Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

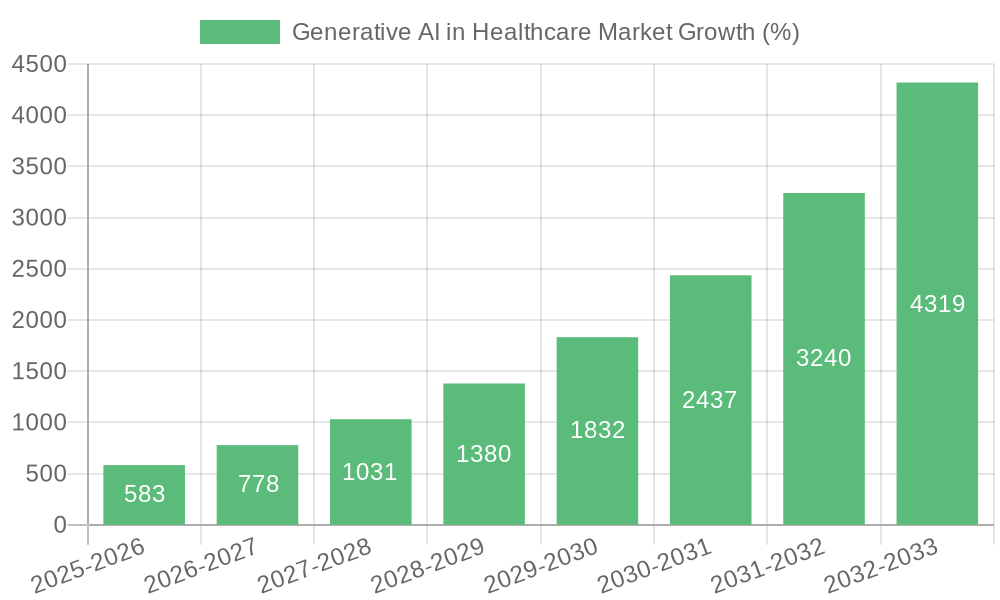

Generative AI in Healthcare Market 2025-2033 Trends: Unveiling Growth Opportunities and Competitor Dynamics

Generative AI in Healthcare Market by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. (Similarly, in August 2023, Cognizant expanded collaboration with Google Cloud, utilizing generative AI to enhance administrative processes, aiming for cost optimization and improved user experiences. This collaborative partnership aimed to strengthen the healthcare solutions, improved business efficiencies, and enhanced user experiences., Therefore, as the industry prioritized data-driven decision-making, generative AI's predictive capabilities became increasingly vital, contributing to improved patient outcomes and revolutionizing healthcare delivery. The convergence of the aforementioned drivers highlighted the generative AI's demand in coming years.), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. (Healthcare providers, including hospitals, clinics, and diagnostic centers, emerged as dominant players in the generative AI in healthcare market. Their prominence is attributed to leveraging generative AI to streamline medical processes, enhance diagnostics, and optimize patient care. Also, the application of generative AI technologies within these healthcare settings has led to improved efficiency, accuracy in diagnostics, and overall advancements in healthcare delivery, establishing healthcare providers as key drivers of innovation and progress in the evolving landscape of healthcare technology.), by Application, 2018 – 2032 (USD Million) (Personalized treatment plans, Virtual patient assistance, Patient monitoring and predictive analytics, Medical image analysis and diagnostics, Drug discovery and development, Other applications), by End-use, 2018 – 2032 (USD Million) (Healthcare providers, Pharmaceutical and life science companies, Healthcare payers), by North America (U.S., Canada), by Europe (Germany, UK, France, Spain, Italy, Rest of Europe), by Asia Pacific (China, Japan, India, Australia, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Rest of Latin America), by Middle East & Africa (South Africa, Saudi Arabia, Rest of Middle East & Africa) Forecast 2025-2033

Key Insights

The Generative AI in Healthcare market is experiencing explosive growth, projected to reach a market size of $1.8 billion in 2025, expanding at a remarkable Compound Annual Growth Rate (CAGR) of 32.6%. This rapid expansion is fueled by several key drivers. Firstly, the increasing adoption of data-driven decision-making within healthcare organizations is creating a significant demand for generative AI's predictive capabilities. This allows for more accurate diagnoses, personalized treatment plans, and optimized resource allocation, ultimately leading to improved patient outcomes. Secondly, the industry's ongoing digital transformation, exemplified by initiatives like Merck's introduction of Aiddison and Cognizant's collaboration with Google Cloud, is accelerating the integration of generative AI into existing workflows. These partnerships and new software solutions streamline administrative processes, enhance drug discovery, and improve overall efficiency. Finally, the diverse applications of generative AI across healthcare, from personalized medicine and virtual patient assistance to medical image analysis and drug development, are driving market expansion across various segments. The healthcare providers segment, encompassing hospitals, clinics, and diagnostic centers, currently dominates the market, leveraging generative AI for enhanced diagnostics, streamlined processes, and improved patient care. This segment's projected value of $11.8 billion by 2032 underscores its significant contribution to the overall market growth.

The market's segmentation by application (personalized treatment plans, virtual patient assistance, etc.) and end-use (healthcare providers, pharmaceutical companies, payers) reveals a complex but rapidly evolving landscape. While the healthcare providers segment currently leads, the pharmaceutical and life science sectors are also significant adopters, leveraging generative AI for faster and more efficient drug discovery and development. Geographical distribution shows strong growth across North America and Europe, but the Asia-Pacific region is poised for significant expansion given its burgeoning healthcare infrastructure and increasing investment in digital health technologies. Competition is fierce, with major players like IBM Watson Health, Google Cloud, Microsoft, and several specialized health-tech companies vying for market share through strategic partnerships, innovative software development, and robust data analytics capabilities. The continued focus on improving patient care, optimizing operational efficiency, and accelerating drug discovery will undoubtedly sustain the high growth trajectory of the generative AI in healthcare market in the coming years.

Generative AI in Healthcare Market Concentration & Characteristics

The Generative AI in Healthcare market is characterized by a moderate level of concentration, with a few large players like IBM Watson Health, Google, and Microsoft competing alongside numerous smaller, specialized firms. Innovation is concentrated around specific applications, such as drug discovery, medical image analysis, and personalized medicine. However, the market is rapidly expanding, with new entrants and innovative applications emerging constantly.

- Concentration Areas: Drug discovery, medical imaging, personalized medicine, administrative task automation.

- Characteristics of Innovation: Rapid iteration of models, increasing focus on explainability and bias mitigation, integration with existing healthcare infrastructure (EHRs, etc.).

- Impact of Regulations: Stringent data privacy regulations (HIPAA, GDPR) significantly impact data access and model development. Regulatory hurdles for AI-driven medical devices and diagnostic tools also present challenges. Clearer regulatory frameworks are needed to encourage innovation while ensuring safety and ethical considerations.

- Product Substitutes: Traditional methods of drug discovery, manual medical image analysis, and human-driven administrative tasks serve as substitutes, though the efficiency and potential of generative AI are rapidly making these alternatives less competitive.

- End-User Concentration: Healthcare providers (hospitals, clinics) currently represent the largest segment of end-users, driven by the immediate benefits of improved efficiency and diagnostic accuracy.

- Level of M&A: The market is witnessing increased mergers and acquisitions activity as larger players acquire smaller companies with specialized AI capabilities to expand their product portfolios and market share. This is expected to continue, leading to further consolidation in the coming years. We project a significant increase in M&A activity over the next 5 years, fueled by the rapid growth and potential of this market segment.

Generative AI in Healthcare Market Trends

The Generative AI in Healthcare market is experiencing explosive growth, driven by several key trends. The increasing availability of large, high-quality healthcare datasets is fueling the development of more sophisticated and accurate AI models. This data, combined with advancements in deep learning and natural language processing, enables the creation of applications that were previously inconceivable. The focus is shifting from simply automating existing tasks to generating entirely new insights and capabilities. This includes personalized medicine, where AI models tailor treatments based on individual patient characteristics, leading to improved outcomes and reduced side effects. The rising cost of healthcare and the increasing demand for efficient and cost-effective solutions are further driving adoption.

The integration of generative AI with existing healthcare infrastructure, such as Electronic Health Records (EHRs), is also a major trend. This seamless integration streamlines workflows and enhances the usability of AI tools for healthcare professionals. Simultaneously, advancements in cloud computing are providing the necessary infrastructure to support the computationally intensive tasks involved in training and deploying generative AI models. Furthermore, the collaborative efforts between tech giants (Google, Microsoft, etc.) and healthcare organizations are accelerating innovation and fostering the development of cutting-edge solutions. This trend will continue to fuel significant growth and will further drive the market towards more sophisticated applications and better integration with existing healthcare systems. The increasing emphasis on data security and privacy is also shaping the development of robust and compliant AI solutions. This trend will ensure ethical and responsible use of sensitive patient data. The rising investment in research and development is boosting the pace of innovation, leading to improved accuracy, efficiency, and effectiveness of generative AI applications in healthcare.

The global market is projected to surpass USD 50 billion by 2032, reflecting the substantial impact of these trends.

Key Region or Country & Segment to Dominate the Market

The North American market, particularly the United States, is currently the largest and fastest-growing segment of the Generative AI in Healthcare market. This dominance stems from several factors:

- High adoption rates: The US healthcare system is at the forefront of technology adoption, particularly in data-driven approaches.

- Significant investment: substantial private and public investment fuels the development and deployment of AI solutions.

- Strong regulatory frameworks (although complex): While complex, the regulatory landscape is relatively advanced compared to other regions, providing a structured environment for the development and deployment of AI in healthcare.

- Presence of major players: Numerous leading technology companies and healthcare organizations are based in North America, fueling innovation and competition.

However, other regions are rapidly catching up. The European market is expected to experience significant growth, driven by increasing investments in healthcare technology and growing awareness of the potential of AI. Similarly, the Asia-Pacific region is poised for substantial expansion, particularly in countries like China and India, where large populations and rapidly developing healthcare systems are creating significant opportunities.

The healthcare providers segment will continue to dominate the market due to the direct benefits to patient care and operational efficiency. This segment encompasses hospitals, clinics, and diagnostic centers, all benefiting from using AI for tasks such as medical image analysis, personalized medicine, and administrative workflow improvement. The market size for healthcare providers is projected to reach USD 25 Billion by 2032. This segment is expected to maintain its leadership in the coming years, driven by ongoing efforts to optimize patient care and healthcare delivery.

Generative AI in Healthcare Market Product Insights Report Coverage & Deliverables

This report provides comprehensive market analysis, including detailed segmentation by application (drug discovery, medical imaging, personalized treatment plans, virtual patient assistance, etc.) and end-use (healthcare providers, pharmaceutical companies, payers). It examines market size, growth projections, and key trends, analyzing leading players, emerging technologies, and regulatory landscape impacts. The report also includes detailed regional analyses and future outlook for market participants, highlighting challenges and opportunities for growth.

Generative AI in Healthcare Market Analysis

The Generative AI in Healthcare market is experiencing substantial growth, driven by technological advancements and the increasing need for efficient and effective healthcare solutions. The market size was valued at approximately USD 8 billion in 2023 and is projected to reach USD 45 Billion by 2028, and exceed USD 50 billion by 2032, exhibiting a Compound Annual Growth Rate (CAGR) of over 30% during this period. This growth is propelled by several factors, including the increasing availability of large healthcare datasets, advancements in deep learning and natural language processing, and the rising adoption of AI-powered solutions by healthcare providers.

The market share is currently concentrated among a few major players such as IBM Watson Health, Google, Microsoft, and several smaller specialized firms. However, this landscape is dynamic and evolving, with new entrants continuously emerging. As the technology matures and becomes more accessible, we expect the market share to become more fragmented in the coming years. The competitive landscape is marked by intense innovation and collaboration, with companies partnering to integrate their technologies and expand their offerings. The healthcare providers segment currently holds the largest market share, followed by pharmaceutical and life sciences companies and healthcare payers. This distribution is likely to remain relatively stable in the short term, although the increasing adoption of AI across the healthcare value chain may lead to shifts in the future.

Generative AI in Healthcare Market Regional Insights

- North America:

- U.S.

- Canada

- Europe:

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific:

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

- Latin America:

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa:

- South Africa

- Saudi Arabia

- Rest of Middle East & Africa

North America, particularly the US, currently dominates the market. However, Europe and the Asia-Pacific region are demonstrating strong growth potential, fueled by increasing healthcare investments and digitalization.

Driving Forces: What's Propelling the Generative AI in Healthcare Market

- Increasing availability of large, high-quality healthcare datasets.

- Advancements in deep learning and natural language processing.

- Rising demand for personalized medicine and improved patient outcomes.

- Growing need for efficient and cost-effective healthcare solutions.

- Increased investment in AI research and development.

- Growing adoption of cloud computing and related infrastructure.

Challenges and Restraints in Generative AI in Healthcare Market

- Data privacy and security concerns.

- Regulatory hurdles and compliance requirements.

- Lack of standardized data formats and interoperability issues.

- High computational costs associated with training and deploying AI models.

- Concerns about algorithm bias and fairness.

- Shortage of skilled professionals to develop and implement AI solutions.

Emerging Trends in Generative AI in Healthcare Market

- Increased focus on explainable AI (XAI) to build trust and transparency.

- Growing use of federated learning to address data privacy concerns.

- Development of more robust and secure AI models resistant to adversarial attacks.

- Integration of generative AI with other healthcare technologies (e.g., IoT, blockchain).

- Expansion into new applications such as drug repurposing and personalized diagnostics.

Generative AI in Healthcare Industry News

- October 2023: Harman launched HealthGPT, a healthcare-focused large language model (LLM).

- September 2023: Oracle introduced a generative AI service for healthcare organizations, the Oracle Clinical Digital Assistant.

Leading Players in the Generative AI in Healthcare Market

- Epic Systems Corporation

- DiagnaMed Holdings Corp.

- Syntegra Medical Mind

- IBM Watson Health Corporation

- Google LLC

- Oracle Corporation

- Microsoft Corporation

- Nvidia Corporation

- Insilico Medicine

- Abridge AI Inc.

- ELEKS

- Persistent Systems

Generative AI in Healthcare Market Segmentation

-

1. Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 1.1. Similarly, in August 2023, Cognizant expanded collaboration with Google Cloud, utilizing generative AI to enhance administrative processes, aiming for cost optimization and improved user experiences. This collaborative partnership aimed to strengthen the healthcare solutions, improved business efficiencies, and enhanced user experiences.

- 1.2. Therefore, as the industry prioritized data-driven decision-making, generative AI's predictive capabilities became increasingly vital, contributing to improved patient outcomes and revolutionizing healthcare delivery. The convergence of the aforementioned drivers highlighted the generative AI's demand in coming years.

-

2. Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032.

- 2.1. Healthcare providers, including hospitals, clinics, and diagnostic centers, emerged as dominant players in the generative AI in healthcare market. Their prominence is attributed to leveraging generative AI to streamline medical processes, enhance diagnostics, and optimize patient care. Also, the application of generative AI technologies within these healthcare settings has led to improved efficiency, accuracy in diagnostics, and overall advancements in healthcare delivery, establishing healthcare providers as key drivers of innovation and progress in the evolving landscape of healthcare technology.

-

3. Application, 2018 – 2032 (USD Million)

- 3.1. Personalized treatment plans

- 3.2. Virtual patient assistance

- 3.3. Patient monitoring and predictive analytics

- 3.4. Medical image analysis and diagnostics

- 3.5. Drug discovery and development

- 3.6. Other applications

-

4. End-use, 2018 – 2032 (USD Million)

-

4.1. Healthcare providers

- 4.1.1. Hospitals

- 4.1.2. Clinics

- 4.1.3. Diagnostic centers

- 4.1.4. Other healthcare providers

- 4.2. Pharmaceutical and life science companies

- 4.3. Healthcare payers

-

4.1. Healthcare providers

Generative AI in Healthcare Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East & Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East & Africa

Generative AI in Healthcare Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 32.6% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing demand for precision medicine and treatment

- 3.2.2 Increasing focus on enhancing medical imaging

- 3.2.3 Expanding advancement in AI

- 3.2.4 Increasing venture funding

- 3.3. Market Restrains

- 3.3.1 Data privacy and security concerns

- 3.3.2 Regulatory compliance

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Generative AI in Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 5.1.1. Similarly, in August 2023, Cognizant expanded collaboration with Google Cloud, utilizing generative AI to enhance administrative processes, aiming for cost optimization and improved user experiences. This collaborative partnership aimed to strengthen the healthcare solutions, improved business efficiencies, and enhanced user experiences.

- 5.1.2. Therefore, as the industry prioritized data-driven decision-making, generative AI's predictive capabilities became increasingly vital, contributing to improved patient outcomes and revolutionizing healthcare delivery. The convergence of the aforementioned drivers highlighted the generative AI's demand in coming years.

- 5.2. Market Analysis, Insights and Forecast - by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032.

- 5.2.1. Healthcare providers, including hospitals, clinics, and diagnostic centers, emerged as dominant players in the generative AI in healthcare market. Their prominence is attributed to leveraging generative AI to streamline medical processes, enhance diagnostics, and optimize patient care. Also, the application of generative AI technologies within these healthcare settings has led to improved efficiency, accuracy in diagnostics, and overall advancements in healthcare delivery, establishing healthcare providers as key drivers of innovation and progress in the evolving landscape of healthcare technology.

- 5.3. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 5.3.1. Personalized treatment plans

- 5.3.2. Virtual patient assistance

- 5.3.3. Patient monitoring and predictive analytics

- 5.3.4. Medical image analysis and diagnostics

- 5.3.5. Drug discovery and development

- 5.3.6. Other applications

- 5.4. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 5.4.1. Healthcare providers

- 5.4.1.1. Hospitals

- 5.4.1.2. Clinics

- 5.4.1.3. Diagnostic centers

- 5.4.1.4. Other healthcare providers

- 5.4.2. Pharmaceutical and life science companies

- 5.4.3. Healthcare payers

- 5.4.1. Healthcare providers

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East & Africa

- 5.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 6. North America Generative AI in Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 6.1.1. Similarly, in August 2023, Cognizant expanded collaboration with Google Cloud, utilizing generative AI to enhance administrative processes, aiming for cost optimization and improved user experiences. This collaborative partnership aimed to strengthen the healthcare solutions, improved business efficiencies, and enhanced user experiences.

- 6.1.2. Therefore, as the industry prioritized data-driven decision-making, generative AI's predictive capabilities became increasingly vital, contributing to improved patient outcomes and revolutionizing healthcare delivery. The convergence of the aforementioned drivers highlighted the generative AI's demand in coming years.

- 6.2. Market Analysis, Insights and Forecast - by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032.

- 6.2.1. Healthcare providers, including hospitals, clinics, and diagnostic centers, emerged as dominant players in the generative AI in healthcare market. Their prominence is attributed to leveraging generative AI to streamline medical processes, enhance diagnostics, and optimize patient care. Also, the application of generative AI technologies within these healthcare settings has led to improved efficiency, accuracy in diagnostics, and overall advancements in healthcare delivery, establishing healthcare providers as key drivers of innovation and progress in the evolving landscape of healthcare technology.

- 6.3. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 6.3.1. Personalized treatment plans

- 6.3.2. Virtual patient assistance

- 6.3.3. Patient monitoring and predictive analytics

- 6.3.4. Medical image analysis and diagnostics

- 6.3.5. Drug discovery and development

- 6.3.6. Other applications

- 6.4. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 6.4.1. Healthcare providers

- 6.4.1.1. Hospitals

- 6.4.1.2. Clinics

- 6.4.1.3. Diagnostic centers

- 6.4.1.4. Other healthcare providers

- 6.4.2. Pharmaceutical and life science companies

- 6.4.3. Healthcare payers

- 6.4.1. Healthcare providers

- 6.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 7. Europe Generative AI in Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 7.1.1. Similarly, in August 2023, Cognizant expanded collaboration with Google Cloud, utilizing generative AI to enhance administrative processes, aiming for cost optimization and improved user experiences. This collaborative partnership aimed to strengthen the healthcare solutions, improved business efficiencies, and enhanced user experiences.

- 7.1.2. Therefore, as the industry prioritized data-driven decision-making, generative AI's predictive capabilities became increasingly vital, contributing to improved patient outcomes and revolutionizing healthcare delivery. The convergence of the aforementioned drivers highlighted the generative AI's demand in coming years.

- 7.2. Market Analysis, Insights and Forecast - by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032.

- 7.2.1. Healthcare providers, including hospitals, clinics, and diagnostic centers, emerged as dominant players in the generative AI in healthcare market. Their prominence is attributed to leveraging generative AI to streamline medical processes, enhance diagnostics, and optimize patient care. Also, the application of generative AI technologies within these healthcare settings has led to improved efficiency, accuracy in diagnostics, and overall advancements in healthcare delivery, establishing healthcare providers as key drivers of innovation and progress in the evolving landscape of healthcare technology.

- 7.3. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 7.3.1. Personalized treatment plans

- 7.3.2. Virtual patient assistance

- 7.3.3. Patient monitoring and predictive analytics

- 7.3.4. Medical image analysis and diagnostics

- 7.3.5. Drug discovery and development

- 7.3.6. Other applications

- 7.4. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 7.4.1. Healthcare providers

- 7.4.1.1. Hospitals

- 7.4.1.2. Clinics

- 7.4.1.3. Diagnostic centers

- 7.4.1.4. Other healthcare providers

- 7.4.2. Pharmaceutical and life science companies

- 7.4.3. Healthcare payers

- 7.4.1. Healthcare providers

- 7.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 8. Asia Pacific Generative AI in Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 8.1.1. Similarly, in August 2023, Cognizant expanded collaboration with Google Cloud, utilizing generative AI to enhance administrative processes, aiming for cost optimization and improved user experiences. This collaborative partnership aimed to strengthen the healthcare solutions, improved business efficiencies, and enhanced user experiences.

- 8.1.2. Therefore, as the industry prioritized data-driven decision-making, generative AI's predictive capabilities became increasingly vital, contributing to improved patient outcomes and revolutionizing healthcare delivery. The convergence of the aforementioned drivers highlighted the generative AI's demand in coming years.

- 8.2. Market Analysis, Insights and Forecast - by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032.

- 8.2.1. Healthcare providers, including hospitals, clinics, and diagnostic centers, emerged as dominant players in the generative AI in healthcare market. Their prominence is attributed to leveraging generative AI to streamline medical processes, enhance diagnostics, and optimize patient care. Also, the application of generative AI technologies within these healthcare settings has led to improved efficiency, accuracy in diagnostics, and overall advancements in healthcare delivery, establishing healthcare providers as key drivers of innovation and progress in the evolving landscape of healthcare technology.

- 8.3. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 8.3.1. Personalized treatment plans

- 8.3.2. Virtual patient assistance

- 8.3.3. Patient monitoring and predictive analytics

- 8.3.4. Medical image analysis and diagnostics

- 8.3.5. Drug discovery and development

- 8.3.6. Other applications

- 8.4. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 8.4.1. Healthcare providers

- 8.4.1.1. Hospitals

- 8.4.1.2. Clinics

- 8.4.1.3. Diagnostic centers

- 8.4.1.4. Other healthcare providers

- 8.4.2. Pharmaceutical and life science companies

- 8.4.3. Healthcare payers

- 8.4.1. Healthcare providers

- 8.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 9. Latin America Generative AI in Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 9.1.1. Similarly, in August 2023, Cognizant expanded collaboration with Google Cloud, utilizing generative AI to enhance administrative processes, aiming for cost optimization and improved user experiences. This collaborative partnership aimed to strengthen the healthcare solutions, improved business efficiencies, and enhanced user experiences.

- 9.1.2. Therefore, as the industry prioritized data-driven decision-making, generative AI's predictive capabilities became increasingly vital, contributing to improved patient outcomes and revolutionizing healthcare delivery. The convergence of the aforementioned drivers highlighted the generative AI's demand in coming years.

- 9.2. Market Analysis, Insights and Forecast - by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032.

- 9.2.1. Healthcare providers, including hospitals, clinics, and diagnostic centers, emerged as dominant players in the generative AI in healthcare market. Their prominence is attributed to leveraging generative AI to streamline medical processes, enhance diagnostics, and optimize patient care. Also, the application of generative AI technologies within these healthcare settings has led to improved efficiency, accuracy in diagnostics, and overall advancements in healthcare delivery, establishing healthcare providers as key drivers of innovation and progress in the evolving landscape of healthcare technology.

- 9.3. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 9.3.1. Personalized treatment plans

- 9.3.2. Virtual patient assistance

- 9.3.3. Patient monitoring and predictive analytics

- 9.3.4. Medical image analysis and diagnostics

- 9.3.5. Drug discovery and development

- 9.3.6. Other applications

- 9.4. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 9.4.1. Healthcare providers

- 9.4.1.1. Hospitals

- 9.4.1.2. Clinics

- 9.4.1.3. Diagnostic centers

- 9.4.1.4. Other healthcare providers

- 9.4.2. Pharmaceutical and life science companies

- 9.4.3. Healthcare payers

- 9.4.1. Healthcare providers

- 9.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 10. Middle East & Africa Generative AI in Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 10.1.1. Similarly, in August 2023, Cognizant expanded collaboration with Google Cloud, utilizing generative AI to enhance administrative processes, aiming for cost optimization and improved user experiences. This collaborative partnership aimed to strengthen the healthcare solutions, improved business efficiencies, and enhanced user experiences.

- 10.1.2. Therefore, as the industry prioritized data-driven decision-making, generative AI's predictive capabilities became increasingly vital, contributing to improved patient outcomes and revolutionizing healthcare delivery. The convergence of the aforementioned drivers highlighted the generative AI's demand in coming years.

- 10.2. Market Analysis, Insights and Forecast - by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032.

- 10.2.1. Healthcare providers, including hospitals, clinics, and diagnostic centers, emerged as dominant players in the generative AI in healthcare market. Their prominence is attributed to leveraging generative AI to streamline medical processes, enhance diagnostics, and optimize patient care. Also, the application of generative AI technologies within these healthcare settings has led to improved efficiency, accuracy in diagnostics, and overall advancements in healthcare delivery, establishing healthcare providers as key drivers of innovation and progress in the evolving landscape of healthcare technology.

- 10.3. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 10.3.1. Personalized treatment plans

- 10.3.2. Virtual patient assistance

- 10.3.3. Patient monitoring and predictive analytics

- 10.3.4. Medical image analysis and diagnostics

- 10.3.5. Drug discovery and development

- 10.3.6. Other applications

- 10.4. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 10.4.1. Healthcare providers

- 10.4.1.1. Hospitals

- 10.4.1.2. Clinics

- 10.4.1.3. Diagnostic centers

- 10.4.1.4. Other healthcare providers

- 10.4.2. Pharmaceutical and life science companies

- 10.4.3. Healthcare payers

- 10.4.1. Healthcare providers

- 10.1. Market Analysis, Insights and Forecast - by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process.

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Epic Systems Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DiagnaMed Holdings Corp.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Syntegra Medical Mind

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Watson Health Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Google LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oracle Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microsoft Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nvidia Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Insilico Medicine

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Abridge AI Inc.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ELEKS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Persistent Systems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Epic Systems Corporation

- Figure 1: Global Generative AI in Healthcare Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Generative AI in Healthcare Market Revenue (Billion), by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2024 & 2032

- Figure 3: North America Generative AI in Healthcare Market Revenue Share (%), by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2024 & 2032

- Figure 4: North America Generative AI in Healthcare Market Revenue (Billion), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2024 & 2032

- Figure 5: North America Generative AI in Healthcare Market Revenue Share (%), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2024 & 2032

- Figure 6: North America Generative AI in Healthcare Market Revenue (Billion), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 7: North America Generative AI in Healthcare Market Revenue Share (%), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 8: North America Generative AI in Healthcare Market Revenue (Billion), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 9: North America Generative AI in Healthcare Market Revenue Share (%), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 10: North America Generative AI in Healthcare Market Revenue (Billion), by Country 2024 & 2032

- Figure 11: North America Generative AI in Healthcare Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Generative AI in Healthcare Market Revenue (Billion), by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2024 & 2032

- Figure 13: Europe Generative AI in Healthcare Market Revenue Share (%), by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2024 & 2032

- Figure 14: Europe Generative AI in Healthcare Market Revenue (Billion), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2024 & 2032

- Figure 15: Europe Generative AI in Healthcare Market Revenue Share (%), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2024 & 2032

- Figure 16: Europe Generative AI in Healthcare Market Revenue (Billion), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 17: Europe Generative AI in Healthcare Market Revenue Share (%), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 18: Europe Generative AI in Healthcare Market Revenue (Billion), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 19: Europe Generative AI in Healthcare Market Revenue Share (%), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 20: Europe Generative AI in Healthcare Market Revenue (Billion), by Country 2024 & 2032

- Figure 21: Europe Generative AI in Healthcare Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Generative AI in Healthcare Market Revenue (Billion), by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2024 & 2032

- Figure 23: Asia Pacific Generative AI in Healthcare Market Revenue Share (%), by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2024 & 2032

- Figure 24: Asia Pacific Generative AI in Healthcare Market Revenue (Billion), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2024 & 2032

- Figure 25: Asia Pacific Generative AI in Healthcare Market Revenue Share (%), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2024 & 2032

- Figure 26: Asia Pacific Generative AI in Healthcare Market Revenue (Billion), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 27: Asia Pacific Generative AI in Healthcare Market Revenue Share (%), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 28: Asia Pacific Generative AI in Healthcare Market Revenue (Billion), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 29: Asia Pacific Generative AI in Healthcare Market Revenue Share (%), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 30: Asia Pacific Generative AI in Healthcare Market Revenue (Billion), by Country 2024 & 2032

- Figure 31: Asia Pacific Generative AI in Healthcare Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Generative AI in Healthcare Market Revenue (Billion), by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2024 & 2032

- Figure 33: Latin America Generative AI in Healthcare Market Revenue Share (%), by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2024 & 2032

- Figure 34: Latin America Generative AI in Healthcare Market Revenue (Billion), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2024 & 2032

- Figure 35: Latin America Generative AI in Healthcare Market Revenue Share (%), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2024 & 2032

- Figure 36: Latin America Generative AI in Healthcare Market Revenue (Billion), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 37: Latin America Generative AI in Healthcare Market Revenue Share (%), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 38: Latin America Generative AI in Healthcare Market Revenue (Billion), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 39: Latin America Generative AI in Healthcare Market Revenue Share (%), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 40: Latin America Generative AI in Healthcare Market Revenue (Billion), by Country 2024 & 2032

- Figure 41: Latin America Generative AI in Healthcare Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East & Africa Generative AI in Healthcare Market Revenue (Billion), by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2024 & 2032

- Figure 43: Middle East & Africa Generative AI in Healthcare Market Revenue Share (%), by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2024 & 2032

- Figure 44: Middle East & Africa Generative AI in Healthcare Market Revenue (Billion), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2024 & 2032

- Figure 45: Middle East & Africa Generative AI in Healthcare Market Revenue Share (%), by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2024 & 2032

- Figure 46: Middle East & Africa Generative AI in Healthcare Market Revenue (Billion), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 47: Middle East & Africa Generative AI in Healthcare Market Revenue Share (%), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 48: Middle East & Africa Generative AI in Healthcare Market Revenue (Billion), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 49: Middle East & Africa Generative AI in Healthcare Market Revenue Share (%), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 50: Middle East & Africa Generative AI in Healthcare Market Revenue (Billion), by Country 2024 & 2032

- Figure 51: Middle East & Africa Generative AI in Healthcare Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2019 & 2032

- Table 3: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2019 & 2032

- Table 4: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 5: Global Generative AI in Healthcare Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 6: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 7: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2019 & 2032

- Table 8: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2019 & 2032

- Table 9: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 10: Global Generative AI in Healthcare Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 11: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 12: U.S. Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 13: Canada Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 14: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2019 & 2032

- Table 15: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2019 & 2032

- Table 16: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 17: Global Generative AI in Healthcare Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 18: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 19: Germany Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: UK Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 21: France Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Spain Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 23: Italy Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 25: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2019 & 2032

- Table 26: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2019 & 2032

- Table 27: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 28: Global Generative AI in Healthcare Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 29: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 30: China Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 31: Japan Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: India Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 33: Australia Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 34: Rest of Asia Pacific Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 35: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2019 & 2032

- Table 36: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2019 & 2032

- Table 37: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 38: Global Generative AI in Healthcare Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 39: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 40: Brazil Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 41: Mexico Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 42: Rest of Latin America Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 43: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Health-tech companies are continually responding by developing integrated software solutions to pioneer in the competitive market. For instance, in December 2023, Merck introduced Aiddison, a pioneering software-as-a-service for drug discovery. This platform integrated a virtual design and manufacturability through Synthia retrosynthesis software application programing interface (API) integration. The launch aimed to expedite drug development with the ability to speed up to about 70% process compared to traditional process. 2019 & 2032

- Table 44: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Based on end-use, the generative AI in healthcare market is classified into healthcare providers, pharmaceutical and life science companies, and healthcare payers. In 2023, the healthcare providers segment is expected to reach USD 11.8 billion by 2032. 2019 & 2032

- Table 45: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 46: Global Generative AI in Healthcare Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 47: Global Generative AI in Healthcare Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 48: South Africa Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 49: Saudi Arabia Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East & Africa Generative AI in Healthcare Market Revenue (Billion) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Are there any restraints impacting market growth?

Data privacy and security concerns., Regulatory compliance.

What is the projected Compound Annual Growth Rate (CAGR) of the Generative AI in Healthcare Market ?

The projected CAGR is approximately 32.6%.

Can you provide examples of recent developments in the market?

In October 2023, Harman, a subsidiary of Samsung Electronics, introduced HealthGPT, an innovative Healthcare Private Language Model (LLM). The advancement aimed to harnessed generative AI in enhancing patient care, medical research, and decision-making, positioning Harman for a strategic edge in the competitive generative AI market.

What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4,850 , USD 5,350, and USD 8,350 respectively.

Are there any additional resources or data provided in the report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

What are some drivers contributing to market growth?

Growing demand for precision medicine and treatment., Increasing focus on enhancing medical imaging., Expanding advancement in AI., Increasing venture funding.

Which companies are prominent players in the Generative AI in Healthcare Market?

Key companies in the market include Epic Systems Corporation,DiagnaMed Holdings Corp.,Syntegra Medical Mind,IBM Watson Health Corporation,Google LLC,Oracle Corporation,Microsoft Corporation,Nvidia Corporation,Insilico Medicine,Abridge AI Inc.,ELEKS,Persistent Systems

Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Generative AI in Healthcare Market," which aids in identifying and referencing the specific market segment covered.

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)