Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Scrambled Egg Mix Market 2025-2033 Overview: Trends, Competitor Dynamics, and Opportunities

Scrambled Egg Mix Market by Product Type (Powdered mix, Liquid mix, Frozen mix), by Packaging Type (Pouches, Cartons, Cans, Other (Blister Packs, Tubs)), by Sales Channel (Online Retail, Supermarket/Hypermarket, Grocery Store, Other (Convenience Stores, Specialty Stores)), by North America (U.S., Canada), by Europe (Germany, UK, France, Italy, Spain, Rest of Europe), by Asia Pacific (China, India, Japan, South Korea, Australia, Rest of Asia Pacific), by Latin America (Brazil, Mexico, Argentina, Rest of Latin America), by MEA (Saudi Arabia, UAE, South Africa, Rest of MEA) Forecast 2025-2033

Key Insights

The global scrambled egg mix market, valued at $577.89 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing demand for convenient and time-saving breakfast options fuels the market's expansion, particularly among busy professionals and families. The growing popularity of ready-to-eat meals and the rising adoption of online grocery shopping further contribute to market growth. Product innovation, with the introduction of healthier, organic, and specialized mixes catering to dietary restrictions (e.g., vegan, low-sodium), also stimulates market expansion. The market is segmented by product type (powdered, liquid, frozen), packaging (pouches, cartons, cans), and sales channel (online, supermarkets, grocery stores), each presenting unique growth opportunities. While the competitive landscape includes established players like Augason Farms and Backpacker's Pantry alongside newer entrants, the market shows potential for further consolidation and expansion through strategic partnerships and acquisitions. Geographic expansion, particularly in developing economies with rising disposable incomes, also presents a lucrative avenue for growth. Challenges include fluctuating raw material prices (eggs and other ingredients) and maintaining product quality and shelf life, particularly for liquid and frozen mixes.

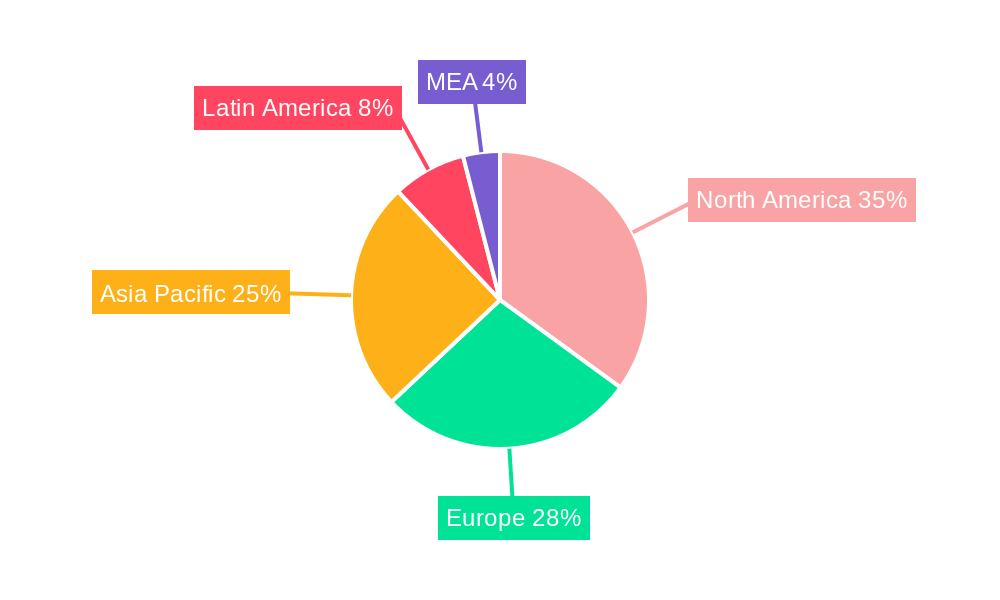

Continued growth is anticipated through 2033, with a compound annual growth rate (CAGR) of 3.7%. This sustained expansion will be fueled by evolving consumer preferences towards healthier and more diverse breakfast choices. The market's regional distribution is expected to see growth across North America and Asia-Pacific, reflecting robust food processing industries and high demand for ready-to-eat meals in these regions. To maintain a competitive edge, manufacturers are focusing on sustainable packaging solutions, catering to the increasing environmental awareness among consumers. Furthermore, targeted marketing campaigns highlighting convenience and health benefits are crucial for driving sales within specific consumer demographics. The long-term outlook for the scrambled egg mix market remains positive, underpinned by continuous innovation and evolving consumer needs.

Scrambled Egg Mix Market Concentration & Characteristics

The scrambled egg mix market is moderately fragmented, with several regional and national players competing alongside larger multinational food companies. Market concentration is higher in developed regions like North America and Europe, where established brands hold significant market share. However, emerging markets in Asia-Pacific and Latin America present opportunities for smaller players and new entrants.

Characteristics of Innovation: Innovation focuses primarily on convenience, health, and sustainability. This includes advancements in packaging (e.g., single-serving pouches, shelf-stable options), formulation (e.g., organic, reduced-fat, protein-enhanced mixes), and distribution channels (e.g., online retail expansion).

Impact of Regulations: Food safety regulations concerning egg handling and processing significantly impact the market. Compliance with these regulations adds to production costs and influences market entry barriers. Clean label trends and increasing demand for natural ingredients also exert pressure.

Product Substitutes: Traditional eggs, breakfast cereals, and other quick-meal options represent key substitutes. The market's growth hinges on demonstrating the convenience and value proposition of scrambled egg mixes over these alternatives.

End User Concentration: The market caters to a broad range of end-users, including households, restaurants (HoReCa), food service providers, and institutions. However, household consumption forms the largest end-user segment.

Level of M&A: Consolidation in the market is moderate. Larger food companies may acquire smaller, specialized producers to expand their product portfolio and distribution networks. We estimate M&A activity accounts for approximately 5% of annual market growth.

Scrambled Egg Mix Market Trends

The scrambled egg mix market is experiencing robust growth driven by several key trends. The increasing demand for convenient and ready-to-eat meals is a primary driver, particularly among busy professionals and families. Consumers are seeking time-saving alternatives to preparing breakfast from scratch, boosting the demand for quick and easy options. The rising popularity of on-the-go consumption further fuels market expansion, as convenient packaging options like single-serving pouches and cups gain traction. Health-conscious consumers are driving demand for products with improved nutritional profiles, such as reduced-fat or organic scrambled egg mixes. This segment is expected to witness significant growth in coming years. The market is also witnessing an upswing in demand for clean label and natural products, free from artificial additives and preservatives. This trend is compelling manufacturers to adopt sustainable sourcing practices and use natural ingredients. Finally, the growing penetration of e-commerce and online grocery shopping is rapidly expanding the reach of scrambled egg mixes, offering wider market access and increasing sales. The shift towards a more health-conscious lifestyle is anticipated to propel market expansion substantially. The adoption of innovative packaging solutions designed for both storage and convenience is expected to contribute to the market's expansion. Furthermore, the rise in disposable incomes, particularly in emerging economies, is creating an increased demand for ready-to-eat and convenient food options like scrambled egg mixes. The continued focus on creating healthier and more convenient options, supported by robust marketing efforts, positions the market for sustained growth in the coming years. We project a Compound Annual Growth Rate (CAGR) of approximately 6% over the next five years.

Key Region or Country & Segment to Dominate the Market

The North American market currently dominates the scrambled egg mix market, driven by high consumer disposable incomes, a preference for convenient breakfast options, and the widespread availability of retail channels. However, the Asia-Pacific region exhibits the highest growth potential, fueled by rising urbanization, changing lifestyles, and increasing demand for convenient foods. Within segments, the liquid mix dominates due to its ease of preparation and versatile culinary applications.

Product Type: Liquid mix holds the largest market share (estimated at 55% in 2023) due to its convenience and ease of preparation compared to powdered or frozen options.

Packaging Type: Cartons are the leading packaging type, offering a balance of cost-effectiveness and consumer appeal, followed closely by pouches that are gaining popularity for their portability and convenience.

Sales Channel: Supermarket/Hypermarkets account for the most significant proportion of sales, offering wide distribution and reach to consumers. However, online retail is expanding rapidly, with its convenience and reach driving increasing market share.

Scrambled Egg Mix Market Product Insights Report Coverage & Deliverables

This report provides a comprehensive overview of the scrambled egg mix market, analyzing market size, growth trends, key players, product segmentation, and regional dynamics. The report offers detailed insights into consumer preferences, competitive landscape, and emerging market trends. It delivers actionable recommendations for businesses to capitalize on market opportunities and navigate industry challenges. Key deliverables include market sizing, segmentation analysis, competitive benchmarking, and future growth forecasts.

Scrambled Egg Mix Market Analysis

The global scrambled egg mix market is valued at approximately $1.2 billion in 2023. This is projected to reach $1.8 billion by 2028, reflecting a robust Compound Annual Growth Rate (CAGR). Market growth is driven primarily by increasing demand for convenient breakfast options and a rising preference for ready-to-eat meals. The market is segmented by product type (powdered, liquid, frozen), packaging type (pouches, cartons, cans), and sales channel (online retail, supermarkets, grocery stores). The liquid mix segment holds the largest market share, while cartons are the preferred packaging type. Supermarket/hypermarkets remain the dominant sales channel, though online sales are rapidly growing.

Scrambled Egg Mix Market Regional Insights

- North America:

- U.S.: Dominates the region due to high demand for convenient foods. (Estimated Market Size: $600 million)

- Canada: Shows steady growth, driven by similar trends to the U.S. (Estimated Market Size: $150 million)

- Europe:

- Germany: Strong market due to established food processing industry. (Estimated Market Size: $200 million)

- UK: High demand for convenient breakfasts drives growth. (Estimated Market Size: $180 million)

- France, Italy, Spain, Rest of Europe: Moderate growth in these markets. (Estimated Market Size: $270 million)

- Asia Pacific:

- China: Rapid expansion driven by urbanization and changing lifestyles. (Estimated Market Size: $100 million)

- India: Growing market potential, fueled by rising disposable incomes. (Estimated Market Size: $50 million)

- Japan, South Korea, Australia, Rest of Asia Pacific: Moderate to strong growth potential. (Estimated Market Size: $120 million)

- Latin America:

- Brazil: Growing market, with increasing demand for convenient foods. (Estimated Market Size: $40 million)

- Mexico, Argentina, Rest of Latin America: Moderate growth potential. (Estimated Market Size: $30 million)

- MEA:

- Saudi Arabia, UAE, South Africa, Rest of MEA: Limited market size currently, but with potential for future growth. (Estimated Market Size: $20 million)

Driving Forces: What's Propelling the Scrambled Egg Mix Market

The market is propelled by several factors: increasing demand for convenient and ready-to-eat breakfast options, busy lifestyles leading to a time crunch, and rising disposable incomes in developing countries, creating demand for higher-quality and convenient food options. Health-conscious consumers are also driving the adoption of organic and low-fat options.

Challenges and Restraints in Scrambled Egg Mix Market

Challenges include competition from fresh eggs and other breakfast alternatives, stringent food safety regulations, and fluctuating raw material prices (eggs, milk, etc.). Maintaining consistent product quality and managing supply chain complexities are also key challenges.

Emerging Trends in Scrambled Egg Mix Market

Emerging trends include the rise of plant-based egg alternatives, single-serve packaging for portability, and the increasing integration of online retail channels. Sustainability and clean-label claims are gaining importance, driving innovation in ingredients and packaging.

Scrambled Egg Mix Industry News

- January 2020: Ovostar Europe launched a new liquid scrambled egg product in the European market.

- October 2018: Noble Foods’ happy egg co. brand launched a scrambled egg mix into Asda.

Leading Players in the Scrambled Egg Mix Market

- Augason Farms

- Backpacker’s Pantry

- GCF Corporation

- Lodewijckx NV/SA

- National Food Group

- Nutriom OvaEasy

- Saratoga Farms

- Sonstegard Foods Company

- Thrive Life, LLC.

- Zeagold Quality Eggs

Scrambled Egg Mix Market Segmentation

-

1. Product Type

- 1.1. Powdered mix

- 1.2. Liquid mix

- 1.3. Frozen mix

-

2. Packaging Type

- 2.1. Pouches

- 2.2. Cartons

- 2.3. Cans

- 2.4. Other (Blister Packs, Tubs)

-

3. Sales Channel

- 3.1. Online Retail

- 3.2. Supermarket/Hypermarket

- 3.3. Grocery Store

- 3.4. Other (Convenience Stores, Specialty Stores)

Scrambled Egg Mix Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of Latin America

-

5. MEA

- 5.1. Saudi Arabia

- 5.2. UAE

- 5.3. South Africa

- 5.4. Rest of MEA

Scrambled Egg Mix Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.7% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Convenience and Busy Lifestyles

- 3.2.2 Health and Nutrition Trends

- 3.2.3 Expansion of Online Retail

- 3.3. Market Restrains

- 3.3.1. Perceived Freshness and Quality Issues

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Scrambled Egg Mix Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Powdered mix

- 5.1.2. Liquid mix

- 5.1.3. Frozen mix

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Pouches

- 5.2.2. Cartons

- 5.2.3. Cans

- 5.2.4. Other (Blister Packs, Tubs)

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Online Retail

- 5.3.2. Supermarket/Hypermarket

- 5.3.3. Grocery Store

- 5.3.4. Other (Convenience Stores, Specialty Stores)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Scrambled Egg Mix Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Powdered mix

- 6.1.2. Liquid mix

- 6.1.3. Frozen mix

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Pouches

- 6.2.2. Cartons

- 6.2.3. Cans

- 6.2.4. Other (Blister Packs, Tubs)

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. Online Retail

- 6.3.2. Supermarket/Hypermarket

- 6.3.3. Grocery Store

- 6.3.4. Other (Convenience Stores, Specialty Stores)

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Scrambled Egg Mix Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Powdered mix

- 7.1.2. Liquid mix

- 7.1.3. Frozen mix

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Pouches

- 7.2.2. Cartons

- 7.2.3. Cans

- 7.2.4. Other (Blister Packs, Tubs)

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. Online Retail

- 7.3.2. Supermarket/Hypermarket

- 7.3.3. Grocery Store

- 7.3.4. Other (Convenience Stores, Specialty Stores)

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Scrambled Egg Mix Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Powdered mix

- 8.1.2. Liquid mix

- 8.1.3. Frozen mix

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Pouches

- 8.2.2. Cartons

- 8.2.3. Cans

- 8.2.4. Other (Blister Packs, Tubs)

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. Online Retail

- 8.3.2. Supermarket/Hypermarket

- 8.3.3. Grocery Store

- 8.3.4. Other (Convenience Stores, Specialty Stores)

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Scrambled Egg Mix Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Powdered mix

- 9.1.2. Liquid mix

- 9.1.3. Frozen mix

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Pouches

- 9.2.2. Cartons

- 9.2.3. Cans

- 9.2.4. Other (Blister Packs, Tubs)

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. Online Retail

- 9.3.2. Supermarket/Hypermarket

- 9.3.3. Grocery Store

- 9.3.4. Other (Convenience Stores, Specialty Stores)

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. MEA Scrambled Egg Mix Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Powdered mix

- 10.1.2. Liquid mix

- 10.1.3. Frozen mix

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Pouches

- 10.2.2. Cartons

- 10.2.3. Cans

- 10.2.4. Other (Blister Packs, Tubs)

- 10.3. Market Analysis, Insights and Forecast - by Sales Channel

- 10.3.1. Online Retail

- 10.3.2. Supermarket/Hypermarket

- 10.3.3. Grocery Store

- 10.3.4. Other (Convenience Stores, Specialty Stores)

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Augason Farms

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Backpacker’s Pantry

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GCF Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lodewijckx NV/SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 National Food Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nutriom OvaEasy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Saratoga Farms

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sonstegard Foods Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thrive Life LLC.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zeagold Quality Eggs

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Augason Farms

- Figure 1: Global Scrambled Egg Mix Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Scrambled Egg Mix Market Revenue (Million), by Product Type 2024 & 2032

- Figure 3: North America Scrambled Egg Mix Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 4: North America Scrambled Egg Mix Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 5: North America Scrambled Egg Mix Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 6: North America Scrambled Egg Mix Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 7: North America Scrambled Egg Mix Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 8: North America Scrambled Egg Mix Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Scrambled Egg Mix Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Scrambled Egg Mix Market Revenue (Million), by Product Type 2024 & 2032

- Figure 11: Europe Scrambled Egg Mix Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: Europe Scrambled Egg Mix Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 13: Europe Scrambled Egg Mix Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 14: Europe Scrambled Egg Mix Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 15: Europe Scrambled Egg Mix Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 16: Europe Scrambled Egg Mix Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Scrambled Egg Mix Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Scrambled Egg Mix Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Asia Pacific Scrambled Egg Mix Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Asia Pacific Scrambled Egg Mix Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 21: Asia Pacific Scrambled Egg Mix Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 22: Asia Pacific Scrambled Egg Mix Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 23: Asia Pacific Scrambled Egg Mix Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 24: Asia Pacific Scrambled Egg Mix Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Scrambled Egg Mix Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Latin America Scrambled Egg Mix Market Revenue (Million), by Product Type 2024 & 2032

- Figure 27: Latin America Scrambled Egg Mix Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 28: Latin America Scrambled Egg Mix Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 29: Latin America Scrambled Egg Mix Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 30: Latin America Scrambled Egg Mix Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 31: Latin America Scrambled Egg Mix Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 32: Latin America Scrambled Egg Mix Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America Scrambled Egg Mix Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: MEA Scrambled Egg Mix Market Revenue (Million), by Product Type 2024 & 2032

- Figure 35: MEA Scrambled Egg Mix Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 36: MEA Scrambled Egg Mix Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 37: MEA Scrambled Egg Mix Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 38: MEA Scrambled Egg Mix Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 39: MEA Scrambled Egg Mix Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 40: MEA Scrambled Egg Mix Market Revenue (Million), by Country 2024 & 2032

- Figure 41: MEA Scrambled Egg Mix Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Scrambled Egg Mix Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Scrambled Egg Mix Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Scrambled Egg Mix Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: Global Scrambled Egg Mix Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 5: Global Scrambled Egg Mix Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Scrambled Egg Mix Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Global Scrambled Egg Mix Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 8: Global Scrambled Egg Mix Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 9: Global Scrambled Egg Mix Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: U.S. Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Scrambled Egg Mix Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Global Scrambled Egg Mix Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 14: Global Scrambled Egg Mix Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 15: Global Scrambled Egg Mix Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: UK Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Scrambled Egg Mix Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Global Scrambled Egg Mix Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 24: Global Scrambled Egg Mix Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 25: Global Scrambled Egg Mix Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: China Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: India Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Japan Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: South Korea Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Australia Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Scrambled Egg Mix Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 33: Global Scrambled Egg Mix Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 34: Global Scrambled Egg Mix Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 35: Global Scrambled Egg Mix Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Brazil Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Mexico Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Argentina Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of Latin America Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Scrambled Egg Mix Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 41: Global Scrambled Egg Mix Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 42: Global Scrambled Egg Mix Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 43: Global Scrambled Egg Mix Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Saudi Arabia Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: UAE Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of MEA Scrambled Egg Mix Market Revenue (Million) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)