Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Antiviral Drugs Market to Grow at 3.4 CAGR: Market Size Analysis and Forecasts 2025-2033

Antiviral Drugs Market by Drug Class (DNA polymerase inhibitors, Reverse transcriptase inhibitors, Protease inhibitors, Neuraminidase inhibitors, Others), by Indication (Influenza, HIV AIDS, Hepatitis, Herpes simplex virus (HSV), Coronavirus infection, Others), by Type (Branded, Generic), by Age Group (Adult, Pediatric, Geriatric), by Region (North America, Europe, Asia Pacific, Latin America, Middle East Asia & Africa), by North America (U.S., Canada), by Europe (Germany, UK, France, Italy, Spain, Netherlands, Sweden, Rest of Europe), by Asia Pacific (China, India, Japan, South Korea, Australia, Singapore, Thailand, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Argentina, Chile, Colombia, Rest of Latin America), by MEA (Saudi Arabia, UAE, South Africa, Egypt, Nigeria, Rest of MEA) Forecast 2025-2033

Key Insights

The global antiviral drugs market, valued at $49.1 billion in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 3.4% from 2025 to 2033. This growth is driven by several factors. The increasing prevalence of viral infections, including influenza, HIV/AIDS, hepatitis, herpes simplex virus (HSV), and emerging coronaviruses, fuels demand for effective antiviral treatments. Furthermore, the ongoing development and introduction of novel antiviral drugs with improved efficacy, safety profiles, and broader spectrums of activity contribute to market expansion. The market is segmented by drug class (DNA polymerase inhibitors, reverse transcriptase inhibitors, protease inhibitors, neuraminidase inhibitors, and others), indication (influenza, HIV/AIDS, hepatitis, HSV, coronavirus infection, and others), type (branded and generic), age group (adult, pediatric, and geriatric), and region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa). The branded segment currently holds a larger market share, but the generic segment is expected to witness significant growth due to increasing affordability and expanding access to healthcare.

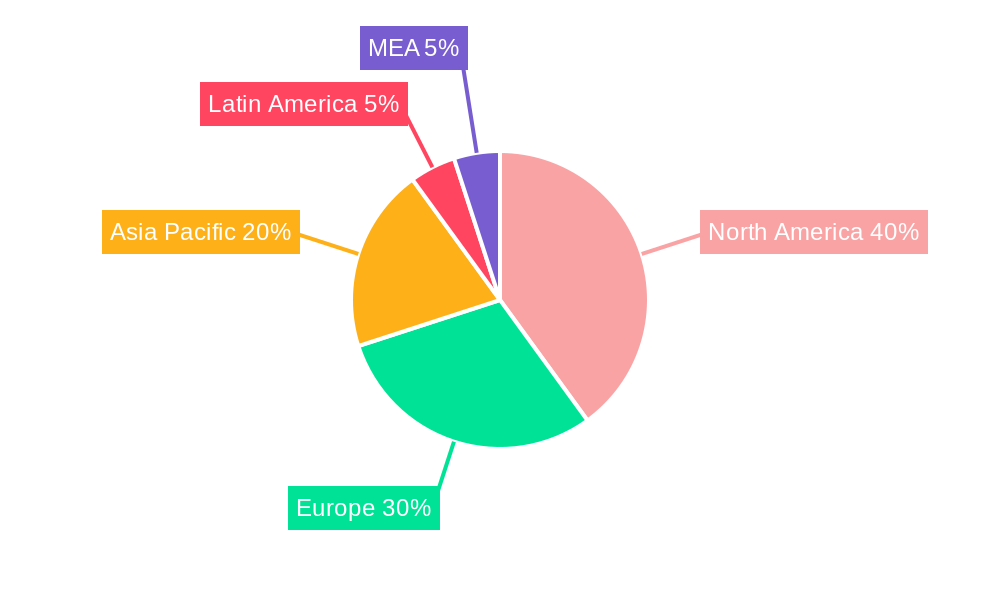

Regional variations in market size and growth rate reflect differences in healthcare infrastructure, disease prevalence, and regulatory landscapes. North America and Europe are currently the largest markets, driven by high healthcare expenditure and advanced healthcare infrastructure. However, the Asia Pacific region is anticipated to showcase robust growth during the forecast period, fueled by rising disposable incomes, increased awareness of viral infections, and expanding healthcare access. The competitive landscape features major pharmaceutical companies such as Gilead Sciences, AbbVie, Merck & Co, GlaxoSmithKline, and others, engaging in research and development, strategic partnerships, and mergers and acquisitions to maintain their market positions and expand their product portfolios. The market is likely to witness intensified competition among both branded and generic drug manufacturers, further driving innovation and potentially influencing pricing dynamics.

Antiviral Drugs Market Concentration & Characteristics

The antiviral drugs market is moderately concentrated, with a few large multinational pharmaceutical companies holding significant market share. Gilead Sciences, AbbVie, Merck & Co., and GlaxoSmithKline plc are key players, contributing substantially to the overall revenue. However, the market also features a considerable number of smaller companies and generic drug manufacturers, especially in the production of older antiviral medications.

- Characteristics of Innovation: Innovation is driven by the emergence of novel viral strains (like new coronavirus variants) and the need for more effective and safer treatments with improved resistance profiles. Significant R&D investment focuses on developing broad-spectrum antivirals and combination therapies.

- Impact of Regulations: Stringent regulatory approvals and clinical trial requirements significantly impact the market entry of new antiviral drugs. Regulatory bodies like the FDA (in the U.S.) and EMA (in Europe) play a crucial role in ensuring drug safety and efficacy.

- Product Substitutes: The presence of generic alternatives, particularly for older antiviral drugs, impacts pricing and market share of branded products. The development of new drug classes also creates substitution possibilities.

- End-User Concentration: The end-users are primarily hospitals, clinics, and individual patients, with hospitals and specialized treatment centers representing significant demand for advanced therapies.

- Level of M&A: Mergers and acquisitions play a significant role in shaping the market landscape. Larger companies often acquire smaller biotech firms with promising antiviral drug candidates to expand their product portfolios and enhance their market position. The M&A activity is expected to remain robust in the coming years, driven by the need for market expansion and diversification.

Antiviral Drugs Market Trends

The antiviral drugs market is witnessing several key trends. The rising prevalence of viral infections globally, particularly influenza, HIV/AIDS, hepatitis, and herpes, is driving market growth. The emergence of novel viruses and drug-resistant strains presents continuous challenges, necessitating the development of new antiviral agents and treatment strategies. Increasing healthcare expenditure, coupled with growing awareness about viral infections and improved diagnostic capabilities, are contributing to higher demand. The shift towards personalized medicine, focusing on tailored antiviral therapies based on individual patient characteristics, is another significant trend. Additionally, the growing focus on prophylactic antiviral therapies is driving market expansion. The increasing demand for convenient and effective oral formulations is shaping the market. The market is witnessing a significant push for cost-effective generic alternatives for existing drugs, impacting pricing strategies and market competition. Furthermore, the expanding research and development efforts focused on novel drug targets and mechanisms of action are shaping the future of antiviral drug development. The development and market entry of novel antiviral drugs for emerging viral infections, such as COVID-19 and other potential pandemics, is creating significant growth opportunities. Finally, government initiatives to improve public health infrastructure and expand access to antiviral medications, especially in developing countries, are impacting market dynamics.

Key Region or Country & Segment to Dominate the Market

North America currently dominates the antiviral drugs market, driven by high healthcare expenditure, advanced healthcare infrastructure, and a substantial prevalence of viral infections. Within North America, the U.S. holds the largest market share.

- Dominant Segments:

- Drug Class: Reverse transcriptase inhibitors (primarily for HIV) and protease inhibitors (for HIV and Hepatitis C) currently hold substantial market shares. The rise of new drug classes is however likely to change this in the long run.

- Indication: HIV/AIDS remains a major driver, followed by Hepatitis C and Influenza. The market for coronavirus antivirals is rapidly expanding.

- Type: Branded drugs continue to command higher prices but generic alternatives are increasingly gaining market share.

- Age Group: Adults constitute the largest segment, but the pediatric and geriatric segments are also growing as more targeted therapies emerge.

The Asia-Pacific region is expected to witness significant growth in the coming years, fueled by the rising prevalence of viral infections, increasing healthcare spending, and expanding healthcare infrastructure in many parts of the region. The increasing awareness of disease, combined with expanding access to healthcare, is driving market expansion. India and China, in particular, will play a key role in this growth given their size and populations.

Antiviral Drugs Market Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the antiviral drugs market, encompassing market size, segmentation, key trends, regional insights, competitive landscape, and future growth prospects. It offers detailed insights into various drug classes, indications, and types of antiviral drugs, along with their market potential and growth trajectories. The report also includes profiles of key market players, discussing their strategies and market position.

Antiviral Drugs Market Analysis

The global antiviral drugs market size was estimated at approximately $45 billion in 2022 and is projected to reach approximately $60 billion by 2028, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5%. This growth is fueled by several factors, including the rising prevalence of chronic viral infections like HIV, Hepatitis, and Herpes. The market share is significantly influenced by the success of new drug launches and the availability of generic alternatives. The branded segment currently accounts for a larger share of the revenue, but the generic segment is experiencing rapid growth due to patent expirations and increasing affordability. The market growth is also influenced by geographic variations in healthcare expenditure and access to treatment. Further, government initiatives aimed at disease prevention and management are driving market demand.

Antiviral Drugs Market Regional Insights

- North America:

- U.S.

- Canada

- Europe:

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Sweden

- Rest of Europe

- Asia Pacific:

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Thailand

- Rest of Asia Pacific

- Latin America:

- Brazil

- Mexico

- Argentina

- Chile

- Colombia

- Rest of Latin America

- MEA:

- Saudi Arabia

- UAE

- South Africa

- Egypt

- Nigeria

- Rest of MEA

Driving Forces: What's Propelling the Antiviral Drugs Market

The market is driven by several factors: rising prevalence of viral infections, increasing healthcare expenditure, technological advancements in antiviral drug development, the emergence of novel viral strains requiring new treatment options, and government initiatives promoting better disease management and prevention.

Challenges and Restraints in Antiviral Drugs Market

Challenges include the high cost of drug development and the emergence of drug resistance, stringent regulatory approvals, patent expirations leading to generic competition, and the need for continuous R&D to combat evolving viral strains.

Emerging Trends in Antiviral Drugs Market

Emerging trends include the development of broad-spectrum antivirals, personalized medicine approaches, the rise of combination therapies, improved drug delivery systems, and the focus on preventing viral infections through prophylaxis.

Antiviral Drugs Industry News

- January 2023: Gilead Sciences announces positive phase 3 trial results for a new HIV drug.

- March 2023: AbbVie secures regulatory approval for an updated Hepatitis C treatment.

- July 2024: Merck & Co. announces a strategic partnership to develop a novel influenza antiviral.

Leading Players in the Antiviral Drugs Market

- Gilead Sciences

- AbbVie, Inc

- Merck & Co

- GlaxoSmithKline plc

- Aurobindo Pharma Limited

- Johnson & Johnson

- Sun Pharmaceutical Industries Ltd

- Cipla, Inc

- Mylan N V

- Bristol-Myers Squibb

Antiviral Drugs Market Segmentation

-

1. Drug Class

- 1.1. DNA polymerase inhibitors

- 1.2. Reverse transcriptase inhibitors

- 1.3. Protease inhibitors

- 1.4. Neuraminidase inhibitors

- 1.5. Others

-

2. Indication

- 2.1. Influenza

- 2.2. HIV AIDS

- 2.3. Hepatitis

- 2.4. Herpes simplex virus (HSV)

- 2.5. Coronavirus infection

- 2.6. Others

-

3. Type

- 3.1. Branded

- 3.2. Generic

-

4. Age Group

- 4.1. Adult

- 4.2. Pediatric

- 4.3. Geriatric

-

5. Region

-

5.1. North America

- 5.1.1. U.S.

- 5.1.2. Canada

-

5.2. Europe

- 5.2.1. Germany

- 5.2.2. UK

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Russia

- 5.2.7. Poland

- 5.2.8. Switzerland

- 5.2.9. The Netherlands

- 5.2.10. Sweden

- 5.2.11. Others

-

5.3. Asia Pacific

- 5.3.1. Japan

- 5.3.2. China

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. South Korea

- 5.3.6. Singapore

- 5.3.7. Indonesia

- 5.3.8. Thailand

- 5.3.9. Malaysia

- 5.3.10. Philippines

- 5.3.11. Others

-

5.4. Latin America

- 5.4.1. Brazil

- 5.4.2. Mexico

- 5.4.3. Argentina

- 5.4.4. Others

-

5.5. Middle East Asia & Africa

- 5.5.1. South Africa

- 5.5.2. Saudi Arabia

- 5.5.3. UAE

- 5.5.4. Others

-

5.1. North America

Antiviral Drugs Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Netherlands

- 2.7. Sweden

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Singapore

- 3.7. Thailand

- 3.8. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Chile

- 4.5. Colombia

- 4.6. Rest of Latin America

-

5. MEA

- 5.1. Saudi Arabia

- 5.2. UAE

- 5.3. South Africa

- 5.4. Egypt

- 5.5. Nigeria

- 5.6. Rest of MEA

Antiviral Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.4% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising prevalence of viral infections including COVID-19

- 3.2.2 Increasing number of product launches for HIV treatment

- 3.2.3 High investment in R&D activities and presence of pipeline products

- 3.2.4 Increasing geriatric population

- 3.3. Market Restrains

- 3.3.1 Presence of generics

- 3.3.2 Rising awareness about preventive drugs treatment

- 3.3.3 Drug resistance

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antiviral Drugs Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. DNA polymerase inhibitors

- 5.1.2. Reverse transcriptase inhibitors

- 5.1.3. Protease inhibitors

- 5.1.4. Neuraminidase inhibitors

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Influenza

- 5.2.2. HIV AIDS

- 5.2.3. Hepatitis

- 5.2.4. Herpes simplex virus (HSV)

- 5.2.5. Coronavirus infection

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Branded

- 5.3.2. Generic

- 5.4. Market Analysis, Insights and Forecast - by Age Group

- 5.4.1. Adult

- 5.4.2. Pediatric

- 5.4.3. Geriatric

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.1.1. U.S.

- 5.5.1.2. Canada

- 5.5.2. Europe

- 5.5.2.1. Germany

- 5.5.2.2. UK

- 5.5.2.3. France

- 5.5.2.4. Italy

- 5.5.2.5. Spain

- 5.5.2.6. Russia

- 5.5.2.7. Poland

- 5.5.2.8. Switzerland

- 5.5.2.9. The Netherlands

- 5.5.2.10. Sweden

- 5.5.2.11. Others

- 5.5.3. Asia Pacific

- 5.5.3.1. Japan

- 5.5.3.2. China

- 5.5.3.3. India

- 5.5.3.4. Australia

- 5.5.3.5. South Korea

- 5.5.3.6. Singapore

- 5.5.3.7. Indonesia

- 5.5.3.8. Thailand

- 5.5.3.9. Malaysia

- 5.5.3.10. Philippines

- 5.5.3.11. Others

- 5.5.4. Latin America

- 5.5.4.1. Brazil

- 5.5.4.2. Mexico

- 5.5.4.3. Argentina

- 5.5.4.4. Others

- 5.5.5. Middle East Asia & Africa

- 5.5.5.1. South Africa

- 5.5.5.2. Saudi Arabia

- 5.5.5.3. UAE

- 5.5.5.4. Others

- 5.5.1. North America

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Latin America

- 5.6.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Antiviral Drugs Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. DNA polymerase inhibitors

- 6.1.2. Reverse transcriptase inhibitors

- 6.1.3. Protease inhibitors

- 6.1.4. Neuraminidase inhibitors

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Indication

- 6.2.1. Influenza

- 6.2.2. HIV AIDS

- 6.2.3. Hepatitis

- 6.2.4. Herpes simplex virus (HSV)

- 6.2.5. Coronavirus infection

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Branded

- 6.3.2. Generic

- 6.4. Market Analysis, Insights and Forecast - by Age Group

- 6.4.1. Adult

- 6.4.2. Pediatric

- 6.4.3. Geriatric

- 6.5. Market Analysis, Insights and Forecast - by Region

- 6.5.1. North America

- 6.5.1.1. U.S.

- 6.5.1.2. Canada

- 6.5.2. Europe

- 6.5.2.1. Germany

- 6.5.2.2. UK

- 6.5.2.3. France

- 6.5.2.4. Italy

- 6.5.2.5. Spain

- 6.5.2.6. Russia

- 6.5.2.7. Poland

- 6.5.2.8. Switzerland

- 6.5.2.9. The Netherlands

- 6.5.2.10. Sweden

- 6.5.2.11. Others

- 6.5.3. Asia Pacific

- 6.5.3.1. Japan

- 6.5.3.2. China

- 6.5.3.3. India

- 6.5.3.4. Australia

- 6.5.3.5. South Korea

- 6.5.3.6. Singapore

- 6.5.3.7. Indonesia

- 6.5.3.8. Thailand

- 6.5.3.9. Malaysia

- 6.5.3.10. Philippines

- 6.5.3.11. Others

- 6.5.4. Latin America

- 6.5.4.1. Brazil

- 6.5.4.2. Mexico

- 6.5.4.3. Argentina

- 6.5.4.4. Others

- 6.5.5. Middle East Asia & Africa

- 6.5.5.1. South Africa

- 6.5.5.2. Saudi Arabia

- 6.5.5.3. UAE

- 6.5.5.4. Others

- 6.5.1. North America

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Antiviral Drugs Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. DNA polymerase inhibitors

- 7.1.2. Reverse transcriptase inhibitors

- 7.1.3. Protease inhibitors

- 7.1.4. Neuraminidase inhibitors

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Indication

- 7.2.1. Influenza

- 7.2.2. HIV AIDS

- 7.2.3. Hepatitis

- 7.2.4. Herpes simplex virus (HSV)

- 7.2.5. Coronavirus infection

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Branded

- 7.3.2. Generic

- 7.4. Market Analysis, Insights and Forecast - by Age Group

- 7.4.1. Adult

- 7.4.2. Pediatric

- 7.4.3. Geriatric

- 7.5. Market Analysis, Insights and Forecast - by Region

- 7.5.1. North America

- 7.5.1.1. U.S.

- 7.5.1.2. Canada

- 7.5.2. Europe

- 7.5.2.1. Germany

- 7.5.2.2. UK

- 7.5.2.3. France

- 7.5.2.4. Italy

- 7.5.2.5. Spain

- 7.5.2.6. Russia

- 7.5.2.7. Poland

- 7.5.2.8. Switzerland

- 7.5.2.9. The Netherlands

- 7.5.2.10. Sweden

- 7.5.2.11. Others

- 7.5.3. Asia Pacific

- 7.5.3.1. Japan

- 7.5.3.2. China

- 7.5.3.3. India

- 7.5.3.4. Australia

- 7.5.3.5. South Korea

- 7.5.3.6. Singapore

- 7.5.3.7. Indonesia

- 7.5.3.8. Thailand

- 7.5.3.9. Malaysia

- 7.5.3.10. Philippines

- 7.5.3.11. Others

- 7.5.4. Latin America

- 7.5.4.1. Brazil

- 7.5.4.2. Mexico

- 7.5.4.3. Argentina

- 7.5.4.4. Others

- 7.5.5. Middle East Asia & Africa

- 7.5.5.1. South Africa

- 7.5.5.2. Saudi Arabia

- 7.5.5.3. UAE

- 7.5.5.4. Others

- 7.5.1. North America

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Antiviral Drugs Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. DNA polymerase inhibitors

- 8.1.2. Reverse transcriptase inhibitors

- 8.1.3. Protease inhibitors

- 8.1.4. Neuraminidase inhibitors

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Indication

- 8.2.1. Influenza

- 8.2.2. HIV AIDS

- 8.2.3. Hepatitis

- 8.2.4. Herpes simplex virus (HSV)

- 8.2.5. Coronavirus infection

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Branded

- 8.3.2. Generic

- 8.4. Market Analysis, Insights and Forecast - by Age Group

- 8.4.1. Adult

- 8.4.2. Pediatric

- 8.4.3. Geriatric

- 8.5. Market Analysis, Insights and Forecast - by Region

- 8.5.1. North America

- 8.5.1.1. U.S.

- 8.5.1.2. Canada

- 8.5.2. Europe

- 8.5.2.1. Germany

- 8.5.2.2. UK

- 8.5.2.3. France

- 8.5.2.4. Italy

- 8.5.2.5. Spain

- 8.5.2.6. Russia

- 8.5.2.7. Poland

- 8.5.2.8. Switzerland

- 8.5.2.9. The Netherlands

- 8.5.2.10. Sweden

- 8.5.2.11. Others

- 8.5.3. Asia Pacific

- 8.5.3.1. Japan

- 8.5.3.2. China

- 8.5.3.3. India

- 8.5.3.4. Australia

- 8.5.3.5. South Korea

- 8.5.3.6. Singapore

- 8.5.3.7. Indonesia

- 8.5.3.8. Thailand

- 8.5.3.9. Malaysia

- 8.5.3.10. Philippines

- 8.5.3.11. Others

- 8.5.4. Latin America

- 8.5.4.1. Brazil

- 8.5.4.2. Mexico

- 8.5.4.3. Argentina

- 8.5.4.4. Others

- 8.5.5. Middle East Asia & Africa

- 8.5.5.1. South Africa

- 8.5.5.2. Saudi Arabia

- 8.5.5.3. UAE

- 8.5.5.4. Others

- 8.5.1. North America

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Latin America Antiviral Drugs Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. DNA polymerase inhibitors

- 9.1.2. Reverse transcriptase inhibitors

- 9.1.3. Protease inhibitors

- 9.1.4. Neuraminidase inhibitors

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Indication

- 9.2.1. Influenza

- 9.2.2. HIV AIDS

- 9.2.3. Hepatitis

- 9.2.4. Herpes simplex virus (HSV)

- 9.2.5. Coronavirus infection

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Branded

- 9.3.2. Generic

- 9.4. Market Analysis, Insights and Forecast - by Age Group

- 9.4.1. Adult

- 9.4.2. Pediatric

- 9.4.3. Geriatric

- 9.5. Market Analysis, Insights and Forecast - by Region

- 9.5.1. North America

- 9.5.1.1. U.S.

- 9.5.1.2. Canada

- 9.5.2. Europe

- 9.5.2.1. Germany

- 9.5.2.2. UK

- 9.5.2.3. France

- 9.5.2.4. Italy

- 9.5.2.5. Spain

- 9.5.2.6. Russia

- 9.5.2.7. Poland

- 9.5.2.8. Switzerland

- 9.5.2.9. The Netherlands

- 9.5.2.10. Sweden

- 9.5.2.11. Others

- 9.5.3. Asia Pacific

- 9.5.3.1. Japan

- 9.5.3.2. China

- 9.5.3.3. India

- 9.5.3.4. Australia

- 9.5.3.5. South Korea

- 9.5.3.6. Singapore

- 9.5.3.7. Indonesia

- 9.5.3.8. Thailand

- 9.5.3.9. Malaysia

- 9.5.3.10. Philippines

- 9.5.3.11. Others

- 9.5.4. Latin America

- 9.5.4.1. Brazil

- 9.5.4.2. Mexico

- 9.5.4.3. Argentina

- 9.5.4.4. Others

- 9.5.5. Middle East Asia & Africa

- 9.5.5.1. South Africa

- 9.5.5.2. Saudi Arabia

- 9.5.5.3. UAE

- 9.5.5.4. Others

- 9.5.1. North America

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. MEA Antiviral Drugs Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. DNA polymerase inhibitors

- 10.1.2. Reverse transcriptase inhibitors

- 10.1.3. Protease inhibitors

- 10.1.4. Neuraminidase inhibitors

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Indication

- 10.2.1. Influenza

- 10.2.2. HIV AIDS

- 10.2.3. Hepatitis

- 10.2.4. Herpes simplex virus (HSV)

- 10.2.5. Coronavirus infection

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Branded

- 10.3.2. Generic

- 10.4. Market Analysis, Insights and Forecast - by Age Group

- 10.4.1. Adult

- 10.4.2. Pediatric

- 10.4.3. Geriatric

- 10.5. Market Analysis, Insights and Forecast - by Region

- 10.5.1. North America

- 10.5.1.1. U.S.

- 10.5.1.2. Canada

- 10.5.2. Europe

- 10.5.2.1. Germany

- 10.5.2.2. UK

- 10.5.2.3. France

- 10.5.2.4. Italy

- 10.5.2.5. Spain

- 10.5.2.6. Russia

- 10.5.2.7. Poland

- 10.5.2.8. Switzerland

- 10.5.2.9. The Netherlands

- 10.5.2.10. Sweden

- 10.5.2.11. Others

- 10.5.3. Asia Pacific

- 10.5.3.1. Japan

- 10.5.3.2. China

- 10.5.3.3. India

- 10.5.3.4. Australia

- 10.5.3.5. South Korea

- 10.5.3.6. Singapore

- 10.5.3.7. Indonesia

- 10.5.3.8. Thailand

- 10.5.3.9. Malaysia

- 10.5.3.10. Philippines

- 10.5.3.11. Others

- 10.5.4. Latin America

- 10.5.4.1. Brazil

- 10.5.4.2. Mexico

- 10.5.4.3. Argentina

- 10.5.4.4. Others

- 10.5.5. Middle East Asia & Africa

- 10.5.5.1. South Africa

- 10.5.5.2. Saudi Arabia

- 10.5.5.3. UAE

- 10.5.5.4. Others

- 10.5.1. North America

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Gilead Sciences

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AbbVie Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck & Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GlaxoSmithKline plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aurobindo Pharma Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ohnson & Johnson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sun Pharmaceutical Industries Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cipla Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mylan N V

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bristol-Myers Squibb

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Gilead Sciences

- Figure 1: Global Antiviral Drugs Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Antiviral Drugs Market Revenue (Billion), by Drug Class 2024 & 2032

- Figure 3: North America Antiviral Drugs Market Revenue Share (%), by Drug Class 2024 & 2032

- Figure 4: North America Antiviral Drugs Market Revenue (Billion), by Indication 2024 & 2032

- Figure 5: North America Antiviral Drugs Market Revenue Share (%), by Indication 2024 & 2032

- Figure 6: North America Antiviral Drugs Market Revenue (Billion), by Type 2024 & 2032

- Figure 7: North America Antiviral Drugs Market Revenue Share (%), by Type 2024 & 2032

- Figure 8: North America Antiviral Drugs Market Revenue (Billion), by Age Group 2024 & 2032

- Figure 9: North America Antiviral Drugs Market Revenue Share (%), by Age Group 2024 & 2032

- Figure 10: North America Antiviral Drugs Market Revenue (Billion), by Region 2024 & 2032

- Figure 11: North America Antiviral Drugs Market Revenue Share (%), by Region 2024 & 2032

- Figure 12: North America Antiviral Drugs Market Revenue (Billion), by Country 2024 & 2032

- Figure 13: North America Antiviral Drugs Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Antiviral Drugs Market Revenue (Billion), by Drug Class 2024 & 2032

- Figure 15: Europe Antiviral Drugs Market Revenue Share (%), by Drug Class 2024 & 2032

- Figure 16: Europe Antiviral Drugs Market Revenue (Billion), by Indication 2024 & 2032

- Figure 17: Europe Antiviral Drugs Market Revenue Share (%), by Indication 2024 & 2032

- Figure 18: Europe Antiviral Drugs Market Revenue (Billion), by Type 2024 & 2032

- Figure 19: Europe Antiviral Drugs Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Antiviral Drugs Market Revenue (Billion), by Age Group 2024 & 2032

- Figure 21: Europe Antiviral Drugs Market Revenue Share (%), by Age Group 2024 & 2032

- Figure 22: Europe Antiviral Drugs Market Revenue (Billion), by Region 2024 & 2032

- Figure 23: Europe Antiviral Drugs Market Revenue Share (%), by Region 2024 & 2032

- Figure 24: Europe Antiviral Drugs Market Revenue (Billion), by Country 2024 & 2032

- Figure 25: Europe Antiviral Drugs Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Antiviral Drugs Market Revenue (Billion), by Drug Class 2024 & 2032

- Figure 27: Asia Pacific Antiviral Drugs Market Revenue Share (%), by Drug Class 2024 & 2032

- Figure 28: Asia Pacific Antiviral Drugs Market Revenue (Billion), by Indication 2024 & 2032

- Figure 29: Asia Pacific Antiviral Drugs Market Revenue Share (%), by Indication 2024 & 2032

- Figure 30: Asia Pacific Antiviral Drugs Market Revenue (Billion), by Type 2024 & 2032

- Figure 31: Asia Pacific Antiviral Drugs Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Antiviral Drugs Market Revenue (Billion), by Age Group 2024 & 2032

- Figure 33: Asia Pacific Antiviral Drugs Market Revenue Share (%), by Age Group 2024 & 2032

- Figure 34: Asia Pacific Antiviral Drugs Market Revenue (Billion), by Region 2024 & 2032

- Figure 35: Asia Pacific Antiviral Drugs Market Revenue Share (%), by Region 2024 & 2032

- Figure 36: Asia Pacific Antiviral Drugs Market Revenue (Billion), by Country 2024 & 2032

- Figure 37: Asia Pacific Antiviral Drugs Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Antiviral Drugs Market Revenue (Billion), by Drug Class 2024 & 2032

- Figure 39: Latin America Antiviral Drugs Market Revenue Share (%), by Drug Class 2024 & 2032

- Figure 40: Latin America Antiviral Drugs Market Revenue (Billion), by Indication 2024 & 2032

- Figure 41: Latin America Antiviral Drugs Market Revenue Share (%), by Indication 2024 & 2032

- Figure 42: Latin America Antiviral Drugs Market Revenue (Billion), by Type 2024 & 2032

- Figure 43: Latin America Antiviral Drugs Market Revenue Share (%), by Type 2024 & 2032

- Figure 44: Latin America Antiviral Drugs Market Revenue (Billion), by Age Group 2024 & 2032

- Figure 45: Latin America Antiviral Drugs Market Revenue Share (%), by Age Group 2024 & 2032

- Figure 46: Latin America Antiviral Drugs Market Revenue (Billion), by Region 2024 & 2032

- Figure 47: Latin America Antiviral Drugs Market Revenue Share (%), by Region 2024 & 2032

- Figure 48: Latin America Antiviral Drugs Market Revenue (Billion), by Country 2024 & 2032

- Figure 49: Latin America Antiviral Drugs Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: MEA Antiviral Drugs Market Revenue (Billion), by Drug Class 2024 & 2032

- Figure 51: MEA Antiviral Drugs Market Revenue Share (%), by Drug Class 2024 & 2032

- Figure 52: MEA Antiviral Drugs Market Revenue (Billion), by Indication 2024 & 2032

- Figure 53: MEA Antiviral Drugs Market Revenue Share (%), by Indication 2024 & 2032

- Figure 54: MEA Antiviral Drugs Market Revenue (Billion), by Type 2024 & 2032

- Figure 55: MEA Antiviral Drugs Market Revenue Share (%), by Type 2024 & 2032

- Figure 56: MEA Antiviral Drugs Market Revenue (Billion), by Age Group 2024 & 2032

- Figure 57: MEA Antiviral Drugs Market Revenue Share (%), by Age Group 2024 & 2032

- Figure 58: MEA Antiviral Drugs Market Revenue (Billion), by Region 2024 & 2032

- Figure 59: MEA Antiviral Drugs Market Revenue Share (%), by Region 2024 & 2032

- Figure 60: MEA Antiviral Drugs Market Revenue (Billion), by Country 2024 & 2032

- Figure 61: MEA Antiviral Drugs Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Antiviral Drugs Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Antiviral Drugs Market Revenue Billion Forecast, by Drug Class 2019 & 2032

- Table 3: Global Antiviral Drugs Market Revenue Billion Forecast, by Indication 2019 & 2032

- Table 4: Global Antiviral Drugs Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 5: Global Antiviral Drugs Market Revenue Billion Forecast, by Age Group 2019 & 2032

- Table 6: Global Antiviral Drugs Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 7: Global Antiviral Drugs Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 8: Global Antiviral Drugs Market Revenue Billion Forecast, by Drug Class 2019 & 2032

- Table 9: Global Antiviral Drugs Market Revenue Billion Forecast, by Indication 2019 & 2032

- Table 10: Global Antiviral Drugs Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 11: Global Antiviral Drugs Market Revenue Billion Forecast, by Age Group 2019 & 2032

- Table 12: Global Antiviral Drugs Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 13: Global Antiviral Drugs Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 14: U.S. Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 15: Canada Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Global Antiviral Drugs Market Revenue Billion Forecast, by Drug Class 2019 & 2032

- Table 17: Global Antiviral Drugs Market Revenue Billion Forecast, by Indication 2019 & 2032

- Table 18: Global Antiviral Drugs Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 19: Global Antiviral Drugs Market Revenue Billion Forecast, by Age Group 2019 & 2032

- Table 20: Global Antiviral Drugs Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 21: Global Antiviral Drugs Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 22: Germany Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 23: UK Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 24: France Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 25: Italy Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 26: Spain Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: Sweden Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 30: Global Antiviral Drugs Market Revenue Billion Forecast, by Drug Class 2019 & 2032

- Table 31: Global Antiviral Drugs Market Revenue Billion Forecast, by Indication 2019 & 2032

- Table 32: Global Antiviral Drugs Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 33: Global Antiviral Drugs Market Revenue Billion Forecast, by Age Group 2019 & 2032

- Table 34: Global Antiviral Drugs Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 35: Global Antiviral Drugs Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 36: China Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 37: India Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 38: Japan Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 39: South Korea Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 40: Australia Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 41: Singapore Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 42: Thailand Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 44: Global Antiviral Drugs Market Revenue Billion Forecast, by Drug Class 2019 & 2032

- Table 45: Global Antiviral Drugs Market Revenue Billion Forecast, by Indication 2019 & 2032

- Table 46: Global Antiviral Drugs Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 47: Global Antiviral Drugs Market Revenue Billion Forecast, by Age Group 2019 & 2032

- Table 48: Global Antiviral Drugs Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 49: Global Antiviral Drugs Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 50: Brazil Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 51: Mexico Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 52: Argentina Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 53: Chile Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 54: Colombia Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 55: Rest of Latin America Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 56: Global Antiviral Drugs Market Revenue Billion Forecast, by Drug Class 2019 & 2032

- Table 57: Global Antiviral Drugs Market Revenue Billion Forecast, by Indication 2019 & 2032

- Table 58: Global Antiviral Drugs Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 59: Global Antiviral Drugs Market Revenue Billion Forecast, by Age Group 2019 & 2032

- Table 60: Global Antiviral Drugs Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 61: Global Antiviral Drugs Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 62: Saudi Arabia Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 63: UAE Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 64: South Africa Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 65: Egypt Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 66: Nigeria Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 67: Rest of MEA Antiviral Drugs Market Revenue (Billion) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)