Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

North America PVC Door Frame Market Strategic Roadmap: Analysis and Forecasts 2025-2033

North America PVC Door Frame Market by Door Type (Single-door frames, Double-door frames, Sliding door frames, French door frames, Others), by Installation (Mobile homes, Manufactured homes), by Application (Residential, Commercial), by End Use (Exterior, Interior), by Distribution Channel (Direct sales, Indirect sales), by North America (U.S., Canada, Mexico) Forecast 2025-2033

Key Insights

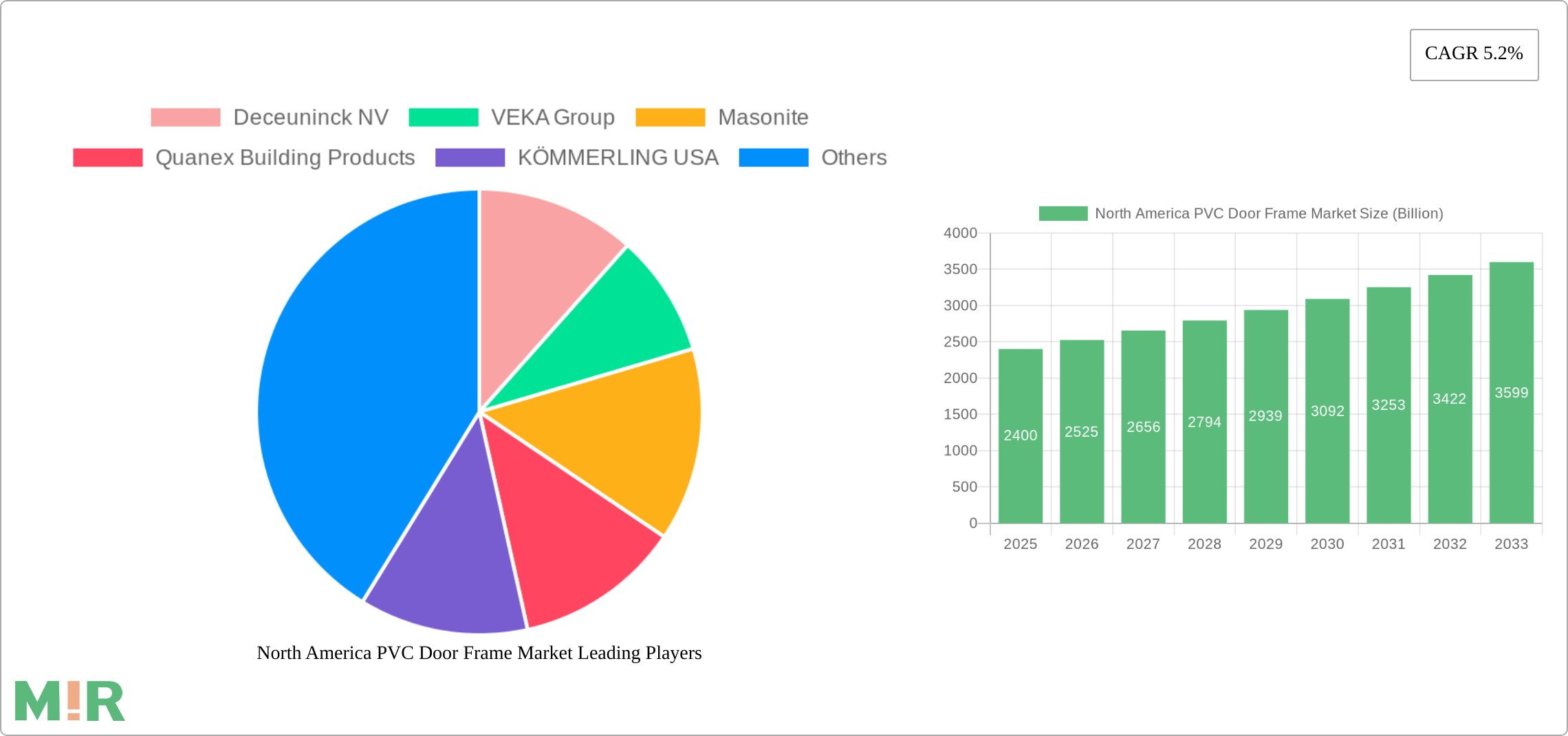

The North American PVC door frame market, valued at $2.4 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033. This growth is fueled by several key factors. The increasing preference for energy-efficient building materials, coupled with the rising demand for aesthetically pleasing and durable door frames, is a significant driver. Furthermore, the burgeoning residential construction sector, particularly new home builds and renovations, significantly contributes to market expansion. The commercial construction sector, encompassing both new constructions and renovations, also contributes substantially to market demand. PVC's inherent advantages, such as low maintenance, resistance to rot and decay, and cost-effectiveness compared to traditional wood frames, further enhance market appeal. Growth is also spurred by innovation in design, with a diverse range of door types—including single, double, sliding, and French door frames—catering to varied architectural preferences and home styles. The market segmentation also includes mobile and manufactured homes, showcasing the adaptability of PVC frames across various housing types. Distribution channels, encompassing both direct and indirect sales, further facilitate market penetration and reach.

However, certain challenges exist. Fluctuations in raw material prices, particularly PVC resin, can impact profitability and price competitiveness. Stringent environmental regulations surrounding PVC manufacturing and disposal present an ongoing challenge for manufacturers. Competition from alternative materials, such as aluminum and fiberglass, demands continuous product innovation and value proposition enhancements. Despite these restraints, the market outlook remains positive, driven by sustained demand from the construction industry and the inherent advantages of PVC door frames. The continued focus on sustainable and energy-efficient building practices is expected to further bolster market growth in the forecast period. The US market, being the largest contributor within North America, will continue to lead growth due to its substantial construction activities and housing market dynamics. Canada and Mexico will also contribute to overall regional expansion, though at a potentially slightly lower pace than the US.

North America PVC Door Frame Market Concentration & Characteristics

The North American PVC door frame market is moderately concentrated, with a few major players holding significant market share. However, numerous smaller regional and specialized manufacturers also contribute substantially. The market exhibits characteristics of ongoing innovation, with companies focusing on enhancing durability, energy efficiency, and aesthetics. This includes developing new profiles, improved weather-sealing technologies, and incorporating advanced composite materials.

- Concentration Areas: The US, particularly the Southeast and Southwest regions, accounts for the largest market share due to high construction activity and favorable climatic conditions. Canada and Mexico exhibit moderate growth.

- Characteristics:

- Innovation: Focus on energy-efficient designs, enhanced security features, and aesthetically pleasing options.

- Impact of Regulations: Building codes and energy efficiency standards significantly influence product design and demand, driving adoption of high-performance frames.

- Product Substitutes: Aluminum and wood frames are primary competitors, although PVC's cost-effectiveness and maintenance advantages provide a strong competitive edge.

- End-User Concentration: Residential construction is the largest segment, followed by commercial construction and renovation projects.

- Level of M&A: The market is witnessing a moderate level of mergers and acquisitions, as larger players seek to expand their product portfolios and geographical reach, as seen in recent acquisitions by Pella and Masonite.

North America PVC Door Frame Market Trends

The North American PVC door frame market is experiencing steady growth, driven by several key trends. The increasing demand for energy-efficient and sustainable building materials is a primary factor, as PVC frames offer excellent insulation properties compared to traditional materials. Furthermore, the rising popularity of custom-designed homes and commercial buildings is fueling demand for aesthetically versatile PVC door frames, available in a wider array of colors and styles than previously possible. The affordability of PVC frames relative to wood or aluminum, coupled with their low-maintenance characteristics, further enhances market appeal. Technological advancements are leading to stronger, more durable frames with improved weather resistance. The growth of the home renovation market is also contributing to market expansion, as homeowners opt to replace older, less energy-efficient frames with newer, PVC alternatives. Finally, a growing awareness of the environmental benefits of PVC (in terms of its recyclable nature compared to wood and its longevity versus other materials) is also increasing its attractiveness to environmentally conscious consumers. These factors, combined with the steady expansion of the construction industry, are positioning the North American PVC door frame market for continued growth in the coming years. The market is also witnessing a shift towards pre-fabricated and modular door frames to reduce construction time and improve efficiency.

Key Region or Country & Segment to Dominate the Market

The Residential New Construction segment within the U.S. market is poised to dominate the North American PVC door frame market. This is attributed to the robust housing market growth, particularly in the Southern and Western regions of the US, and the increasing preference for energy-efficient building materials among homebuilders.

- Dominant Segments:

- Residential (New Construction): This segment benefits from the large-scale construction of new homes, especially single-family residences. The demand for energy efficiency and cost-effectiveness fuels the preference for PVC frames.

- U.S. Market: The U.S. boasts the largest housing market in North America, leading to the largest demand for PVC door frames. Population growth and migration patterns further enhance demand within this region.

The dominance of the U.S. residential new construction segment stems from several factors: Firstly, the sheer size of the U.S. housing market compared to Canada and Mexico ensures high demand. Secondly, the growing awareness of energy efficiency and the associated financial benefits associated with PVC frames makes them a popular choice among homebuilders. Thirdly, the cost-effectiveness of PVC relative to other materials remains a key factor in choosing these frames. Finally, continued innovations in PVC frame technology, producing even more durable and aesthetically pleasing products, are driving further growth in this sector.

North America PVC Door Frame Market Product Insights Report Coverage & Deliverables

This report provides comprehensive insights into the North American PVC door frame market, encompassing market sizing, segmentation analysis, competitive landscape, and future growth projections. It includes detailed analysis of key market segments like door type (single, double, sliding, French), installation (mobile homes, manufactured homes), application (residential, commercial), and end-use (exterior, interior). The report also offers a detailed competitive analysis, profiling major market players and their strategies. Deliverables include market size estimates, market share analysis by segment, growth forecasts, and an assessment of key market trends and drivers.

North America PVC Door Frame Market Analysis

The North American PVC door frame market is estimated to be valued at approximately $4.5 billion in 2023. The market is projected to experience a Compound Annual Growth Rate (CAGR) of 5-6% over the next five years, reaching an estimated value of $6.0 billion by 2028. This growth is primarily driven by the expanding construction industry, increasing preference for energy-efficient building materials, and the affordability of PVC frames. Market share is distributed among a mix of large multinational companies and smaller regional manufacturers. The largest players hold a significant portion of the market, but smaller companies maintain a considerable presence, particularly in niche segments or specific geographical regions. The competition is primarily based on product innovation, pricing strategies, and brand recognition.

North America PVC Door Frame Market Regional Insights

- North America

- U.S.

- High demand due to large housing market and construction activity. Further segmented by region (Southeast, Southwest, Northeast, Midwest, West). Each region would have its specific growth rate and market size based on local construction trends.

- Canada

- Moderate growth driven by residential and commercial construction projects. Market size significantly smaller than the U.S.

- Mexico

- Growing market, but comparatively smaller than the U.S. and Canada. Growth potential exists, driven by infrastructure development and foreign investment.

- U.S.

Driving Forces: What's Propelling the North America PVC Door Frame Market

The North American PVC door frame market's growth is fueled by several key factors: increased demand for energy-efficient building materials, rising construction activity in both residential and commercial sectors, the affordability and low maintenance requirements of PVC compared to other materials, and continuous product innovation leading to improved durability, aesthetics, and functionality. Government regulations promoting energy efficiency further incentivize the adoption of PVC frames.

Challenges and Restraints in North America PVC Door Frame Market

Challenges include fluctuations in raw material prices (primarily PVC resin), intense competition from alternative materials (wood, aluminum), potential environmental concerns regarding PVC production and disposal (though advancements in recycling technologies are mitigating this), and economic downturns affecting construction spending.

Emerging Trends in North America PVC Door Frame Market

Emerging trends include the growing demand for smart home technology integration (e.g., smart locks), increasing use of recycled PVC content in frame manufacturing, development of more durable and weather-resistant frames, and a rising preference for customized designs and colors to meet individual aesthetic preferences.

North America PVC Door Frame Industry News

- December 2022: Pella Corporation acquired Regency Windows Corporation, expanding its door offerings.

- January 2023: Masonite International Corporation acquired Endura Products, focusing on high-performance door frames.

Leading Players in the North America PVC Door Frame Market

- Deceuninck NV

- VEKA Group

- Masonite

- Quanex Building Products

- KÖMMERLING USA

- ProVia

- Royal Building Products (Westlake Chemical Corporation)

- Quaker Windows and Doors

- MITER Brands

- Chelsea Building Products

- JELD-WEN Holding, Inc.

- Andersen Corporation

- Ply Gem Holdings, Inc.

- Novatech Group

- Crystal Window & Door Systems Ltd.

North America PVC Door Frame Market Segmentation

-

1. Door Type

- 1.1. Single-door frames

- 1.2. Double-door frames

- 1.3. Sliding door frames

- 1.4. French door frames

- 1.5. Others

-

2. Installation

- 2.1. Mobile homes

- 2.2. Manufactured homes

-

3. Application

-

3.1. Residential

- 3.1.1. New construction

- 3.1.2. Renovation/Repair

-

3.2. Commercial

- 3.2.1. New construction

- 3.2.2. Renovation/Repair

-

3.1. Residential

-

4. End Use

- 4.1. Exterior

- 4.2. Interior

-

5. Distribution Channel

- 5.1. Direct sales

- 5.2. Indirect sales

North America PVC Door Frame Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

- 1.3. Mexico

North America PVC Door Frame Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.2% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising spending on housing/commercial infrastructure

- 3.2.2 Increasing replacement of aging infrastructure

- 3.2.3 Proliferating demand for UOVC profiles

- 3.3. Market Restrains

- 3.3.1. Environmental impacts of waste generated through replacements

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America PVC Door Frame Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Door Type

- 5.1.1. Single-door frames

- 5.1.2. Double-door frames

- 5.1.3. Sliding door frames

- 5.1.4. French door frames

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Mobile homes

- 5.2.2. Manufactured homes

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.1.1. New construction

- 5.3.1.2. Renovation/Repair

- 5.3.2. Commercial

- 5.3.2.1. New construction

- 5.3.2.2. Renovation/Repair

- 5.3.1. Residential

- 5.4. Market Analysis, Insights and Forecast - by End Use

- 5.4.1. Exterior

- 5.4.2. Interior

- 5.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.5.1. Direct sales

- 5.5.2. Indirect sales

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Door Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Deceuninck NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 VEKA Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Masonite

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Quanex Building Products

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KÖMMERLING USA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ProVia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Building Products (Westlake Chemical Corporation)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Quaker Windows and Doors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MITER Brands

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chelsea Building Products

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 JELD-WEN Holding Inc.

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Andersen Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Ply Gem Holdings Inc.

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Novatech Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Crystal Window & Door Systems Ltd.

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Deceuninck NV

- Figure 1: North America PVC Door Frame Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: North America PVC Door Frame Market Share (%) by Company 2024

- Table 1: North America PVC Door Frame Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: North America PVC Door Frame Market Revenue Billion Forecast, by Door Type 2019 & 2032

- Table 3: North America PVC Door Frame Market Revenue Billion Forecast, by Installation 2019 & 2032

- Table 4: North America PVC Door Frame Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 5: North America PVC Door Frame Market Revenue Billion Forecast, by End Use 2019 & 2032

- Table 6: North America PVC Door Frame Market Revenue Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: North America PVC Door Frame Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 8: North America PVC Door Frame Market Revenue Billion Forecast, by Door Type 2019 & 2032

- Table 9: North America PVC Door Frame Market Revenue Billion Forecast, by Installation 2019 & 2032

- Table 10: North America PVC Door Frame Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 11: North America PVC Door Frame Market Revenue Billion Forecast, by End Use 2019 & 2032

- Table 12: North America PVC Door Frame Market Revenue Billion Forecast, by Distribution Channel 2019 & 2032

- Table 13: North America PVC Door Frame Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 14: U.S. North America PVC Door Frame Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 15: Canada North America PVC Door Frame Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America PVC Door Frame Market Revenue (Billion) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)