Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Joint Reconstruction Devices Market Analysis 2025 and Forecasts 2033: Unveiling Growth Opportunities

Joint Reconstruction Devices Market by Joint (Knee Replacement, Hip Replacement, Shoulder Replacement, Ankle Replacement, Others), by North America (U.S., Canada), by Europe (Germany, UK, France, Spain, Italy, Poland, Netherlands, Sweden) Forecast 2025-2033

Key Insights

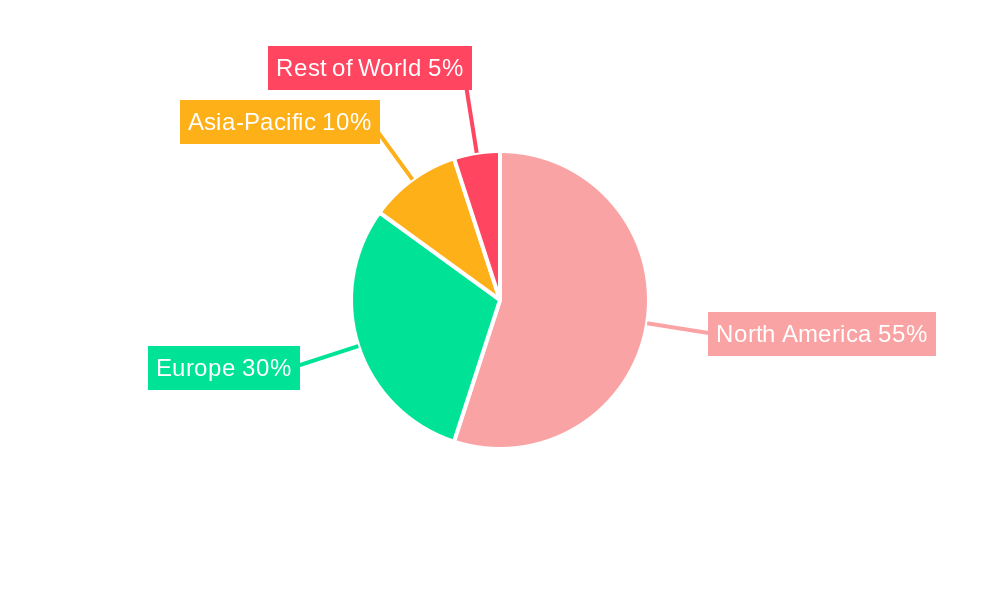

The global Joint Reconstruction Devices market, valued at $18.5 billion in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 4% from 2025 to 2033. This growth is fueled by several key factors. The aging global population is a significant driver, leading to an increased incidence of osteoarthritis and other degenerative joint diseases requiring surgical intervention. Technological advancements in implant design, such as improved materials and minimally invasive surgical techniques, are enhancing surgical outcomes and patient recovery times, further stimulating market expansion. Furthermore, rising healthcare expenditure and increasing awareness of joint replacement options among patients are contributing to market growth. The market is segmented by joint type (knee, hip, shoulder, ankle, and others), with knee and hip replacements currently dominating due to higher prevalence of associated conditions. Major players like Medtronic, Stryker, Zimmer Biomet, and Smith & Nephew are actively involved in research and development, fostering innovation and competition within the market. Geographic analysis reveals strong market presence in North America and Europe, particularly in the U.S., Germany, and the UK, driven by higher adoption rates and advanced healthcare infrastructure.

However, market growth is not without its challenges. High costs associated with joint replacement surgeries, coupled with potential complications and long-term rehabilitation needs, pose significant restraints. Furthermore, the market faces regulatory hurdles and reimbursement complexities in various regions, potentially impacting market access and expansion. Despite these constraints, the long-term outlook for the Joint Reconstruction Devices market remains positive, driven by continued demographic shifts, technological advancements, and rising healthcare spending. The market will likely witness increased adoption of advanced implant designs, innovative surgical techniques, and personalized medicine approaches in the coming years. Growth will also be influenced by emerging markets showing increasing demand for joint reconstruction procedures.

Joint Reconstruction Devices Market Concentration & Characteristics

The Joint Reconstruction Devices market is moderately concentrated, with several large multinational corporations holding significant market share. This concentration is primarily driven by high capital expenditures required for R&D, manufacturing, and global distribution networks. However, the market also features several smaller, specialized companies focusing on niche areas like minimally invasive techniques or patient-specific implants, creating a dynamic competitive landscape.

Concentration Areas:

- Knee and Hip Replacements: These segments dominate the market, accounting for over 70% of total revenue, due to high incidence of osteoarthritis and trauma in these joints.

- North America and Europe: These regions represent the largest market segments, reflecting higher healthcare spending and aging populations.

Characteristics:

- Innovation: The market is characterized by continuous innovation, with advancements in materials science (e.g., biocompatible polymers, advanced alloys), surgical techniques (e.g., minimally invasive surgery, robotic-assisted surgery), and implant designs (e.g., patient-specific implants, improved fixation mechanisms).

- Impact of Regulations: Stringent regulatory approvals (e.g., FDA in the US, CE marking in Europe) significantly impact market entry and product lifecycles, favoring established players with substantial resources.

- Product Substitutes: While total joint replacements are often the preferred treatment option for end-stage osteoarthritis, conservative treatments like physical therapy and medication represent substitutes, especially in early stages.

- End-User Concentration: Hospitals and specialized orthopedic clinics are the primary end users. The concentration of these facilities, coupled with the increasing trend towards hospital networks, influences market dynamics.

- Level of M&A: The market witnesses a moderate level of mergers and acquisitions (M&A) activity, with larger companies strategically acquiring smaller companies to expand product portfolios or gain access to specific technologies or markets. This activity is expected to continue as market consolidation gathers pace.

Joint Reconstruction Devices Market Trends

The Joint Reconstruction Devices market is experiencing robust growth, driven by several key trends. The aging global population, coupled with rising incidence of osteoarthritis and other degenerative joint diseases, represents a significant demographic driver. Improvements in implant design, materials science, and surgical techniques are leading to improved patient outcomes and longer implant lifespans, increasing demand. The rising adoption of minimally invasive surgical procedures is streamlining surgeries, reducing recovery time, and making joint replacement more accessible. Simultaneously, increasing awareness of joint replacement options and improved healthcare access, particularly in emerging economies, are fueling market expansion. Technological advancements are not just limited to implants; they also include the burgeoning field of digital health, incorporating AI and machine learning for better diagnostics, surgical planning, and post-operative care. This personalized medicine approach further contributes to the market's growth. Finally, the increasing focus on value-based care is incentivizing the development of cost-effective and durable implant solutions, creating a sustainable market growth path. These factors combine to produce a highly dynamic market poised for continued expansion in the coming years, with projections suggesting a market value surpassing $50 billion by 2030.

Key Region or Country & Segment to Dominate the Market

The knee replacement segment is projected to dominate the Joint Reconstruction Devices market, accounting for a substantial share of the total revenue, estimated to be around $25 billion in the coming years. This is primarily driven by the high prevalence of knee osteoarthritis, a degenerative condition affecting millions globally, particularly in aging populations.

- North America: Remains the largest market due to high healthcare expenditure, advanced medical infrastructure, and a significant proportion of elderly individuals.

- Europe: Represents a sizable and mature market with ongoing growth fueled by technological advancements and rising incidence of osteoarthritis.

- Asia-Pacific: Is experiencing rapid growth, driven by increasing awareness, rising disposable incomes, and improved healthcare infrastructure in certain regions.

Knee Replacement Sub-segments:

- Femoral Component: This sub-segment is expected to be the largest within knee replacements, accounting for a significant proportion due to its critical role in providing support and stability.

- Tibial Component: This sub-segment is equally crucial for providing stability and alignment, making it a significant contributor to the overall market.

- Patellar Component: While smaller compared to femoral and tibial components, it plays a vital role in knee function and is an integral part of total knee replacements.

Joint Reconstruction Devices Market Product Insights Report Coverage & Deliverables

This report provides comprehensive product insights into the Joint Reconstruction Devices market, covering diverse aspects from market size and share to growth projections across various segments (knee, hip, shoulder, ankle). It analyzes the performance of individual product categories, such as femoral, tibial, and acetabular components, detailed technological advancements, and the competitive landscape of leading players. The report also encompasses a detailed analysis of the clinical efficacy, safety profiles, and market adoption rates of various implant materials and designs. Finally, future market prospects are explored, considering emerging technologies and regulatory influences.

Joint Reconstruction Devices Market Analysis

The global Joint Reconstruction Devices market is experiencing substantial growth, projected to reach approximately $45 billion by 2028. This growth is fueled by several factors, including an aging population, increased prevalence of osteoarthritis and other joint disorders, advancements in implant technology, and rising healthcare expenditure. The market is characterized by a moderate level of concentration, with several major players holding substantial market share. However, the entry of smaller, specialized companies offering innovative solutions is increasing competition. The knee replacement segment currently holds the largest market share, followed by hip replacement. However, other segments, such as shoulder and ankle replacements, are showing promising growth potential. Market growth is expected to be geographically diverse, with North America and Europe remaining dominant markets, while Asia-Pacific demonstrates significant growth potential. The increasing preference for minimally invasive surgical procedures and the development of patient-specific implants contribute to market dynamism.

Joint Reconstruction Devices Market Regional Insights

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Poland

- Netherlands

- Sweden

Each region’s market is further segmented by joint type (knee, hip, shoulder, ankle, others) and then by component type (e.g., femoral, tibial, acetabular). Market size and growth projections will vary across these sub-segments and regions, reflecting factors like demographics, healthcare infrastructure, and regulatory frameworks. For instance, the U.S. market will exhibit higher growth than many European markets due to higher healthcare spending, whereas certain Asian markets are demonstrating rapid expansion rates driven by increasing access to healthcare and rising prevalence of osteoarthritis.

Driving Forces: What's Propelling the Joint Reconstruction Devices Market

The market is propelled by a confluence of factors: the aging global population leading to increased incidence of osteoarthritis; advancements in implant technology, offering improved biocompatibility, longevity, and minimally invasive surgical options; rising healthcare expenditure and insurance coverage enabling greater access to joint replacement surgeries; and increasing awareness among patients about the benefits of joint replacement procedures.

Challenges and Restraints in Joint Reconstruction Devices Market

Challenges include high costs associated with joint replacement surgery, potential risks and complications associated with the procedure, stringent regulatory approvals, and the need for ongoing research and development to improve implant designs and materials. The increasing prevalence of antibiotic-resistant infections also presents a significant concern.

Emerging Trends in Joint Reconstruction Devices Market

Emerging trends include the growing adoption of minimally invasive surgical techniques, the development of patient-specific implants, the integration of robotics and AI in surgical planning and execution, and the increasing focus on value-based healthcare models. Research into new biomaterials and implant designs that enhance longevity and reduce complications also continues.

Joint Reconstruction Devices Industry News

- January 2023: Stryker announced the launch of a new knee replacement system.

- March 2023: Zimmer Biomet reported strong sales growth in its joint reconstruction devices segment.

- June 2023: Medtronic secured FDA approval for a novel hip implant technology.

- October 2024: A significant clinical trial demonstrating the efficacy of a new biomaterial in hip implants concluded.

Leading Players in the Joint Reconstruction Devices Market

- Medtronic

- MicroPort Scientific Corporation

- Stryker

- DJO Global

- ConforMIS

- NuVasive

- Zimmer Biomet

- Globus Medical

- Waldemar LINK

- Smith & Nephew

- Medacta

Joint Reconstruction Devices Market Segmentation

-

1. Joint

-

1.1. Knee Replacement

- 1.1.1. Femoral Component

- 1.1.2. Tibial Component

- 1.1.3. Patellar Component

-

1.2. Hip Replacement

- 1.2.1. Acetabular component

- 1.2.2. Femoral Component

-

1.3. Shoulder Replacement

- 1.3.1. Shoulder Arthroplasty Resurfacing Implants

- 1.3.2. Shoulder Arthroplasty Trauma Implants

- 1.3.3. Shoulder Arthroplasty Platform Implants

-

1.4. Ankle Replacement

- 1.4.1. Two-Component Fixed Bearing

- 1.4.2. Three-Component Mobile Bearing

- 1.5. Others

-

1.1. Knee Replacement

Joint Reconstruction Devices Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Poland

- 2.7. Netherlands

- 2.8. Sweden

Joint Reconstruction Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing base of geriatric population

- 3.2.2 Increasing prevalence of orthopedic diseases

- 3.2.3 Technological advancements

- 3.2.4 Growing rate of joint reconstruction surgeries

- 3.2.5 Need for personalized and patient-specific implants

- 3.3. Market Restrains

- 3.3.1 High cost of the devices

- 3.3.2 Stringent FDA regulations

- 3.3.3 Post-surgical complications

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Joint Reconstruction Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Joint

- 5.1.1. Knee Replacement

- 5.1.1.1. Femoral Component

- 5.1.1.2. Tibial Component

- 5.1.1.3. Patellar Component

- 5.1.2. Hip Replacement

- 5.1.2.1. Acetabular component

- 5.1.2.2. Femoral Component

- 5.1.3. Shoulder Replacement

- 5.1.3.1. Shoulder Arthroplasty Resurfacing Implants

- 5.1.3.2. Shoulder Arthroplasty Trauma Implants

- 5.1.3.3. Shoulder Arthroplasty Platform Implants

- 5.1.4. Ankle Replacement

- 5.1.4.1. Two-Component Fixed Bearing

- 5.1.4.2. Three-Component Mobile Bearing

- 5.1.5. Others

- 5.1.1. Knee Replacement

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.1. Market Analysis, Insights and Forecast - by Joint

- 6. North America Joint Reconstruction Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Joint

- 6.1.1. Knee Replacement

- 6.1.1.1. Femoral Component

- 6.1.1.2. Tibial Component

- 6.1.1.3. Patellar Component

- 6.1.2. Hip Replacement

- 6.1.2.1. Acetabular component

- 6.1.2.2. Femoral Component

- 6.1.3. Shoulder Replacement

- 6.1.3.1. Shoulder Arthroplasty Resurfacing Implants

- 6.1.3.2. Shoulder Arthroplasty Trauma Implants

- 6.1.3.3. Shoulder Arthroplasty Platform Implants

- 6.1.4. Ankle Replacement

- 6.1.4.1. Two-Component Fixed Bearing

- 6.1.4.2. Three-Component Mobile Bearing

- 6.1.5. Others

- 6.1.1. Knee Replacement

- 6.1. Market Analysis, Insights and Forecast - by Joint

- 7. Europe Joint Reconstruction Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Joint

- 7.1.1. Knee Replacement

- 7.1.1.1. Femoral Component

- 7.1.1.2. Tibial Component

- 7.1.1.3. Patellar Component

- 7.1.2. Hip Replacement

- 7.1.2.1. Acetabular component

- 7.1.2.2. Femoral Component

- 7.1.3. Shoulder Replacement

- 7.1.3.1. Shoulder Arthroplasty Resurfacing Implants

- 7.1.3.2. Shoulder Arthroplasty Trauma Implants

- 7.1.3.3. Shoulder Arthroplasty Platform Implants

- 7.1.4. Ankle Replacement

- 7.1.4.1. Two-Component Fixed Bearing

- 7.1.4.2. Three-Component Mobile Bearing

- 7.1.5. Others

- 7.1.1. Knee Replacement

- 7.1. Market Analysis, Insights and Forecast - by Joint

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2024

- 8.2. Company Profiles

- 8.2.1 Medtronic

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 MicroPort Scientific Corporation

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Stryker

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 DJO Global

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 ConforMIS

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 NuVasive

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Zimmer Biomet

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Globus Medical

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Waldemar LINK

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Smith & Nephew

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 and Medacta

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.1 Medtronic

- Figure 1: Global Joint Reconstruction Devices Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Joint Reconstruction Devices Market Revenue (Billion), by Joint 2024 & 2032

- Figure 3: North America Joint Reconstruction Devices Market Revenue Share (%), by Joint 2024 & 2032

- Figure 4: North America Joint Reconstruction Devices Market Revenue (Billion), by Country 2024 & 2032

- Figure 5: North America Joint Reconstruction Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Joint Reconstruction Devices Market Revenue (Billion), by Joint 2024 & 2032

- Figure 7: Europe Joint Reconstruction Devices Market Revenue Share (%), by Joint 2024 & 2032

- Figure 8: Europe Joint Reconstruction Devices Market Revenue (Billion), by Country 2024 & 2032

- Figure 9: Europe Joint Reconstruction Devices Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Joint Reconstruction Devices Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Joint Reconstruction Devices Market Revenue Billion Forecast, by Joint 2019 & 2032

- Table 3: Global Joint Reconstruction Devices Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 4: Global Joint Reconstruction Devices Market Revenue Billion Forecast, by Joint 2019 & 2032

- Table 5: Global Joint Reconstruction Devices Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 6: U.S. Joint Reconstruction Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 7: Canada Joint Reconstruction Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 8: Global Joint Reconstruction Devices Market Revenue Billion Forecast, by Joint 2019 & 2032

- Table 9: Global Joint Reconstruction Devices Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 10: Germany Joint Reconstruction Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 11: UK Joint Reconstruction Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 12: France Joint Reconstruction Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 13: Spain Joint Reconstruction Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 14: Italy Joint Reconstruction Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 15: Poland Joint Reconstruction Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Netherlands Joint Reconstruction Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 17: Sweden Joint Reconstruction Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)