specific market segment covered.

How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

Which companies are prominent players in the Vegan Protein Powder Market?

Key companies in the market include Archer-Daniels-Midland Company (ADM),Cargill Inc.,Farbest Brands,Abott Laboratories,The Scoular Company,Glanbia Group.,Makers Nutrition,Vitaco Health,Ingredion Incorporated,and Kerry Group.

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)