Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Multi-omics Market Unlocking Growth Potential: Analysis and Forecasts 2025-2033

Multi-omics Market by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. (The integration of genomics, transcriptomics, proteomics, and metabolomics has allowed researchers and clinicians to unravel the complex landscape of cancer at a molecular level, paving the way for more targeted therapies., Also, advancements in technology and data analysis tools have streamlined the process of generating and interpreting multi-omics data, making it more accessible and applicable in clinical settings.), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. (Academic & research organizations have embraced multi-omics as a powerful tool to unravel the complexities of diseases, identify biomarkers, and personalize therapeutic strategies., With their substantial budgets and focus on interdisciplinary research, academic institutes and research centers continue to be key drivers of innovation in the multi-omics industry, thereby aiding in high segment development.), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: (Becton, Dickinson and Company, Thermo Fisher Scientific Inc., Illumina, Inc, Danaher, PerkinElmer Inc., Shimadzu Corporation, Bruker, QIAGEN, Agilent Technologies, Inc., BGI, 10x Genomics, CYTENA GmbH), by Product & Services, 2018 – 2032 (USD Million) (Products, Instruments, Consumables, Software), by Type, 2018 – 2032 (USD Million) (Single-cell multi-omics, Bulk multi-omics), by Platform, 2018 – 2032 (USD Million) (Genomics, Transcriptomics, Proteomics, Metabolomics, Integrated omics platforms), by Application, 2018 – 2032 (USD Million) (Oncology, Cell biology, Neurology, Immunology, Other applications), by End-use, 2018 – 2032 (USD Million) (Academic and research organizations, Pharmaceutical & biotechnology companies, Hospital and diagnostic laboratories, Other end-users), by North America (U.S., Canada), by Europe (Germany, UK, France, Spain, Italy, Rest of Europe), by Asia Pacific (China, Japan, India, Australia, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Rest of Latin America), by Middle East & Africa (South Africa, Saudi Arabia, Rest of Middle East & Africa) Forecast 2025-2033

Key Insights

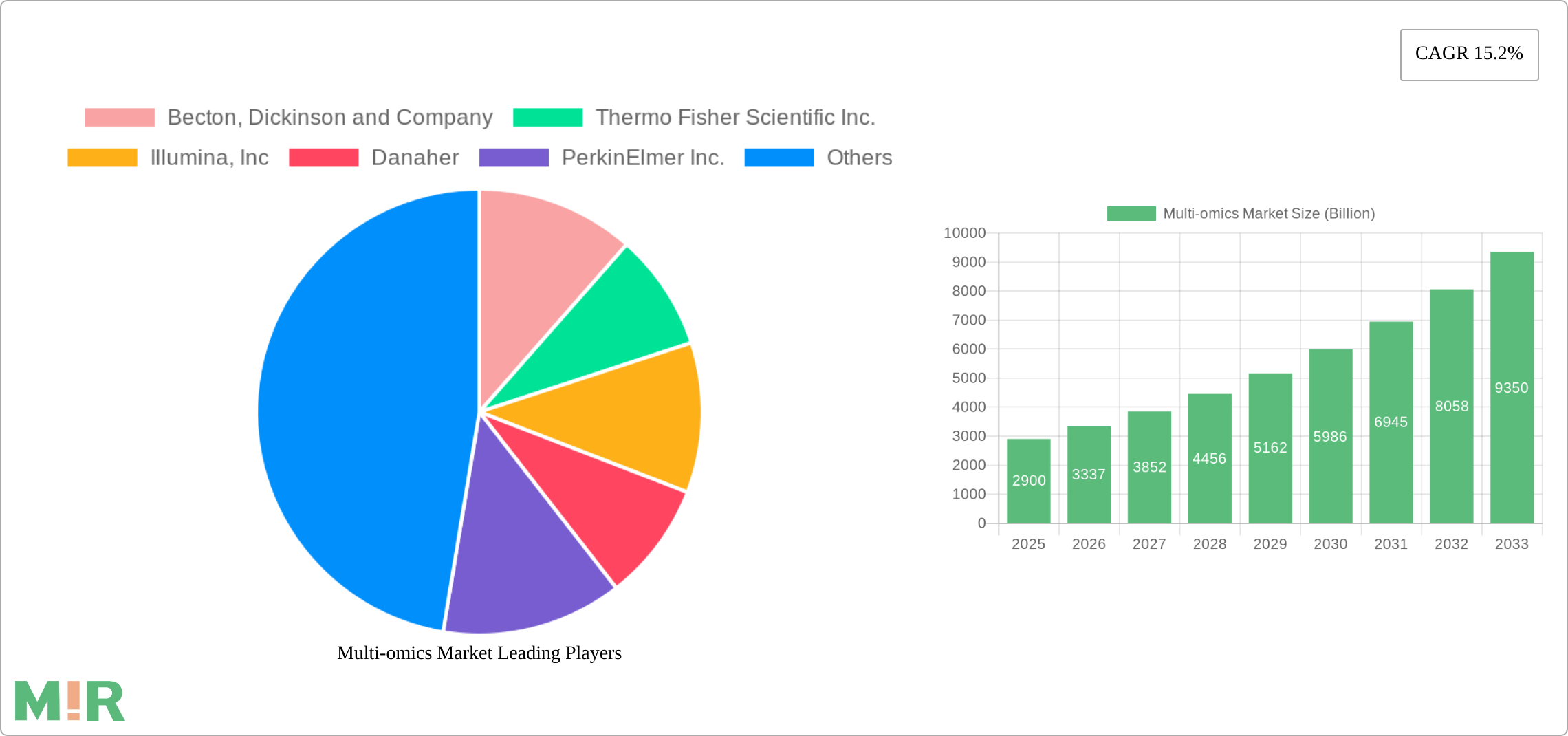

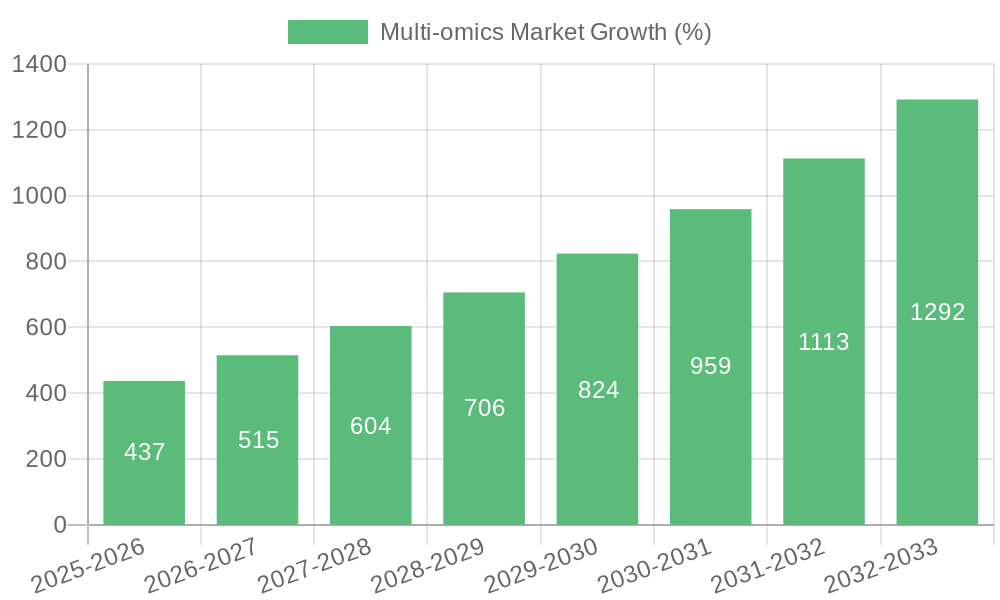

The multi-omics market, valued at $2.9 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 15.2% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the integration of genomics, transcriptomics, proteomics, and metabolomics provides unparalleled insights into complex diseases like cancer, enabling the development of more precise and effective targeted therapies. Advancements in technology, particularly in data analysis tools, are making multi-omics data more accessible and readily applicable in clinical settings, further fueling market growth. The oncology segment is a significant contributor, anticipated to reach $3.3 billion by 2032, reflecting the substantial potential of multi-omics in cancer research and treatment. Academic and research organizations represent a major end-user segment, driven by their commitment to uncovering disease mechanisms, identifying biomarkers, and personalizing therapeutic approaches. Their significant research budgets and focus on interdisciplinary collaboration solidify their role as key drivers of innovation within the multi-omics industry.

The market's competitive landscape features established players such as Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc., alongside other significant contributors like Danaher, PerkinElmer Inc., Shimadzu Corporation, Bruker, QIAGEN, Agilent Technologies, Inc., BGI, 10x Genomics, and CYTENA GmbH. These companies are leveraging various strategies, including substantial investments in research and development, geographical expansion, strategic acquisitions, product diversification, and rigorous adherence to regulatory compliance, to maintain and expand their market share. The market is segmented by product type (instruments, consumables, software), platform (single-cell, bulk), application (oncology, cell biology, neurology, immunology), and end-user (academic/research, pharmaceutical/biotech, hospitals/diagnostic labs). The continued technological advancements, coupled with the increasing adoption of multi-omics in diverse applications, positions the market for sustained, significant growth in the coming years. North America and Europe currently hold substantial market share, however, the Asia-Pacific region is expected to witness significant growth driven by increasing research funding and infrastructural development.

Multi-omics Market Concentration & Characteristics

The multi-omics market is moderately concentrated, with a few major players holding significant market share. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. are prominent examples. However, the market also features a significant number of smaller companies specializing in niche technologies or applications, leading to a dynamic competitive landscape.

Concentration Areas: Instrument manufacturing (high-throughput sequencing, mass spectrometry), software and data analysis solutions, and specific multi-omics applications (e.g., oncology).

Characteristics of Innovation: Rapid technological advancements drive innovation, particularly in single-cell technologies, data analysis algorithms, and integrated multi-omics platforms. The market exhibits a high level of R&D investment by key players.

Impact of Regulations: Regulatory approvals for diagnostic applications and data privacy regulations significantly impact market growth and adoption, especially within the clinical settings. Stringent quality control and data security measures are essential.

Product Substitutes: While direct substitutes are limited, alternative analytical approaches (e.g., focusing on individual "omics" like genomics alone) may compete with comprehensive multi-omics analyses depending on the specific research question.

End-User Concentration: Academic and research organizations currently represent a substantial portion of the market, but pharmaceutical and biotechnology companies are rapidly expanding their adoption of multi-omics technologies for drug discovery and development. The level of mergers and acquisitions (M&A) activity is moderate, with larger players acquiring smaller companies with specialized technologies or to expand into new market segments. This activity is expected to increase in the coming years to further consolidate the industry.

Multi-omics Market Trends

The multi-omics market is experiencing explosive growth, driven by several converging trends. The increasing availability of high-throughput technologies enables researchers to generate massive datasets at an affordable cost. This has propelled the development of sophisticated bioinformatics tools capable of handling and analyzing the complex multi-omics data, leading to a deeper understanding of biological systems.

Simultaneously, the focus on precision medicine and personalized healthcare is driving demand for multi-omics applications in diagnostics and therapeutics. The ability to integrate information across multiple "omics" layers enables a more holistic and precise understanding of disease mechanisms, paving the way for tailored treatments and improved patient outcomes. The rise of single-cell multi-omics technologies allows researchers to analyze individual cells within complex tissues, offering unparalleled resolution in studying cellular heterogeneity and developmental processes.

Furthermore, the growing adoption of cloud computing and data analytics solutions facilitates data sharing and collaboration among researchers globally. This fosters accelerated scientific discovery and accelerates translation of research findings into clinical applications. The global market is expanding rapidly, spurred by government initiatives promoting biomedical research, increasing investments from both public and private sectors, and the growth of personalized medicine. The shift towards preventative medicine and early disease detection further strengthens the market’s potential. This confluence of technological innovation, improved data analysis capabilities, and the pressing need for personalized medicine fuels sustained high growth within the multi-omics sector. The market is expected to be significantly shaped by the increasing focus on artificial intelligence and machine learning for data analysis and the development of novel therapeutic strategies.

Key Region or Country & Segment to Dominate the Market

Oncology Segment Dominance: The oncology segment is projected to dominate the multi-omics market, driven by the need for more precise cancer diagnostics and targeted therapies. The integration of genomic, transcriptomic, proteomic, and metabolomic data offers unprecedented opportunities for understanding cancer development, progression, and response to treatment. This understanding leads to improved diagnostics, prediction of treatment response, and development of personalized cancer therapies. The oncology segment is expected to reach USD 3.3 billion by 2032, highlighting its significant growth potential.

North America Market Leadership: North America is anticipated to maintain its leading position in the multi-omics market due to substantial investments in R&D, a strong presence of major players, and well-established healthcare infrastructure. The region boasts a large number of research institutions, pharmaceutical companies, and diagnostic laboratories actively engaged in multi-omics research and application.

Asia Pacific's Emerging Role: While currently smaller than North America, the Asia Pacific region is experiencing rapid growth, driven by rising healthcare spending, increasing awareness of personalized medicine, and growing collaborations between international and regional research groups. Significant government support and funding initiatives are also boosting the market's expansion.

Multi-omics Market Product Insights Report Coverage & Deliverables

This report provides comprehensive insights into the multi-omics market, covering product segments (instruments, consumables, software), technology platforms (single-cell vs. bulk), omics layers (genomics, transcriptomics, proteomics, metabolomics, integrated platforms), applications (oncology, neurology, immunology, cell biology), and end-users (academic research, pharmaceutical companies, diagnostic laboratories). The report analyzes market size, growth trends, competitive landscape, regulatory factors, and key technological advancements, providing a detailed understanding of this rapidly evolving market.

Multi-omics Market Analysis

The global multi-omics market is witnessing substantial growth, projected to reach tens of billions of USD by 2032, with a Compound Annual Growth Rate (CAGR) significantly above the global average market growth. This expansion is driven by increasing demand for personalized medicine, advanced diagnostic tools, and improved disease understanding. The market is segmented into multiple categories, including instruments, consumables, software, and service offerings. While the precise market share for each company varies, leading players like Illumina, Thermo Fisher, and Becton Dickinson hold significant positions due to their established brand reputation, extensive product portfolios, and strong distribution networks. The competitive landscape is dynamic, with ongoing innovation and a continuous emergence of new technologies. The market's growth is influenced by factors such as increasing investment in research and development, government funding initiatives, and technological advancements. Furthermore, the market expansion is fueled by the increasing demand for high-throughput screening technologies and data analysis tools to handle the large datasets generated by multi-omics experiments.

Multi-omics Market Regional Insights

- North America

- U.S.: Strong R&D investment, large pharmaceutical & biotech presence.

- Canada: Growing research infrastructure, government support.

- Europe

- Germany, UK, France: Established research hubs, strong regulatory frameworks.

- Rest of Europe: Emerging markets with increasing adoption.

- Asia Pacific

- China, Japan, India: Rapidly growing markets driven by increasing healthcare spending and government initiatives.

- Australia: Strong research capabilities, increasing investment in personalized medicine.

- Rest of Asia Pacific: Emerging markets with high growth potential.

- Latin America

- Brazil, Mexico: Growing healthcare sectors, increasing adoption of advanced technologies.

- Rest of Latin America: Developing markets with significant growth opportunities.

- Middle East & Africa

- South Africa, Saudi Arabia: Increasing healthcare infrastructure investments.

- Rest of Middle East & Africa: Emerging markets with significant untapped potential.

Driving Forces: What's Propelling the Multi-omics Market

The multi-omics market is driven by the convergence of several factors: the need for personalized medicine, advancements in high-throughput technologies, and the development of sophisticated data analysis tools. Increased government funding for research and development, coupled with the growing adoption of multi-omics approaches in various fields like drug discovery and diagnostics, are further propelling market growth. The demand for comprehensive disease understanding and improved patient outcomes serves as a significant driver.

Challenges and Restraints in Multi-omics Market

High costs associated with instrumentation, data storage, and analysis represent significant challenges. The complexity of data interpretation and the need for specialized expertise pose obstacles to wider adoption. Data standardization and interoperability issues also present hurdles. Regulatory approvals and compliance requirements add complexity, particularly in clinical settings.

Emerging Trends in Multi-omics Market

Single-cell multi-omics is rapidly gaining traction, enabling detailed analysis of cellular heterogeneity. Artificial intelligence (AI) and machine learning are transforming data analysis capabilities, facilitating pattern recognition and prediction. Cloud computing and big data solutions are improving data management and collaboration. Integration of multi-omics data with other clinical information (e.g., electronic health records) is enhancing diagnostic and therapeutic applications.

Multi-omics Industry News

- September 2023: 10x Genomics launched a new kit expanding its chromium single-cell gene expression flex assay to include high-throughput multi-omic cellular profiling.

- February 2023: Becton, Dickinson and Company launched the Rhapsody HT Xpress System, a high-throughput single-cell multiomics platform.

Leading Players in the Multi-omics Market

- Becton, Dickinson and Company

- Thermo Fisher Scientific Inc.

- Illumina, Inc

- Danaher

- PerkinElmer Inc.

- Shimadzu Corporation

- Bruker

- QIAGEN

- Agilent Technologies, Inc.

- BGI

- 10x Genomics

- CYTENA GmbH

Multi-omics Market Segmentation

-

1. application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 1.1. The integration of genomics, transcriptomics, proteomics, and metabolomics has allowed researchers and clinicians to unravel the complex landscape of cancer at a molecular level, paving the way for more targeted therapies.

- 1.2. Also, advancements in technology and data analysis tools have streamlined the process of generating and interpreting multi-omics data, making it more accessible and applicable in clinical settings.

-

2. end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations.

- 2.1. Academic & research organizations have embraced multi-omics as a powerful tool to unravel the complexities of diseases, identify biomarkers, and personalize therapeutic strategies.

- 2.2. With their substantial budgets and focus on interdisciplinary research, academic institutes and research centers continue to be key drivers of innovation in the multi-omics industry, thereby aiding in high segment development.

-

3. The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below:

- 3.1. Becton, Dickinson and Company

- 3.2. Thermo Fisher Scientific Inc.

- 3.3. Illumina, Inc

- 3.4. Danaher

- 3.5. PerkinElmer Inc.

- 3.6. Shimadzu Corporation

- 3.7. Bruker

- 3.8. QIAGEN

- 3.9. Agilent Technologies, Inc.

- 3.10. BGI

- 3.11. 10x Genomics

- 3.12. CYTENA GmbH

-

4. Product & Services, 2018 – 2032 (USD Million)

- 4.1. Products

- 4.2. Instruments

- 4.3. Consumables

- 4.4. Software

-

5. Type, 2018 – 2032 (USD Million)

- 5.1. Single-cell multi-omics

- 5.2. Bulk multi-omics

-

6. Platform, 2018 – 2032 (USD Million)

- 6.1. Genomics

- 6.2. Transcriptomics

- 6.3. Proteomics

- 6.4. Metabolomics

- 6.5. Integrated omics platforms

-

7. Application, 2018 – 2032 (USD Million)

- 7.1. Oncology

- 7.2. Cell biology

- 7.3. Neurology

- 7.4. Immunology

- 7.5. Other applications

-

8. End-use, 2018 – 2032 (USD Million)

- 8.1. Academic and research organizations

- 8.2. Pharmaceutical & biotechnology companies

- 8.3. Hospital and diagnostic laboratories

- 8.4. Other end-users

Multi-omics Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East & Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East & Africa

Multi-omics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.2% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Advancements in omics technologies

- 3.2.2 Increasing applications in personalized medicine

- 3.2.3 Rising government initiatives and funding

- 3.3. Market Restrains

- 3.3.1 High cost of instruments and data storage

- 3.3.2 Complex regulatory requirements and standardization issues

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Multi-omics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 5.1.1. The integration of genomics, transcriptomics, proteomics, and metabolomics has allowed researchers and clinicians to unravel the complex landscape of cancer at a molecular level, paving the way for more targeted therapies.

- 5.1.2. Also, advancements in technology and data analysis tools have streamlined the process of generating and interpreting multi-omics data, making it more accessible and applicable in clinical settings.

- 5.2. Market Analysis, Insights and Forecast - by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations.

- 5.2.1. Academic & research organizations have embraced multi-omics as a powerful tool to unravel the complexities of diseases, identify biomarkers, and personalize therapeutic strategies.

- 5.2.2. With their substantial budgets and focus on interdisciplinary research, academic institutes and research centers continue to be key drivers of innovation in the multi-omics industry, thereby aiding in high segment development.

- 5.3. Market Analysis, Insights and Forecast - by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below:

- 5.3.1. Becton, Dickinson and Company

- 5.3.2. Thermo Fisher Scientific Inc.

- 5.3.3. Illumina, Inc

- 5.3.4. Danaher

- 5.3.5. PerkinElmer Inc.

- 5.3.6. Shimadzu Corporation

- 5.3.7. Bruker

- 5.3.8. QIAGEN

- 5.3.9. Agilent Technologies, Inc.

- 5.3.10. BGI

- 5.3.11. 10x Genomics

- 5.3.12. CYTENA GmbH

- 5.4. Market Analysis, Insights and Forecast - by Product & Services, 2018 – 2032 (USD Million)

- 5.4.1. Products

- 5.4.2. Instruments

- 5.4.3. Consumables

- 5.4.4. Software

- 5.5. Market Analysis, Insights and Forecast - by Type, 2018 – 2032 (USD Million)

- 5.5.1. Single-cell multi-omics

- 5.5.2. Bulk multi-omics

- 5.6. Market Analysis, Insights and Forecast - by Platform, 2018 – 2032 (USD Million)

- 5.6.1. Genomics

- 5.6.2. Transcriptomics

- 5.6.3. Proteomics

- 5.6.4. Metabolomics

- 5.6.5. Integrated omics platforms

- 5.7. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 5.7.1. Oncology

- 5.7.2. Cell biology

- 5.7.3. Neurology

- 5.7.4. Immunology

- 5.7.5. Other applications

- 5.8. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 5.8.1. Academic and research organizations

- 5.8.2. Pharmaceutical & biotechnology companies

- 5.8.3. Hospital and diagnostic laboratories

- 5.8.4. Other end-users

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. North America

- 5.9.2. Europe

- 5.9.3. Asia Pacific

- 5.9.4. Latin America

- 5.9.5. Middle East & Africa

- 5.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 6. North America Multi-omics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 6.1.1. The integration of genomics, transcriptomics, proteomics, and metabolomics has allowed researchers and clinicians to unravel the complex landscape of cancer at a molecular level, paving the way for more targeted therapies.

- 6.1.2. Also, advancements in technology and data analysis tools have streamlined the process of generating and interpreting multi-omics data, making it more accessible and applicable in clinical settings.

- 6.2. Market Analysis, Insights and Forecast - by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations.

- 6.2.1. Academic & research organizations have embraced multi-omics as a powerful tool to unravel the complexities of diseases, identify biomarkers, and personalize therapeutic strategies.

- 6.2.2. With their substantial budgets and focus on interdisciplinary research, academic institutes and research centers continue to be key drivers of innovation in the multi-omics industry, thereby aiding in high segment development.

- 6.3. Market Analysis, Insights and Forecast - by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below:

- 6.3.1. Becton, Dickinson and Company

- 6.3.2. Thermo Fisher Scientific Inc.

- 6.3.3. Illumina, Inc

- 6.3.4. Danaher

- 6.3.5. PerkinElmer Inc.

- 6.3.6. Shimadzu Corporation

- 6.3.7. Bruker

- 6.3.8. QIAGEN

- 6.3.9. Agilent Technologies, Inc.

- 6.3.10. BGI

- 6.3.11. 10x Genomics

- 6.3.12. CYTENA GmbH

- 6.4. Market Analysis, Insights and Forecast - by Product & Services, 2018 – 2032 (USD Million)

- 6.4.1. Products

- 6.4.2. Instruments

- 6.4.3. Consumables

- 6.4.4. Software

- 6.5. Market Analysis, Insights and Forecast - by Type, 2018 – 2032 (USD Million)

- 6.5.1. Single-cell multi-omics

- 6.5.2. Bulk multi-omics

- 6.6. Market Analysis, Insights and Forecast - by Platform, 2018 – 2032 (USD Million)

- 6.6.1. Genomics

- 6.6.2. Transcriptomics

- 6.6.3. Proteomics

- 6.6.4. Metabolomics

- 6.6.5. Integrated omics platforms

- 6.7. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 6.7.1. Oncology

- 6.7.2. Cell biology

- 6.7.3. Neurology

- 6.7.4. Immunology

- 6.7.5. Other applications

- 6.8. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 6.8.1. Academic and research organizations

- 6.8.2. Pharmaceutical & biotechnology companies

- 6.8.3. Hospital and diagnostic laboratories

- 6.8.4. Other end-users

- 6.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 7. Europe Multi-omics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 7.1.1. The integration of genomics, transcriptomics, proteomics, and metabolomics has allowed researchers and clinicians to unravel the complex landscape of cancer at a molecular level, paving the way for more targeted therapies.

- 7.1.2. Also, advancements in technology and data analysis tools have streamlined the process of generating and interpreting multi-omics data, making it more accessible and applicable in clinical settings.

- 7.2. Market Analysis, Insights and Forecast - by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations.

- 7.2.1. Academic & research organizations have embraced multi-omics as a powerful tool to unravel the complexities of diseases, identify biomarkers, and personalize therapeutic strategies.

- 7.2.2. With their substantial budgets and focus on interdisciplinary research, academic institutes and research centers continue to be key drivers of innovation in the multi-omics industry, thereby aiding in high segment development.

- 7.3. Market Analysis, Insights and Forecast - by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below:

- 7.3.1. Becton, Dickinson and Company

- 7.3.2. Thermo Fisher Scientific Inc.

- 7.3.3. Illumina, Inc

- 7.3.4. Danaher

- 7.3.5. PerkinElmer Inc.

- 7.3.6. Shimadzu Corporation

- 7.3.7. Bruker

- 7.3.8. QIAGEN

- 7.3.9. Agilent Technologies, Inc.

- 7.3.10. BGI

- 7.3.11. 10x Genomics

- 7.3.12. CYTENA GmbH

- 7.4. Market Analysis, Insights and Forecast - by Product & Services, 2018 – 2032 (USD Million)

- 7.4.1. Products

- 7.4.2. Instruments

- 7.4.3. Consumables

- 7.4.4. Software

- 7.5. Market Analysis, Insights and Forecast - by Type, 2018 – 2032 (USD Million)

- 7.5.1. Single-cell multi-omics

- 7.5.2. Bulk multi-omics

- 7.6. Market Analysis, Insights and Forecast - by Platform, 2018 – 2032 (USD Million)

- 7.6.1. Genomics

- 7.6.2. Transcriptomics

- 7.6.3. Proteomics

- 7.6.4. Metabolomics

- 7.6.5. Integrated omics platforms

- 7.7. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 7.7.1. Oncology

- 7.7.2. Cell biology

- 7.7.3. Neurology

- 7.7.4. Immunology

- 7.7.5. Other applications

- 7.8. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 7.8.1. Academic and research organizations

- 7.8.2. Pharmaceutical & biotechnology companies

- 7.8.3. Hospital and diagnostic laboratories

- 7.8.4. Other end-users

- 7.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 8. Asia Pacific Multi-omics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 8.1.1. The integration of genomics, transcriptomics, proteomics, and metabolomics has allowed researchers and clinicians to unravel the complex landscape of cancer at a molecular level, paving the way for more targeted therapies.

- 8.1.2. Also, advancements in technology and data analysis tools have streamlined the process of generating and interpreting multi-omics data, making it more accessible and applicable in clinical settings.

- 8.2. Market Analysis, Insights and Forecast - by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations.

- 8.2.1. Academic & research organizations have embraced multi-omics as a powerful tool to unravel the complexities of diseases, identify biomarkers, and personalize therapeutic strategies.

- 8.2.2. With their substantial budgets and focus on interdisciplinary research, academic institutes and research centers continue to be key drivers of innovation in the multi-omics industry, thereby aiding in high segment development.

- 8.3. Market Analysis, Insights and Forecast - by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below:

- 8.3.1. Becton, Dickinson and Company

- 8.3.2. Thermo Fisher Scientific Inc.

- 8.3.3. Illumina, Inc

- 8.3.4. Danaher

- 8.3.5. PerkinElmer Inc.

- 8.3.6. Shimadzu Corporation

- 8.3.7. Bruker

- 8.3.8. QIAGEN

- 8.3.9. Agilent Technologies, Inc.

- 8.3.10. BGI

- 8.3.11. 10x Genomics

- 8.3.12. CYTENA GmbH

- 8.4. Market Analysis, Insights and Forecast - by Product & Services, 2018 – 2032 (USD Million)

- 8.4.1. Products

- 8.4.2. Instruments

- 8.4.3. Consumables

- 8.4.4. Software

- 8.5. Market Analysis, Insights and Forecast - by Type, 2018 – 2032 (USD Million)

- 8.5.1. Single-cell multi-omics

- 8.5.2. Bulk multi-omics

- 8.6. Market Analysis, Insights and Forecast - by Platform, 2018 – 2032 (USD Million)

- 8.6.1. Genomics

- 8.6.2. Transcriptomics

- 8.6.3. Proteomics

- 8.6.4. Metabolomics

- 8.6.5. Integrated omics platforms

- 8.7. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 8.7.1. Oncology

- 8.7.2. Cell biology

- 8.7.3. Neurology

- 8.7.4. Immunology

- 8.7.5. Other applications

- 8.8. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 8.8.1. Academic and research organizations

- 8.8.2. Pharmaceutical & biotechnology companies

- 8.8.3. Hospital and diagnostic laboratories

- 8.8.4. Other end-users

- 8.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 9. Latin America Multi-omics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 9.1.1. The integration of genomics, transcriptomics, proteomics, and metabolomics has allowed researchers and clinicians to unravel the complex landscape of cancer at a molecular level, paving the way for more targeted therapies.

- 9.1.2. Also, advancements in technology and data analysis tools have streamlined the process of generating and interpreting multi-omics data, making it more accessible and applicable in clinical settings.

- 9.2. Market Analysis, Insights and Forecast - by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations.

- 9.2.1. Academic & research organizations have embraced multi-omics as a powerful tool to unravel the complexities of diseases, identify biomarkers, and personalize therapeutic strategies.

- 9.2.2. With their substantial budgets and focus on interdisciplinary research, academic institutes and research centers continue to be key drivers of innovation in the multi-omics industry, thereby aiding in high segment development.

- 9.3. Market Analysis, Insights and Forecast - by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below:

- 9.3.1. Becton, Dickinson and Company

- 9.3.2. Thermo Fisher Scientific Inc.

- 9.3.3. Illumina, Inc

- 9.3.4. Danaher

- 9.3.5. PerkinElmer Inc.

- 9.3.6. Shimadzu Corporation

- 9.3.7. Bruker

- 9.3.8. QIAGEN

- 9.3.9. Agilent Technologies, Inc.

- 9.3.10. BGI

- 9.3.11. 10x Genomics

- 9.3.12. CYTENA GmbH

- 9.4. Market Analysis, Insights and Forecast - by Product & Services, 2018 – 2032 (USD Million)

- 9.4.1. Products

- 9.4.2. Instruments

- 9.4.3. Consumables

- 9.4.4. Software

- 9.5. Market Analysis, Insights and Forecast - by Type, 2018 – 2032 (USD Million)

- 9.5.1. Single-cell multi-omics

- 9.5.2. Bulk multi-omics

- 9.6. Market Analysis, Insights and Forecast - by Platform, 2018 – 2032 (USD Million)

- 9.6.1. Genomics

- 9.6.2. Transcriptomics

- 9.6.3. Proteomics

- 9.6.4. Metabolomics

- 9.6.5. Integrated omics platforms

- 9.7. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 9.7.1. Oncology

- 9.7.2. Cell biology

- 9.7.3. Neurology

- 9.7.4. Immunology

- 9.7.5. Other applications

- 9.8. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 9.8.1. Academic and research organizations

- 9.8.2. Pharmaceutical & biotechnology companies

- 9.8.3. Hospital and diagnostic laboratories

- 9.8.4. Other end-users

- 9.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 10. Middle East & Africa Multi-omics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 10.1.1. The integration of genomics, transcriptomics, proteomics, and metabolomics has allowed researchers and clinicians to unravel the complex landscape of cancer at a molecular level, paving the way for more targeted therapies.

- 10.1.2. Also, advancements in technology and data analysis tools have streamlined the process of generating and interpreting multi-omics data, making it more accessible and applicable in clinical settings.

- 10.2. Market Analysis, Insights and Forecast - by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations.

- 10.2.1. Academic & research organizations have embraced multi-omics as a powerful tool to unravel the complexities of diseases, identify biomarkers, and personalize therapeutic strategies.

- 10.2.2. With their substantial budgets and focus on interdisciplinary research, academic institutes and research centers continue to be key drivers of innovation in the multi-omics industry, thereby aiding in high segment development.

- 10.3. Market Analysis, Insights and Forecast - by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below:

- 10.3.1. Becton, Dickinson and Company

- 10.3.2. Thermo Fisher Scientific Inc.

- 10.3.3. Illumina, Inc

- 10.3.4. Danaher

- 10.3.5. PerkinElmer Inc.

- 10.3.6. Shimadzu Corporation

- 10.3.7. Bruker

- 10.3.8. QIAGEN

- 10.3.9. Agilent Technologies, Inc.

- 10.3.10. BGI

- 10.3.11. 10x Genomics

- 10.3.12. CYTENA GmbH

- 10.4. Market Analysis, Insights and Forecast - by Product & Services, 2018 – 2032 (USD Million)

- 10.4.1. Products

- 10.4.2. Instruments

- 10.4.3. Consumables

- 10.4.4. Software

- 10.5. Market Analysis, Insights and Forecast - by Type, 2018 – 2032 (USD Million)

- 10.5.1. Single-cell multi-omics

- 10.5.2. Bulk multi-omics

- 10.6. Market Analysis, Insights and Forecast - by Platform, 2018 – 2032 (USD Million)

- 10.6.1. Genomics

- 10.6.2. Transcriptomics

- 10.6.3. Proteomics

- 10.6.4. Metabolomics

- 10.6.5. Integrated omics platforms

- 10.7. Market Analysis, Insights and Forecast - by Application, 2018 – 2032 (USD Million)

- 10.7.1. Oncology

- 10.7.2. Cell biology

- 10.7.3. Neurology

- 10.7.4. Immunology

- 10.7.5. Other applications

- 10.8. Market Analysis, Insights and Forecast - by End-use, 2018 – 2032 (USD Million)

- 10.8.1. Academic and research organizations

- 10.8.2. Pharmaceutical & biotechnology companies

- 10.8.3. Hospital and diagnostic laboratories

- 10.8.4. Other end-users

- 10.1. Market Analysis, Insights and Forecast - by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032.

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermo Fisher Scientific Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Illumina Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Danaher

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PerkinElmer Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shimadzu Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bruker

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 QIAGEN

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agilent Technologies Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BGI

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 10x Genomics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CYTENA GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

- Figure 1: Global Multi-omics Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Multi-omics Market Revenue (Billion), by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2024 & 2032

- Figure 3: North America Multi-omics Market Revenue Share (%), by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2024 & 2032

- Figure 4: North America Multi-omics Market Revenue (Billion), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2024 & 2032

- Figure 5: North America Multi-omics Market Revenue Share (%), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2024 & 2032

- Figure 6: North America Multi-omics Market Revenue (Billion), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2024 & 2032

- Figure 7: North America Multi-omics Market Revenue Share (%), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2024 & 2032

- Figure 8: North America Multi-omics Market Revenue (Billion), by Product & Services, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 9: North America Multi-omics Market Revenue Share (%), by Product & Services, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 10: North America Multi-omics Market Revenue (Billion), by Type, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 11: North America Multi-omics Market Revenue Share (%), by Type, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 12: North America Multi-omics Market Revenue (Billion), by Platform, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 13: North America Multi-omics Market Revenue Share (%), by Platform, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 14: North America Multi-omics Market Revenue (Billion), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 15: North America Multi-omics Market Revenue Share (%), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 16: North America Multi-omics Market Revenue (Billion), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 17: North America Multi-omics Market Revenue Share (%), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 18: North America Multi-omics Market Revenue (Billion), by Country 2024 & 2032

- Figure 19: North America Multi-omics Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Multi-omics Market Revenue (Billion), by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2024 & 2032

- Figure 21: Europe Multi-omics Market Revenue Share (%), by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2024 & 2032

- Figure 22: Europe Multi-omics Market Revenue (Billion), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2024 & 2032

- Figure 23: Europe Multi-omics Market Revenue Share (%), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2024 & 2032

- Figure 24: Europe Multi-omics Market Revenue (Billion), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2024 & 2032

- Figure 25: Europe Multi-omics Market Revenue Share (%), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2024 & 2032

- Figure 26: Europe Multi-omics Market Revenue (Billion), by Product & Services, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 27: Europe Multi-omics Market Revenue Share (%), by Product & Services, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 28: Europe Multi-omics Market Revenue (Billion), by Type, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 29: Europe Multi-omics Market Revenue Share (%), by Type, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 30: Europe Multi-omics Market Revenue (Billion), by Platform, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 31: Europe Multi-omics Market Revenue Share (%), by Platform, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 32: Europe Multi-omics Market Revenue (Billion), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 33: Europe Multi-omics Market Revenue Share (%), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 34: Europe Multi-omics Market Revenue (Billion), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 35: Europe Multi-omics Market Revenue Share (%), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 36: Europe Multi-omics Market Revenue (Billion), by Country 2024 & 2032

- Figure 37: Europe Multi-omics Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Multi-omics Market Revenue (Billion), by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2024 & 2032

- Figure 39: Asia Pacific Multi-omics Market Revenue Share (%), by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2024 & 2032

- Figure 40: Asia Pacific Multi-omics Market Revenue (Billion), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2024 & 2032

- Figure 41: Asia Pacific Multi-omics Market Revenue Share (%), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2024 & 2032

- Figure 42: Asia Pacific Multi-omics Market Revenue (Billion), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2024 & 2032

- Figure 43: Asia Pacific Multi-omics Market Revenue Share (%), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2024 & 2032

- Figure 44: Asia Pacific Multi-omics Market Revenue (Billion), by Product & Services, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 45: Asia Pacific Multi-omics Market Revenue Share (%), by Product & Services, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 46: Asia Pacific Multi-omics Market Revenue (Billion), by Type, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 47: Asia Pacific Multi-omics Market Revenue Share (%), by Type, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 48: Asia Pacific Multi-omics Market Revenue (Billion), by Platform, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 49: Asia Pacific Multi-omics Market Revenue Share (%), by Platform, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 50: Asia Pacific Multi-omics Market Revenue (Billion), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 51: Asia Pacific Multi-omics Market Revenue Share (%), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 52: Asia Pacific Multi-omics Market Revenue (Billion), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 53: Asia Pacific Multi-omics Market Revenue Share (%), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 54: Asia Pacific Multi-omics Market Revenue (Billion), by Country 2024 & 2032

- Figure 55: Asia Pacific Multi-omics Market Revenue Share (%), by Country 2024 & 2032

- Figure 56: Latin America Multi-omics Market Revenue (Billion), by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2024 & 2032

- Figure 57: Latin America Multi-omics Market Revenue Share (%), by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2024 & 2032

- Figure 58: Latin America Multi-omics Market Revenue (Billion), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2024 & 2032

- Figure 59: Latin America Multi-omics Market Revenue Share (%), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2024 & 2032

- Figure 60: Latin America Multi-omics Market Revenue (Billion), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2024 & 2032

- Figure 61: Latin America Multi-omics Market Revenue Share (%), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2024 & 2032

- Figure 62: Latin America Multi-omics Market Revenue (Billion), by Product & Services, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 63: Latin America Multi-omics Market Revenue Share (%), by Product & Services, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 64: Latin America Multi-omics Market Revenue (Billion), by Type, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 65: Latin America Multi-omics Market Revenue Share (%), by Type, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 66: Latin America Multi-omics Market Revenue (Billion), by Platform, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 67: Latin America Multi-omics Market Revenue Share (%), by Platform, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 68: Latin America Multi-omics Market Revenue (Billion), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 69: Latin America Multi-omics Market Revenue Share (%), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 70: Latin America Multi-omics Market Revenue (Billion), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 71: Latin America Multi-omics Market Revenue Share (%), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 72: Latin America Multi-omics Market Revenue (Billion), by Country 2024 & 2032

- Figure 73: Latin America Multi-omics Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Middle East & Africa Multi-omics Market Revenue (Billion), by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2024 & 2032

- Figure 75: Middle East & Africa Multi-omics Market Revenue Share (%), by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2024 & 2032

- Figure 76: Middle East & Africa Multi-omics Market Revenue (Billion), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2024 & 2032

- Figure 77: Middle East & Africa Multi-omics Market Revenue Share (%), by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2024 & 2032

- Figure 78: Middle East & Africa Multi-omics Market Revenue (Billion), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2024 & 2032

- Figure 79: Middle East & Africa Multi-omics Market Revenue Share (%), by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2024 & 2032

- Figure 80: Middle East & Africa Multi-omics Market Revenue (Billion), by Product & Services, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 81: Middle East & Africa Multi-omics Market Revenue Share (%), by Product & Services, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 82: Middle East & Africa Multi-omics Market Revenue (Billion), by Type, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 83: Middle East & Africa Multi-omics Market Revenue Share (%), by Type, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 84: Middle East & Africa Multi-omics Market Revenue (Billion), by Platform, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 85: Middle East & Africa Multi-omics Market Revenue Share (%), by Platform, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 86: Middle East & Africa Multi-omics Market Revenue (Billion), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 87: Middle East & Africa Multi-omics Market Revenue Share (%), by Application, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 88: Middle East & Africa Multi-omics Market Revenue (Billion), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 89: Middle East & Africa Multi-omics Market Revenue Share (%), by End-use, 2018 – 2032 (USD Million) 2024 & 2032

- Figure 90: Middle East & Africa Multi-omics Market Revenue (Billion), by Country 2024 & 2032

- Figure 91: Middle East & Africa Multi-omics Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Multi-omics Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Multi-omics Market Revenue Billion Forecast, by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2019 & 2032

- Table 3: Global Multi-omics Market Revenue Billion Forecast, by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2019 & 2032

- Table 4: Global Multi-omics Market Revenue Billion Forecast, by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2019 & 2032

- Table 5: Global Multi-omics Market Revenue Billion Forecast, by Product & Services, 2018 – 2032 (USD Million) 2019 & 2032

- Table 6: Global Multi-omics Market Revenue Billion Forecast, by Type, 2018 – 2032 (USD Million) 2019 & 2032

- Table 7: Global Multi-omics Market Revenue Billion Forecast, by Platform, 2018 – 2032 (USD Million) 2019 & 2032

- Table 8: Global Multi-omics Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 9: Global Multi-omics Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 10: Global Multi-omics Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 11: Global Multi-omics Market Revenue Billion Forecast, by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2019 & 2032

- Table 12: Global Multi-omics Market Revenue Billion Forecast, by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2019 & 2032

- Table 13: Global Multi-omics Market Revenue Billion Forecast, by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2019 & 2032

- Table 14: Global Multi-omics Market Revenue Billion Forecast, by Product & Services, 2018 – 2032 (USD Million) 2019 & 2032

- Table 15: Global Multi-omics Market Revenue Billion Forecast, by Type, 2018 – 2032 (USD Million) 2019 & 2032

- Table 16: Global Multi-omics Market Revenue Billion Forecast, by Platform, 2018 – 2032 (USD Million) 2019 & 2032

- Table 17: Global Multi-omics Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 18: Global Multi-omics Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 19: Global Multi-omics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 20: U.S. Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 21: Canada Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Global Multi-omics Market Revenue Billion Forecast, by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2019 & 2032

- Table 23: Global Multi-omics Market Revenue Billion Forecast, by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2019 & 2032

- Table 24: Global Multi-omics Market Revenue Billion Forecast, by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2019 & 2032

- Table 25: Global Multi-omics Market Revenue Billion Forecast, by Product & Services, 2018 – 2032 (USD Million) 2019 & 2032

- Table 26: Global Multi-omics Market Revenue Billion Forecast, by Type, 2018 – 2032 (USD Million) 2019 & 2032

- Table 27: Global Multi-omics Market Revenue Billion Forecast, by Platform, 2018 – 2032 (USD Million) 2019 & 2032

- Table 28: Global Multi-omics Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 29: Global Multi-omics Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 30: Global Multi-omics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 31: Germany Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: UK Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 33: France Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 34: Spain Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 35: Italy Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 37: Global Multi-omics Market Revenue Billion Forecast, by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2019 & 2032

- Table 38: Global Multi-omics Market Revenue Billion Forecast, by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2019 & 2032

- Table 39: Global Multi-omics Market Revenue Billion Forecast, by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2019 & 2032

- Table 40: Global Multi-omics Market Revenue Billion Forecast, by Product & Services, 2018 – 2032 (USD Million) 2019 & 2032

- Table 41: Global Multi-omics Market Revenue Billion Forecast, by Type, 2018 – 2032 (USD Million) 2019 & 2032

- Table 42: Global Multi-omics Market Revenue Billion Forecast, by Platform, 2018 – 2032 (USD Million) 2019 & 2032

- Table 43: Global Multi-omics Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 44: Global Multi-omics Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 45: Global Multi-omics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 46: China Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 47: Japan Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 48: India Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 49: Australia Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 50: Rest of Asia Pacific Multi-omics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 51: Global Multi-omics Market Revenue Billion Forecast, by application, the multi-omics market is categorized into cell biology, oncology, neurology, immunology, and other applications. The oncology segment is poised for high growth and is anticipated to reach USD 3.3 billion by 2032. 2019 & 2032

- Table 52: Global Multi-omics Market Revenue Billion Forecast, by end-use, the multi-omics market is segmented into academic & research organizations, pharmaceutical & biotechnology companies, hospital and diagnostic laboratories, and other end-users. Wide application of multi-omics data in research, is anticipated to propel the growth of academic and research organizations. 2019 & 2032

- Table 53: Global Multi-omics Market Revenue Billion Forecast, by The market is characterized by diverse players competing in the industry. Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Illumina, Inc. account for significant market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, geographical expansion, strategic approaches, product diversification, and regulatory compliance. The foremost market players operating in the multi-omics industry is as mentioned below: 2019 & 2032

- Table 54: Global Multi-omics Market Revenue Billion Forecast, by Product & Services, 2018 – 2032 (USD Million) 2019 & 2032

- Table 55: Global Multi-omics Market Revenue Billion Forecast, by Type, 2018 – 2032 (USD Million) 2019 & 2032

- Table 56: Global Multi-omics Market Revenue Billion Forecast, by Platform, 2018 – 2032 (USD Million) 2019 & 2032

- Table 57: Global Multi-omics Market Revenue Billion Forecast, by Application, 2018 – 2032 (USD Million) 2019 & 2032

- Table 58: Global Multi-omics Market Revenue Billion Forecast, by End-use, 2018 – 2032 (USD Million) 2019 & 2032

- Table 59: Global Multi-omics Market Revenue Billion Forecast, by Country 2019 & 2032