Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Body Fat Measurement Market 2025 to Grow at 7 CAGR with 860 Million Market Size: Analysis and Forecasts 2033

Body Fat Measurement Market by Product (Bioimpedance analyzers, Calipers, Hydrostatic weighing, Air-displacement plethysmography, Dual-energy X-ray absorptiometry (DEXA), Others), by End-use (Hospitals, Fitness centers, Clinics, Others), by North America (U.S., Canada), by Europe (Germany, UK, France, Spain, Italy, Poland, Switzerland, Sweden, Denmark, The Netherlands, Belgium), by Asia Pacific (China, Japan, India, Australia, South Korea, Indonesia, Thailand, Vietnam), by Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru), by Middle East & Africa (South Africa, Saudi Arabia, UAE, Israel, Iran) Forecast 2025-2033

Key Insights

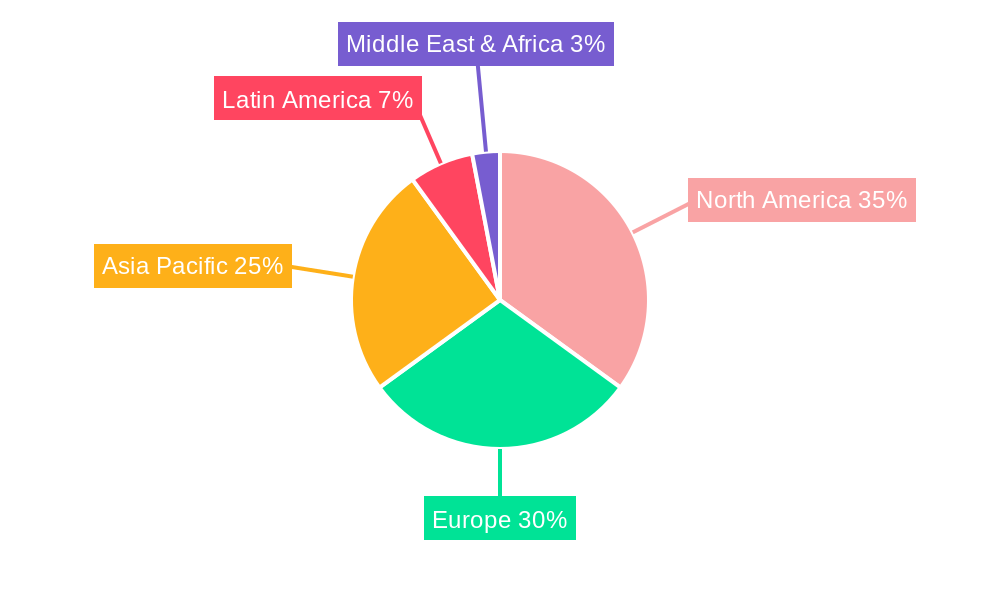

The global body fat measurement market, currently valued at $860 million in 2025, is projected to experience robust growth, driven by increasing health consciousness, rising obesity rates worldwide, and the expanding adoption of advanced technologies in fitness and healthcare. The market's compound annual growth rate (CAGR) of 7% from 2025 to 2033 indicates a significant expansion opportunity. Key growth drivers include the increasing prevalence of lifestyle-related diseases like diabetes and cardiovascular issues, prompting individuals and healthcare professionals to actively monitor body composition. Furthermore, technological advancements in body fat analyzers, such as the development of more accurate and user-friendly devices, are fueling market expansion. The diverse range of products available, including bioimpedance analyzers, calipers, DEXA scans, and air-displacement plethysmography, caters to various needs and budgets, contributing to market growth across different segments. The market is segmented by product type and end-user, with hospitals, fitness centers, and clinics representing major end-use segments. North America and Europe currently hold significant market shares, owing to high healthcare spending and greater awareness of health and wellness. However, emerging economies in Asia-Pacific and Latin America are expected to demonstrate strong growth potential in the coming years due to rising disposable incomes and increased access to healthcare facilities. While the market faces certain restraints, such as the high cost of some advanced technologies and potential inaccuracies with certain measurement methods, the overall market outlook remains positive, driven by increasing demand for precise body composition analysis.

The competitive landscape is characterized by a mix of established players and emerging companies. Key players like Tanita Corporation, Omron Healthcare, and InBody are constantly innovating to enhance their product offerings, while smaller companies are focusing on niche market segments. The market is likely to witness increased consolidation and strategic partnerships in the coming years. The focus will remain on improving the accuracy, affordability, and accessibility of body fat measurement technologies. This will further drive adoption across various demographics and healthcare settings, ultimately boosting the market's overall growth trajectory. The integration of body fat measurement into broader health management systems and the development of smart devices with body composition tracking capabilities are also expected to significantly impact market dynamics in the forecast period.

Body Fat Measurement Market Concentration & Characteristics

The Body Fat Measurement market is moderately concentrated, with a few major players holding significant market share, but also a considerable number of smaller companies competing in niche segments. The market is estimated at $2.5 Billion in 2023. Tanita Corporation, Omron Healthcare, and InBody Pvt. Ltd. are key players holding an estimated combined 35% market share.

Concentration Areas:

- Bioimpedance Analyzers: This segment exhibits the highest concentration, with a few dominant players controlling a significant portion of the market due to economies of scale in manufacturing and distribution.

- North America and Europe: These regions exhibit higher market concentration due to established healthcare infrastructure and greater consumer awareness.

Characteristics:

- Innovation: Continuous innovation focuses on improving accuracy, portability, and ease of use of devices. Integration with smart devices and health apps is a significant driver.

- Impact of Regulations: Stringent regulatory requirements for medical devices in various regions impact market entry and operations. Compliance with standards like those from the FDA is crucial.

- Product Substitutes: While DEXA scans provide the most accurate results, they are expensive. This opens opportunities for other less expensive technologies to compete based on factors like affordability and convenience.

- End-user Concentration: The market is fragmented across various end-users, with hospitals, fitness centers, and clinics being major segments. However, a large segment of the market is driven by individual consumers buying home-use devices.

- Level of M&A: The level of mergers and acquisitions is moderate. Strategic acquisitions are focused on enhancing product portfolios and expanding market reach.

Body Fat Measurement Market Trends

The Body Fat Measurement market is experiencing robust growth driven by several key trends. The increasing prevalence of obesity and related health issues is a major factor, pushing consumers and healthcare providers to adopt more precise methods for body fat assessment. This is amplified by rising health consciousness and a greater focus on preventative healthcare.

Technological advancements are another significant trend, with the development of more accurate, portable, and user-friendly devices. Bioimpedance analyzers, while dominant, are facing competition from devices offering greater precision, such as DEXA scans and air-displacement plethysmography, albeit at a higher price point. The integration of these devices with smartphones and fitness apps is further boosting their appeal and expanding market reach.

The market is also witnessing a shift towards personalized health management. Individuals are increasingly seeking personalized assessments and recommendations to manage their weight and overall health. This fuels the demand for advanced body composition analysis beyond simple body fat percentage. The emergence of AI-driven analysis tools offering insights beyond basic measurements is another significant trend.

The increasing penetration of fitness centers and wellness clinics in emerging economies is also driving market growth. These businesses are investing in body composition analysis equipment to enhance their service offerings and attract clients. Finally, reimbursement policies in certain healthcare systems for body fat measurement play a crucial role in market dynamics. Expanding coverage by insurance providers could significantly boost market growth.

Key Region or Country & Segment to Dominate the Market

The Bioimpedance Analyzer segment is projected to dominate the Body Fat Measurement market through 2028. Its affordability and ease of use make it accessible to a wide range of consumers and healthcare settings.

Dominant Segment: Bioimpedance Analyzers

- High market penetration due to lower cost compared to other methods.

- Technological advancements leading to increased accuracy and convenience.

- Suitable for both home use and clinical settings.

Dominant Region: North America

- High prevalence of obesity and related health concerns.

- Strong adoption of advanced healthcare technologies.

- Significant consumer spending on health and wellness products.

While North America currently dominates, the Asia-Pacific region is expected to witness rapid growth due to increasing awareness and a rising middle class with greater disposable income to spend on health and wellness. The market growth in emerging economies will be fueled by increased healthcare infrastructure development and affordability of bioimpedance analyzers in particular.

Body Fat Measurement Market Product Insights Report Coverage & Deliverables

This report provides comprehensive insights into the Body Fat Measurement market, covering all key product segments, including Bioimpedance Analyzers, Calipers, Hydrostatic Weighing, Air-displacement Plethysmography, DEXA scans, and Others. The analysis delves into market size, growth rates, and future projections for each segment. Competitive landscapes, including market share, leading players, and key strategies are also covered. The report includes detailed regional analysis, identifying key growth areas and growth drivers at a regional and country level.

Body Fat Measurement Market Analysis

The global Body Fat Measurement market is experiencing significant growth, driven by rising health consciousness, increasing prevalence of obesity, and technological advancements in measurement techniques. The market size is estimated at $2.5 billion in 2023 and is projected to reach $3.8 billion by 2028, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7%. This growth is largely fueled by the increasing adoption of bioimpedance analyzers due to their cost-effectiveness and ease of use.

However, the market share distribution is dynamic. While bioimpedance analyzers currently hold the largest market share (estimated at 60% in 2023), the DEXA segment is projected to experience the fastest growth, driven by its superior accuracy. This will lead to gradual erosion of the bioimpedance analyzer market share over the forecast period. The market shares of other technologies, such as air-displacement plethysmography and hydrostatic weighing, are relatively small but are expected to grow steadily, driven by increasing demand for higher accuracy in specific clinical settings. The competitive landscape is characterized by both established players and emerging companies, with ongoing innovation and product diversification shaping the market dynamics.

Body Fat Measurement Market Regional Insights

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Poland

- Switzerland

- Sweden

- Denmark

- The Netherlands

- Belgium

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Indonesia

- Thailand

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Israel

- Iran

Driving Forces: What's Propelling the Body Fat Measurement Market

The market is propelled by rising obesity rates globally, increasing health consciousness among consumers, advancements in technology leading to more accurate and user-friendly devices, and growing demand for personalized healthcare solutions. The integration of these devices with fitness trackers and health apps further enhances their appeal. Finally, the growing number of fitness centers and wellness clinics also contributes to market growth.

Challenges and Restraints in Body Fat Measurement Market

Challenges include the high cost of advanced technologies like DEXA scans, which limits accessibility, and concerns about accuracy and reliability of certain measurement methods. Regulatory hurdles and reimbursement issues in some healthcare systems also pose challenges. The availability of alternative, less expensive methods for assessing body composition poses ongoing competition.

Emerging Trends in Body Fat Measurement Market

Emerging trends include the development of AI-powered analysis tools, integration with wearables and telehealth platforms, and a focus on holistic body composition analysis beyond simple body fat percentage. Miniaturization and increased portability of devices are also major trends. The use of non-invasive and easy-to-use technologies for body fat measurement is expanding.

Body Fat Measurement Industry News

- January 2023: Omron Healthcare launches a new generation of body composition analyzers with improved accuracy.

- March 2023: Tanita Corporation announces a strategic partnership to expand its distribution network in Asia.

- June 2023: InBody Pvt. Ltd. secures FDA approval for its new DEXA scanner.

Leading Players in the Body Fat Measurement Market

- Tanita Corporation

- Omron Healthcare

- L'Acn Srl.

- InBody Pvt. Ltd.

- Hologic, Inc.

- GE Healthcare

- DMS Imaging

- Cosmed

- Beurer GmbH

- AccuFitness, LLC

Body Fat Measurement Market Segmentation

-

1. Product

- 1.1. Bioimpedance analyzers

- 1.2. Calipers

- 1.3. Hydrostatic weighing

- 1.4. Air-displacement plethysmography

- 1.5. Dual-energy X-ray absorptiometry (DEXA)

- 1.6. Others

-

2. End-use

- 2.1. Hospitals

- 2.2. Fitness centers

- 2.3. Clinics

- 2.4. Others

Body Fat Measurement Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Poland

- 2.7. Switzerland

- 2.8. Sweden

- 2.9. Denmark

- 2.10. The Netherlands

- 2.11. Belgium

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Indonesia

- 3.7. Thailand

- 3.8. Vietnam

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Colombia

- 4.5. Chile

- 4.6. Peru

-

5. Middle East & Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. UAE

- 5.4. Israel

- 5.5. Iran

Body Fat Measurement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising prevalence of obesity and metabolism related disorders

- 3.2.2 Considerable accuracy of BIA devices

- 3.2.3 Increasing awareness regarding body weight management

- 3.3. Market Restrains

- 3.3.1. High cost of the devices

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Body Fat Measurement Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bioimpedance analyzers

- 5.1.2. Calipers

- 5.1.3. Hydrostatic weighing

- 5.1.4. Air-displacement plethysmography

- 5.1.5. Dual-energy X-ray absorptiometry (DEXA)

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-use

- 5.2.1. Hospitals

- 5.2.2. Fitness centers

- 5.2.3. Clinics

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East & Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Body Fat Measurement Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Bioimpedance analyzers

- 6.1.2. Calipers

- 6.1.3. Hydrostatic weighing

- 6.1.4. Air-displacement plethysmography

- 6.1.5. Dual-energy X-ray absorptiometry (DEXA)

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by End-use

- 6.2.1. Hospitals

- 6.2.2. Fitness centers

- 6.2.3. Clinics

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Body Fat Measurement Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Bioimpedance analyzers

- 7.1.2. Calipers

- 7.1.3. Hydrostatic weighing

- 7.1.4. Air-displacement plethysmography

- 7.1.5. Dual-energy X-ray absorptiometry (DEXA)

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by End-use

- 7.2.1. Hospitals

- 7.2.2. Fitness centers

- 7.2.3. Clinics

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Body Fat Measurement Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Bioimpedance analyzers

- 8.1.2. Calipers

- 8.1.3. Hydrostatic weighing

- 8.1.4. Air-displacement plethysmography

- 8.1.5. Dual-energy X-ray absorptiometry (DEXA)

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by End-use

- 8.2.1. Hospitals

- 8.2.2. Fitness centers

- 8.2.3. Clinics

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America Body Fat Measurement Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Bioimpedance analyzers

- 9.1.2. Calipers

- 9.1.3. Hydrostatic weighing

- 9.1.4. Air-displacement plethysmography

- 9.1.5. Dual-energy X-ray absorptiometry (DEXA)

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by End-use

- 9.2.1. Hospitals

- 9.2.2. Fitness centers

- 9.2.3. Clinics

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East & Africa Body Fat Measurement Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Bioimpedance analyzers

- 10.1.2. Calipers

- 10.1.3. Hydrostatic weighing

- 10.1.4. Air-displacement plethysmography

- 10.1.5. Dual-energy X-ray absorptiometry (DEXA)

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by End-use

- 10.2.1. Hospitals

- 10.2.2. Fitness centers

- 10.2.3. Clinics

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tanita Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Omron Healthcare

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 L'Acn Srl.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 InBody Pvt. Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hologic Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GE Healthcare

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DMS Imaging

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cosmed

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beurer GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 and AccuFitness LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tanita Corporation

- Figure 1: Global Body Fat Measurement Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Body Fat Measurement Market Revenue (Million), by Product 2024 & 2032

- Figure 3: North America Body Fat Measurement Market Revenue Share (%), by Product 2024 & 2032

- Figure 4: North America Body Fat Measurement Market Revenue (Million), by End-use 2024 & 2032

- Figure 5: North America Body Fat Measurement Market Revenue Share (%), by End-use 2024 & 2032

- Figure 6: North America Body Fat Measurement Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Body Fat Measurement Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Europe Body Fat Measurement Market Revenue (Million), by Product 2024 & 2032

- Figure 9: Europe Body Fat Measurement Market Revenue Share (%), by Product 2024 & 2032

- Figure 10: Europe Body Fat Measurement Market Revenue (Million), by End-use 2024 & 2032

- Figure 11: Europe Body Fat Measurement Market Revenue Share (%), by End-use 2024 & 2032

- Figure 12: Europe Body Fat Measurement Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe Body Fat Measurement Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Body Fat Measurement Market Revenue (Million), by Product 2024 & 2032

- Figure 15: Asia Pacific Body Fat Measurement Market Revenue Share (%), by Product 2024 & 2032

- Figure 16: Asia Pacific Body Fat Measurement Market Revenue (Million), by End-use 2024 & 2032

- Figure 17: Asia Pacific Body Fat Measurement Market Revenue Share (%), by End-use 2024 & 2032

- Figure 18: Asia Pacific Body Fat Measurement Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Asia Pacific Body Fat Measurement Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Latin America Body Fat Measurement Market Revenue (Million), by Product 2024 & 2032

- Figure 21: Latin America Body Fat Measurement Market Revenue Share (%), by Product 2024 & 2032

- Figure 22: Latin America Body Fat Measurement Market Revenue (Million), by End-use 2024 & 2032

- Figure 23: Latin America Body Fat Measurement Market Revenue Share (%), by End-use 2024 & 2032

- Figure 24: Latin America Body Fat Measurement Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Latin America Body Fat Measurement Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East & Africa Body Fat Measurement Market Revenue (Million), by Product 2024 & 2032

- Figure 27: Middle East & Africa Body Fat Measurement Market Revenue Share (%), by Product 2024 & 2032

- Figure 28: Middle East & Africa Body Fat Measurement Market Revenue (Million), by End-use 2024 & 2032

- Figure 29: Middle East & Africa Body Fat Measurement Market Revenue Share (%), by End-use 2024 & 2032

- Figure 30: Middle East & Africa Body Fat Measurement Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East & Africa Body Fat Measurement Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Body Fat Measurement Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Body Fat Measurement Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Body Fat Measurement Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 4: Global Body Fat Measurement Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Body Fat Measurement Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Global Body Fat Measurement Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 7: Global Body Fat Measurement Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: U.S. Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Body Fat Measurement Market Revenue Million Forecast, by Product 2019 & 2032

- Table 11: Global Body Fat Measurement Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 12: Global Body Fat Measurement Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Germany Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: UK Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Poland Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Switzerland Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sweden Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Denmark Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: The Netherlands Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Belgium Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Body Fat Measurement Market Revenue Million Forecast, by Product 2019 & 2032

- Table 25: Global Body Fat Measurement Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 26: Global Body Fat Measurement Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: China Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Japan Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: India Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Australia Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Korea Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Indonesia Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Thailand Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Vietnam Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Body Fat Measurement Market Revenue Million Forecast, by Product 2019 & 2032

- Table 36: Global Body Fat Measurement Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 37: Global Body Fat Measurement Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Brazil Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Mexico Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Argentina Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Colombia Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Chile Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Peru Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Body Fat Measurement Market Revenue Million Forecast, by Product 2019 & 2032

- Table 45: Global Body Fat Measurement Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 46: Global Body Fat Measurement Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: South Africa Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: UAE Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Israel Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Iran Body Fat Measurement Market Revenue (Million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)