1. What is the projected Compound Annual Growth Rate (CAGR) of the Lupin Market?

The projected CAGR is approximately 5.2%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Lupin Market by Form (Protein Concentrates, Protein Isolates, Lupin Flour), by Type (White Lupin, Narrow-leafed Lupin, Yellow Lupin, Sweet Pearl Lupin, Others), by End-Use Industry (Food & Beverages Industry, Animal Feed Industry, Cosmetic Industry, Others), by North America (U.S., Canada), by Europe (Germany, UK, France, Italy, Spain, Rest of Europe), by Asia Pacific (China, India, Japan, South Korea, Australia, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Argentina, Rest of Latin America), by MEA (Saudi Arabia, UAE, South Africa, Rest of MEA) Forecast 2025-2033

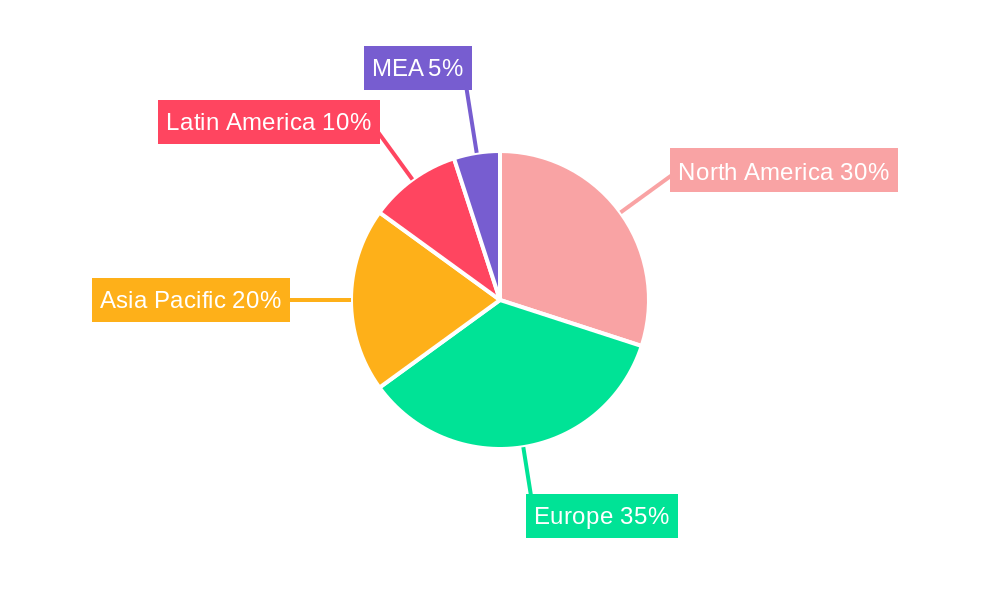

The global lupin market, valued at $89.9 million in 2025, is projected to experience robust growth, driven by increasing consumer demand for plant-based protein sources and the rising popularity of lupin-based food products. The market's Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033 indicates a significant expansion over the forecast period. Key drivers include the growing awareness of the health benefits associated with lupin consumption, such as its high protein content and fiber, along with its relatively low allergenicity compared to other legumes. The rising adoption of lupin ingredients in food and beverage products, particularly in vegan and vegetarian alternatives to traditional dairy and meat products, further fuels market expansion. Furthermore, the increasing demand for sustainable and ethically sourced ingredients is bolstering the growth of the lupin market, as lupin cultivation practices often align with environmentally friendly farming methods. The market is segmented by form (concentrates, isolates, flour), type (white, narrow-leafed, yellow, sweet pearl), and end-use industry (food & beverages, animal feed, cosmetics). The food and beverage segment currently holds a dominant share, however, significant growth potential exists within animal feed and cosmetics segments as awareness and applications expand. Regional growth varies, with North America and Europe currently representing significant markets, while the Asia-Pacific region demonstrates strong potential for future growth due to its rapidly expanding population and increasing adoption of plant-based diets.

The competitive landscape is characterized by a mix of established players and emerging companies involved in lupin cultivation, processing, and distribution. Companies are focusing on product innovation, expanding their product portfolios to cater to the diverse needs of various end-use industries, and exploring new market opportunities. Strategic partnerships, mergers, and acquisitions are also shaping the market dynamics. Challenges include the relatively low awareness of lupin as a protein source in some regions and the need for further research and development to optimize processing techniques and enhance the functional properties of lupin-based ingredients. Despite these challenges, the overall outlook for the lupin market remains positive, with continued growth fueled by changing consumer preferences and evolving market trends towards sustainable and healthy food options.

The global lupin market is moderately concentrated, with several key players holding significant market share, but a substantial number of smaller regional producers also contributing. Innovation is driven by the development of new lupin varieties with improved nutritional profiles and processing characteristics, focusing primarily on enhanced protein content and reduced bitterness. Regulations concerning food labeling and allergen declaration significantly impact market dynamics, requiring producers to meet stringent standards. Product substitutes, such as soy and other legume-based proteins, exert competitive pressure, particularly in the food and beverage sector. End-user concentration is notable in the food and beverage industry, particularly within specific niches like vegan and vegetarian products. The level of mergers and acquisitions (M&A) activity is moderate, with strategic acquisitions focused on expanding product portfolios and geographical reach. We estimate the global market concentration ratio (CR4) to be around 35%, indicating a relatively fragmented market.

The global lupin market is experiencing substantial growth, driven by several key trends. The rising global demand for plant-based proteins fuels significant interest in lupins as a sustainable and nutritionally rich alternative to traditional sources like soy. This demand is particularly strong in developed countries with established vegan and vegetarian markets and is expanding rapidly in developing economies seeking affordable and high-protein food sources. The growing awareness of the health benefits associated with lupin consumption, such as its high protein content, fiber, and essential amino acids, further contributes to market expansion. Consumers are increasingly seeking healthier and more sustainable food options, boosting the demand for lupin-based products across various food and beverage applications. Additionally, advancements in lupin processing technologies are enhancing the functionality and palatability of lupin ingredients, expanding their applicability in various food products and improving consumer acceptance. The increasing use of lupins in animal feed, driven by their nutritional value and sustainability aspects, is another important trend. This trend is particularly pronounced in regions with stringent regulations on antibiotic use in livestock farming. Finally, the exploration of lupins in niche applications, such as cosmetics and pharmaceuticals, opens up new avenues for market growth. This reflects the growing interest in natural and sustainable ingredients across diverse industries. The market is expected to reach approximately $1.2 Billion by 2028, growing at a CAGR of 7%.

The European region is expected to dominate the global lupin market, driven by strong demand from the food and beverage and animal feed industries. Within Europe, Germany and Australia are particularly significant.

The high protein content of lupin flour makes it an attractive substitute for wheat flour in many applications, addressing growing concerns about gluten intolerance and the demand for protein-rich foods. Australia's established lupin cultivation practices and strong export capabilities further consolidate its position.

Within the types of lupin, Narrow-leafed Lupin is currently the leading type. However, the development of new varieties like sweet pearl lupin is expected to improve market penetration in the future.

The animal feed industry also represents a significant and growing market segment for lupins, driven by the increasing demand for sustainable and protein-rich animal feed.

This report provides comprehensive insights into the global lupin market, encompassing market size, segmentation analysis, regional trends, key players' profiles, and future growth prospects. The report offers detailed information on lupin forms (protein concentrates, isolates, flour), types (white, narrow-leafed, yellow, sweet pearl, others), and end-use industries (food & beverages, animal feed, cosmetics, others). It also analyzes market drivers, challenges, and emerging trends impacting the market's growth trajectory.

The global lupin market is estimated to be valued at approximately $800 million in 2024. The market is characterized by robust growth, driven by increasing demand for plant-based protein sources and sustainable ingredients. The market is segmented by form (protein concentrates, isolates, and flour), type (white, narrow-leafed, yellow, sweet pearl, and others), and end-use industry (food & beverages, animal feed, cosmetics, and others). The food and beverage sector holds the largest market share, followed by the animal feed industry. Major players in the market are strategically focusing on product innovation and geographic expansion to enhance their market positions. The market is experiencing a considerable influx of new product introductions, which are anticipated to fuel future market expansion. Growth is projected at a compound annual growth rate (CAGR) of approximately 7% from 2024 to 2028.

Each region's market is further segmented by form, type, and end-use industry, allowing for granular analysis of market dynamics and growth potential within specific geographic areas and market segments.

The primary drivers for lupin market growth are the surging demand for plant-based protein, the increasing awareness of lupin's health benefits, and the growing interest in sustainable agriculture. The development of new lupin varieties with improved characteristics and the advancements in processing technologies further propel market expansion. Government support for sustainable agriculture practices also contributes to the positive market outlook.

Challenges facing the lupin market include the relatively limited cultivation area compared to other legume crops, seasonal variations in production, and the need to address the inherent bitterness in some lupin varieties. Fluctuations in raw material prices and stringent food safety regulations also pose potential constraints on market growth.

Emerging trends include the development of novel lupin-based food products, the exploration of lupins in niche applications like cosmetics and pharmaceuticals, and the increasing focus on traceability and sustainability throughout the supply chain. The use of lupin ingredients in functional foods and beverages is also gaining momentum.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.2% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.2%.

Key companies in the market include Barentz International B.V., Blooming Foods, Coorow Seeds, COSMOVEDA eK Günther Eckerle, Dipasa USA Inc, Eagle Foods Australia, Frank Food Products, Golden West Foods Pty Ltd, Inveja SAS - Lup'Ingredients, Raab Vitalfood GmbH, Soja Austria.

The market segments include Form, Type, End-Use Industry.

The market size is estimated to be USD 89.9 Million as of 2022.

Increasing adoption for lupin in the food industry. Increase in the population of individuals prioritizing their health.. Increasing demand for plant-based protein products.

N/A

Presence of alternative protein source. Lack of awareness.

In 202: Barentz International, a leading global life science and specialty performance ingredients distributor, announces the acquisition of Radian Chemical Products in India. Enforces and complements the Barentz India product portfolio with innovative color cosmetic ingredients.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4,850, USD 5,350, and USD 8,350 respectively.

The market size is provided in terms of value, measured in Million.

Yes, the market keyword associated with the report is "Lupin Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Lupin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

See the similar reports

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.