Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

U.S. Hormone Replacement Therapy Market Insightful Analysis: Trends, Competitor Dynamics, and Opportunities 2025-2033

U.S. Hormone Replacement Therapy Market by Based on product, the market is segmented into estrogen & progesterone replacement therapy, thyroid replacement therapy, growth hormone replacement therapy, parathyroid hormone replacement therapy, and testosterone replacement therapy. The estrogen & progesterone replacement therapy segment accounted for highest market share of 55.3% in 2022 and is expected to reach USD 7.5 billion by 2032. (Estrogen and progesterone replacement therapy has a well-established track record of effectiveness in managing menopausal symptoms and can be used for postmenopausal osteoporosis treatment. It is considered one of the most effective treatments for addressing these health concerns, which enhances its popularity and market share., The efficacy and safety of estrogen and progesterone replacement therapy are supported by a substantial body of clinical research and scientific evidence.), by disease type, the U.S. hormone replacement therapy market is segmented into menopause, hypothyroidism, growth hormone deficiency, hypoparathyroidism, male hypogonadism, and other disease type. In 2022, the menopause segment accounted for highest market share of 50.5% and is anticipated to witness growth at 7 % during the analysis period. (Menopause is characterized by a range of symptoms, including hot flashes, night sweats, mood swings, sleep disturbances, vaginal dryness, and more. These symptoms can be disruptive and significantly impact a woman's quality of life. HRT provides an effective means of alleviating these symptoms, leading to improved comfort and well-being., Thus, the large share of the menopause segment can be attributed to the higher usage of HRT for the management of its symptoms, the increasing prevalence of menopause, and the growing availability of various formulation for management of its symptoms.), by Product, 2018 – 2032 (USD Million) (Estrogen & progesterone replacement therapy, Thyroid replacement therapy, Growth hormone replacement therapy, Parathyroid hormone replacement therapy, Testosterone replacement therapy), by Route of Administration, 2018 – 2032 (USD Million) (Oral, Parenteral, Other routes of administration), by Disease Type, 2018 – 2032 (USD Million) (Menopause, Growth hormone deficiency, Male hypogonadism, Hypothyroidism, Hypoparathyroidism, Other disease types), by Distribution Channel, 2018 – 2032 (USD Million) (Retail pharmacies, Hospital pharmacies, Online pharmacies), by U.S. Forecast 2025-2033

Key Insights

The size of the U.S. Hormone Replacement Therapy Market was valued at USD 6.9 Billion in 2024 and is projected to reach USD 10.72 Billion by 2033, with an expected CAGR of 6.5% during the forecast period. The Hormone Replacement Therapy (HRT) Market in the U.S. is an important part of the healthcare sector, concentrating on therapies designed to restore hormones in people, especially women undergoing menopause and men with decreased testosterone levels. HRT is commonly utilized to relieve symptoms like hot flashes, night sweats, mood swings, and vaginal dryness in women, and to manage issues such as low libido and fatigue in men experiencing testosterone deficiencies. The U.S. market is fueled by a significant aging demographic, growing awareness of menopause and hormonal changes associated with aging, along with an increasing need for non-invasive therapies. Furthermore, progress in HRT, with the incorporation of bioidentical hormones and modern delivery options like patches, creams, and gels, is driving growth by enhancing safety and convenience for patients. Additionally, increasing worries regarding osteoporosis, heart health, and other hormone-related issues are promoting the use of HRT in preventive treatment. The U.S. Hormone Replacement Therapy Market is projected to keep growing as an increasing number of individuals look for customized options to handle hormone imbalances and enhance their quality of life as they age.

U.S. Hormone Replacement Therapy Market Concentration & Characteristics

The U.S. Hormone Replacement Therapy Market is moderately concentrated, with the top five players accounting for over 50% of the market share. The major players in the market include Eli Lilly and Company, Bayer AG, Pfizer Inc., Viatris, Inc., and Noven Pharmaceuticals, Inc.

U.S. Hormone Replacement Therapy Market Trends

The key trends in the U.S. Hormone Replacement Therapy Market include:

- Increasing prevalence of hormone-related disorders: The prevalence of hormone-related disorders, such as menopause and hypothyroidism, is increasing in the U.S. This is driving the demand for HRT products.

- Rising awareness of HRT: There is a growing awareness of HRT and its benefits among both patients and healthcare professionals. This is leading to increased adoption of HRT products.

- Introduction of innovative HRT products: The introduction of innovative HRT products, such as transdermal HRT and bioidentical HRT, is expanding the market opportunities.

Key Region or Country & Segment to Dominate the Market

- Key region: The U.S. is the largest market for HRT products in the world. This is due to the high prevalence of hormone-related disorders, the increasing awareness of HRT, and the availability of a wide range of HRT products.

- Key segment: The estrogen & progesterone replacement therapy segment is the largest segment in the U.S. HRT market. This is due to the high prevalence of menopause in the U.S. and the effectiveness of estrogen and progesterone replacement therapy in managing menopausal symptoms.

Driving Forces: What's Propelling the U.S. Hormone Replacement Therapy Market

- Rising prevalence of hormone-related disorders: The prevalence of hormone-related disorders, such as menopause and hypothyroidism, is increasing in the U.S. This is driving the demand for HRT products.

- Increasing awareness of HRT: There is a growing awareness of HRT and its benefits among both patients and healthcare professionals. This is leading to increased adoption of HRT products.

- Introduction of innovative HRT products: The introduction of innovative HRT products, such as transdermal HRT and bioidentical HRT, is expanding the market opportunities.

Challenges and Restraints in U.S. Hormone Replacement Therapy Market

- Safety concerns: There are some safety concerns associated with HRT, such as the risk of blood clots and breast cancer. This can limit the adoption of HRT products.

- Cost: HRT products can be expensive, which can limit their accessibility.

- Lack of reimbursement: In some cases, HRT products are not covered by insurance, which can limit their affordability.

Emerging Trends in U.S. Hormone Replacement Therapy Market

- Personalized HRT: The use of personalized HRT is increasing. This involves tailoring HRT treatment to the individual needs of each patient.

- Telemedicine: Telemedicine is becoming more common for HRT. This allows patients to consult with healthcare professionals and receive HRT prescriptions remotely.

- Nutraceuticals: There is a growing interest in nutraceuticals as an alternative to HRT. Nutraceuticals are food supplements that have health benefits.

U.S. Hormone Replacement Therapy Industry News

- In February 2022, Eli Lilly and Company entered a collaboration with Very Inc, an oncology biopharmaceutical company. This is to evaluate enobosarm in combination with verzenio in Phase 3 ENABLAR-2 Trial. This strategy helped to characterize and evaluate the enbosarm efficacy as a hormone replacement therapy and consequently increasing the demand and supply of verzenio, thus increasing the product portfolio of the company.

- In October 2018, Novo Nordisk announced the expansion of its biopharm business with an agreement to acquire the U.S. and Canadian rights to Macrilen, an enhancer of growth hormone secretion and the first and only FDA-approved oral product indicated for the diagnosis of Adult Growth Hormone Deficiency. This strategy prioritized the hormonal deficiency tests and adopting HRT, thereby proliferated the product sales of the company.

Leading Players in the U.S. Hormone Replacement Therapy Market

U.S. Hormone Replacement Therapy Market Segmentation

- 1. Based on product, the market is segmented into estrogen & progesterone replacement therapy, thyroid replacement therapy, growth hormone replacement therapy, parathyroid hormone replacement therapy, and testosterone replacement therapy. The estrogen & progesterone replacement therapy segment accounted for highest market share of 55.3% in 2022 and is expected to reach USD 7.5 billion by 2032.

- 1.1. Estrogen and progesterone replacement therapy has a well-established track record of effectiveness in managing menopausal symptoms and can be used for postmenopausal osteoporosis treatment. It is considered one of the most effective treatments for addressing these health concerns, which enhances its popularity and market share.

- 1.2. The efficacy and safety of estrogen and progesterone replacement therapy are supported by a substantial body of clinical research and scientific evidence.

- 2. disease type, the U.S. hormone replacement therapy market is segmented into menopause, hypothyroidism, growth hormone deficiency, hypoparathyroidism, male hypogonadism, and other disease type. In 2022, the menopause segment accounted for highest market share of 50.5% and is anticipated to witness growth at 7 % during the analysis period.

- 2.1. Menopause is characterized by a range of symptoms, including hot flashes, night sweats, mood swings, sleep disturbances, vaginal dryness, and more. These symptoms can be disruptive and significantly impact a woman's quality of life. HRT provides an effective means of alleviating these symptoms, leading to improved comfort and well-being.

- 2.2. Thus, the large share of the menopause segment can be attributed to the higher usage of HRT for the management of its symptoms, the increasing prevalence of menopause, and the growing availability of various formulation for management of its symptoms.

- 3. Product, 2018 – 2032 (USD Million)

- 3.1. Estrogen & progesterone replacement therapy

- 3.2. Thyroid replacement therapy

- 3.3. Growth hormone replacement therapy

- 3.4. Parathyroid hormone replacement therapy

- 3.5. Testosterone replacement therapy

- 4. Route of Administration, 2018 – 2032 (USD Million)

- 4.1. Oral

- 4.2. Parenteral

- 4.3. Other routes of administration

- 5. Disease Type, 2018 – 2032 (USD Million)

- 5.1. Menopause

- 5.2. Growth hormone deficiency

- 5.3. Male hypogonadism

- 5.4. Hypothyroidism

- 5.5. Hypoparathyroidism

- 5.6. Other disease types

- 6. Distribution Channel, 2018 – 2032 (USD Million)

- 6.1. Retail pharmacies

- 6.2. Hospital pharmacies

- 6.3. Online pharmacies

U.S. Hormone Replacement Therapy Market Segmentation By Geography

- 1. U.S.

U.S. Hormone Replacement Therapy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.5% from 2019-2033 |

| Segmentation |

|

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing geriatric population

- 3.2.2 Rising awareness of post-menopausal issues

- 3.2.3 Increasing development of novel drug delivery systems for hormone imbalance issues

- 3.2.4 Rising prevalence of hormonal disorders

- 3.3. Market Restrains

- 3.3.1 High cost associated with hormone replacement therapy

- 3.3.2 Adverse effects of hormone replacement therapy

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Hormone Replacement Therapy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Based on product, the market is segmented into estrogen & progesterone replacement therapy, thyroid replacement therapy, growth hormone replacement therapy, parathyroid hormone replacement therapy, and testosterone replacement therapy. The estrogen & progesterone replacement therapy segment accounted for highest market share of 55.3% in 2022 and is expected to reach USD 7.5 billion by 2032.

- 5.1.1. Estrogen and progesterone replacement therapy has a well-established track record of effectiveness in managing menopausal symptoms and can be used for postmenopausal osteoporosis treatment. It is considered one of the most effective treatments for addressing these health concerns, which enhances its popularity and market share.

- 5.1.2. The efficacy and safety of estrogen and progesterone replacement therapy are supported by a substantial body of clinical research and scientific evidence.

- 5.2. Market Analysis, Insights and Forecast - by disease type, the U.S. hormone replacement therapy market is segmented into menopause, hypothyroidism, growth hormone deficiency, hypoparathyroidism, male hypogonadism, and other disease type. In 2022, the menopause segment accounted for highest market share of 50.5% and is anticipated to witness growth at 7 % during the analysis period.

- 5.2.1. Menopause is characterized by a range of symptoms, including hot flashes, night sweats, mood swings, sleep disturbances, vaginal dryness, and more. These symptoms can be disruptive and significantly impact a woman's quality of life. HRT provides an effective means of alleviating these symptoms, leading to improved comfort and well-being.

- 5.2.2. Thus, the large share of the menopause segment can be attributed to the higher usage of HRT for the management of its symptoms, the increasing prevalence of menopause, and the growing availability of various formulation for management of its symptoms.

- 5.3. Market Analysis, Insights and Forecast - by Product, 2018 – 2032 (USD Million)

- 5.3.1. Estrogen & progesterone replacement therapy

- 5.3.2. Thyroid replacement therapy

- 5.3.3. Growth hormone replacement therapy

- 5.3.4. Parathyroid hormone replacement therapy

- 5.3.5. Testosterone replacement therapy

- 5.4. Market Analysis, Insights and Forecast - by Route of Administration, 2018 – 2032 (USD Million)

- 5.4.1. Oral

- 5.4.2. Parenteral

- 5.4.3. Other routes of administration

- 5.5. Market Analysis, Insights and Forecast - by Disease Type, 2018 – 2032 (USD Million)

- 5.5.1. Menopause

- 5.5.2. Growth hormone deficiency

- 5.5.3. Male hypogonadism

- 5.5.4. Hypothyroidism

- 5.5.5. Hypoparathyroidism

- 5.5.6. Other disease types

- 5.6. Market Analysis, Insights and Forecast - by Distribution Channel, 2018 – 2032 (USD Million)

- 5.6.1. Retail pharmacies

- 5.6.2. Hospital pharmacies

- 5.6.3. Online pharmacies

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Based on product, the market is segmented into estrogen & progesterone replacement therapy, thyroid replacement therapy, growth hormone replacement therapy, parathyroid hormone replacement therapy, and testosterone replacement therapy. The estrogen & progesterone replacement therapy segment accounted for highest market share of 55.3% in 2022 and is expected to reach USD 7.5 billion by 2032.

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Eli Lilly and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pfizer Inc.

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Viatris Inc.

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Noven Pharmaceuticals Inc.

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Merck KGaA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novo Nordisk A/S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 F. Hoffmann-La Roche Ltd.

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ASCEND Therapeutics US LLC.

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Abbott Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Teva Pharmaceutical Industries Ltd.

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novartis AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Eli Lilly and Company

- Figure 1: U.S. Hormone Replacement Therapy Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: U.S. Hormone Replacement Therapy Market Share (%) by Company 2024

- Table 1: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Based on product, the market is segmented into estrogen & progesterone replacement therapy, thyroid replacement therapy, growth hormone replacement therapy, parathyroid hormone replacement therapy, and testosterone replacement therapy. The estrogen & progesterone replacement therapy segment accounted for highest market share of 55.3% in 2022 and is expected to reach USD 7.5 billion by 2032. 2019 & 2032

- Table 4: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Based on product, the market is segmented into estrogen & progesterone replacement therapy, thyroid replacement therapy, growth hormone replacement therapy, parathyroid hormone replacement therapy, and testosterone replacement therapy. The estrogen & progesterone replacement therapy segment accounted for highest market share of 55.3% in 2022 and is expected to reach USD 7.5 billion by 2032. 2019 & 2032

- Table 5: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by disease type, the U.S. hormone replacement therapy market is segmented into menopause, hypothyroidism, growth hormone deficiency, hypoparathyroidism, male hypogonadism, and other disease type. In 2022, the menopause segment accounted for highest market share of 50.5% and is anticipated to witness growth at 7 % during the analysis period. 2019 & 2032

- Table 6: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by disease type, the U.S. hormone replacement therapy market is segmented into menopause, hypothyroidism, growth hormone deficiency, hypoparathyroidism, male hypogonadism, and other disease type. In 2022, the menopause segment accounted for highest market share of 50.5% and is anticipated to witness growth at 7 % during the analysis period. 2019 & 2032

- Table 7: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Product, 2018 – 2032 (USD Million) 2019 & 2032

- Table 8: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Product, 2018 – 2032 (USD Million) 2019 & 2032

- Table 9: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Route of Administration, 2018 – 2032 (USD Million) 2019 & 2032

- Table 10: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Route of Administration, 2018 – 2032 (USD Million) 2019 & 2032

- Table 11: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Disease Type, 2018 – 2032 (USD Million) 2019 & 2032

- Table 12: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Disease Type, 2018 – 2032 (USD Million) 2019 & 2032

- Table 13: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Distribution Channel, 2018 – 2032 (USD Million) 2019 & 2032

- Table 14: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Distribution Channel, 2018 – 2032 (USD Million) 2019 & 2032

- Table 15: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 16: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 17: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Based on product, the market is segmented into estrogen & progesterone replacement therapy, thyroid replacement therapy, growth hormone replacement therapy, parathyroid hormone replacement therapy, and testosterone replacement therapy. The estrogen & progesterone replacement therapy segment accounted for highest market share of 55.3% in 2022 and is expected to reach USD 7.5 billion by 2032. 2019 & 2032

- Table 18: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Based on product, the market is segmented into estrogen & progesterone replacement therapy, thyroid replacement therapy, growth hormone replacement therapy, parathyroid hormone replacement therapy, and testosterone replacement therapy. The estrogen & progesterone replacement therapy segment accounted for highest market share of 55.3% in 2022 and is expected to reach USD 7.5 billion by 2032. 2019 & 2032

- Table 19: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by disease type, the U.S. hormone replacement therapy market is segmented into menopause, hypothyroidism, growth hormone deficiency, hypoparathyroidism, male hypogonadism, and other disease type. In 2022, the menopause segment accounted for highest market share of 50.5% and is anticipated to witness growth at 7 % during the analysis period. 2019 & 2032

- Table 20: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by disease type, the U.S. hormone replacement therapy market is segmented into menopause, hypothyroidism, growth hormone deficiency, hypoparathyroidism, male hypogonadism, and other disease type. In 2022, the menopause segment accounted for highest market share of 50.5% and is anticipated to witness growth at 7 % during the analysis period. 2019 & 2032

- Table 21: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Product, 2018 – 2032 (USD Million) 2019 & 2032

- Table 22: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Product, 2018 – 2032 (USD Million) 2019 & 2032

- Table 23: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Route of Administration, 2018 – 2032 (USD Million) 2019 & 2032

- Table 24: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Route of Administration, 2018 – 2032 (USD Million) 2019 & 2032

- Table 25: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Disease Type, 2018 – 2032 (USD Million) 2019 & 2032

- Table 26: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Disease Type, 2018 – 2032 (USD Million) 2019 & 2032

- Table 27: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Distribution Channel, 2018 – 2032 (USD Million) 2019 & 2032

- Table 28: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Distribution Channel, 2018 – 2032 (USD Million) 2019 & 2032

- Table 29: U.S. Hormone Replacement Therapy Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 30: U.S. Hormone Replacement Therapy Market Volume K Tons Forecast, by Country 2019 & 2032

STEP 1 - Identification of Relevant Samples Size from Population Database

STEP 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note* : In applicable scenarios

STEP 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

STEP 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

Frequently Asked Questions

Related Reports

See the similar reports

About Market Insights Report

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

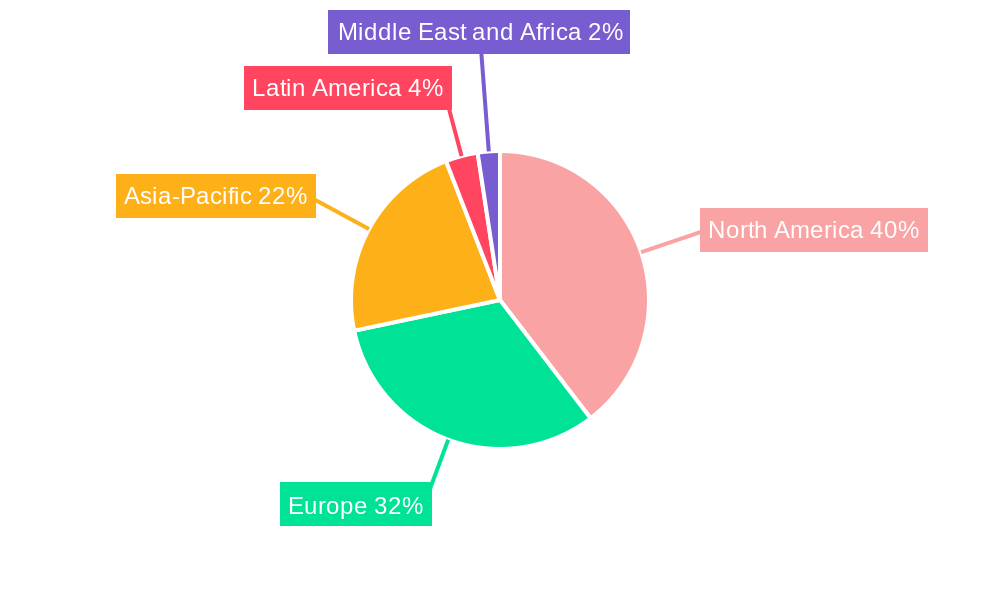

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

.jpg&w=3840&q=100)