Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Travel Insurance Market Strategic Market Roadmap: Analysis and Forecasts 2025-2033

Travel Insurance Market by Type (Domestic, International), by Trip (Single, Multiple, Extended), by Provider (Insurance companies, Banks, Others), by End-Use (Senior citizens, Corporate travellers, Family travellers, Education travellers, Backpacker & adventure travellers, Others), by North America (U.S., Canada), by Europe (UK, Germany, France, Italy, Spain, Russia), by Asia Pacific (China, India, Japan, South Korea, Australia), by Latin America (Brazil, Mexico), by MEA (South Africa, UAE, Saudi Arabia) Forecast 2025-2033

Key Insights

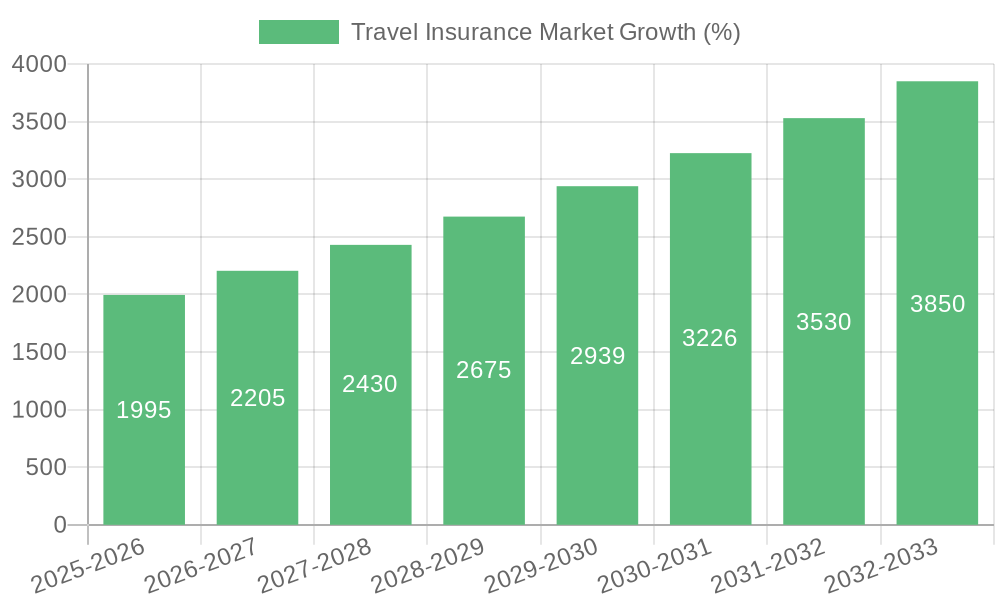

The global travel insurance market, valued at $21 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 9.5% from 2025 to 2033. This expansion is fueled by several key factors. The rising popularity of international travel, particularly among senior citizens and corporate travelers, significantly boosts demand for comprehensive coverage. Increased awareness of potential travel risks, including medical emergencies, trip cancellations, and lost luggage, is driving consumers to prioritize travel insurance. Furthermore, the evolving distribution channels, with banks and insurance companies increasingly offering bundled travel insurance packages, contribute to market growth. The market is segmented by trip type (single, multiple, extended), provider (insurance companies, banks, others), and end-user demographics (senior citizens, corporate, family, education, backpackers/adventure travelers). The Asia-Pacific region, particularly China and India, presents a significant growth opportunity due to the rising middle class and increased disposable incomes facilitating travel. However, market growth may be somewhat constrained by economic downturns affecting consumer spending on discretionary items like travel insurance, and fluctuations in global travel patterns impacted by geopolitical events and health crises.

Despite these potential restraints, the long-term outlook for the travel insurance market remains positive. The increasing penetration of online travel agencies (OTAs) and the integration of travel insurance into online booking platforms streamline the purchasing process, expanding market access. The development of innovative insurance products tailored to specific traveler needs, such as adventure travel insurance or specialized medical coverage, further enhances market appeal. Competition among existing players, including Generali Group, Ping An Insurance, Aviva PLC, and Allianz Partners, is driving innovation and pushing for improved customer experience. The market is expected to see continued fragmentation and consolidation in the coming years, driven by mergers and acquisitions among smaller players. Geographic expansion into emerging markets, particularly in Africa and Latin America, will also present significant future opportunities.

Travel Insurance Market Concentration & Characteristics

The global travel insurance market, estimated at $25 billion in 2023, exhibits moderate concentration. A few large multinational players like Allianz Partners, AIG, and AXA hold significant market share, but numerous regional and niche insurers also contribute substantially.

Concentration Areas:

- Geographically: Market concentration is higher in developed regions like North America and Europe due to higher travel frequency and insurance penetration.

- By Provider: Insurance companies dominate, but banks and online travel agencies are increasingly offering bundled travel insurance packages.

Characteristics:

- Innovation: The market shows innovation in areas like digital distribution, personalized risk assessments (using AI and big data), and the expansion of coverage to include new risks (e.g., pandemic-related disruptions).

- Impact of Regulations: Stringent regulations concerning data privacy and consumer protection vary across jurisdictions, impacting operational costs and product offerings.

- Product Substitutes: Credit card travel insurance and airline-offered coverage provide limited alternatives, but generally lack the comprehensive scope of dedicated travel insurance.

- End-User Concentration: A significant portion of revenue stems from business travel (corporate travelers), followed by family and individual travelers. The senior citizen segment is a rapidly growing market segment.

- Level of M&A: The market witnesses periodic mergers and acquisitions, as large players strategically acquire smaller regional players to expand their geographic reach or gain access to niche products. The recent Generali Group acquisition in India illustrates this trend.

Travel Insurance Market Trends

The travel insurance market is experiencing dynamic shifts, driven by several key trends. The rising popularity of adventure tourism and international travel fuels growth, while technological advancements shape product delivery and customer experience. The increasing awareness of travel-related risks, particularly health emergencies and trip cancellations, is boosting demand. Personalized insurance policies, catering to specific travel styles and risk profiles, are gaining traction. The integration of travel insurance with other travel services, such as flight and hotel bookings, enhances convenience and purchasing ease. The growing adoption of digital platforms, including mobile apps and online comparison websites, simplifies the purchasing process and increases accessibility. Furthermore, the incorporation of telemedicine and virtual assistance services offers customers added value and convenience, enhancing overall satisfaction. The demand for sustainable and responsible travel insurance products, aligned with the growing focus on environmental and social responsibility, is another notable trend. Finally, the insurance industry's adoption of artificial intelligence and machine learning enhances risk assessment, fraud detection, and customer service. This creates more efficient processes and cost optimization. Government regulations and international collaborations are also shaping the industry, particularly concerning data protection, liability, and consumer rights.

Key Region or Country & Segment to Dominate the Market

The North American market, particularly the United States, currently dominates the global travel insurance market due to high levels of outbound travel and a strong insurance culture. Within this region, the corporate travel segment shows strong potential for growth. The increasing number of business trips necessitates comprehensive coverage against various risks, such as trip cancellations, medical emergencies, and liability issues. Businesses are also increasingly realizing the benefit of providing travel insurance to employees, demonstrating the long-term sustainability of this segment. This drives demand for tailored policies addressing the specific needs of corporate travelers, including coverage for lost productivity and business disruption, alongside standard medical and travel assistance benefits. Companies are investing more heavily in offering extensive business travel insurance, which includes provisions for emergency medical evacuation, lost luggage coverage, and repatriation expenses, making it essential for protecting the company's financial investment in their employees' travel and ensuring operational continuity.

- Key Region: North America (specifically the U.S.)

- Dominant Segment: Corporate Travelers

Travel Insurance Market Product Insights Report Coverage & Deliverables

This report provides a comprehensive analysis of the travel insurance market, covering market size, segmentation, key trends, regional insights, competitive landscape, and future outlook. Deliverables include detailed market sizing, forecasts, segment analysis, competitive profiling, and insights into emerging trends and growth drivers. The report offers actionable insights for businesses and stakeholders to navigate the market effectively.

Travel Insurance Market Analysis

The global travel insurance market is witnessing significant growth, driven by increasing international travel, rising disposable incomes, and growing awareness about travel-related risks. The market is valued at approximately $25 billion in 2023, with a projected compound annual growth rate (CAGR) of 7% from 2024 to 2029. This translates to a market size exceeding $38 billion by 2029. The market share distribution is fairly diverse, with leading players holding substantial portions, but numerous smaller regional insurers also contributing significantly. Growth is fueled by factors such as increased international travel, technological advancements, and the rise of adventure and experiential travel.

Travel Insurance Market Regional Insights

- North America

- U.S.: Dominated by corporate travel, strong growth in individual travel insurance.

- Canada: Similar trends to the U.S., with a focus on winter sports and adventure travel.

- Europe

- UK, Germany, France, Italy, Spain: Strong domestic and international travel insurance markets, influenced by regulations and consumer preferences.

- Russia: Experiencing fluctuating growth depending on geopolitical factors.

- Asia Pacific

- China, India, Japan, South Korea, Australia: Rapidly expanding markets, with varying levels of insurance penetration.

- Latin America

- Brazil, Mexico: Growing markets with potential for significant future growth.

- MEA

- South Africa, UAE, Saudi Arabia: Growing middle class driving demand for travel insurance.

Driving Forces: What's Propelling the Travel Insurance Market

The rising frequency of international travel, increased awareness of potential travel risks (medical emergencies, trip cancellations, lost baggage), and the growing adoption of digital distribution channels are key drivers of market growth. Government regulations promoting travel insurance in some regions are also having a positive impact.

Challenges and Restraints in Travel Insurance Market

Fluctuating travel patterns due to global events (pandemics, economic downturns), intense competition from multiple providers, and the need to adapt to rapidly changing customer expectations are key challenges. Maintaining appropriate pricing in relation to risk assessment and managing fraud are also significant concerns.

Emerging Trends in Travel Insurance Market

The integration of travel insurance with other travel services, the rise of personalized and customized policies, the incorporation of technology (AI, big data, telemedicine), and the growing demand for sustainable and ethical travel insurance products are prominent emerging trends.

Travel Insurance Industry News

- May 2022: Generali Group acquired a 25% stake in Future Generali India Insurance (FGII).

Leading Players in the Travel Insurance Market

- Generali Group

- Ping An Insurance Company of China, Ltd

- Aviva PLC

- Allianz Partners

- ERGO Group AG

- American Express Company

- Arch Capital Group Limited

- China Pacific Insurance (Group) Co. Ltd

- American International Group, Inc. (AIG)

- AXA Travel Insurance

- Zurich Insurance Group AG

Travel Insurance Market Segmentation

-

1. Type

- 1.1. Domestic

- 1.2. International

-

2. Trip

- 2.1. Single

- 2.2. Multiple

- 2.3. Extended

-

3. Provider

- 3.1. Insurance companies

- 3.2. Banks

- 3.3. Others

-

4. End-Use

- 4.1. Senior citizens

- 4.2. Corporate travellers

- 4.3. Family travellers

- 4.4. Education travellers

- 4.5. Backpacker & adventure travellers

- 4.6. Others

Travel Insurance Market Segmentation By Geography

-

1. North America

- 1.1. U.S.

- 1.2. Canada

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Russia

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

-

5. MEA

- 5.1. South Africa

- 5.2. UAE

- 5.3. Saudi Arabia

Travel Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.5% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High cost of medical treatment overseas

- 3.2.2 Increasing spending on travel protection plans in North America

- 3.2.3 Mandatory travel insurance policies in North America & Europe

- 3.2.4 Development of international trade and overseas business expansion in Asia Pacific

- 3.2.5 Growth in the tourism industry in Latin America

- 3.2.6 The flourishing business tourism industry in the MEA

- 3.3. Market Restrains

- 3.3.1. Lack of consumer experiences in terms of coverage and premium rates

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Trip

- 5.2.1. Single

- 5.2.2. Multiple

- 5.2.3. Extended

- 5.3. Market Analysis, Insights and Forecast - by Provider

- 5.3.1. Insurance companies

- 5.3.2. Banks

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by End-Use

- 5.4.1. Senior citizens

- 5.4.2. Corporate travellers

- 5.4.3. Family travellers

- 5.4.4. Education travellers

- 5.4.5. Backpacker & adventure travellers

- 5.4.6. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Domestic

- 6.1.2. International

- 6.2. Market Analysis, Insights and Forecast - by Trip

- 6.2.1. Single

- 6.2.2. Multiple

- 6.2.3. Extended

- 6.3. Market Analysis, Insights and Forecast - by Provider

- 6.3.1. Insurance companies

- 6.3.2. Banks

- 6.3.3. Others

- 6.4. Market Analysis, Insights and Forecast - by End-Use

- 6.4.1. Senior citizens

- 6.4.2. Corporate travellers

- 6.4.3. Family travellers

- 6.4.4. Education travellers

- 6.4.5. Backpacker & adventure travellers

- 6.4.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Domestic

- 7.1.2. International

- 7.2. Market Analysis, Insights and Forecast - by Trip

- 7.2.1. Single

- 7.2.2. Multiple

- 7.2.3. Extended

- 7.3. Market Analysis, Insights and Forecast - by Provider

- 7.3.1. Insurance companies

- 7.3.2. Banks

- 7.3.3. Others

- 7.4. Market Analysis, Insights and Forecast - by End-Use

- 7.4.1. Senior citizens

- 7.4.2. Corporate travellers

- 7.4.3. Family travellers

- 7.4.4. Education travellers

- 7.4.5. Backpacker & adventure travellers

- 7.4.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Domestic

- 8.1.2. International

- 8.2. Market Analysis, Insights and Forecast - by Trip

- 8.2.1. Single

- 8.2.2. Multiple

- 8.2.3. Extended

- 8.3. Market Analysis, Insights and Forecast - by Provider

- 8.3.1. Insurance companies

- 8.3.2. Banks

- 8.3.3. Others

- 8.4. Market Analysis, Insights and Forecast - by End-Use

- 8.4.1. Senior citizens

- 8.4.2. Corporate travellers

- 8.4.3. Family travellers

- 8.4.4. Education travellers

- 8.4.5. Backpacker & adventure travellers

- 8.4.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Domestic

- 9.1.2. International

- 9.2. Market Analysis, Insights and Forecast - by Trip

- 9.2.1. Single

- 9.2.2. Multiple

- 9.2.3. Extended

- 9.3. Market Analysis, Insights and Forecast - by Provider

- 9.3.1. Insurance companies

- 9.3.2. Banks

- 9.3.3. Others

- 9.4. Market Analysis, Insights and Forecast - by End-Use

- 9.4.1. Senior citizens

- 9.4.2. Corporate travellers

- 9.4.3. Family travellers

- 9.4.4. Education travellers

- 9.4.5. Backpacker & adventure travellers

- 9.4.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. MEA Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Domestic

- 10.1.2. International

- 10.2. Market Analysis, Insights and Forecast - by Trip

- 10.2.1. Single

- 10.2.2. Multiple

- 10.2.3. Extended

- 10.3. Market Analysis, Insights and Forecast - by Provider

- 10.3.1. Insurance companies

- 10.3.2. Banks

- 10.3.3. Others

- 10.4. Market Analysis, Insights and Forecast - by End-Use

- 10.4.1. Senior citizens

- 10.4.2. Corporate travellers

- 10.4.3. Family travellers

- 10.4.4. Education travellers

- 10.4.5. Backpacker & adventure travellers

- 10.4.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Generali Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ping An Insurance Company of ChinaLtd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aviva PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allianz Partners

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ERGO Group AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 American Express Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arch Capital Group Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 China Pacific Insurance (Group) Co.Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 American International Group Inc. (AIG)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AXA Travel Insurance

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zurich Insurance Group AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Generali Group

- Figure 1: Global Travel Insurance Market Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Travel Insurance Market Revenue (Billion), by Type 2024 & 2032

- Figure 3: North America Travel Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Travel Insurance Market Revenue (Billion), by Trip 2024 & 2032

- Figure 5: North America Travel Insurance Market Revenue Share (%), by Trip 2024 & 2032

- Figure 6: North America Travel Insurance Market Revenue (Billion), by Provider 2024 & 2032

- Figure 7: North America Travel Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 8: North America Travel Insurance Market Revenue (Billion), by End-Use 2024 & 2032

- Figure 9: North America Travel Insurance Market Revenue Share (%), by End-Use 2024 & 2032

- Figure 10: North America Travel Insurance Market Revenue (Billion), by Country 2024 & 2032

- Figure 11: North America Travel Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Travel Insurance Market Revenue (Billion), by Type 2024 & 2032

- Figure 13: Europe Travel Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Europe Travel Insurance Market Revenue (Billion), by Trip 2024 & 2032

- Figure 15: Europe Travel Insurance Market Revenue Share (%), by Trip 2024 & 2032

- Figure 16: Europe Travel Insurance Market Revenue (Billion), by Provider 2024 & 2032

- Figure 17: Europe Travel Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 18: Europe Travel Insurance Market Revenue (Billion), by End-Use 2024 & 2032

- Figure 19: Europe Travel Insurance Market Revenue Share (%), by End-Use 2024 & 2032

- Figure 20: Europe Travel Insurance Market Revenue (Billion), by Country 2024 & 2032

- Figure 21: Europe Travel Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Travel Insurance Market Revenue (Billion), by Type 2024 & 2032

- Figure 23: Asia Pacific Travel Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific Travel Insurance Market Revenue (Billion), by Trip 2024 & 2032

- Figure 25: Asia Pacific Travel Insurance Market Revenue Share (%), by Trip 2024 & 2032

- Figure 26: Asia Pacific Travel Insurance Market Revenue (Billion), by Provider 2024 & 2032

- Figure 27: Asia Pacific Travel Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 28: Asia Pacific Travel Insurance Market Revenue (Billion), by End-Use 2024 & 2032

- Figure 29: Asia Pacific Travel Insurance Market Revenue Share (%), by End-Use 2024 & 2032

- Figure 30: Asia Pacific Travel Insurance Market Revenue (Billion), by Country 2024 & 2032

- Figure 31: Asia Pacific Travel Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Travel Insurance Market Revenue (Billion), by Type 2024 & 2032

- Figure 33: Latin America Travel Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Latin America Travel Insurance Market Revenue (Billion), by Trip 2024 & 2032

- Figure 35: Latin America Travel Insurance Market Revenue Share (%), by Trip 2024 & 2032

- Figure 36: Latin America Travel Insurance Market Revenue (Billion), by Provider 2024 & 2032

- Figure 37: Latin America Travel Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 38: Latin America Travel Insurance Market Revenue (Billion), by End-Use 2024 & 2032

- Figure 39: Latin America Travel Insurance Market Revenue Share (%), by End-Use 2024 & 2032

- Figure 40: Latin America Travel Insurance Market Revenue (Billion), by Country 2024 & 2032

- Figure 41: Latin America Travel Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: MEA Travel Insurance Market Revenue (Billion), by Type 2024 & 2032

- Figure 43: MEA Travel Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 44: MEA Travel Insurance Market Revenue (Billion), by Trip 2024 & 2032

- Figure 45: MEA Travel Insurance Market Revenue Share (%), by Trip 2024 & 2032

- Figure 46: MEA Travel Insurance Market Revenue (Billion), by Provider 2024 & 2032

- Figure 47: MEA Travel Insurance Market Revenue Share (%), by Provider 2024 & 2032

- Figure 48: MEA Travel Insurance Market Revenue (Billion), by End-Use 2024 & 2032

- Figure 49: MEA Travel Insurance Market Revenue Share (%), by End-Use 2024 & 2032

- Figure 50: MEA Travel Insurance Market Revenue (Billion), by Country 2024 & 2032

- Figure 51: MEA Travel Insurance Market Revenue Share (%), by Country 2024 & 2032

- Table 1: Global Travel Insurance Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Travel Insurance Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 3: Global Travel Insurance Market Revenue Billion Forecast, by Trip 2019 & 2032

- Table 4: Global Travel Insurance Market Revenue Billion Forecast, by Provider 2019 & 2032

- Table 5: Global Travel Insurance Market Revenue Billion Forecast, by End-Use 2019 & 2032

- Table 6: Global Travel Insurance Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 7: Global Travel Insurance Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 8: Global Travel Insurance Market Revenue Billion Forecast, by Trip 2019 & 2032

- Table 9: Global Travel Insurance Market Revenue Billion Forecast, by Provider 2019 & 2032

- Table 10: Global Travel Insurance Market Revenue Billion Forecast, by End-Use 2019 & 2032

- Table 11: Global Travel Insurance Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 12: U.S. Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 13: Canada Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 14: Global Travel Insurance Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 15: Global Travel Insurance Market Revenue Billion Forecast, by Trip 2019 & 2032

- Table 16: Global Travel Insurance Market Revenue Billion Forecast, by Provider 2019 & 2032

- Table 17: Global Travel Insurance Market Revenue Billion Forecast, by End-Use 2019 & 2032

- Table 18: Global Travel Insurance Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 19: UK Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: Germany Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 21: France Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Italy Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 23: Spain Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 24: Russia Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 25: Global Travel Insurance Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 26: Global Travel Insurance Market Revenue Billion Forecast, by Trip 2019 & 2032

- Table 27: Global Travel Insurance Market Revenue Billion Forecast, by Provider 2019 & 2032

- Table 28: Global Travel Insurance Market Revenue Billion Forecast, by End-Use 2019 & 2032

- Table 29: Global Travel Insurance Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 30: China Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 31: India Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: Japan Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 33: South Korea Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 34: Australia Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 35: Global Travel Insurance Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 36: Global Travel Insurance Market Revenue Billion Forecast, by Trip 2019 & 2032

- Table 37: Global Travel Insurance Market Revenue Billion Forecast, by Provider 2019 & 2032

- Table 38: Global Travel Insurance Market Revenue Billion Forecast, by End-Use 2019 & 2032

- Table 39: Global Travel Insurance Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 40: Brazil Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 41: Mexico Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 42: Global Travel Insurance Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 43: Global Travel Insurance Market Revenue Billion Forecast, by Trip 2019 & 2032

- Table 44: Global Travel Insurance Market Revenue Billion Forecast, by Provider 2019 & 2032

- Table 45: Global Travel Insurance Market Revenue Billion Forecast, by End-Use 2019 & 2032

- Table 46: Global Travel Insurance Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 47: South Africa Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 48: UAE Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 49: Saudi Arabia Travel Insurance Market Revenue (Billion) Forecast, by Application 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)