Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Connected Drug Delivery Devices Market Soars to 347.9 Million, witnessing a CAGR of 28.1 during the forecast period 2025-2033

Connected Drug Delivery Devices Market by Device (Connected sensors, Integrated devices), by Technology (Bluetooth, Near field communication, Wi-Fi), by Application (Anaphylaxis, Respiratory, Cardiovascular, Diabetes, Hormone Replacement, Others), by End-use (Hospital, Clinics, Homecare settings, Others), by North America (U.S., Canada), by Europe (Germany, UK, France, Italy, Spain, Poland, Switzerland, Netherlands), by Asia Pacific (Japan, China, India, Australia, Indonesia, Vietnam, Thailand, South Korea), by Latin America (Mexico, Brazil, Argentina, Colombia, Peru), by Middle East (South Africa, Saudi Arabia, UAE, Israel) Forecast 2025-2033

Key Insights

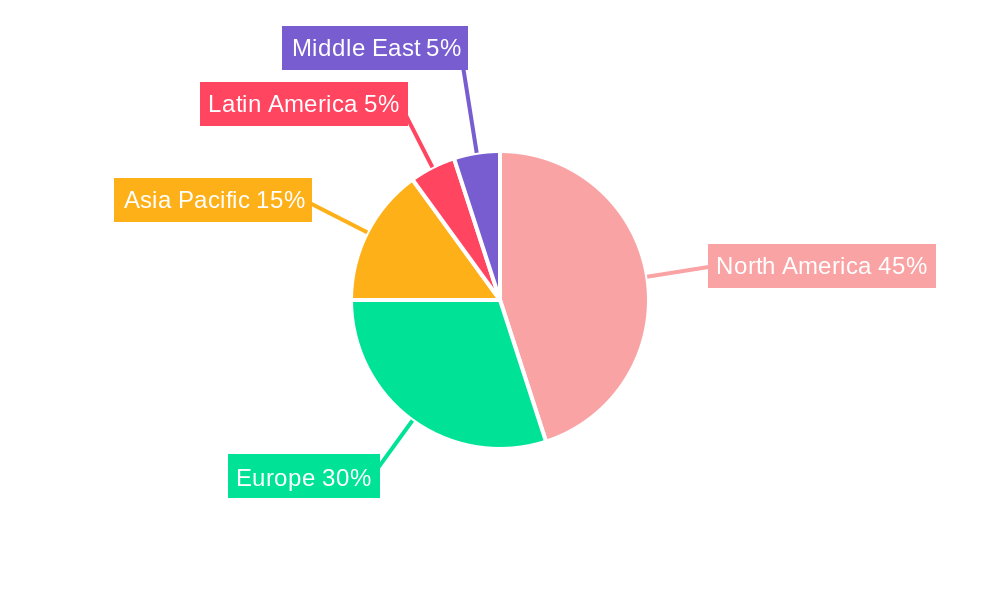

The Connected Drug Delivery Devices market is experiencing robust growth, projected to reach a substantial market size, driven by the increasing prevalence of chronic diseases and the rising demand for improved patient care. The market's Compound Annual Growth Rate (CAGR) of 28.1% from 2019 to 2024 indicates significant momentum. This expansion is fueled by several key factors, including the proliferation of sophisticated connected sensors and integrated devices facilitating remote patient monitoring and personalized medicine. Technological advancements, particularly in Bluetooth, Near Field Communication (NFC), and Wi-Fi connectivity, are enhancing data transmission and accessibility, improving treatment adherence and patient outcomes. The diverse applications across therapeutic areas such as respiratory, cardiovascular, diabetes, and anaphylaxis management further contribute to market growth. Growth is further supported by the increasing adoption of connected devices in hospitals, clinics, and homecare settings, empowering patients with greater control and convenience over their treatment regimens. While challenges like data security concerns and regulatory hurdles exist, the overall market outlook remains positive, with continued innovation and market expansion anticipated across various regions, especially in North America and Asia Pacific. The strategic partnerships between pharmaceutical companies, device manufacturers, and technology providers are accelerating the adoption and integration of these devices, fostering a more streamlined and effective healthcare ecosystem.

The market segmentation reveals significant opportunities within specific device types (connected sensors, integrated devices), communication technologies, and therapeutic applications. Connected inhalation sensors and integrated injectable devices are expected to witness higher demand due to the significant prevalence of related conditions. Regions like North America (especially the U.S.), Europe (Germany and the UK leading the way), and Asia Pacific (China and India showing rapid growth) are expected to dominate the market due to high healthcare expenditure, well-established healthcare infrastructure, and a growing awareness of technological advancements in healthcare. However, Latin America and the Middle East are also projected to experience substantial growth during the forecast period, driven by increasing disposable incomes and rising healthcare investments. This continued growth will be further supported by ongoing research and development focused on improving device functionality, reliability, and user experience, fostering greater patient acceptance and widespread adoption.

Connected Drug Delivery Devices Market Concentration & Characteristics

The connected drug delivery devices market is moderately concentrated, with a few major players holding significant market share. However, the market is characterized by a high level of innovation, with continuous advancements in sensor technology, connectivity protocols, and data analytics capabilities. This leads to a dynamic competitive landscape with frequent product launches and updates.

Concentration Areas:

- North America and Europe: These regions currently hold the largest market share due to higher adoption rates, advanced healthcare infrastructure, and stringent regulatory frameworks driving innovation.

- Integrated Devices: Integrated devices represent a larger market segment compared to connected sensors due to their comprehensive functionalities and improved patient compliance.

- Bluetooth Technology: Bluetooth is the dominant connectivity technology due to its wide compatibility, low power consumption, and cost-effectiveness.

Characteristics:

- High Innovation: Continuous improvements in sensor miniaturization, data security, and integration with electronic health records (EHRs) are driving innovation.

- Regulatory Impact: Stringent regulatory approvals (FDA, EMA) significantly influence market entry and product development, impacting the speed of innovation.

- Product Substitutes: Traditional drug delivery methods remain substitutes, though their limitations in monitoring and compliance are driving a shift towards connected devices.

- End-User Concentration: Hospitals and clinics account for a significant share, but the homecare setting is a rapidly growing segment driven by an aging population and preference for remote monitoring.

- M&A Activity: The market has witnessed several mergers and acquisitions, primarily focused on expanding technological capabilities and market reach. We estimate the M&A activity to have generated approximately $250 million in deal value in the last 5 years.

Connected Drug Delivery Devices Market Trends

The connected drug delivery devices market is experiencing robust growth, driven by several key trends. The rising prevalence of chronic diseases necessitates better patient monitoring and medication adherence, fueling the adoption of these devices. Technological advancements, particularly in miniaturization, data analytics, and wireless connectivity, are enhancing the efficacy and usability of these devices. Furthermore, increasing healthcare expenditure and government initiatives promoting telehealth and remote patient monitoring are contributing significantly to market expansion.

The integration of connected devices with electronic health records (EHRs) and other healthcare IT systems is simplifying data management and enabling better clinical decision-making. This is particularly impactful in managing chronic conditions such as diabetes and respiratory diseases, where continuous monitoring is crucial. Additionally, the development of sophisticated algorithms for data analysis provides valuable insights into patient treatment responses and allows for personalized medication regimens. The increasing demand for personalized medicine is further driving the adoption of connected drug delivery systems that enable tailored dosages and treatment plans. Finally, there's a growing focus on improving patient experience through user-friendly interfaces and mobile applications, boosting acceptance and adherence. We expect the global market value to reach approximately $8 Billion by 2030, representing a Compound Annual Growth Rate (CAGR) of 15%.

Key Region or Country & Segment to Dominate the Market

North America: This region is expected to maintain its leading position due to factors such as high healthcare expenditure, robust technological infrastructure, and early adoption of innovative healthcare solutions. The US alone is projected to account for approximately 60% of the North American market.

Integrated Injectable Devices: This segment is poised for significant growth. Integrated devices offer a combined delivery system and monitoring capabilities, improving patient convenience and compliance. Their higher price point contributes significantly to the overall market revenue. These advantages offset the higher development cost and regulatory hurdles faced by this technology. The increasing prevalence of conditions requiring injectable therapies, such as diabetes and autoimmune disorders, further fuels this growth.

Bluetooth Technology: Bluetooth technology maintains dominance due to its wide adoption and established integration into smartphones and other personal devices. Its relatively lower cost and ease of implementation makes it the preferred choice over other wireless communication protocols. However, competing technologies such as Near Field Communication (NFC) are showing promising growth in niche applications.

Homecare Settings: This segment is experiencing rapid expansion as patients increasingly prefer to manage their health from the convenience of their homes. The capabilities of connected drug delivery devices support this trend by allowing for remote monitoring and reducing hospital readmissions. The growth in this segment is further supported by technological advancements and government initiatives promoting home-based care.

Connected Drug Delivery Devices Market Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the connected drug delivery devices market, covering market size, segmentation, trends, competitive landscape, and future growth projections. The deliverables include detailed market forecasts, in-depth analysis of key players, profiles of leading companies, an assessment of technological advancements, and an evaluation of regulatory frameworks. The report is valuable for stakeholders including manufacturers, suppliers, investors, and healthcare professionals looking to navigate this rapidly evolving market.

Connected Drug Delivery Devices Market Analysis

The global connected drug delivery devices market is experiencing substantial growth, fueled by a confluence of factors, including the rising prevalence of chronic diseases, technological advancements, and supportive regulatory frameworks. Market size, currently estimated at $2.5 billion, is projected to reach $7 billion by 2028. This significant expansion is driven by increasing demand for improved patient outcomes and reduced healthcare costs through enhanced adherence and remote monitoring capabilities. Major players are strategically investing in research and development to enhance device functionality, user experience, and data analytics capabilities.

Market share is currently fragmented, with several companies competing across various segments. However, a consolidation trend is evident, with larger companies acquiring smaller firms to expand their product portfolios and technological expertise. Market growth is influenced by factors such as reimbursement policies, technological advancements, and regulatory approvals. The consistent advancement in sensor technology and data analytics is leading to a more personalized approach to drug delivery and patient management, driving market growth even further. Future growth will likely be determined by the pace of innovation, evolving healthcare policies, and the success of integrating these devices into existing healthcare IT infrastructure.

Connected Drug Delivery Devices Market Regional Insights

- North America

- U.S.: Dominates the market due to high adoption rates, advanced healthcare infrastructure, and robust regulatory framework.

- Canada: Shows steady growth but lags behind the U.S. due to relatively lower healthcare expenditure.

- Europe

- Germany, UK, France: Key markets with strong pharmaceutical industries and significant investments in healthcare technology.

- Italy, Spain, Poland, Switzerland, Netherlands: Exhibiting moderate growth driven by increasing prevalence of chronic diseases and government initiatives.

- Asia Pacific

- Japan, China, India: High growth potential due to a rapidly expanding healthcare sector and rising disposable incomes.

- Australia, Indonesia, Vietnam, Thailand, South Korea: Show moderate growth with increasing focus on digital health solutions.

- Latin America

- Mexico, Brazil, Argentina: Growing markets with increasing healthcare expenditure and adoption of connected healthcare solutions.

- Colombia, Peru: Show moderate growth potential, but with limited market penetration currently.

- Middle East

- South Africa, Saudi Arabia, UAE, Israel: Emerging markets with relatively lower adoption rates compared to developed regions.

Driving Forces: What's Propelling the Connected Drug Delivery Devices Market

The market is primarily driven by the increasing prevalence of chronic diseases, demanding better medication adherence and remote patient monitoring. Technological advancements, including miniaturized sensors, improved data analytics, and robust wireless communication, are key factors. Furthermore, supportive government regulations and initiatives promoting telehealth are accelerating market growth. The growing preference for personalized medicine and improved patient experience also significantly contribute to market expansion.

Challenges and Restraints in Connected Drug Delivery Devices Market

High development costs, stringent regulatory requirements, and concerns regarding data security and privacy pose significant challenges. The need for extensive clinical trials to ensure device safety and efficacy adds to the time and cost involved in market entry. Competition from established drug delivery methods and the potential for high upfront costs for patients can hinder wider adoption. Interoperability issues between different devices and healthcare IT systems also remain a concern.

Emerging Trends in Connected Drug Delivery Devices Market

The integration of artificial intelligence (AI) and machine learning (ML) for personalized treatment regimens and improved data analysis is a major trend. The growing adoption of cloud-based data management platforms for secure data storage and access is another significant development. Furthermore, the focus is shifting towards user-friendly interfaces and mobile applications for better patient engagement and improved medication adherence.

Connected Drug Delivery Devices Industry News

- January 2023: Adherium announced a new partnership to expand its connected inhaler monitoring system.

- June 2022: Propeller Health secured a substantial investment to advance its digital therapeutics platform.

- October 2021: A new clinical trial demonstrated the efficacy of a connected insulin delivery system in improving glycemic control.

Leading Players in the Connected Drug Delivery Devices Market

- Adherium

- Merck

- Phillips Medisize

- Bayer AG

- Nemera

- Findair Sp. z o. o.

- BioCorp Production

- Teva Pharmaceuticals

- Propeller Health

- West Pharmaceutical Services

Connected Drug Delivery Devices Market Segmentation

-

1. Device

-

1.1. Connected sensors

- 1.1.1. Connected inhalation sensors

- 1.1.2. Connected injectable sensors

-

1.2. Integrated devices

- 1.2.1. Integrated inhalation devices

- 1.2.2. Integrated injectable devices

-

1.1. Connected sensors

-

2. Technology

- 2.1. Bluetooth

- 2.2. Near field communication

- 2.3. Wi-Fi

-

3. Application

- 3.1. Anaphylaxis

- 3.2. Respiratory

- 3.3. Cardiovascular

- 3.4. Diabetes

- 3.5. Hormone Replacement

- 3.6. Others

-

4. End-use

- 4.1. Hospital

- 4.2. Clinics

- 4.3. Homecare settings

- 4.4. Others

Connected Drug Delivery Devices Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Poland

- 2.7. Switzerland

- 2.8. Netherlands

-

3. Asia Pacific

- 3.1. Japan

- 3.2. China

- 3.3. India

- 3.4. Australia

- 3.5. Indonesia

- 3.6. Vietnam

- 3.7. Thailand

- 3.8. South Korea

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Colombia

- 4.5. Peru

-

5. Middle East

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. UAE

- 5.4. Israel

Connected Drug Delivery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 28.1% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising patient awareness about adherence to prescribed therapies

- 3.2.2 Rapidly moving healthcare IT infrastructure

- 3.2.3 Soaring adoption of machine learning

- 3.2.4 and artificial intelligence (AI)

- 3.2.5 Rising implementation of telehealth platform integrated with AR/VR technologies

- 3.3. Market Restrains

- 3.3.1 Security concerns regarding patient data

- 3.3.2 High price of the device

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Connected Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Connected sensors

- 5.1.1.1. Connected inhalation sensors

- 5.1.1.2. Connected injectable sensors

- 5.1.2. Integrated devices

- 5.1.2.1. Integrated inhalation devices

- 5.1.2.2. Integrated injectable devices

- 5.1.1. Connected sensors

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Bluetooth

- 5.2.2. Near field communication

- 5.2.3. Wi-Fi

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Anaphylaxis

- 5.3.2. Respiratory

- 5.3.3. Cardiovascular

- 5.3.4. Diabetes

- 5.3.5. Hormone Replacement

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by End-use

- 5.4.1. Hospital

- 5.4.2. Clinics

- 5.4.3. Homecare settings

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. North America Connected Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Connected sensors

- 6.1.1.1. Connected inhalation sensors

- 6.1.1.2. Connected injectable sensors

- 6.1.2. Integrated devices

- 6.1.2.1. Integrated inhalation devices

- 6.1.2.2. Integrated injectable devices

- 6.1.1. Connected sensors

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Bluetooth

- 6.2.2. Near field communication

- 6.2.3. Wi-Fi

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Anaphylaxis

- 6.3.2. Respiratory

- 6.3.3. Cardiovascular

- 6.3.4. Diabetes

- 6.3.5. Hormone Replacement

- 6.3.6. Others

- 6.4. Market Analysis, Insights and Forecast - by End-use

- 6.4.1. Hospital

- 6.4.2. Clinics

- 6.4.3. Homecare settings

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Europe Connected Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Connected sensors

- 7.1.1.1. Connected inhalation sensors

- 7.1.1.2. Connected injectable sensors

- 7.1.2. Integrated devices

- 7.1.2.1. Integrated inhalation devices

- 7.1.2.2. Integrated injectable devices

- 7.1.1. Connected sensors

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Bluetooth

- 7.2.2. Near field communication

- 7.2.3. Wi-Fi

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Anaphylaxis

- 7.3.2. Respiratory

- 7.3.3. Cardiovascular

- 7.3.4. Diabetes

- 7.3.5. Hormone Replacement

- 7.3.6. Others

- 7.4. Market Analysis, Insights and Forecast - by End-use

- 7.4.1. Hospital

- 7.4.2. Clinics

- 7.4.3. Homecare settings

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Asia Pacific Connected Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Connected sensors

- 8.1.1.1. Connected inhalation sensors

- 8.1.1.2. Connected injectable sensors

- 8.1.2. Integrated devices

- 8.1.2.1. Integrated inhalation devices

- 8.1.2.2. Integrated injectable devices

- 8.1.1. Connected sensors

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Bluetooth

- 8.2.2. Near field communication

- 8.2.3. Wi-Fi

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Anaphylaxis

- 8.3.2. Respiratory

- 8.3.3. Cardiovascular

- 8.3.4. Diabetes

- 8.3.5. Hormone Replacement

- 8.3.6. Others

- 8.4. Market Analysis, Insights and Forecast - by End-use

- 8.4.1. Hospital

- 8.4.2. Clinics

- 8.4.3. Homecare settings

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Latin America Connected Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Device

- 9.1.1. Connected sensors

- 9.1.1.1. Connected inhalation sensors

- 9.1.1.2. Connected injectable sensors

- 9.1.2. Integrated devices

- 9.1.2.1. Integrated inhalation devices

- 9.1.2.2. Integrated injectable devices

- 9.1.1. Connected sensors

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Bluetooth

- 9.2.2. Near field communication

- 9.2.3. Wi-Fi

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Anaphylaxis

- 9.3.2. Respiratory

- 9.3.3. Cardiovascular

- 9.3.4. Diabetes

- 9.3.5. Hormone Replacement

- 9.3.6. Others

- 9.4. Market Analysis, Insights and Forecast - by End-use

- 9.4.1. Hospital

- 9.4.2. Clinics

- 9.4.3. Homecare settings

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Device

- 10. Middle East Connected Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Device

- 10.1.1. Connected sensors

- 10.1.1.1. Connected inhalation sensors

- 10.1.1.2. Connected injectable sensors

- 10.1.2. Integrated devices

- 10.1.2.1. Integrated inhalation devices

- 10.1.2.2. Integrated injectable devices

- 10.1.1. Connected sensors

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Bluetooth

- 10.2.2. Near field communication

- 10.2.3. Wi-Fi

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Anaphylaxis

- 10.3.2. Respiratory

- 10.3.3. Cardiovascular

- 10.3.4. Diabetes

- 10.3.5. Hormone Replacement

- 10.3.6. Others

- 10.4. Market Analysis, Insights and Forecast - by End-use

- 10.4.1. Hospital

- 10.4.2. Clinics

- 10.4.3. Homecare settings

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Device

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Adherium

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Phillips Medisize

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nemera

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Findair Sp. z o. o.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BioCorp Production

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Teva Pharmaceuticals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Propeller Health

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 and West Pharmaceutical Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Adherium

- Figure 1: Global Connected Drug Delivery Devices Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Connected Drug Delivery Devices Market Revenue (Million), by Device 2024 & 2032

- Figure 3: North America Connected Drug Delivery Devices Market Revenue Share (%), by Device 2024 & 2032

- Figure 4: North America Connected Drug Delivery Devices Market Revenue (Million), by Technology 2024 & 2032

- Figure 5: North America Connected Drug Delivery Devices Market Revenue Share (%), by Technology 2024 & 2032

- Figure 6: North America Connected Drug Delivery Devices Market Revenue (Million), by Application 2024 & 2032

- Figure 7: North America Connected Drug Delivery Devices Market Revenue Share (%), by Application 2024 & 2032

- Figure 8: North America Connected Drug Delivery Devices Market Revenue (Million), by End-use 2024 & 2032

- Figure 9: North America Connected Drug Delivery Devices Market Revenue Share (%), by End-use 2024 & 2032

- Figure 10: North America Connected Drug Delivery Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Connected Drug Delivery Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Connected Drug Delivery Devices Market Revenue (Million), by Device 2024 & 2032

- Figure 13: Europe Connected Drug Delivery Devices Market Revenue Share (%), by Device 2024 & 2032

- Figure 14: Europe Connected Drug Delivery Devices Market Revenue (Million), by Technology 2024 & 2032

- Figure 15: Europe Connected Drug Delivery Devices Market Revenue Share (%), by Technology 2024 & 2032

- Figure 16: Europe Connected Drug Delivery Devices Market Revenue (Million), by Application 2024 & 2032

- Figure 17: Europe Connected Drug Delivery Devices Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Connected Drug Delivery Devices Market Revenue (Million), by End-use 2024 & 2032

- Figure 19: Europe Connected Drug Delivery Devices Market Revenue Share (%), by End-use 2024 & 2032

- Figure 20: Europe Connected Drug Delivery Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Connected Drug Delivery Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Connected Drug Delivery Devices Market Revenue (Million), by Device 2024 & 2032

- Figure 23: Asia Pacific Connected Drug Delivery Devices Market Revenue Share (%), by Device 2024 & 2032

- Figure 24: Asia Pacific Connected Drug Delivery Devices Market Revenue (Million), by Technology 2024 & 2032

- Figure 25: Asia Pacific Connected Drug Delivery Devices Market Revenue Share (%), by Technology 2024 & 2032

- Figure 26: Asia Pacific Connected Drug Delivery Devices Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Connected Drug Delivery Devices Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Connected Drug Delivery Devices Market Revenue (Million), by End-use 2024 & 2032

- Figure 29: Asia Pacific Connected Drug Delivery Devices Market Revenue Share (%), by End-use 2024 & 2032

- Figure 30: Asia Pacific Connected Drug Delivery Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Connected Drug Delivery Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Connected Drug Delivery Devices Market Revenue (Million), by Device 2024 & 2032

- Figure 33: Latin America Connected Drug Delivery Devices Market Revenue Share (%), by Device 2024 & 2032

- Figure 34: Latin America Connected Drug Delivery Devices Market Revenue (Million), by Technology 2024 & 2032

- Figure 35: Latin America Connected Drug Delivery Devices Market Revenue Share (%), by Technology 2024 & 2032

- Figure 36: Latin America Connected Drug Delivery Devices Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Latin America Connected Drug Delivery Devices Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Latin America Connected Drug Delivery Devices Market Revenue (Million), by End-use 2024 & 2032

- Figure 39: Latin America Connected Drug Delivery Devices Market Revenue Share (%), by End-use 2024 & 2032

- Figure 40: Latin America Connected Drug Delivery Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America Connected Drug Delivery Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East Connected Drug Delivery Devices Market Revenue (Million), by Device 2024 & 2032

- Figure 43: Middle East Connected Drug Delivery Devices Market Revenue Share (%), by Device 2024 & 2032

- Figure 44: Middle East Connected Drug Delivery Devices Market Revenue (Million), by Technology 2024 & 2032

- Figure 45: Middle East Connected Drug Delivery Devices Market Revenue Share (%), by Technology 2024 & 2032

- Figure 46: Middle East Connected Drug Delivery Devices Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East Connected Drug Delivery Devices Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East Connected Drug Delivery Devices Market Revenue (Million), by End-use 2024 & 2032

- Figure 49: Middle East Connected Drug Delivery Devices Market Revenue Share (%), by End-use 2024 & 2032

- Figure 50: Middle East Connected Drug Delivery Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East Connected Drug Delivery Devices Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 3: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 6: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 8: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 9: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 11: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: U.S. Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 15: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 18: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Germany Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: UK Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: France Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Italy Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Spain Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Poland Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Switzerland Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Netherlands Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 28: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 29: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 31: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Japan Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: China Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: India Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Australia Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Indonesia Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Vietnam Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Thailand Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 41: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 42: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 43: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 44: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: Mexico Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Brazil Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Argentina Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Colombia Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Peru Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 51: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 52: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 53: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 54: Global Connected Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: South Africa Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Saudi Arabia Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: UAE Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Israel Connected Drug Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)