Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

North America Commercial Heat Pump Water Heater Market Strategic Roadmap: Analysis and Forecasts 2025-2033

North America Commercial Heat Pump Water Heater Market by Capacity, 2019 – 2032 (Units & USD) (≤ 50 Gallons, > 50 - ≤ 100 Gallons, > 100 - ≤ 200 Gallons, > 200 - ≤ 500 Gallons, > 500 Gallons), by Temperature, 2019 – 2032 (Units & USD) (≤ 140°F, > 140°F - 160°F, > 160°F - 180°F, > 180°F), by Application, 2019 – 2032 (Units & USD) (Multi-Family Apartments, Offices, Warehouse & Storage, Retail, Education, Lodgings, , Public Assembly, Healthcare, Others), by North America (U.S., Canada) Forecast 2025-2033

Key Insights

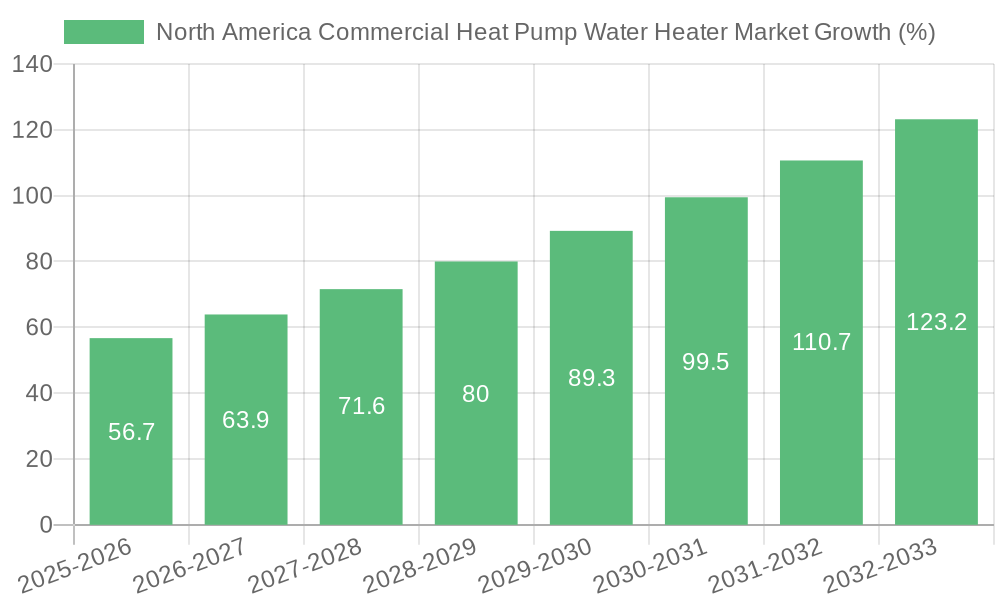

The North America commercial heat pump water heater market, valued at $481.6 million in 2025, is projected to experience robust growth, driven by increasing energy efficiency regulations, rising electricity costs, and a growing focus on sustainability across commercial sectors. The market's Compound Annual Growth Rate (CAGR) of 11.8% from 2019 to 2032 indicates significant expansion potential. Key market segments include various capacity ranges (≤50 gallons, >50-≤100 gallons, >100-≤200 gallons, >200-≤500 gallons, >500 gallons) and temperature capabilities (≤140°F, >140°F-160°F, >160°F-180°F, >180°F). Significant demand is anticipated across diverse applications, including multi-family apartments, offices, warehouses, retail spaces, educational institutions, lodging facilities, public assembly areas, and healthcare settings. The market is highly competitive, with major players such as A. O. Smith, Rheem, Trane, and others vying for market share through technological advancements and strategic partnerships. The increasing adoption of green building practices and government incentives further propel market growth.

The North American region, particularly the U.S. and Canada, dominates the market due to stringent environmental regulations and a high concentration of commercial buildings. Growth within this region is further fueled by the rising construction activity and renovations in commercial sectors. Future market expansion hinges on technological advancements leading to increased efficiency and reduced operational costs, along with the development of innovative solutions catering to specific application needs. However, factors like high initial investment costs and potential concerns about performance in extreme climates could act as restraints. Market segmentation analysis reveals that larger capacity water heaters are likely to experience higher growth due to the needs of larger commercial establishments. Ongoing research and development focused on improving heat pump technology will likely drive further market expansion in the coming years.

North America Commercial Heat Pump Water Heater Market Concentration & Characteristics

The North American commercial heat pump water heater (HPWH) market is moderately concentrated, with several major players holding significant market share. However, the market is also characterized by a dynamic competitive landscape with smaller players and niche entrants continuously emerging. Innovation is a key characteristic, driven by advancements in heat pump technology, energy efficiency standards, and a growing focus on sustainability. Companies are investing in developing smaller, more efficient units, improved controls and smart technology integration.

- Concentration Areas: The market is geographically concentrated in densely populated urban areas and regions with stringent energy codes. The largest players often focus on larger commercial projects, while smaller companies target niche markets.

- Characteristics of Innovation: Innovation is focused on improving energy efficiency (through higher COPs and improved heat exchange), reducing installation complexity (with smaller footprints and simplified plumbing requirements), and enhancing smart capabilities (remote monitoring and control).

- Impact of Regulations: Stringent energy efficiency standards and building codes are significant drivers of market growth. Incentive programs and regulations mandating energy-efficient water heating systems are particularly influential.

- Product Substitutes: Traditional gas and electric water heaters are the primary substitutes, but their higher operating costs and environmental impact are driving the shift towards HPWHs.

- End-User Concentration: Large commercial establishments (hotels, hospitals, multi-family dwellings) represent a significant portion of the market due to higher hot water demands.

- Level of M&A: The level of mergers and acquisitions (M&A) activity is moderate, with occasional strategic acquisitions aimed at expanding product portfolios or market reach.

North America Commercial Heat Pump Water Heater Market Trends

The North American commercial heat pump water heater market is experiencing substantial growth, fueled by several key trends:

Increasing Energy Costs: Rising electricity and natural gas prices make the long-term operating cost savings of HPWHs increasingly attractive to commercial building owners and operators. This trend is particularly evident in regions with volatile energy prices. The significant reduction in operating expenses compared to traditional water heaters is a major incentive for adoption.

Stringent Environmental Regulations: Growing concerns about greenhouse gas emissions and carbon footprints are driving the adoption of cleaner and more efficient heating solutions. Regulations mandating energy efficiency improvements are further accelerating the shift to HPWHs. This includes state-level mandates and incentives offered to encourage energy conservation.

Technological Advancements: Continuous improvements in heat pump technology, resulting in higher Coefficient of Performance (COP) ratings and increased efficiency, are making HPWHs increasingly competitive with traditional options. Innovations include smaller, more compact designs suitable for space-constrained applications.

Growing Awareness of Sustainability: Commercial building owners are increasingly focused on adopting sustainable practices to enhance their environmental credentials and attract environmentally conscious clients. HPWHs align perfectly with these goals, enhancing the overall sustainability profile of commercial buildings.

Improved Installation and Maintenance: Manufacturers are constantly refining designs and installation processes to make HPWHs easier and less disruptive to install and maintain, addressing previous concerns about installation complexities. This streamlining of installation contributes to increased adoption.

Smart Technology Integration: The integration of smart technologies, such as remote monitoring and control, allows building managers to optimize energy use and proactively address any maintenance issues. Smart features add to the appeal and efficient management of these systems, boosting adoption.

Government Incentives and Rebates: Federal, state, and local government incentives and rebates are significantly reducing the upfront cost of installing HPWHs, making them a more financially viable option for commercial projects. These incentives play a critical role in bridging the gap between initial costs and long-term savings.

These factors converge to create a favorable market environment for substantial growth in the coming years, with projections indicating significant unit and revenue increases through 2032. The market is expected to witness a continuous shift from traditional water heating systems towards energy-efficient alternatives.

Key Region or Country & Segment to Dominate the Market

The > 100 - ≤ 200 Gallons capacity segment is projected to dominate the North American commercial HPWH market throughout the forecast period (2019-2032). This is due to its widespread applicability across a broad range of commercial establishments. The segment caters to the needs of medium-sized businesses and institutions, offering a balance between hot water capacity and installation feasibility. Smaller capacity units are often insufficient for the needs of larger commercial entities, while larger units might be unnecessarily bulky and costly.

Capacity Segment Dominance:

- The >100 - ≤ 200 Gallons segment will continue to grow at a robust pace. The balance of capacity and cost effectiveness makes this segment attractive across various applications such as small to medium-sized hotels, restaurants, office buildings and medical clinics. It avoids the cost premium associated with the very large capacity units while still meeting the hot water demand of many mid-sized commercial projects.

Regional Dominance:

The United States will continue to be the largest market, driven by its expansive commercial infrastructure and a higher concentration of larger commercial buildings requiring higher hot water capacities. Stringent energy codes and incentives within various US states further propel this market segment.

Canada will also experience substantial growth, reflecting the ongoing adoption of energy-efficient technologies and government initiatives supporting sustainability within the commercial sector. However, the overall market size will remain smaller compared to the US due to a smaller commercial building stock.

North America Commercial Heat Pump Water Heater Market Product Insights Report Coverage & Deliverables

This report provides comprehensive insights into the North American commercial HPWH market, covering market size and forecast, segment-wise analysis (by capacity, temperature, and application), competitive landscape, key drivers and restraints, emerging trends, and regional insights. It includes detailed profiles of leading market players, analyzing their strategies, product portfolios, and market positions. The deliverables encompass data tables, charts, and insightful analysis to provide a clear understanding of the market dynamics and future outlook.

North America Commercial Heat Pump Water Heater Market Analysis

The North American commercial HPWH market is poised for substantial growth, driven by the factors outlined earlier. The market size, estimated at approximately 3.5 million units in 2023, is projected to reach over 6 million units by 2032, representing a Compound Annual Growth Rate (CAGR) of approximately 6%. This growth is reflected in both unit sales and market revenue, which is anticipated to show a similar rate of expansion.

Market share is currently distributed among several key players, with no single dominant entity. However, larger companies with established distribution networks and strong brand recognition tend to hold a larger share. Smaller players often focus on specific niches or regional markets. This competitive landscape is anticipated to remain largely unchanged in the foreseeable future, with both larger and smaller players maintaining their relative market positions, albeit with gradual shifts due to innovation, market entry, and strategic acquisitions.

The growth will be driven by the increased adoption of heat pump technology in commercial applications due to several factors like rising energy costs, stringent environmental regulations, technological advancements, growing awareness of sustainability, and favorable government incentives. All these factors will contribute towards a consistently expanding market over the next decade, creating ample opportunities for both established players and new entrants.

North America Commercial Heat Pump Water Heater Market Regional Insights

- North America

- U.S.

- Capacity: ≤ 50 Gallons, > 50 - ≤ 100 Gallons, > 100 - ≤ 200 Gallons, > 200 - ≤ 500 Gallons, > 500 Gallons

- Temperature: ≤ 140°F, > 140°F - 160°F, > 160°F - 180°F, > 180°F

- Application: Multi-Family Apartments, Offices, Warehouse & Storage, Retail, Education, Lodgings, Public Assembly, Healthcare, Others

- Canada

- Capacity: ≤ 50 Gallons, > 50 - ≤ 100 Gallons, > 100 - ≤ 200 Gallons, > 200 - ≤ 500 Gallons, > 500 Gallons

- Temperature: ≤ 140°F, > 140°F - 160°F, > 160°F - 180°F, > 180°F

- Application: Multi-Family Apartments, Offices, Warehouse & Storage, Retail, Education, Lodgings, Public Assembly, Healthcare, Others

- U.S.

Driving Forces: What's Propelling the North America Commercial Heat Pump Water Heater Market

The North American commercial HPWH market is driven by a confluence of factors: increasing energy costs, stringent environmental regulations pushing for energy efficiency, technological advancements leading to higher efficiency and reduced installation complexity, and government incentives and rebates accelerating adoption. The growing awareness among building owners and operators of the long-term cost and environmental benefits of HPWHs also contributes to this positive growth trajectory.

Challenges and Restraints in North America Commercial Heat Pump Water Heater Market

Despite the significant growth potential, several challenges and restraints exist: high initial purchase costs compared to traditional water heaters, concerns about performance in extremely cold climates, limited awareness among some commercial building operators about the benefits of HPWHs, and the need for skilled technicians for installation and maintenance. Addressing these challenges through further technological advancements, improved education and training, and expanded financial incentives are crucial for continued market growth.

Emerging Trends in North America Commercial Heat Pump Water Heater Market

Emerging trends include the growing integration of smart technologies for remote monitoring and control, the development of more compact and modular units suitable for retrofitting existing buildings, and the increased adoption of hybrid heat pump systems that combine heat pump technology with supplementary heating elements for reliable performance in cold climates. The market is also seeing a rise in demand for units with higher water flow rates to meet the needs of larger commercial establishments.

North America Commercial Heat Pump Water Heater Industry News

- August 2023: Lochinvar introduced the Veritus Air Source HPWH, featuring advanced features for minimized emissions and optimized heat transfer.

- January 2023: Lochinvar unveiled Aquastore, a wide range of HPWHs for large and medium commercial applications designed for easy installation.

Leading Players in the North America Commercial Heat Pump Water Heater Market

- A. O. Smith

- Lochinvar

- Rheem Manufacturing Company

- Trane

- Hubbell Heaters

- Nyle Systems

- Bradford White Corporation

- INTELLIHOT

- Colmac Industries

- Daikin Industries

- American Water Heaters

- Lync

- LG Electronics

- Panasonic Holdings Corporation

- Ariston Holding

North America Commercial Heat Pump Water Heater Market Segmentation

-

1. Capacity, 2019 – 2032 (Units & USD)

- 1.1. ≤ 50 Gallons

- 1.2. > 50 - ≤ 100 Gallons

- 1.3. > 100 - ≤ 200 Gallons

- 1.4. > 200 - ≤ 500 Gallons

- 1.5. > 500 Gallons

-

2. Temperature, 2019 – 2032 (Units & USD)

- 2.1. ≤ 140°F

- 2.2. > 140°F - 160°F

- 2.3. > 160°F - 180°F

- 2.4. > 180°F

-

3. Application, 2019 – 2032 (Units & USD)

- 3.1. Multi-Family Apartments

- 3.2. Offices

- 3.3. Warehouse & Storage

- 3.4. Retail

- 3.5. Education

- 3.6. Lodgings,

- 3.7. Public Assembly

- 3.8. Healthcare

- 3.9. Others

North America Commercial Heat Pump Water Heater Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

North America Commercial Heat Pump Water Heater Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.8% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing emphasis toward energy efficient heating systems

- 3.2.2 Encouraging regulatory framework to mitigate carbon emissions

- 3.2.3 Shifting focus toward the deployment of low carbon technologies

- 3.2.4 Increasing demand for heating systems

- 3.3. Market Restrains

- 3.3.1. High initial implementation cost coupled with availability of conventional technologies

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Commercial Heat Pump Water Heater Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Capacity, 2019 – 2032 (Units & USD)

- 5.1.1. ≤ 50 Gallons

- 5.1.2. > 50 - ≤ 100 Gallons

- 5.1.3. > 100 - ≤ 200 Gallons

- 5.1.4. > 200 - ≤ 500 Gallons

- 5.1.5. > 500 Gallons

- 5.2. Market Analysis, Insights and Forecast - by Temperature, 2019 – 2032 (Units & USD)

- 5.2.1. ≤ 140°F

- 5.2.2. > 140°F - 160°F

- 5.2.3. > 160°F - 180°F

- 5.2.4. > 180°F

- 5.3. Market Analysis, Insights and Forecast - by Application, 2019 – 2032 (Units & USD)

- 5.3.1. Multi-Family Apartments

- 5.3.2. Offices

- 5.3.3. Warehouse & Storage

- 5.3.4. Retail

- 5.3.5. Education

- 5.3.6. Lodgings,

- 5.3.7. Public Assembly

- 5.3.8. Healthcare

- 5.3.9. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Capacity, 2019 – 2032 (Units & USD)

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 A. O. Smith

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lochinvar

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rheem Manufacturing Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trane

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hubbell Heaters

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nyle Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bradford White Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 INTELLIHOT

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Colmac Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Daikin Industries

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 American Water Heaters

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lync

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 LG Electronics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Panasonic Holdings Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Ariston Holding

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 A. O. Smith

- Figure 1: North America Commercial Heat Pump Water Heater Market Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: North America Commercial Heat Pump Water Heater Market Share (%) by Company 2024

- Table 1: North America Commercial Heat Pump Water Heater Market Revenue million Forecast, by Region 2019 & 2032

- Table 2: North America Commercial Heat Pump Water Heater Market Revenue million Forecast, by Capacity, 2019 – 2032 (Units & USD) 2019 & 2032

- Table 3: North America Commercial Heat Pump Water Heater Market Revenue million Forecast, by Temperature, 2019 – 2032 (Units & USD) 2019 & 2032

- Table 4: North America Commercial Heat Pump Water Heater Market Revenue million Forecast, by Application, 2019 – 2032 (Units & USD) 2019 & 2032

- Table 5: North America Commercial Heat Pump Water Heater Market Revenue million Forecast, by Region 2019 & 2032

- Table 6: North America Commercial Heat Pump Water Heater Market Revenue million Forecast, by Capacity, 2019 – 2032 (Units & USD) 2019 & 2032

- Table 7: North America Commercial Heat Pump Water Heater Market Revenue million Forecast, by Temperature, 2019 – 2032 (Units & USD) 2019 & 2032

- Table 8: North America Commercial Heat Pump Water Heater Market Revenue million Forecast, by Application, 2019 – 2032 (Units & USD) 2019 & 2032

- Table 9: North America Commercial Heat Pump Water Heater Market Revenue million Forecast, by Country 2019 & 2032

- Table 10: U.S. North America Commercial Heat Pump Water Heater Market Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Canada North America Commercial Heat Pump Water Heater Market Revenue (million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)