Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Clinical Trial Imaging Market Growth Opportunities and Market Forecast 2025-2033: A Strategic Analysis

Clinical Trial Imaging Market by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. (In clinical trials, MRI is frequently used to visualize the effects of investigational drugs, medical devices, or therapeutic interventions on the anatomical and physiological aspects of the human body. It can help researchers and clinicians track changes in tumor size, assess the impact of treatment regimens, and monitor safety concerns., Moreover, MRI's non-invasive nature is advantageous as it avoids exposing patients to harmful radiation, making it a safe option for longitudinal studies.), by Service, 2018 – 2032 (USD Million) (Clinical trial design and consultation services, Reading and analytical services, Operational imaging, System and technology support services, Project and data management), by Imaging Technique, 2018 – 2032 (USD Million) (Magnetic resonance imaging (MRI), Computed tomography (CT) scan, Ultrasound, Positron emission tomography (PET), Echocardiography (ECG), X-ray, Other imaging techniques), by Therapeutic Area, 2018 – 2032 (USD Million) (Central nervous system, Oncology, Infectious disease, Endocrinology & metabolic disorders, Diabetes, Musculoskeletal, Cardiovascular diseases, Respiratory, Gastroenterology, Nonalcoholic steatohepatitis (NASH), Other therapeutic areas), by End user, 2018 – 2032 (USD Million) (Biotechnology and pharmaceutical companies, Medical devices manufacturers, Contract research organization (CRO), Academics & government research institutes, Other end users), by North America (U.S., Canada), by Europe (Germany, UK, France, Spain, Italy, Rest of Europe), by Asia Pacific (China, Japan, India, Australia, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Rest of Latin America), by Middle East & Africa (South Africa, Saudi Arabia, Rest of Middle East & Africa) Forecast 2025-2033

Key Insights

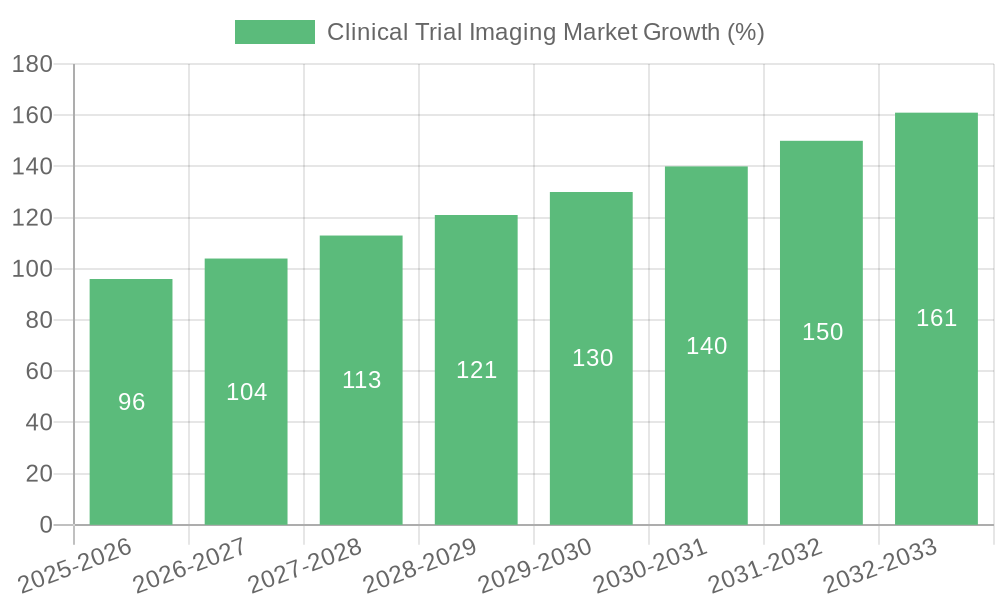

The global clinical trial imaging market is experiencing robust growth, projected to reach a substantial size driven by several key factors. The market's compound annual growth rate (CAGR) of 7.9% from 2018 to 2032 indicates significant expansion, with the market value exceeding $1.1 billion in 2022. This growth is fueled by the increasing adoption of advanced imaging techniques like MRI, CT scans, and PET scans in clinical trials. The non-invasive nature of MRI, particularly, makes it a preferred choice for longitudinal studies, reducing patient exposure to radiation and enhancing data quality. The rising prevalence of chronic diseases like cancer, cardiovascular diseases, and neurological disorders necessitates more sophisticated clinical trials, further boosting the demand for imaging services. The market is segmented by imaging technique (MRI holding a significant share), therapeutic area (oncology and central nervous system showing strong growth), service type (clinical trial design and consultation services being prominent), and end-user (biotechnology and pharmaceutical companies, CROs, and research institutes). North America currently holds a large market share, attributed to advanced healthcare infrastructure and increased research spending. However, Asia-Pacific is projected to witness the fastest growth in the coming years due to rising healthcare expenditure and expanding clinical trial activities in the region.

The competitive landscape is populated by a mix of large multinational companies like ICON PLC and Medidata, alongside smaller specialized providers. These companies offer a range of services, from imaging equipment and technology support to data management and analysis. The growing complexity of clinical trials demands highly specialized services, favoring companies with robust technology platforms and expertise in managing large datasets. Future growth will likely be influenced by technological advancements in imaging techniques (e.g., AI-powered image analysis), increasing regulatory scrutiny, and the growing need for efficient and cost-effective clinical trial solutions. The integration of imaging data with other clinical trial data to provide a holistic view of patient outcomes will continue to shape the market trajectory. Specific market segments like oncology and CNS are exhibiting stronger growth due to the high demand for precise and frequent imaging assessments in these therapeutic areas.

Clinical Trial Imaging Market Concentration & Characteristics

The clinical trial imaging market is moderately concentrated, with a few large players like ICON PLC and Medidata holding significant market share. However, the market also features numerous smaller specialized companies, particularly in niche imaging techniques and service offerings. This fragmented landscape fosters innovation but can also lead to price variability and challenges in standardizing processes.

- Concentration Areas: The market exhibits higher concentration in core imaging modalities like MRI and CT scans due to higher adoption rates and established infrastructure. Specialized imaging, such as PET scans, shows slightly lower concentration due to higher technology costs and specialized expertise required.

- Characteristics of Innovation: Innovation is primarily driven by advancements in imaging technologies (higher resolution, faster scan times, AI-powered image analysis), coupled with the development of efficient data management and analysis platforms. Regulatory changes also indirectly spur innovation, pushing for better data security and interoperability solutions.

- Impact of Regulations: Stringent regulatory frameworks, particularly regarding data privacy (HIPAA, GDPR) and clinical trial protocols, significantly impact the market. Compliance requirements necessitate investment in secure data storage, robust quality control measures, and adherence to standardized protocols. This increases operational costs, potentially slowing market growth for smaller companies.

- Product Substitutes: While the core imaging modalities are relatively established, emerging techniques like advanced ultrasound and hybrid imaging systems offer some substitution potential. The choice of imaging technique depends heavily on the specific clinical trial needs and cost-benefit analysis.

- End User Concentration: The market is driven by a relatively concentrated group of large pharmaceutical and biotechnology companies, contract research organizations (CROs), and a more dispersed group of academic institutions and government research bodies. This concentration creates a reliance on large clients and increases the susceptibility to client-driven pricing pressure.

- Level of M&A: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity, with larger players aiming to expand their service offerings and geographical reach. This consolidating trend is expected to continue as companies seek to enhance their competitive positioning.

Clinical Trial Imaging Market Trends

The clinical trial imaging market is witnessing substantial growth, driven by several key trends. The increasing prevalence of chronic diseases, coupled with the rising demand for personalized medicine, is fueling the need for advanced imaging techniques in clinical trials. This allows researchers to better understand disease progression, assess treatment efficacy, and monitor patient safety.

Technological advancements are another significant driver. The introduction of AI-powered image analysis tools promises to improve diagnostic accuracy, reduce processing times, and enhance data interpretation. The trend towards decentralized clinical trials (DCTs) also plays a critical role, pushing for remote imaging acquisition and management solutions. Furthermore, the integration of imaging data with other sources of patient data (genomics, wearables) offers potential for more comprehensive insights and personalized treatment strategies.

The increasing adoption of cloud-based solutions facilitates secure data storage, collaboration among researchers, and efficient data sharing. This contributes to overall cost efficiency and simplifies the data management processes involved in clinical trials. Regulatory bodies are actively promoting the adoption of electronic data capture (EDC) systems and standardized image formats, which supports data interoperability and reduces data-related inefficiencies.

Finally, a growing emphasis on patient-centric clinical trial design is shaping the development of more comfortable and user-friendly imaging procedures. This can include the utilization of mobile imaging units to minimize patient travel and enhance convenience. This increased patient comfort and convenience improves participation rates and trial efficacy. The overall expansion of the clinical trial industry in response to a growing need for new therapeutics, particularly in oncology and neurology, has further strengthened the demand for clinical trial imaging services and technologies. The rising need for improved risk assessment and safety monitoring in clinical trials is driving market expansion as well.

Key Region or Country & Segment to Dominate the Market

North America is expected to dominate the clinical trial imaging market, driven by the high concentration of pharmaceutical and biotech companies, a robust regulatory framework supporting clinical research, and high healthcare expenditure. The US alone accounts for a significant portion of this market share.

Europe is another significant market, with strong research infrastructure and increasing investments in healthcare innovation. The region is characterized by a complex regulatory landscape, which could influence the adoption rate of new imaging technologies and services.

Asia Pacific presents a rapidly expanding market, driven by rising healthcare spending, increasing prevalence of chronic diseases, and growing outsourcing of clinical trials to this region. While regulatory frameworks might be less established than in the West, the region shows considerable potential for future growth.

MRI is projected to be the dominant imaging technique due to its high resolution, versatility, and non-invasive nature. Its widespread adoption in clinical trials across various therapeutic areas solidifies its leading position. The anticipated growth of MRI to USD 649.7 million by 2032 underscores its market dominance. This is further driven by an increasing demand for advanced MRI techniques such as functional MRI (fMRI) and diffusion tensor imaging (DTI) which allow for a deeper understanding of disease mechanisms and treatment responses. The advantages of MRI in terms of versatility and the non-invasive nature help reduce the risks associated with clinical trials.

Oncology is a key therapeutic area driving the market, with advanced imaging crucial for cancer detection, staging, treatment monitoring, and assessing therapeutic responses. The high prevalence of cancer globally contributes significantly to the growth within this segment. The ability of MRI and PET to assess tumor growth and response to treatment is vital to the success of oncology clinical trials.

The biotechnology and pharmaceutical companies segment forms a major portion of the end-user landscape, as their investments in research and development strongly influence the demand for clinical trial imaging services and technology.

Clinical Trial Imaging Market Product Insights Report Coverage & Deliverables

This report offers comprehensive insights into the clinical trial imaging market, covering market size and growth projections, segment analysis (by imaging technique, therapeutic area, end-user, and region), competitive landscape, key trends, and regulatory overview. It also includes detailed profiles of major market players and analyses of recent industry developments, such as collaborations and mergers and acquisitions. The deliverables encompass market forecasts, competitive benchmarking, and strategic recommendations for market participants.

Clinical Trial Imaging Market Analysis

The global clinical trial imaging market is experiencing robust growth, propelled by the increasing demand for advanced diagnostic tools in clinical research. The market size is substantial, currently valued in the billions of USD, and is projected to expand significantly over the forecast period. This growth is primarily attributed to the rising prevalence of chronic diseases, increasing investments in pharmaceutical R&D, and advancements in imaging technologies. The market is characterized by a mix of large established players and smaller specialized firms, resulting in a moderately fragmented landscape. The market share is distributed among various imaging techniques, with MRI, CT, and PET scans holding significant portions. The growth rate is expected to remain healthy, driven by factors such as the expansion of clinical trials, the adoption of new technologies, and favorable regulatory environments. The market exhibits varying growth patterns across different regions, with North America and Europe currently dominating, while Asia-Pacific shows promising future growth.

Clinical Trial Imaging Market Regional Insights

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- Rest of Middle East & Africa

Each region's market is further segmented by imaging technique, therapeutic area, and end-user, offering granular insights into regional variations in market dynamics.

Driving Forces: What's Propelling the Clinical Trial Imaging Market

The market is driven by several factors:

- Increased prevalence of chronic diseases requiring advanced diagnostics.

- Growing investments in pharmaceutical R&D and clinical trials.

- Advancements in imaging technologies and AI-powered image analysis.

- Rising demand for personalized medicine and targeted therapies.

- Expansion of decentralized clinical trials (DCTs).

Challenges and Restraints in Clinical Trial Imaging Market

Challenges include:

- High cost of advanced imaging technologies.

- Stringent regulatory requirements and compliance costs.

- Data privacy and security concerns.

- Shortage of skilled professionals in image analysis.

- Integration challenges with existing clinical trial workflows.

Emerging Trends in Clinical Trial Imaging Market

Key emerging trends are:

- AI-driven image analysis and automated reporting.

- Cloud-based imaging platforms and data management solutions.

- Integration of imaging data with other omics data.

- Expansion of decentralized clinical trials (DCTs) leveraging remote imaging.

- Focus on patient-centric imaging experiences.

Clinical Trial Imaging Industry News

- August 2023: CitiusTech Healthcare Technology Pvt. Ltd. partnered with Radical Imaging LLC to advance open-source web imaging platform (OHIF).

- August 2023: ECLEVAR MEDTECH and Micron, Inc. formed a strategic partnership to enhance CRO services in the MedTech industry.

Leading Players in the Clinical Trial Imaging Market

- ICON PLC

- Medidata Medidata

- WCG Clinical

- Radiant Sage

- Biomedical Systems Corporation

- Biotelemetry, Inc.

- Image Core Lab

- Ixico PLC

- Medspace Holdings Inc.

- Resonance Health Limited

- Median Technologies

- WorldCare Clinical

- Navitas Clinical Research, Inc

Note: Website links are provided where readily available. If a global company website is unavailable, only the company name is listed.

Clinical Trial Imaging Market Segmentation

-

1. Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 1.1. In clinical trials, MRI is frequently used to visualize the effects of investigational drugs, medical devices, or therapeutic interventions on the anatomical and physiological aspects of the human body. It can help researchers and clinicians track changes in tumor size, assess the impact of treatment regimens, and monitor safety concerns.

- 1.2. Moreover, MRI's non-invasive nature is advantageous as it avoids exposing patients to harmful radiation, making it a safe option for longitudinal studies.

-

2. Service, 2018 – 2032 (USD Million)

- 2.1. Clinical trial design and consultation services

- 2.2. Reading and analytical services

- 2.3. Operational imaging

- 2.4. System and technology support services

- 2.5. Project and data management

-

3. Imaging Technique, 2018 – 2032 (USD Million)

- 3.1. Magnetic resonance imaging (MRI)

- 3.2. Computed tomography (CT) scan

- 3.3. Ultrasound

- 3.4. Positron emission tomography (PET)

- 3.5. Echocardiography (ECG)

- 3.6. X-ray

- 3.7. Other imaging techniques

-

4. Therapeutic Area, 2018 – 2032 (USD Million)

- 4.1. Central nervous system

- 4.2. Oncology

- 4.3. Infectious disease

- 4.4. Endocrinology & metabolic disorders

- 4.5. Diabetes

- 4.6. Musculoskeletal

- 4.7. Cardiovascular diseases

- 4.8. Respiratory

- 4.9. Gastroenterology

- 4.10. Nonalcoholic steatohepatitis (NASH)

- 4.11. Other therapeutic areas

-

5. End user, 2018 – 2032 (USD Million)

- 5.1. Biotechnology and pharmaceutical companies

- 5.2. Medical devices manufacturers

- 5.3. Contract research organization (CRO)

- 5.4. Academics & government research institutes

- 5.5. Other end users

Clinical Trial Imaging Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East & Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East & Africa

Clinical Trial Imaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.9% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing number of clinical studies

- 3.2.2 Increasing number of contract research organizations (CROS)

- 3.2.3 Rise in R&D expenditure

- 3.3. Market Restrains

- 3.3.1 Clinical study expenses

- 3.3.2 High cost associated with the imaging techniques and potential exposure to radiation

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Clinical Trial Imaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 5.1.1. In clinical trials, MRI is frequently used to visualize the effects of investigational drugs, medical devices, or therapeutic interventions on the anatomical and physiological aspects of the human body. It can help researchers and clinicians track changes in tumor size, assess the impact of treatment regimens, and monitor safety concerns.

- 5.1.2. Moreover, MRI's non-invasive nature is advantageous as it avoids exposing patients to harmful radiation, making it a safe option for longitudinal studies.

- 5.2. Market Analysis, Insights and Forecast - by Service, 2018 – 2032 (USD Million)

- 5.2.1. Clinical trial design and consultation services

- 5.2.2. Reading and analytical services

- 5.2.3. Operational imaging

- 5.2.4. System and technology support services

- 5.2.5. Project and data management

- 5.3. Market Analysis, Insights and Forecast - by Imaging Technique, 2018 – 2032 (USD Million)

- 5.3.1. Magnetic resonance imaging (MRI)

- 5.3.2. Computed tomography (CT) scan

- 5.3.3. Ultrasound

- 5.3.4. Positron emission tomography (PET)

- 5.3.5. Echocardiography (ECG)

- 5.3.6. X-ray

- 5.3.7. Other imaging techniques

- 5.4. Market Analysis, Insights and Forecast - by Therapeutic Area, 2018 – 2032 (USD Million)

- 5.4.1. Central nervous system

- 5.4.2. Oncology

- 5.4.3. Infectious disease

- 5.4.4. Endocrinology & metabolic disorders

- 5.4.5. Diabetes

- 5.4.6. Musculoskeletal

- 5.4.7. Cardiovascular diseases

- 5.4.8. Respiratory

- 5.4.9. Gastroenterology

- 5.4.10. Nonalcoholic steatohepatitis (NASH)

- 5.4.11. Other therapeutic areas

- 5.5. Market Analysis, Insights and Forecast - by End user, 2018 – 2032 (USD Million)

- 5.5.1. Biotechnology and pharmaceutical companies

- 5.5.2. Medical devices manufacturers

- 5.5.3. Contract research organization (CRO)

- 5.5.4. Academics & government research institutes

- 5.5.5. Other end users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Latin America

- 5.6.5. Middle East & Africa

- 5.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 6. North America Clinical Trial Imaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 6.1.1. In clinical trials, MRI is frequently used to visualize the effects of investigational drugs, medical devices, or therapeutic interventions on the anatomical and physiological aspects of the human body. It can help researchers and clinicians track changes in tumor size, assess the impact of treatment regimens, and monitor safety concerns.

- 6.1.2. Moreover, MRI's non-invasive nature is advantageous as it avoids exposing patients to harmful radiation, making it a safe option for longitudinal studies.

- 6.2. Market Analysis, Insights and Forecast - by Service, 2018 – 2032 (USD Million)

- 6.2.1. Clinical trial design and consultation services

- 6.2.2. Reading and analytical services

- 6.2.3. Operational imaging

- 6.2.4. System and technology support services

- 6.2.5. Project and data management

- 6.3. Market Analysis, Insights and Forecast - by Imaging Technique, 2018 – 2032 (USD Million)

- 6.3.1. Magnetic resonance imaging (MRI)

- 6.3.2. Computed tomography (CT) scan

- 6.3.3. Ultrasound

- 6.3.4. Positron emission tomography (PET)

- 6.3.5. Echocardiography (ECG)

- 6.3.6. X-ray

- 6.3.7. Other imaging techniques

- 6.4. Market Analysis, Insights and Forecast - by Therapeutic Area, 2018 – 2032 (USD Million)

- 6.4.1. Central nervous system

- 6.4.2. Oncology

- 6.4.3. Infectious disease

- 6.4.4. Endocrinology & metabolic disorders

- 6.4.5. Diabetes

- 6.4.6. Musculoskeletal

- 6.4.7. Cardiovascular diseases

- 6.4.8. Respiratory

- 6.4.9. Gastroenterology

- 6.4.10. Nonalcoholic steatohepatitis (NASH)

- 6.4.11. Other therapeutic areas

- 6.5. Market Analysis, Insights and Forecast - by End user, 2018 – 2032 (USD Million)

- 6.5.1. Biotechnology and pharmaceutical companies

- 6.5.2. Medical devices manufacturers

- 6.5.3. Contract research organization (CRO)

- 6.5.4. Academics & government research institutes

- 6.5.5. Other end users

- 6.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 7. Europe Clinical Trial Imaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 7.1.1. In clinical trials, MRI is frequently used to visualize the effects of investigational drugs, medical devices, or therapeutic interventions on the anatomical and physiological aspects of the human body. It can help researchers and clinicians track changes in tumor size, assess the impact of treatment regimens, and monitor safety concerns.

- 7.1.2. Moreover, MRI's non-invasive nature is advantageous as it avoids exposing patients to harmful radiation, making it a safe option for longitudinal studies.

- 7.2. Market Analysis, Insights and Forecast - by Service, 2018 – 2032 (USD Million)

- 7.2.1. Clinical trial design and consultation services

- 7.2.2. Reading and analytical services

- 7.2.3. Operational imaging

- 7.2.4. System and technology support services

- 7.2.5. Project and data management

- 7.3. Market Analysis, Insights and Forecast - by Imaging Technique, 2018 – 2032 (USD Million)

- 7.3.1. Magnetic resonance imaging (MRI)

- 7.3.2. Computed tomography (CT) scan

- 7.3.3. Ultrasound

- 7.3.4. Positron emission tomography (PET)

- 7.3.5. Echocardiography (ECG)

- 7.3.6. X-ray

- 7.3.7. Other imaging techniques

- 7.4. Market Analysis, Insights and Forecast - by Therapeutic Area, 2018 – 2032 (USD Million)

- 7.4.1. Central nervous system

- 7.4.2. Oncology

- 7.4.3. Infectious disease

- 7.4.4. Endocrinology & metabolic disorders

- 7.4.5. Diabetes

- 7.4.6. Musculoskeletal

- 7.4.7. Cardiovascular diseases

- 7.4.8. Respiratory

- 7.4.9. Gastroenterology

- 7.4.10. Nonalcoholic steatohepatitis (NASH)

- 7.4.11. Other therapeutic areas

- 7.5. Market Analysis, Insights and Forecast - by End user, 2018 – 2032 (USD Million)

- 7.5.1. Biotechnology and pharmaceutical companies

- 7.5.2. Medical devices manufacturers

- 7.5.3. Contract research organization (CRO)

- 7.5.4. Academics & government research institutes

- 7.5.5. Other end users

- 7.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 8. Asia Pacific Clinical Trial Imaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 8.1.1. In clinical trials, MRI is frequently used to visualize the effects of investigational drugs, medical devices, or therapeutic interventions on the anatomical and physiological aspects of the human body. It can help researchers and clinicians track changes in tumor size, assess the impact of treatment regimens, and monitor safety concerns.

- 8.1.2. Moreover, MRI's non-invasive nature is advantageous as it avoids exposing patients to harmful radiation, making it a safe option for longitudinal studies.

- 8.2. Market Analysis, Insights and Forecast - by Service, 2018 – 2032 (USD Million)

- 8.2.1. Clinical trial design and consultation services

- 8.2.2. Reading and analytical services

- 8.2.3. Operational imaging

- 8.2.4. System and technology support services

- 8.2.5. Project and data management

- 8.3. Market Analysis, Insights and Forecast - by Imaging Technique, 2018 – 2032 (USD Million)

- 8.3.1. Magnetic resonance imaging (MRI)

- 8.3.2. Computed tomography (CT) scan

- 8.3.3. Ultrasound

- 8.3.4. Positron emission tomography (PET)

- 8.3.5. Echocardiography (ECG)

- 8.3.6. X-ray

- 8.3.7. Other imaging techniques

- 8.4. Market Analysis, Insights and Forecast - by Therapeutic Area, 2018 – 2032 (USD Million)

- 8.4.1. Central nervous system

- 8.4.2. Oncology

- 8.4.3. Infectious disease

- 8.4.4. Endocrinology & metabolic disorders

- 8.4.5. Diabetes

- 8.4.6. Musculoskeletal

- 8.4.7. Cardiovascular diseases

- 8.4.8. Respiratory

- 8.4.9. Gastroenterology

- 8.4.10. Nonalcoholic steatohepatitis (NASH)

- 8.4.11. Other therapeutic areas

- 8.5. Market Analysis, Insights and Forecast - by End user, 2018 – 2032 (USD Million)

- 8.5.1. Biotechnology and pharmaceutical companies

- 8.5.2. Medical devices manufacturers

- 8.5.3. Contract research organization (CRO)

- 8.5.4. Academics & government research institutes

- 8.5.5. Other end users

- 8.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 9. Latin America Clinical Trial Imaging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 9.1.1. In clinical trials, MRI is frequently used to visualize the effects of investigational drugs, medical devices, or therapeutic interventions on the anatomical and physiological aspects of the human body. It can help researchers and clinicians track changes in tumor size, assess the impact of treatment regimens, and monitor safety concerns.

- 9.1.2. Moreover, MRI's non-invasive nature is advantageous as it avoids exposing patients to harmful radiation, making it a safe option for longitudinal studies.

- 9.2. Market Analysis, Insights and Forecast - by Service, 2018 – 2032 (USD Million)

- 9.2.1. Clinical trial design and consultation services

- 9.2.2. Reading and analytical services

- 9.2.3. Operational imaging

- 9.2.4. System and technology support services

- 9.2.5. Project and data management

- 9.3. Market Analysis, Insights and Forecast - by Imaging Technique, 2018 – 2032 (USD Million)

- 9.3.1. Magnetic resonance imaging (MRI)

- 9.3.2. Computed tomography (CT) scan

- 9.3.3. Ultrasound

- 9.3.4. Positron emission tomography (PET)

- 9.3.5. Echocardiography (ECG)

- 9.3.6. X-ray

- 9.3.7. Other imaging techniques

- 9.4. Market Analysis, Insights and Forecast - by Therapeutic Area, 2018 – 2032 (USD Million)

- 9.4.1. Central nervous system

- 9.4.2. Oncology

- 9.4.3. Infectious disease

- 9.4.4. Endocrinology & metabolic disorders

- 9.4.5. Diabetes

- 9.4.6. Musculoskeletal

- 9.4.7. Cardiovascular diseases

- 9.4.8. Respiratory

- 9.4.9. Gastroenterology

- 9.4.10. Nonalcoholic steatohepatitis (NASH)

- 9.4.11. Other therapeutic areas

- 9.5. Market Analysis, Insights and Forecast - by End user, 2018 – 2032 (USD Million)

- 9.5.1. Biotechnology and pharmaceutical companies

- 9.5.2. Medical devices manufacturers

- 9.5.3. Contract research organization (CRO)

- 9.5.4. Academics & government research institutes

- 9.5.5. Other end users

- 9.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 10. Middle East & Africa Clinical Trial Imaging Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 10.1.1. In clinical trials, MRI is frequently used to visualize the effects of investigational drugs, medical devices, or therapeutic interventions on the anatomical and physiological aspects of the human body. It can help researchers and clinicians track changes in tumor size, assess the impact of treatment regimens, and monitor safety concerns.

- 10.1.2. Moreover, MRI's non-invasive nature is advantageous as it avoids exposing patients to harmful radiation, making it a safe option for longitudinal studies.

- 10.2. Market Analysis, Insights and Forecast - by Service, 2018 – 2032 (USD Million)

- 10.2.1. Clinical trial design and consultation services

- 10.2.2. Reading and analytical services

- 10.2.3. Operational imaging

- 10.2.4. System and technology support services

- 10.2.5. Project and data management

- 10.3. Market Analysis, Insights and Forecast - by Imaging Technique, 2018 – 2032 (USD Million)

- 10.3.1. Magnetic resonance imaging (MRI)

- 10.3.2. Computed tomography (CT) scan

- 10.3.3. Ultrasound

- 10.3.4. Positron emission tomography (PET)

- 10.3.5. Echocardiography (ECG)

- 10.3.6. X-ray

- 10.3.7. Other imaging techniques

- 10.4. Market Analysis, Insights and Forecast - by Therapeutic Area, 2018 – 2032 (USD Million)

- 10.4.1. Central nervous system

- 10.4.2. Oncology

- 10.4.3. Infectious disease

- 10.4.4. Endocrinology & metabolic disorders

- 10.4.5. Diabetes

- 10.4.6. Musculoskeletal

- 10.4.7. Cardiovascular diseases

- 10.4.8. Respiratory

- 10.4.9. Gastroenterology

- 10.4.10. Nonalcoholic steatohepatitis (NASH)

- 10.4.11. Other therapeutic areas

- 10.5. Market Analysis, Insights and Forecast - by End user, 2018 – 2032 (USD Million)

- 10.5.1. Biotechnology and pharmaceutical companies

- 10.5.2. Medical devices manufacturers

- 10.5.3. Contract research organization (CRO)

- 10.5.4. Academics & government research institutes

- 10.5.5. Other end users

- 10.1. Market Analysis, Insights and Forecast - by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032.

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ICON PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medidata

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 WCG Clinical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Radiant Sage

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Biomedical Systems Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Biotelemetry Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Image Core Lab

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 WCG Clinical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ixico PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Medspace Holdings Inc.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Resonance Health Limited Median Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 WorldCare Clinical

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Navitas Clinical Research Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 ICON PLC

- Figure 1: Global Clinical Trial Imaging Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Clinical Trial Imaging Market Revenue (Billion), by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2024 & 2032

- Figure 3: North America Clinical Trial Imaging Market Revenue Share (%), by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2024 & 2032

- Figure 4: North America Clinical Trial Imaging Market Revenue (Billion), by Service, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 5: North America Clinical Trial Imaging Market Revenue Share (%), by Service, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 6: North America Clinical Trial Imaging Market Revenue (Billion), by Imaging Technique, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 7: North America Clinical Trial Imaging Market Revenue Share (%), by Imaging Technique, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 8: North America Clinical Trial Imaging Market Revenue (Billion), by Therapeutic Area, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 9: North America Clinical Trial Imaging Market Revenue Share (%), by Therapeutic Area, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 10: North America Clinical Trial Imaging Market Revenue (Billion), by End user, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 11: North America Clinical Trial Imaging Market Revenue Share (%), by End user, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 12: North America Clinical Trial Imaging Market Revenue (Billion), by Country 2024 & 2032

- Figure 13: North America Clinical Trial Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Clinical Trial Imaging Market Revenue (Billion), by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2024 & 2032

- Figure 15: Europe Clinical Trial Imaging Market Revenue Share (%), by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2024 & 2032

- Figure 16: Europe Clinical Trial Imaging Market Revenue (Billion), by Service, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 17: Europe Clinical Trial Imaging Market Revenue Share (%), by Service, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 18: Europe Clinical Trial Imaging Market Revenue (Billion), by Imaging Technique, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 19: Europe Clinical Trial Imaging Market Revenue Share (%), by Imaging Technique, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 20: Europe Clinical Trial Imaging Market Revenue (Billion), by Therapeutic Area, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 21: Europe Clinical Trial Imaging Market Revenue Share (%), by Therapeutic Area, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 22: Europe Clinical Trial Imaging Market Revenue (Billion), by End user, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 23: Europe Clinical Trial Imaging Market Revenue Share (%), by End user, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 24: Europe Clinical Trial Imaging Market Revenue (Billion), by Country 2024 & 2032

- Figure 25: Europe Clinical Trial Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Clinical Trial Imaging Market Revenue (Billion), by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2024 & 2032

- Figure 27: Asia Pacific Clinical Trial Imaging Market Revenue Share (%), by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2024 & 2032

- Figure 28: Asia Pacific Clinical Trial Imaging Market Revenue (Billion), by Service, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 29: Asia Pacific Clinical Trial Imaging Market Revenue Share (%), by Service, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 30: Asia Pacific Clinical Trial Imaging Market Revenue (Billion), by Imaging Technique, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 31: Asia Pacific Clinical Trial Imaging Market Revenue Share (%), by Imaging Technique, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 32: Asia Pacific Clinical Trial Imaging Market Revenue (Billion), by Therapeutic Area, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 33: Asia Pacific Clinical Trial Imaging Market Revenue Share (%), by Therapeutic Area, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 34: Asia Pacific Clinical Trial Imaging Market Revenue (Billion), by End user, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 35: Asia Pacific Clinical Trial Imaging Market Revenue Share (%), by End user, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 36: Asia Pacific Clinical Trial Imaging Market Revenue (Billion), by Country 2024 & 2032

- Figure 37: Asia Pacific Clinical Trial Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Clinical Trial Imaging Market Revenue (Billion), by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2024 & 2032

- Figure 39: Latin America Clinical Trial Imaging Market Revenue Share (%), by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2024 & 2032

- Figure 40: Latin America Clinical Trial Imaging Market Revenue (Billion), by Service, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 41: Latin America Clinical Trial Imaging Market Revenue Share (%), by Service, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 42: Latin America Clinical Trial Imaging Market Revenue (Billion), by Imaging Technique, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 43: Latin America Clinical Trial Imaging Market Revenue Share (%), by Imaging Technique, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 44: Latin America Clinical Trial Imaging Market Revenue (Billion), by Therapeutic Area, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 45: Latin America Clinical Trial Imaging Market Revenue Share (%), by Therapeutic Area, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 46: Latin America Clinical Trial Imaging Market Revenue (Billion), by End user, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 47: Latin America Clinical Trial Imaging Market Revenue Share (%), by End user, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 48: Latin America Clinical Trial Imaging Market Revenue (Billion), by Country 2024 & 2032

- Figure 49: Latin America Clinical Trial Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Clinical Trial Imaging Market Revenue (Billion), by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2024 & 2032

- Figure 51: Middle East & Africa Clinical Trial Imaging Market Revenue Share (%), by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2024 & 2032

- Figure 52: Middle East & Africa Clinical Trial Imaging Market Revenue (Billion), by Service, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 53: Middle East & Africa Clinical Trial Imaging Market Revenue Share (%), by Service, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 54: Middle East & Africa Clinical Trial Imaging Market Revenue (Billion), by Imaging Technique, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 55: Middle East & Africa Clinical Trial Imaging Market Revenue Share (%), by Imaging Technique, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 56: Middle East & Africa Clinical Trial Imaging Market Revenue (Billion), by Therapeutic Area, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 57: Middle East & Africa Clinical Trial Imaging Market Revenue Share (%), by Therapeutic Area, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 58: Middle East & Africa Clinical Trial Imaging Market Revenue (Billion), by End user, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 59: Middle East & Africa Clinical Trial Imaging Market Revenue Share (%), by End user, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 60: Middle East & Africa Clinical Trial Imaging Market Revenue (Billion), by Country 2024 & 2032

- Figure 61: Middle East & Africa Clinical Trial Imaging Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2019 & 2032

- Table 3: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Service, 2018 – 2032 (USD Million) 2019 & 2032

- Table 4: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Imaging Technique, 2018 – 2032 (USD Million) 2019 & 2032

- Table 5: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Therapeutic Area, 2018 – 2032 (USD Million) 2019 & 2032

- Table 6: Global Clinical Trial Imaging Market Revenue Billion Forecast, by End user, 2018 – 2032 (USD Million) 2019 & 2032

- Table 7: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 8: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2019 & 2032

- Table 9: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Service, 2018 – 2032 (USD Million) 2019 & 2032

- Table 10: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Imaging Technique, 2018 – 2032 (USD Million) 2019 & 2032

- Table 11: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Therapeutic Area, 2018 – 2032 (USD Million) 2019 & 2032

- Table 12: Global Clinical Trial Imaging Market Revenue Billion Forecast, by End user, 2018 – 2032 (USD Million) 2019 & 2032

- Table 13: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 14: U.S. Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 15: Canada Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2019 & 2032

- Table 17: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Service, 2018 – 2032 (USD Million) 2019 & 2032

- Table 18: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Imaging Technique, 2018 – 2032 (USD Million) 2019 & 2032

- Table 19: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Therapeutic Area, 2018 – 2032 (USD Million) 2019 & 2032

- Table 20: Global Clinical Trial Imaging Market Revenue Billion Forecast, by End user, 2018 – 2032 (USD Million) 2019 & 2032

- Table 21: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 22: Germany Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 23: UK Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 24: France Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 25: Spain Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 26: Italy Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 27: Rest of Europe Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2019 & 2032

- Table 29: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Service, 2018 – 2032 (USD Million) 2019 & 2032

- Table 30: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Imaging Technique, 2018 – 2032 (USD Million) 2019 & 2032

- Table 31: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Therapeutic Area, 2018 – 2032 (USD Million) 2019 & 2032

- Table 32: Global Clinical Trial Imaging Market Revenue Billion Forecast, by End user, 2018 – 2032 (USD Million) 2019 & 2032

- Table 33: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 34: China Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 35: Japan Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 36: India Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 37: Australia Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 38: Rest of Asia Pacific Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 39: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2019 & 2032

- Table 40: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Service, 2018 – 2032 (USD Million) 2019 & 2032

- Table 41: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Imaging Technique, 2018 – 2032 (USD Million) 2019 & 2032

- Table 42: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Therapeutic Area, 2018 – 2032 (USD Million) 2019 & 2032

- Table 43: Global Clinical Trial Imaging Market Revenue Billion Forecast, by End user, 2018 – 2032 (USD Million) 2019 & 2032

- Table 44: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 45: Brazil Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 46: Mexico Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 47: Rest of Latin America Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 48: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Based on imaging techniques, the global clinical trial imaging market is classified into magnetic resonance imaging (MRI), computed tomography (CT) scan, ultrasound, positron emission tomography (PET), echocardiography (ECG), X-ray and other imaging techniques. The magnetic resonance imaging (MRI) segment is expected to reach USD 649.7 million by the end of 2032. 2019 & 2032

- Table 49: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Service, 2018 – 2032 (USD Million) 2019 & 2032

- Table 50: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Imaging Technique, 2018 – 2032 (USD Million) 2019 & 2032

- Table 51: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Therapeutic Area, 2018 – 2032 (USD Million) 2019 & 2032

- Table 52: Global Clinical Trial Imaging Market Revenue Billion Forecast, by End user, 2018 – 2032 (USD Million) 2019 & 2032

- Table 53: Global Clinical Trial Imaging Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 54: South Africa Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 55: Saudi Arabia Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 56: Rest of Middle East & Africa Clinical Trial Imaging Market Revenue (Billion) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)