Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Arc Welding Equipment Market Strategic Roadmap: Analysis and Forecasts 2025-2033

Arc Welding Equipment Market by Power Source Type (Ac arc welding equipment, Dc arc welding equipment, Others), by Welding Method (Shielded metal arc welding (SMAW), Gas metal arc welding (GMAW/MIG), Flux-cored arc welding (FCAW), Others), by End User (Automotive, Aerospace & defense, Construction, Oil & gas, Manufacturing, Others), by North America (U.S., Canada), by Europe (Germany, UK, France, Italy, Spain, Rest of Europe), by Asia Pacific (China, India, Japan, South Korea, ANZ, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Rest of Latin America), by MEA (UAE, Saudi Arabia, South Africa, Rest of MEA) Forecast 2025-2033

Key Insights

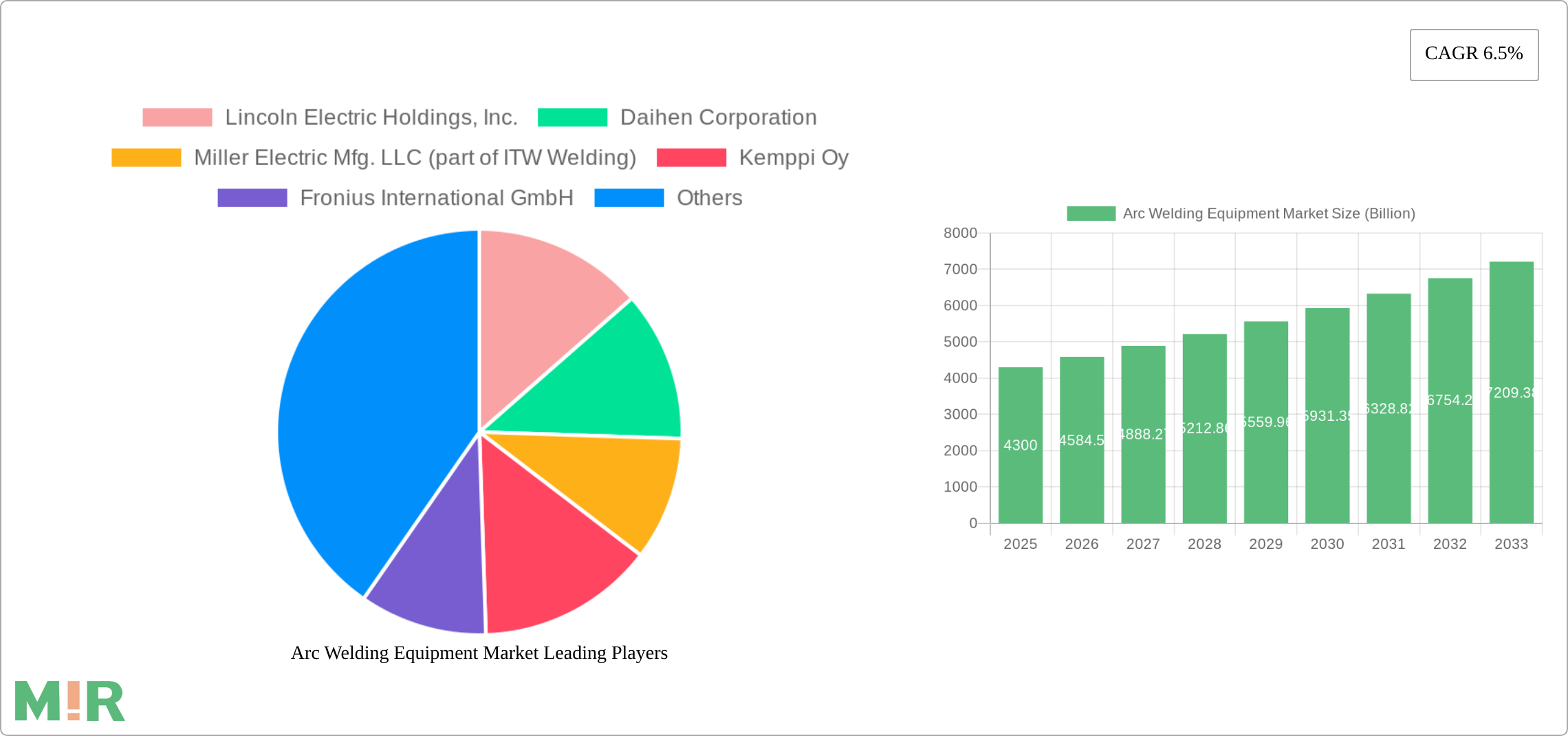

The global arc welding equipment market, valued at $4.3 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.5% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning automotive and aerospace & defense sectors are significantly increasing demand for advanced welding solutions. The rising adoption of automation in manufacturing processes, particularly in industries like construction and oil & gas, is further propelling market growth. Furthermore, the ongoing development and adoption of more efficient and precise welding technologies, such as robotic welding systems and advanced power sources like pulsed GMAW, are contributing to this positive trajectory. Increased infrastructure development globally and the focus on sustainable manufacturing practices are also contributing factors.

However, certain restraints may moderate the market's growth rate. Fluctuations in raw material prices, particularly metals, can impact production costs and profitability. Stringent safety regulations and the need for skilled welders pose challenges to market expansion. Despite these challenges, the market is expected to witness considerable growth across various segments. The AC arc welding equipment segment is likely to maintain its dominance due to its cost-effectiveness, while the GMAW/MIG welding method will continue to witness significant adoption due to its versatility and high deposition rates. Geographically, North America and Asia Pacific are expected to be key contributors to market growth, driven by robust industrial activity and infrastructure development. The market's continued expansion will be shaped by innovations in welding technology, the adoption of Industry 4.0 practices, and the overall growth of related manufacturing industries.

Arc Welding Equipment Market Concentration & Characteristics

The global arc welding equipment market is moderately concentrated, with a few major players holding significant market share. However, numerous smaller regional and specialized manufacturers also contribute to the overall market. The market is characterized by continuous innovation driven by the demand for higher efficiency, improved weld quality, and enhanced safety features. This innovation manifests in advancements in power source technology (e.g., inverter-based systems), welding processes (e.g., pulsed GMAW), and automation (e.g., robotic welding systems).

Concentration Areas: North America and Europe represent key concentration areas due to established industrial bases and higher adoption rates of advanced welding technologies. Asia Pacific is a rapidly growing region with increasing demand, particularly from China and India.

Characteristics:

- Innovation: Emphasis on automation, digitalization (smart welding), and improved ergonomics.

- Impact of Regulations: Stringent safety and environmental regulations influence equipment design and manufacturing processes.

- Product Substitutes: While arc welding remains dominant, alternative joining techniques like adhesive bonding and laser welding are gaining traction in specific niches.

- End-User Concentration: Automotive, construction, and manufacturing industries are major end-users.

- M&A Activity: The market witnesses occasional mergers and acquisitions, primarily focusing on technological integration and geographic expansion.

Arc Welding Equipment Market Trends

The arc welding equipment market is experiencing significant transformation driven by several key trends. Automation is a dominant force, with robotic welding systems and collaborative robots (cobots) gaining popularity to enhance productivity and consistency. Digitalization is also impacting the industry, with smart welding solutions incorporating data analytics and cloud connectivity for process optimization and predictive maintenance. The demand for lightweight and portable equipment is increasing, particularly in sectors requiring on-site welding. Sustainability concerns are leading manufacturers to develop energy-efficient and environmentally friendly welding processes and equipment. Furthermore, the increasing focus on worker safety and improved ergonomics is driving the development of user-friendly and safer welding systems. The market is witnessing the rise of advanced welding processes such as pulsed GMAW, which offer greater control and improved weld quality, especially in critical applications like aerospace. Finally, the integration of advanced sensors and vision systems into welding equipment is enhancing real-time monitoring and process control. This shift towards intelligent welding systems enables improved productivity, reduced waste, and better quality control. The increasing adoption of Industry 4.0 principles in manufacturing is driving demand for intelligent welding systems which can be integrated into wider production management systems. This enhances data collection, enabling better analysis of welding processes and ultimately leading to improved efficiency and profitability. The global skills gap in skilled welders is also driving the demand for easier-to-use equipment and automation solutions to increase the number of people who can effectively use welding equipment. These trends together paint a dynamic picture of a market pushing boundaries and evolving toward increased efficiency, safety, and sustainability.

Key Region or Country & Segment to Dominate the Market

The Gas Metal Arc Welding (GMAW/MIG) segment is poised to dominate the market due to its versatility, high deposition rates, and relatively ease of use. Its application in various industries including automotive, construction and manufacturing contributes significantly to its market share. Furthermore, continuous improvements in GMAW technology, such as pulsed GMAW and advanced wire feed systems, further strengthen its position.

Dominant Regions: North America and Europe currently hold significant market share, attributed to their mature industrial sectors and high adoption rates. However, the Asia Pacific region, particularly China and India, is projected to experience the fastest growth, driven by substantial infrastructure development and manufacturing expansion.

Segment-Specific Insights:

- GMAW/MIG: This welding method is preferred due to its high deposition rates, versatility, and relatively easy operation, making it suitable for a wide range of applications and industries. Continuous technological advancements, such as pulsed GMAW and advanced wire feed systems, further enhance its market appeal.

- Automotive: This sector remains a major driver of GMAW/MIG adoption due to the high volume of welding required in vehicle manufacturing. The focus on automation in this sector also enhances the demand for automated GMAW systems.

- Manufacturing: The versatility of GMAW/MIG allows its application across a variety of manufacturing processes, making it a vital part of numerous industrial applications. The ability to weld different materials and thicknesses also contributes to its prevalence in this segment.

Arc Welding Equipment Market Product Insights Report Coverage & Deliverables

This report offers detailed insights into the arc welding equipment market, encompassing market sizing, segmentation analysis, regional breakdowns, competitive landscapes, and future market trends. Key deliverables include comprehensive market forecasts, analysis of key players, identification of emerging technologies, and market drivers/restraints. Furthermore, the report provides crucial information on various power source types (AC, DC, others), welding methods (SMAW, GMAW/MIG, FCAW, others), and end-user industries.

Arc Welding Equipment Market Analysis

The global arc welding equipment market is valued at approximately $15 billion in 2023. This market demonstrates a steady growth trajectory, projected to reach approximately $20 billion by 2028, reflecting a Compound Annual Growth Rate (CAGR) of around 5%. Market share is distributed among several key players, with the top five companies holding an estimated 40% of the global market. GMAW/MIG welding equipment currently holds the largest market share among welding methods, driven by its versatility and widespread adoption across various industries. Growth is primarily driven by increased industrial automation, infrastructure development, and advancements in welding technologies.

Arc Welding Equipment Market Regional Insights

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Driving Forces: What's Propelling the Arc Welding Equipment Market

The arc welding equipment market is driven by the expanding manufacturing and construction sectors, increased demand for automation in welding processes, and ongoing technological advancements in welding equipment. Government initiatives supporting infrastructure development in various regions also contribute to market growth. Furthermore, rising demand for high-quality welds in various industries such as automotive and aerospace fuels market expansion.

Challenges and Restraints in Arc Welding Equipment Market

Challenges include fluctuations in raw material prices, increasing competition, and the need for skilled welders. Stringent safety and environmental regulations also present challenges for manufacturers. Furthermore, the high initial investment costs associated with advanced welding equipment can hinder adoption in some smaller businesses.

Emerging Trends in Arc Welding Equipment Market

Emerging trends include the growing adoption of robotic and automated welding systems, the integration of digital technologies for process optimization and monitoring, and a focus on sustainable welding practices. Increased emphasis on worker safety and ergonomic design of welding equipment is also a significant trend.

Arc Welding Equipment Industry News

- February 2023: Miller Electric Mfg. LLC launched the Copilot collaborative welding system.

Leading Players in the Arc Welding Equipment Market

- Lincoln Electric Holdings, Inc. Lincoln Electric

- Daihen Corporation

- Miller Electric Mfg. LLC (part of ITW Welding)

- Kemppi Oy

- Fronius International GmbH Fronius

- Panasonic Welding Systems Co., Ltd.

- Obara Corporation

Arc Welding Equipment Market Segmentation

-

1. Power Source Type

- 1.1. Ac arc welding equipment

- 1.2. Dc arc welding equipment

- 1.3. Others

-

2. Welding Method

- 2.1. Shielded metal arc welding (SMAW)

- 2.2. Gas metal arc welding (GMAW/MIG)

- 2.3. Flux-cored arc welding (FCAW)

- 2.4. Others

-

3. End User

- 3.1. Automotive

- 3.2. Aerospace & defense

- 3.3. Construction

- 3.4. Oil & gas

- 3.5. Manufacturing

- 3.6. Others

Arc Welding Equipment Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ANZ

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. MEA

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of MEA

Arc Welding Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.5% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing demand from automotive and construction sectors

- 3.2.2 Technological advancements in welding equipment

- 3.2.3 Growth in infrastructure development projects

- 3.2.4 Rising industrial automation

- 3.2.5 Stringent safety regulations and standards

- 3.3. Market Restrains

- 3.3.1 High initial setup and maintenance costs

- 3.3.2 Skilled labor shortage

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Arc Welding Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Source Type

- 5.1.1. Ac arc welding equipment

- 5.1.2. Dc arc welding equipment

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Welding Method

- 5.2.1. Shielded metal arc welding (SMAW)

- 5.2.2. Gas metal arc welding (GMAW/MIG)

- 5.2.3. Flux-cored arc welding (FCAW)

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Automotive

- 5.3.2. Aerospace & defense

- 5.3.3. Construction

- 5.3.4. Oil & gas

- 5.3.5. Manufacturing

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Power Source Type

- 6. North America Arc Welding Equipment Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Power Source Type

- 6.1.1. Ac arc welding equipment

- 6.1.2. Dc arc welding equipment

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Welding Method

- 6.2.1. Shielded metal arc welding (SMAW)

- 6.2.2. Gas metal arc welding (GMAW/MIG)

- 6.2.3. Flux-cored arc welding (FCAW)

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Automotive

- 6.3.2. Aerospace & defense

- 6.3.3. Construction

- 6.3.4. Oil & gas

- 6.3.5. Manufacturing

- 6.3.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Power Source Type

- 7. Europe Arc Welding Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Power Source Type

- 7.1.1. Ac arc welding equipment

- 7.1.2. Dc arc welding equipment

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Welding Method

- 7.2.1. Shielded metal arc welding (SMAW)

- 7.2.2. Gas metal arc welding (GMAW/MIG)

- 7.2.3. Flux-cored arc welding (FCAW)

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Automotive

- 7.3.2. Aerospace & defense

- 7.3.3. Construction

- 7.3.4. Oil & gas

- 7.3.5. Manufacturing

- 7.3.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Power Source Type

- 8. Asia Pacific Arc Welding Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Power Source Type

- 8.1.1. Ac arc welding equipment

- 8.1.2. Dc arc welding equipment

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Welding Method

- 8.2.1. Shielded metal arc welding (SMAW)

- 8.2.2. Gas metal arc welding (GMAW/MIG)

- 8.2.3. Flux-cored arc welding (FCAW)

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Automotive

- 8.3.2. Aerospace & defense

- 8.3.3. Construction

- 8.3.4. Oil & gas

- 8.3.5. Manufacturing

- 8.3.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Power Source Type

- 9. Latin America Arc Welding Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Power Source Type

- 9.1.1. Ac arc welding equipment

- 9.1.2. Dc arc welding equipment

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Welding Method

- 9.2.1. Shielded metal arc welding (SMAW)

- 9.2.2. Gas metal arc welding (GMAW/MIG)

- 9.2.3. Flux-cored arc welding (FCAW)

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Automotive

- 9.3.2. Aerospace & defense

- 9.3.3. Construction

- 9.3.4. Oil & gas

- 9.3.5. Manufacturing

- 9.3.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Power Source Type

- 10. MEA Arc Welding Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Power Source Type

- 10.1.1. Ac arc welding equipment

- 10.1.2. Dc arc welding equipment

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Welding Method

- 10.2.1. Shielded metal arc welding (SMAW)

- 10.2.2. Gas metal arc welding (GMAW/MIG)

- 10.2.3. Flux-cored arc welding (FCAW)

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Automotive

- 10.3.2. Aerospace & defense

- 10.3.3. Construction

- 10.3.4. Oil & gas

- 10.3.5. Manufacturing

- 10.3.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Power Source Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Lincoln Electric Holdings Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daihen Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Miller Electric Mfg. LLC (part of ITW Welding)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kemppi Oy

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fronius International GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panasonic Welding Systems Co. Ltd.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Obara Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Lincoln Electric Holdings Inc.

- Figure 1: Global Arc Welding Equipment Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Arc Welding Equipment Market Revenue (Billion), by Power Source Type 2024 & 2032

- Figure 3: North America Arc Welding Equipment Market Revenue Share (%), by Power Source Type 2024 & 2032

- Figure 4: North America Arc Welding Equipment Market Revenue (Billion), by Welding Method 2024 & 2032

- Figure 5: North America Arc Welding Equipment Market Revenue Share (%), by Welding Method 2024 & 2032

- Figure 6: North America Arc Welding Equipment Market Revenue (Billion), by End User 2024 & 2032

- Figure 7: North America Arc Welding Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 8: North America Arc Welding Equipment Market Revenue (Billion), by Country 2024 & 2032

- Figure 9: North America Arc Welding Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Arc Welding Equipment Market Revenue (Billion), by Power Source Type 2024 & 2032

- Figure 11: Europe Arc Welding Equipment Market Revenue Share (%), by Power Source Type 2024 & 2032

- Figure 12: Europe Arc Welding Equipment Market Revenue (Billion), by Welding Method 2024 & 2032

- Figure 13: Europe Arc Welding Equipment Market Revenue Share (%), by Welding Method 2024 & 2032

- Figure 14: Europe Arc Welding Equipment Market Revenue (Billion), by End User 2024 & 2032

- Figure 15: Europe Arc Welding Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 16: Europe Arc Welding Equipment Market Revenue (Billion), by Country 2024 & 2032

- Figure 17: Europe Arc Welding Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Arc Welding Equipment Market Revenue (Billion), by Power Source Type 2024 & 2032

- Figure 19: Asia Pacific Arc Welding Equipment Market Revenue Share (%), by Power Source Type 2024 & 2032

- Figure 20: Asia Pacific Arc Welding Equipment Market Revenue (Billion), by Welding Method 2024 & 2032

- Figure 21: Asia Pacific Arc Welding Equipment Market Revenue Share (%), by Welding Method 2024 & 2032

- Figure 22: Asia Pacific Arc Welding Equipment Market Revenue (Billion), by End User 2024 & 2032

- Figure 23: Asia Pacific Arc Welding Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 24: Asia Pacific Arc Welding Equipment Market Revenue (Billion), by Country 2024 & 2032

- Figure 25: Asia Pacific Arc Welding Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Latin America Arc Welding Equipment Market Revenue (Billion), by Power Source Type 2024 & 2032

- Figure 27: Latin America Arc Welding Equipment Market Revenue Share (%), by Power Source Type 2024 & 2032

- Figure 28: Latin America Arc Welding Equipment Market Revenue (Billion), by Welding Method 2024 & 2032

- Figure 29: Latin America Arc Welding Equipment Market Revenue Share (%), by Welding Method 2024 & 2032

- Figure 30: Latin America Arc Welding Equipment Market Revenue (Billion), by End User 2024 & 2032

- Figure 31: Latin America Arc Welding Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 32: Latin America Arc Welding Equipment Market Revenue (Billion), by Country 2024 & 2032

- Figure 33: Latin America Arc Welding Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: MEA Arc Welding Equipment Market Revenue (Billion), by Power Source Type 2024 & 2032

- Figure 35: MEA Arc Welding Equipment Market Revenue Share (%), by Power Source Type 2024 & 2032

- Figure 36: MEA Arc Welding Equipment Market Revenue (Billion), by Welding Method 2024 & 2032

- Figure 37: MEA Arc Welding Equipment Market Revenue Share (%), by Welding Method 2024 & 2032

- Figure 38: MEA Arc Welding Equipment Market Revenue (Billion), by End User 2024 & 2032

- Figure 39: MEA Arc Welding Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 40: MEA Arc Welding Equipment Market Revenue (Billion), by Country 2024 & 2032

- Figure 41: MEA Arc Welding Equipment Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Arc Welding Equipment Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Arc Welding Equipment Market Revenue Billion Forecast, by Power Source Type 2019 & 2032

- Table 3: Global Arc Welding Equipment Market Revenue Billion Forecast, by Welding Method 2019 & 2032

- Table 4: Global Arc Welding Equipment Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 5: Global Arc Welding Equipment Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 6: Global Arc Welding Equipment Market Revenue Billion Forecast, by Power Source Type 2019 & 2032

- Table 7: Global Arc Welding Equipment Market Revenue Billion Forecast, by Welding Method 2019 & 2032

- Table 8: Global Arc Welding Equipment Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 9: Global Arc Welding Equipment Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 10: U.S. Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 11: Canada Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 12: Global Arc Welding Equipment Market Revenue Billion Forecast, by Power Source Type 2019 & 2032

- Table 13: Global Arc Welding Equipment Market Revenue Billion Forecast, by Welding Method 2019 & 2032

- Table 14: Global Arc Welding Equipment Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 15: Global Arc Welding Equipment Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 16: Germany Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 17: UK Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: France Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 19: Italy Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: Spain Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Global Arc Welding Equipment Market Revenue Billion Forecast, by Power Source Type 2019 & 2032

- Table 23: Global Arc Welding Equipment Market Revenue Billion Forecast, by Welding Method 2019 & 2032

- Table 24: Global Arc Welding Equipment Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 25: Global Arc Welding Equipment Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 26: China Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 27: India Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: Japan Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 29: South Korea Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 30: ANZ Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: Global Arc Welding Equipment Market Revenue Billion Forecast, by Power Source Type 2019 & 2032

- Table 33: Global Arc Welding Equipment Market Revenue Billion Forecast, by Welding Method 2019 & 2032

- Table 34: Global Arc Welding Equipment Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 35: Global Arc Welding Equipment Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 36: Brazil Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 37: Mexico Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 38: Rest of Latin America Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 39: Global Arc Welding Equipment Market Revenue Billion Forecast, by Power Source Type 2019 & 2032

- Table 40: Global Arc Welding Equipment Market Revenue Billion Forecast, by Welding Method 2019 & 2032

- Table 41: Global Arc Welding Equipment Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 42: Global Arc Welding Equipment Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 43: UAE Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 44: Saudi Arabia Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 45: South Africa Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 46: Rest of MEA Arc Welding Equipment Market Revenue (Billion) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)